PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934758

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934758

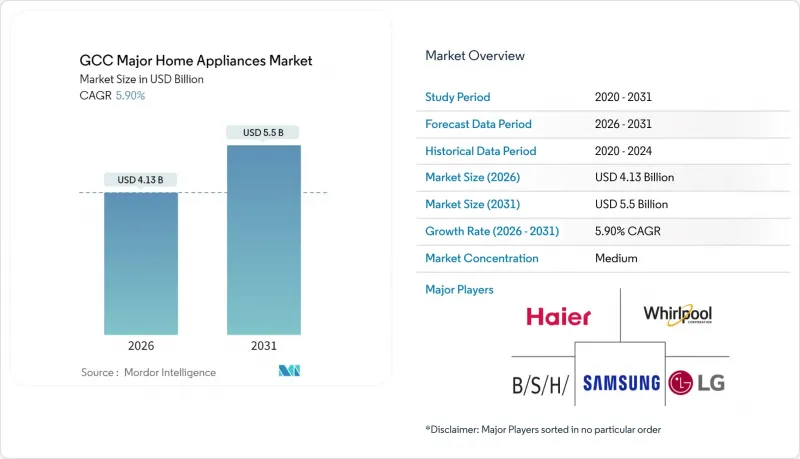

GCC Major Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

GCC major home appliances market size in 2026 is estimated at USD 4.13 billion, growing from 2025 value of USD 3.90 billion with 2031 projections showing USD 5.5 billion, growing at 5.9% CAGR over 2026-2031.

Expansive infrastructure spending linked to Vision 2030, a rapidly urbanizing population, and government incentives for local electronics production are reshaping competitive priorities within the GCC major home appliances market. Hospitality megaprojects in Saudi Arabia and rising disposable incomes in the United Arab Emirates are accelerating demand for premium, energy-efficient refrigerators, washing machines, and air conditioners, while regional e-commerce platforms enable direct-to-consumer business models that compress traditional retail margins. Regulatory mandates such as SASO 2663:2021 and ESMA five-star labeling standards spur faster replacement cycles, nudging consumers toward smart connected products that synchronize with national sustainability goals. Logistics modernization worth USD 266 billion across Saudi multimodal corridors improves last-mile delivery economics, supporting wider geographic penetration of the GCC major home appliances market.

GCC Major Home Appliances Market Trends and Insights

Rising Disposable Incomes

Saudi Arabia's population of 36.96 million with a median age of 29.6 supports an expanding middle class that prioritizes premium appliances even at higher up-front costs. Non-oil GDP ambitions under Vision 2030 add purchasing power, with dual-income households on the rise due to increased female labor force participation. LG's Objet Collection generated 30.14 trillion won sales in 2024, confirming robust appetite for high-end designs. Higher wages improve credit availability, encouraging consumers to select refrigerators with AI inventory tracking and washing machines offering sensor-based detergent dosing. Retailers respond by promoting installment plans and extended warranties, driving loyalty in the GCC major home appliances market. Rising disposable incomes also enable consumers to prioritize energy-efficient models despite higher upfront costs, aligning with regional sustainability goals.

Rapid Urbanization & Housing Boom

Urbanization exceeds 85% in Saudi Arabia, and mega-projects such as NEOM, Lusail, and Expo City introduce thousands of new apartments, hotels, and serviced residences that require turnkey appliance packages. Hospitality pipelines alone will add 320,000 hotel rooms by 2030, expanding institutional demand for bulk orders of refrigerators, ovens, and laundry systems. Compact living trends stimulate interest in slim dishwashers and washer-dryer combos, while smart building codes encourage IoT-enabled monitoring of appliance performance. These factors secure long-run volume growth for the GCC major home appliances market. New residential completions in these projects typically feature built-in appliance packages, creating bulk procurement opportunities. The urbanization trend also drives apartment living, increasing demand for compact and multi-functional appliances that maximize space efficiency.

Slower Expatriate Population Growth

Kuwait's expatriate population constitutes 70% of total residents, with labor nationalization policies like 'Kuwaitization' creating segmented markets that reserve certain employment categories for nationals. The UAE's Gold Card residency program and Saudi Arabia's Privileged Iqama initiative aim to attract skilled workers, yet tighter visa regulations reduce overall expatriate inflows that historically drove appliance replacement cycles. This demographic shift particularly impacts mid-range appliance segments, as expatriate households typically exhibit higher replacement frequencies due to housing mobility. The trend also affects rental market dynamics, where landlords traditionally provided basic appliances, potentially reducing overall market volume. However, the shift toward permanent residency programs may eventually stabilize demand as long-term residents invest in higher-quality appliances.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficiency Regulations Spur Replacement Demand

- E-Commerce Penetration Widens Access

- High Import-Linked Logistics Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerators held 30.74% GCC major home appliances market share in 2025, buoyed by regulatory replacement incentives and premium built-in packages for urban housing projects. The GCC major home appliances market size for refrigerator purchases is projected to grow at a 12.71% CAGR in smart connected models through 2031, anchored by AI Vision Inside systems that monitor expiration dates and suggest recipes. Washing machines remain the second-largest sub-segment, supported by 25 kg washer-dryer combos with micro-foam cleaning that consume less detergent per cycle. Air conditioners confront district cooling headwinds yet stay essential in Saudi residential estates where cooling accounts for 44% of household electricity. Dishwashers and ovens capture smaller shares but post steady gains from hospitality kitchens and luxury villas that bundle full appliance suites. Manufacturers expand smart refrigeration capacity to 900 liters while maintaining ENERGY STAR Most Efficient ratings, reinforcing the leadership of refrigerators in the GCC major home appliances market.

Broader product convergence blurs traditional category lines: oven ranges now integrate Wi-Fi diagnostics, and air conditioners embed Home Connectivity Alliance APIs to participate in demand-response programs. Sharp's joint venture in Egypt plans 500,000 refrigerator units by 2027, signaling a pivot toward regional manufacturing that can hedge shipping costs and align with SASO energy labeling thresholds. These shifts affirm sustained innovation cycles and strategic localization across product types.

The GCC Major Home Appliances Market Report is Segmented by Product Type (Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Ovens, Air Conditioners, Other Major Home Appliances), Distribution Channel (Multi-Brand Stores, and Other), Technology (Smart Connected Major Appliances, Conventional Major Appliances), and Geography (Saudi Arabia, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- BSH Hausgerate GmbH

- Haier Group Corporation

- Midea Group Co. Ltd.

- Electrolux AB

- Panasonic Corporation

- Arcelik A.S.

- Hisense Group Co. Ltd.

- TCL Technology Group Corp.

- Hitachi Ltd.

- Sharp Corporation

- Vestel Elektronik

- Daikin Industries Ltd.

- Gree Electric Appliances Inc.

- Godrej & Boyce Mfg. Co. Ltd.

- Nikai Group

- Super General Company

- Siemens AG (Built-in)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising disposable incomes

- 4.2.2 Rapid urbanisation & housing boom

- 4.2.3 Energy-efficiency regulations spur replacement demand

- 4.2.4 E-commerce penetration widens access

- 4.2.5 Localisation incentives under Vision 2030

- 4.2.6 Mega-project hospitality demand (NEOM, Expo City)

- 4.3 Market Restraints

- 4.3.1 Slower expatriate population growth

- 4.3.2 High import-linked logistics costs

- 4.3.3 District cooling & rooftop solar curb AC sales

- 4.3.4 Higher water-tariffs dampen washer/dishwasher usage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashing Machines

- 5.1.4 Washing Machines

- 5.1.5 Ovens

- 5.1.6 Air Conditioners

- 5.1.7 Other Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Technology

- 5.3.1 Smart Connected Major Appliances

- 5.3.2 Conventional Major Appliances

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Kuwait

- 5.4.4 Qatar

- 5.4.5 Oman

- 5.4.6 Bahrain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd.

- 6.4.2 LG Electronics Inc.

- 6.4.3 Whirlpool Corporation

- 6.4.4 BSH Hausgerate GmbH

- 6.4.5 Haier Group Corporation

- 6.4.6 Midea Group Co. Ltd.

- 6.4.7 Electrolux AB

- 6.4.8 Panasonic Corporation

- 6.4.9 Arcelik A.S.

- 6.4.10 Hisense Group Co. Ltd.

- 6.4.11 TCL Technology Group Corp.

- 6.4.12 Hitachi Ltd.

- 6.4.13 Sharp Corporation

- 6.4.14 Vestel Elektronik

- 6.4.15 Daikin Industries Ltd.

- 6.4.16 Gree Electric Appliances Inc.

- 6.4.17 Godrej & Boyce Mfg. Co. Ltd.

- 6.4.18 Nikai Group

- 6.4.19 Super General Company

- 6.4.20 Siemens AG (Built-in)

7 Market Opportunities & Future Outlook

- 7.1 Local assembly partnerships to bypass GCC import tariffs

- 7.2 Smart-retrofit kits for legacy appliances in rental stock