PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934623

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934623

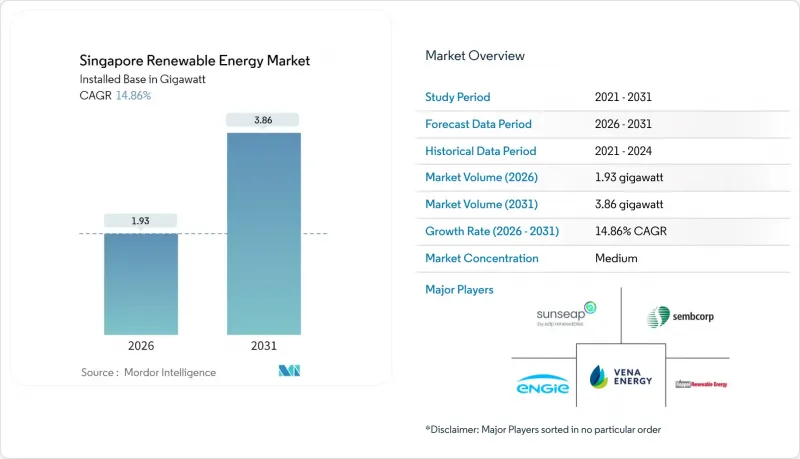

Singapore Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Singapore Renewable Energy Market size in 2026 is estimated at 1.93 gigawatt, growing from 2025 value of 1.68 gigawatt with 2031 projections showing 3.86 gigawatt, growing at 14.86% CAGR over 2026-2031.

Rising corporate demand for clean electricity, stringent net-zero rules, and region-wide power import plans are accelerating investment. Solar keeps its dominant role because rooftop, floating, and near-shore deployments are the most space-efficient options in a city-state with only 728 sq km of land. The roll-out of Southeast Asia's largest 285 MWh battery system, together with a solar forecasting model funded by SGD 6.2 million in R&D grants, shows how grid operators are tackling intermittency. Regional import targets of 6 GW by 2035 add supply diversity while anchoring Singapore's position as a cross-border clean-power hub. Intensifying sustainability mandates in the fast-growing data-center cluster further lifts long-term electricity offtake certainty for project developers.

Singapore Renewable Energy Market Trends and Insights

Net-zero 2050 & Green Plan 2030 targets intensifying renewable build-out

Singapore's legally binding net-zero target for 2050 and its updated goal of 45-50 million tCO2e by 2035 create an unambiguous demand signal. A USD 1 billion hydrogen-ready power plant with carbon-capture features reached final investment decision right after the February 2025 policy update. New generation units must now be at least 30% hydrogen-ready, forcing technology upgrades that favor renewable hybrids. The Energy Market Authority (EMA) has embedded emissions-based bidding criteria into its electricity market, tightening the cost of carbon-intensive output. Clear accountability mechanisms from the National Climate Change Secretariat have moved renewables from an optional efficiency gain to a compliance necessity. Long lead-time assets, such as floating solar or utility-scale storage, therefore secure faster permitting and cheaper green financing in the Singapore renewable energy market.

Declining solar-PV CAPEX amid high rooftop irradiance

Capital costs for Tier-1 modules fell another 7% between 2024 and 2025, intersecting with Singapore's steady 1,700 kWh/m2 annual irradiance to sharpen project economics. The government refrains from feed-in tariffs; instead, simplified credit schemes let owners sell excess power without bureaucratic delay. Private sector players delivered 63.5% of new capacity in 2024, proving that pure cost competitiveness now drives uptake. Solar forecasting linked to advanced weather analytics has trimmed balancing charges, lifting internal rates of return. With rooftop leases structured around 15- to 20-year payback horizons, commercial landlords increasingly treat photovoltaics as a core infrastructure upgrade rather than an ESG add-on in the Singapore renewable energy market.

Severe land scarcity for utility-scale assets

Only 23% of Singapore's surface is zoned for industrial or infrastructure use, constraining ground-mount projects. Developers request longer land-lease tenures to match 25-year asset lives, but state agencies often grant parcels for 15 years or less. The UNFCCC label of "alternative-energy-disadvantaged" underscores structural limits. Innovations such as vertical bifacial arrays on building facades and car-park canopy systems squeeze power into overlooked surfaces, yet aggregate contribution remains modest. Therefore, policy pivots to regional imports and floating solar maintains growth momentum in the Singapore renewable energy market.

Other drivers and restraints analyzed in the detailed report include:

- Corporate sustainability pledges pushing onsite solar PPAs

- Rapid roll-out of floating PV on inland reservoirs

- Intermittency & grid-stability challenges in a dense network

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar supplied 83.65% of 2025 capacity and is tracking a 15.38% CAGR to 2031, cementing its role as the backbone of the Singapore renewable energy market. Floating arrays on Tengeh, Bedok, and Pandan reservoirs alone unlock more than 200 MW that would otherwise require 150-200 ha of scarce land. Roof-mounted systems dominate industrial estates, leveraging 1,580 kWh/m2 irradiance and bifacial modules to deliver sub-grid pricing to factories and data centers. Wind remains marginal given 2-3 m/s average speeds and crowded coastal waters, while domestic hydropower is nonexistent due to flat topography. Waste-to-energy plants add 150 MW of bioenergy, capturing 3 M t of municipal waste and reducing landfill reliance. Geothermal and ocean energy sit in the research phase, hindered by low thermal gradients and minimal tidal ranges.

The Singapore renewable energy market share outside solar is therefore shaped by necessity rather than optional diversification. Hydropower imports from Laos supply 100 MW under a 25-year PPA; future links could arrive from Cambodia and Vietnam via the Low-Carbon Energy Imports Scheme. Building-integrated photovoltaics are gaining traction in marquee developments such as Marina Bay Sands, where facade-mounted systems meet Green Mark mandates. Collectively, non-solar technologies will retain a sub-20% share of installed capacity through 2031.

The Singapore Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- EDPR Sunseap

- Sembcorp Industries

- Keppel Renewable Energy

- Vena Energy

- ENGIE Southeast Asia

- TotalEnergies Distributed Generation SEA

- Cleantech Solar

- LYS Energy Group

- Terrenus Energy

- SP Group

- Solargy Pte Ltd

- SunPro Energies Pte Ltd

- REC Solar Holdings AS

- Keppel Seghers

- GreenYellow Singapore

- Blueleaf Energy

- Shell Energy Singapore

- JinkoSolar (Singapore)

- Trina Solar APAC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Net-zero 2050 & Green Plan 2030 targets intensifying renewable build-out

- 4.2.2 Declining solar-PV CAPEX amid high rooftop irradiance

- 4.2.3 Corporate sustainability pledges pushing onsite solar PPAs

- 4.2.4 Rapid roll-out of floating PV on inland reservoirs

- 4.2.5 Agrivoltaic pilots unlocking dual-use of scarce land

- 4.2.6 Surge in REC demand from hyperscale data-centre boom

- 4.3 Market Restraints

- 4.3.1 Severe land scarcity for utility-scale assets

- 4.3.2 Intermittency & grid-stability challenges in a dense network

- 4.3.3 Competition from low-carbon power imports under LTMS-P

- 4.3.4 Limited biomass feedstock after waste-to-energy prioritisation

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape (Government Policies & Regulations)

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 EDPR Sunseap

- 6.4.2 Sembcorp Industries

- 6.4.3 Keppel Renewable Energy

- 6.4.4 Vena Energy

- 6.4.5 ENGIE Southeast Asia

- 6.4.6 TotalEnergies Distributed Generation SEA

- 6.4.7 Cleantech Solar

- 6.4.8 LYS Energy Group

- 6.4.9 Terrenus Energy

- 6.4.10 SP Group

- 6.4.11 Solargy Pte Ltd

- 6.4.12 SunPro Energies Pte Ltd

- 6.4.13 REC Solar Holdings AS

- 6.4.14 Keppel Seghers

- 6.4.15 GreenYellow Singapore

- 6.4.16 Blueleaf Energy

- 6.4.17 Shell Energy Singapore

- 6.4.18 JinkoSolar (Singapore)

- 6.4.19 Trina Solar APAC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment