PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934698

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934698

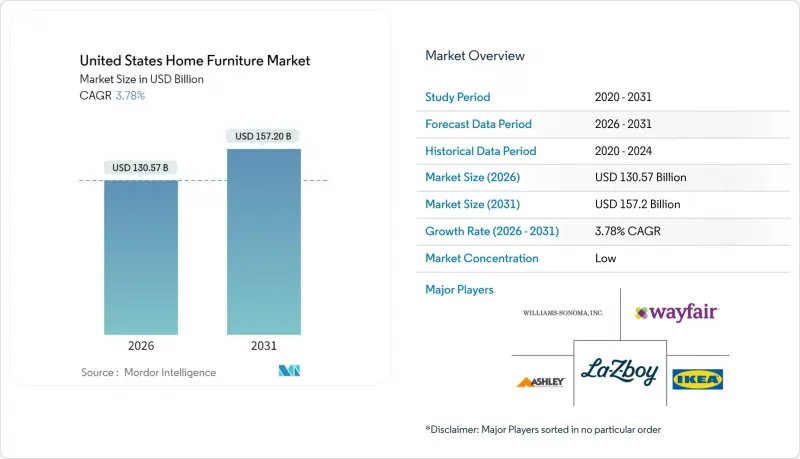

United States Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The US home furniture market was valued at USD 125.81 billion in 2025 and estimated to grow from USD 130.57 billion in 2026 to reach USD 157.2 billion by 2031, at a CAGR of 3.78% during the forecast period (2026-2031).

Growth rests on immigration-driven household formation, a remodeling boom, and rising demand for multi-functional furnishings that fit compact urban layouts. Housing turnover remains muted because mortgage rates stay elevated, encouraging owners to remodel and replace furniture instead of relocating. The US home furniture market benefits from sustained federal and state sustainability incentives that favor certified wooden products. Import competition and freight volatility continue to challenge margins even as supply-chain automation lowers production cost for leading manufacturers.

United States Home Furniture Market Trends and Insights

Improved Condo Affordability Spurs Demand for Modular, Multi-Functional Furniture

Condominium price corrections in several coastal markets enable first-time buyers to enter homeownership sooner. These smaller units require versatile furniture, and buyers spend 23% more on space-saving products than single-family counterparts. Millennials favor sectional sofas that separate into configurable pieces, fueling sectional demand across living-room lines. Manufacturers now bundle storage ottomans and convertible tables that shift from work to dining use within minutes. The US home furniture market gains incremental revenue as condo buyers furnish entire units in compressed purchasing windows.

Rising Home-Renovation Spending

Americans spent USD 603 billion on remodeling in 2024, and outlays are slated to reach USD 509 billion in 2025 despite tighter credit. Kitchen projects averaging USD 35,000 and bathroom remodels near USD 17,000 lead to coordinated furniture upgrades that complement new finishes. Elevated mortgage rates lock many owners into existing homes, multiplying renovation cycles across longer ownership periods. Baby Boomers account for the majority of projects and prioritize age-friendly furniture designs. Premium cabinets and dining pieces that match renovated interiors raise average selling prices in the US home furniture market.

Interest-Rate-Driven Housing-Market Slowdown Dampening Big-Ticket Sales

Existing-home transactions are projected to decline by 4.3% year-on-year in early 2025, reducing furniture purchases typically associated with home moves. Mortgage rates exceeding 6% are expected to deter budget-conscious buyers, impacting demand for complete bedroom and dining sets. Consumer confidence has reached decade lows, prompting households to delay discretionary upgrades. While retailers offer promotional financing to mitigate high prices, tighter credit standards have lowered acceptance rates. The US home furniture market faces a mixed scenario, with renovation-driven orders partially offsetting the decline in transaction-related demand.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of D2C Online Furniture Start-Ups with Free-Return Logistics

- Immigration-Led Household Formation Increasing First-Time Purchases

- Persistent Freight & Port Delays Lengthening Delivery Lead Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living Room and Dining Room Furniture accounted for 37.05% of the US home furniture market share in 2025, underscoring the central role of communal spaces. Open-concept designs encourage coordinated sectional seating, media consoles, and dining sets that deliver visual continuity across connected zones. Manufacturers integrate stain-resistant fabrics and modular footprints to meet lifestyle demands for flexibility and easy maintenance. Bedroom Furniture posts the fastest growth at a 4.11% CAGR as consumers upgrade mattresses, nightstands, and wardrobes that now double as remote-work backdrops. Sleep-wellness awareness fuels premium mattress pairs bundled with adjustable bases and tech-enabled headboards.

Living-room dominance persists because streaming entertainment keeps households at home more often, driving replacement cycles for sofas and recliners subjected to daily use. Dining categories regain momentum after pandemic disruptions as consumers resume in-home gatherings. Bedroom spending benefits from bundled financing that allows shoppers to complete suites rather than purchase piecemeal. Emerging niches such as convertible vanity-desk hybrids tap the work-from-home trend without sacrificing floor space. Across categories, the US home furniture market favors designs that pivot smoothly between leisure, dining, and professional needs.

Wood secured 62.10% of 2025 revenue thanks to tactile warmth, renewable sourcing, and favorable carbon narratives verified under FSC protocols. Solid-oak dining tables and walnut bedroom frames anchor premium lines aimed at buyers seeking heirloom durability. Plastic & Polymer pieces are growing at a 4.6% CAGR as recycled composites and bio-based resins shed historical stigma around perceived flimsiness. Injection molding now produces sleek silhouettes impossible with traditional joinery, opening mid-century design reinterpretations at accessible prices. Metal lines hold steady by capitalizing on loft aesthetics and outdoor durability.

Supply-chain shocks spur interest in domestic hardwoods, reducing dependency on volatile Asian plywood flows. Consumer education campaigns by the Sustainable Furnishings Council elevate awareness of low-VOC finishes and formaldehyde limits. Polymer innovators tout closed-loop recyclability, aligning with rising Gen Z eco-values. Hybrid constructions mix wood veneers with polymer cores, cutting cost without undermining surface authenticity. Material choices hence diversify while wood continues anchoring brand narratives around craftsmanship within the US home furniture market size.

The US Home Furniture Market Report is Segmented by Product (Living Room and Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, Online, Other Distribution Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ashley Furniture Industries

- Inter IKEA Holding B.V.

- Williams-Sonoma Inc. (Pottery Barn, West Elm)

- Wayfair Inc.

- La-Z-Boy Inc.

- American Signature Inc. (Value City)

- RH (Restoration Hardware)

- Ethan Allen Interiors

- Bassett Furniture Industries

- Flexsteel Industries

- Haverty Furniture Companies

- Hooker Furnishings Corp.

- Sauder Woodworking Co.

- American Woodmark Corp.

- Sleep Number Corp.

- Tempur Sealy International

- Casper Sleep Inc.

- Rooms To Go Inc.

- Crate & Barrel Holdings

- Amazon.com Inc. (Furniture category)

- Walmart Inc.

- Overstock.com Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Improved Condo Affordability Spurs Demand for Modular, Multi-Functional Furniture

- 4.2.2 Rising Home-Renovation Spending

- 4.2.3 Rapid Growth Of D2C Online Furniture Start-Ups With Free-Return Logistics

- 4.2.4 Immigration-Led Household Formation Increasing First-Time Furniture Purchases

- 4.2.5 Federal/Provincial Sustainability Rebates Accelerating Uptake Of Eco-Certified Wooden Products

- 4.2.6 AI-powered AR/VR visualization tools boosting conversion

- 4.3 Market Restraints

- 4.3.1 Interest-Rate-Driven Housing-Market Slowdown Dampening Big-Ticket Furniture Sales

- 4.3.2 Persistent Freight & Port Delays Lengthening Delivery Lead-Times

- 4.3.3 US Import Price Competition Under USMCA Squeezing Domestic Margins

- 4.3.4 Rising import penetration despite Section 301 tariffs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Living Room and Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, warehouse clubs, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 Northeast

- 5.5.2 Southeast

- 5.5.3 Midwest

- 5.5.4 Southwest

- 5.5.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Ashley Furniture Industries

- 6.4.2 Inter IKEA Holding B.V.

- 6.4.3 Williams-Sonoma Inc. (Pottery Barn, West Elm)

- 6.4.4 Wayfair Inc.

- 6.4.5 La-Z-Boy Inc.

- 6.4.6 American Signature Inc. (Value City)

- 6.4.7 RH (Restoration Hardware)

- 6.4.8 Ethan Allen Interiors

- 6.4.9 Bassett Furniture Industries

- 6.4.10 Flexsteel Industries

- 6.4.11 Haverty Furniture Companies

- 6.4.12 Hooker Furnishings Corp.

- 6.4.13 Sauder Woodworking Co.

- 6.4.14 American Woodmark Corp.

- 6.4.15 Sleep Number Corp.

- 6.4.16 Tempur Sealy International

- 6.4.17 Casper Sleep Inc.

- 6.4.18 Rooms To Go Inc.

- 6.4.19 Crate & Barrel Holdings

- 6.4.20 Amazon.com Inc. (Furniture category)

- 6.4.21 Walmart Inc.

- 6.4.22 Overstock.com Inc.

7 Market Opportunities & Future Outlook

- 7.1 Customization demand reshaping modular furniture design