PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934700

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934700

Asia-Pacific Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

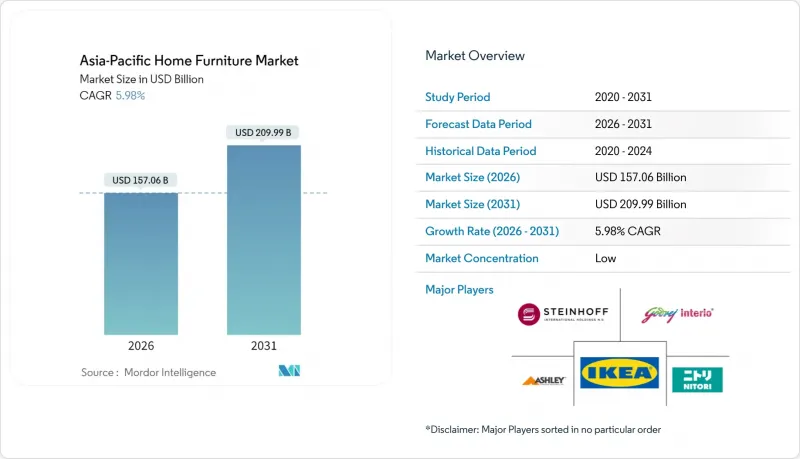

The Asia-Pacific Home Furniture Market is expected to grow from USD 148.20 billion in 2025 to USD 157.06 billion in 2026 and is forecast to reach USD 209.99 billion by 2031 at 5.98% CAGR over 2026-2031.

Rising urban populations, deeper internet penetration, and an expanding middle class propel sustained demand for functional yet aesthetically pleasing furnishings. Digital-native shoppers accelerate channel shifts toward e-commerce even as store-based retailers refine omnichannel models to defend share. Manufacturers seek supply-chain resilience by diversifying production beyond China into Vietnam, Indonesia and Malaysia while upgrading factories to meet stricter emission rules. Government-led affordable-housing programs across India, China, and the Philippines, coupled with premiumization trends in Japan, South Korea, and Australia, create a dual-track growth pattern that supports the long-term outlook.

Asia-Pacific Home Furniture Market Trends and Insights

Rising Disposable Incomes and Rapid Urbanization

Urban residents are projected to exceed 60% of Asia-Pacific's population by 2030, intensifying demand for space-efficient and multifunctional furniture solutions. Rising middle-income households in India, set to climb from 18% to 37% of total households by 2030, underpin higher spending on durable household goods. China's urban housing policies emphasize improved living standards, bolstering replacement sales as dwellers seek quality upgrades. Vietnam and Indonesia follow similar paths as secondary cities urbanize and consumers adopt branded furnishings to signal social status. Collectively, these demographic shifts lift baseline demand across price tiers in the Asia-Pacific home furniture market.

Expansion of E-commerce Furniture Platforms

Asia-Pacific is the world's largest e-commerce region; furniture buyers increasingly rely on digital storefronts that pair rich product content with augmented-reality visualization tools offered by leading retailers. Mobile wallets facilitate frictionless payments, and regional logistics hubs shorten delivery windows, improving conversion rates. Cross-border marketplaces extend assortment to tier-2 and tier-3 cities where organized furniture retail remains nascent. Brand owners shift media spending toward social commerce and influencer collaborations that resonate with design-conscious millennials. As omnichannel strategies mature, retailers integrate click-and-collect and ship-from-store capabilities to balance convenience with experiential showrooms.

Volatility in Timber and Metal Prices

China's log imports fell 5% in volume in early 2025 as suppliers faced tighter quotas, pushing up raw-material costs for panel producers. Australia's domestic sawmills meet barely two-thirds of structural timber demand, keeping import premiums elevated despite recent easing. Malaysian rubberwood shortages prompt furniture associations to prioritize local allocation over exports, constraining downstream production. Fluctuating aluminum and steel prices further squeeze margins on hardware-intensive categories such as adjustable desks. To mitigate risk, manufacturers adopt multi-species sourcing, laminated composites and design simplification that reduces metal content.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Residential Construction and Renovation

- Increasing Demand for Multifunctional and Modular Designs

- Supply-Chain Bottlenecks for Imported Hardware

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living and dining furniture represented 34.72% of Asia-Pacific home furniture market share in 2025, benefiting from cultural emphasis on family gatherings. Home office lines are projected to post the quickest 6.55% CAGR as hybrid work practices become permanent across white-collar sectors. Height-adjustable desks, ergonomic chairs and cable-management systems anchor this surge, while technology integration such as wireless charging lifts perceived value. Bedroom and kitchen categories retain steady demand tied to household formation, with modular kitchen systems gaining ground in condo developments. Outdoor living spaces are another bright spot as urban consumers invest in balconies and rooftop terraces.

Innovation centers on adaptable configurations that merge work and leisure, aligning with emerging wellness priorities. Global brands market chairs with pressure-mapping sensors, and regional specialists introduce fold-away workstations for micro-apartments. Upholstery suppliers develop stain-resistant fabrics to withstand multi-use environments, adding durability without compromising aesthetics. Marketing campaigns stress lifestyle storytelling over technical specifications to attract younger buyers. As a result, the Asia-Pacific home furniture market maintains a balanced product mix that supports both high-volume staples and niche growth segments.

Wood retained a dominant 54.56% market share in 2025, supported by abundant plantation resources and consumer affinity for natural finishes. Nevertheless, recycled plastics and polymer composites are forecast to expand at a 7.12% CAGR due to cost and moisture-resistance advantages. Engineered bamboo panels gain institutional acceptance after achieving ENF formaldehyde-free ratings in China's GB 18584-2024 standard. Japan's F4-Star certification remains the strictest global benchmark at 0.3 mg/L emissions, reinforcing demand for low-VOC substrates. Furniture makers increasingly blend metal frames with wood veneers and bio-resins to balance strength, weight, and sustainability.

Material innovation responds to twin pressures of resource scarcity and regulation. Plantation teak, rubberwood, and acacia chains adopt blockchain tracing to prove legal harvests as the EU Deforestation Regulation intensifies due diligence audits. Water-borne coatings replace solvent-based lacquers to meet 10 mg/m3 TVOC thresholds in spray booths. Fire-retardant treatments developed by Korean researchers enhance safety for hospitality projects without degrading aesthetics. These shifts favor vertically integrated producers able to control fiber inputs and invest in advanced finishing lines. Consequently, sustainability differentiates premium brands while lowering risk of regulatory non-compliance.

The Asia-Pacific Home Furniture Market Report is Segmented by Product (Living Room and Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, and More), Material (Wood, Metal, Plastic and Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, Online, Other Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA Group

- Ashley Furniture Industries

- Nitori Holdings

- Godrej Interio

- Freedom (Steinhoff Asia Pacific)

- Jiangsu Yangzi Furniture

- Daikin Home and Living

- Kimball International

- HNI Corp

- Livspace

- Urban Ladder

- Wayfair

- Herman Miller

- Steelcase

- Stanley Furniture

- Zuoyou Furniture

- Kuka Home

- LIXIL

- IKEA TaskRabbit

- Muji Furniture

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes and Rapid Urbanization

- 4.2.2 Expansion of E-Commerce Furniture Platforms

- 4.2.3 Growth in Residential Construction and Renovation

- 4.2.4 Increasing Demand For Multifunctional and Modular Designs

- 4.2.5 Adoption of Engineered Bamboo and Other Eco Materials

- 4.2.6 Government-Backed Affordable-Housing Programs

- 4.3 Market Restraints

- 4.3.1 Volatility in Timber and Metal Prices

- 4.3.2 Supply-Chain Bottlenecks for Imported Hardware

- 4.3.3 Rising Anti-Dumping Duties Within Asia-Pacific Trade Blocs

- 4.3.4 Heightened Fire-Safety and VOC Emission Standards

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size and Growth Forecasts

- 5.1 By Product

- 5.1.1 Living Room and Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic and Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores

- 5.4.3 Online

- 5.4.4 Other Channels

- 5.5 By Geography

- 5.5.1 India

- 5.5.2 China

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 South Korea

- 5.5.6 South-East Asia

- 5.5.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 IKEA Group

- 6.4.2 Ashley Furniture Industries

- 6.4.3 Nitori Holdings

- 6.4.4 Godrej Interio

- 6.4.5 Freedom (Steinhoff Asia Pacific)

- 6.4.6 Jiangsu Yangzi Furniture

- 6.4.7 Daikin Home and Living

- 6.4.8 Kimball International

- 6.4.9 HNI Corp

- 6.4.10 Livspace

- 6.4.11 Urban Ladder

- 6.4.12 Wayfair

- 6.4.13 Herman Miller

- 6.4.14 Steelcase

- 6.4.15 Stanley Furniture

- 6.4.16 Zuoyou Furniture

- 6.4.17 Kuka Home

- 6.4.18 LIXIL

- 6.4.19 IKEA TaskRabbit

- 6.4.20 Muji Furniture

7 Market Opportunities and Future Outlook

- 7.1 Modular, Multifunctional and Space-Saving Solutions

- 7.2 Premiumization in Outdoor and Patio Living Spaces