PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934706

Singapore Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

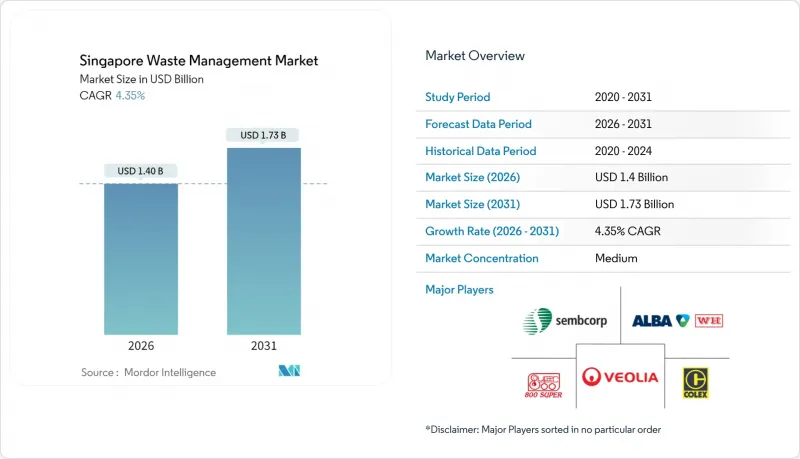

The Singapore Waste Management Market is expected to grow from USD 1.34 billion in 2025 to USD 1.4 billion in 2026 and is forecast to reach USD 1.73 billion by 2031 at 4.35% CAGR over 2026-2031.

This steady expansion reflects Singapore's pivot toward circular-economy practices that prize material recovery over disposal. Tight land availability reinforces investment in waste-to-energy (WTE) assets, while the Resource Sustainability Act (RSA) and the Zero-Waste Masterplan create compulsory demand for recycling capacity across food, packaging, and electronic waste streams. Private operators gain ground as public agencies outsource specialized services, and national hydrogen ambitions underpin research into waste-derived fuels. Rising operating costs, fuel, labor, and carbon taxes are nudging the market toward automation, data-driven route optimization, and integrated processing complexes.

Singapore Waste Management Market Trends and Insights

Zero-Waste Masterplan and Circular-Economy Mandates

The Zero-Waste Masterplan sets a mandatory 70% national recycling rate and orders a 30% cut in landfill waste by 2030, reshaping the cash-flow logic of the Singapore waste management market. Three priority streams, e-waste, food waste, and packaging, together generate more than 40% of total waste, so compliance drives demand for sorting, composting, and advanced recycling kits. The RSA makes food-waste segregation compulsory for large premises from 2024, funneling business toward on-site digesters and bio-pulpers. A new build must now reserve space for such equipment, guaranteeing pipeline projects for technology vendors. Revenue predictability rises because enforcement includes mandatory monthly reporting and escalating penalties. Operators that supply integrated WTE and water recovery, as seen in the Tuas Nexus concept, sit in the policy sweet spot.

Limited Landfill Capacity Driving Incineration and Recycling Demand

Semakau Landfill may reach its design limit by 2035, so the island republic must divert waste or miniaturize it. Four WTE plants currently vaporize 3.8 million t annually and supply 2% of the grid, while the 2021-commissioned TuasOne unit processes 3,600 t per day and delivers 120 MW to the network. The coming Integrated Waste Management Facility (IWMF) at Tuas Nexus will be able to handle 5,800 t per day, becoming the largest single waste complex worldwide. Each incremental tonne incinerated frees scarce land, so feedstock certainty underwrites private-sector appetite for long-term build-operate-transfer deals.

Scarcity of Land for New Facilities

Competing land uses raise opportunity costs, and only a handful of industrial plots remain zoned for odorous or potentially hazardous activities. Multi-story or subterranean designs can compress footprints but raise capex and O&M intricacy. Operators must design for higher throughput in the same envelope, which in turn raises technology risk and insurance premiums. Recycling centers need lay-down yards for baled goods, yet affordable space near collection zones is scarce, limiting new entrants.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Extended Producer Responsibility Schemes

- NEA Incentive Grants Accelerating Private-Sector Recycling Capacity

- High Capital Expenditure of Advanced Treatment Assets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential streams captured a commanding 39.12% share of the Singapore waste management market in 2025 as Housing Development Board estates and condominiums generated steady daily tonnage. Commercial waste is the fastest riser, expanding at a 6.31% CAGR on the back of RSA-mandated food-waste segregation, electronics take-back kiosks, and green-lease requirements that compel malls to file waste-reduction plans. The residential backbone ensures base-load demand for public-sector collection routes, yet private haulers now court hotels and business parks with pay-as-you-throw schemes that bundle composters and real-time bin-level sensors.

Growth in the commercial slice also reflects aggressive service diversification. Chain eateries have begun installing 2 t-per-day digesters sourced from local start-ups such as Westcom Bio-Chem, shrinking disposal volumes at source. Office towers adopt Bluetooth-enabled compactors to unlock data that feeds ESG dashboards. Because these innovations go beyond traditional curbside pickup, operators secure higher-margin contracts that underpin the future value of the Singapore waste management market.

Collection, transport, and sorting still represent 47.15% of 2025 revenue, embodying the logistics backbone of the Singapore waste management market. Trucks make short urban hops to transfer stations, supported by Telematics that cut idle time. Yet the recycling and resource-recovery cluster is on a 6.42% CAGR trajectory through 2031. One example is REMEX's bottom-ash processing plant that recovers 90% of ferrous metals from incinerator ash, monetizing an otherwise wasted stream.

Technology upgrades lift margins in recycling. Shell's new pyrolysis oil upgrader turns 50,000 t of hard-to-recycle plastics into cracker feedstock at Pulau Bukom, signaling how resource recovery will dominate incremental dollar value. These moves reposition Singapore as a regional node for high-value circular materials, and they embed the Singapore waste management market size into the petrochemical supply chain.

The Singapore Waste Management Report is Segmented by Source (Residential, Commercial, Industrial, and More), by Service Type (Collection, Transportation, Sorting & Segregation, and More), by Waste Type (Municipal Solid, Industrial Hazardous, E-Waste, Plastic, and More), and by by Contract Model (Private and Public). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SembWaste (Sembcorp)

- Veolia Singapore

- ALBA W&H Smart City

- Colex Holdings Ltd.

- 800 Super Holdings

- ECO Industrial Environmental Engineering

- Wah & Hua Pte Ltd.

- TES-AMM Singapore

- Ramky Cleantech Services

- Enviro-Hub Holdings

- Cleanway Disposal Services

- ChemCollect Services

- Envipure

- Rictec Pte Ltd.

- CH E-Recycling

- Indsutrial Wastes Auction

- Citic Envirotech

- IUT Global

- ENVAC Singapore

- Zero Waste SG (Services arm)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Zero-Waste Masterplan & Circular Economy mandates

- 4.2.2 Mandatory Extended Producer Responsibility (EPR) schemes

- 4.2.3 Limited landfill capacity driving incineration & recycling demand

- 4.2.4 NEA incentive grants accelerating private-sector recycling capacity

- 4.2.5 Pneumatic Waste Conveyance Systems (PWCS) deployment momentum

- 4.2.6 Tuas Nexus waste-to-hydrogen pilot projects

- 4.3 Market Restraints

- 4.3.1 High capex of advanced treatment infrastructure

- 4.3.2 Scarcity of land for new facilities

- 4.3.3 Rising operating costs (labour, fuel, carbon tax)

- 4.3.4 Volatile recyclables prices in a small domestic market

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Source

- 5.1.1 Residential

- 5.1.2 Commercial (retail, office, etc.)

- 5.1.3 Industrial

- 5.1.4 Medical (Health and Pharmaceutical)

- 5.1.5 Construction & Demolition

- 5.1.6 Others (institutional, agricultural, etc)

- 5.2 By Service Type

- 5.2.1 Collection, Transportation, Sorting & Segregation

- 5.2.2 Disposal / Treatment

- 5.2.2.1 Landfill

- 5.2.2.2 Recycling & Resource Recovery

- 5.2.2.3 Incineration & Waste-to-Energy

- 5.2.2.4 Others (Chemical Treatment, Composting, etc.)

- 5.2.3 Others (Consulting, Audit & Training, etc.)

- 5.3 By Waste Type

- 5.3.1 Municipal Solid Waste

- 5.3.2 Industrial Hazardous Waste

- 5.3.3 E-waste

- 5.3.4 Plastic Waste

- 5.3.5 Biomedical Waste

- 5.3.6 Construction & Demolition Waste

- 5.3.7 Agricultural Waste

- 5.3.8 Other Specialized Waste (radio active, etc)

- 5.4 By Contract Model

- 5.4.1 Public

- 5.4.2 Private

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 SembWaste (Sembcorp)

- 6.4.2 Veolia Singapore

- 6.4.3 ALBA W&H Smart City

- 6.4.4 Colex Holdings Ltd.

- 6.4.5 800 Super Holdings

- 6.4.6 ECO Industrial Environmental Engineering

- 6.4.7 Wah & Hua Pte Ltd.

- 6.4.8 TES-AMM Singapore

- 6.4.9 Ramky Cleantech Services

- 6.4.10 Enviro-Hub Holdings

- 6.4.11 Cleanway Disposal Services

- 6.4.12 ChemCollect Services

- 6.4.13 Envipure

- 6.4.14 Rictec Pte Ltd.

- 6.4.15 CH E-Recycling

- 6.4.16 Indsutrial Wastes Auction

- 6.4.17 Citic Envirotech

- 6.4.18 IUT Global

- 6.4.19 ENVAC Singapore

- 6.4.20 Zero Waste SG (Services arm)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment