PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937341

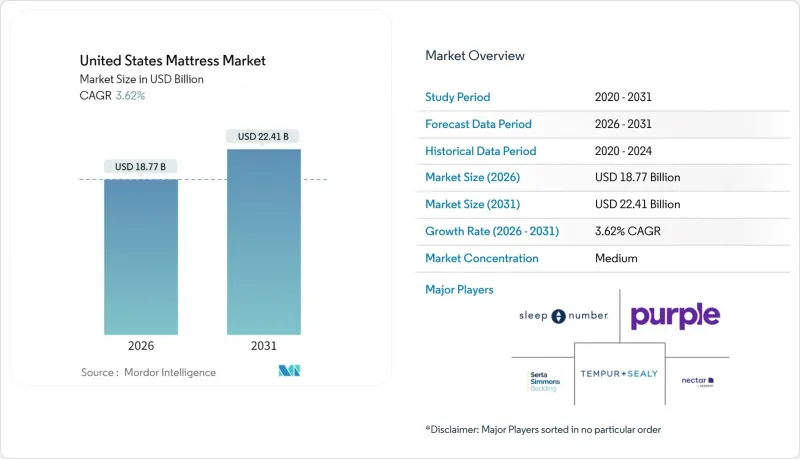

United States Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Mattress Market is expected to grow from USD 18.11 billion in 2025 to USD 18.77 billion in 2026 and is forecast to reach USD 22.41 billion by 2031 at 3.62% CAGR over 2026-2031.

Demand now hinges more on replacement cycles, housing construction, and technology-focused sleep upgrades than on first-time purchases. Wellness-centric positioning, smart features, and on-shore manufacturing investments are redefining competitive advantages across the United States mattress market, while consolidation and federal scrutiny temper unchecked expansion. Elevated input costs and stringent disposal regulations pose near-term headwinds, but demographic shifts and product innovation sustain a steady medium-term outlook for the United States mattress market.

United States Mattress Market Trends and Insights

Rising Housing Starts & Home-Furnishing Spend

Single-family housing starts are projected at 1.01 million units in 2025. New homeowners typically replace mattresses within 18 months, creating a reliable volume pipeline for the United States mattress market. Remodeling outlays are increasing 5% annually, further lifting premium replacement demand. Equity gains correlate with a higher willingness to upgrade to smart or hybrid models rather than standard innerspring units. Consumer confidence surveys show 71% of potential buyers are ready to pay mortgage premiums above prevailing rents, signaling sustained furnishing expenditure. These dynamics particularly favor the memory-foam and hybrid sub-segments that promise better pressure relief and climate control.

Rapid Proliferation of "Bed-in-a-Box" D2C Model

Direct-to-consumer brands have rewritten distribution economics by collapsing supply chains and eliminating showroom overheads. Online interest in mattress buying rose from 27% in 2016 to 47% in 2020. An average online ticket of USD 303 on Amazon contrasts sharply with USD 1,194 in traditional stores, demonstrating margin reallocation rather than compression. Free 365-night trials and expedited white-glove delivery have neutralized tactile-testing barriers. Established manufacturers such as Serta Simmons launched dedicated online-only lines in 2025, underlining the D2C playbook's endurance. Regional fulfillment centers now achieve two-day delivery across most metropolitan ZIP codes, meeting consumer immediacy expectations.

Raw-Material (Foam & Steel) Price Volatility

Supply chain disruptions have created unprecedented cost pressures, with foam prices increasing 50% and steel coil materials experiencing similar inflation, while container shipping costs surged from USD 3,400 to over USD 10,000 per container. Steel coil costs traced a similar trajectory. Successive price increases throughout 2024 kept revenue stable but risked demand elasticity. Producers with diversified domestic suppliers mitigated shocks, unlike smaller firms reliant on spot imports. Tariffs on Canadian and Mexican steel, plus residual levies on Chinese foam, further pressure cost structures. Margin compression is likely to linger until commodity indices normalize. Companies with diversified supply chains and domestic sourcing capabilities gain competitive advantages, while smaller manufacturers face existential pressures from sustained input cost inflation.

Other drivers and restraints analyzed in the detailed report include:

- Growing Incidence of Back-Pain Driving Premium Mattress Demand

- Product Innovation in Memory-Foam & Hybrid Constructions

- Market Saturation & Longer Replacement Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Innerspring mattresses held 44.72% of the United States mattress market share in 2025, underscoring the value placed on edge support and bounce among older buyers. Foam products, especially memory foam, are projected to grow at a 4.30% CAGR through 2031, the highest within the United States mattress market. Hybrid adaptations combining coils and advanced foams are narrowing the performance gap, encouraging incumbents to pivot portfolios. Latex maintains a premium niche, appealing to eco-conscious consumers with natural material preferences.

Aging demographics still gravitate toward firmer feel and easier ingress, sustaining core innerspring demand. Conversely, newly formed households-often in smaller urban dwellings opt for roll-packed foam units that simplify delivery. Smart variants overwhelmingly use foam cores because embedded sensors and actuators integrate more readily into homogeneous material structures. Consequently, manufacturers segment marketing, traditional support for legacy buyers, cooling foams and sleep-tracking hybrids for tech-savvy cohorts, maximizing cross-selling. Foam segment leadership in growth rates indicates successful resolution of historical heat retention issues through gel infusion and phase-change materials, while innerspring manufacturers increasingly adopt hybrid approaches to maintain relevance in evolving market dynamics.

Queen-size captured 44.65% of the United States mattress market in 2025 and is forecast to expand at a 3.74% CAGR, the fastest among all sizes. Urban condos and suburban master bedrooms are routinely designed around queen dimensions, reinforcing default demand. King sizes command prestige positioning in luxury housing, while twin and full serve youth and hospitality turnover channels. Custom and specialty sizes cater to niche applications, including RV markets, adjustable bed frames, and therapeutic requirements, though volumes remain limited compared to standard configurations.

Smart launches typically roll out in queen formats first, leveraging the highest installed base for network effects. The universality of queen sizing simplifies supply-chain SKUs and marketing spend. Even as replacement cycles lengthen, queen refresh volumes remain resilient because married and cohabiting couples prioritize comfort upgrades earlier than single sleepers in smaller beds. The size category's stability suggests limited disruption potential from alternative configurations, with growth driven primarily by replacement cycles and new household formation rather than consumer switching between size preferences.

The United States Mattress Market Report is Segmented by Product Type (Innerspring/Coil, Foam Including Memory Foam, Latex, Hybrid, Other Mattress Types), Mattress Size (Single-Size, Double-Size, Queen-Size, King-Size, Custom & Specialty Sizes), End User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B/Project), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tempur Sealy International Inc.

- Serta Simmons Bedding LLC

- Sleep Number Corporation

- Purple Innovation Inc.

- Casper Sleep Inc.

- Resident (Home of Nectar, DreamCloud)

- Saatva Inc.

- Helix Sleep LLC

- Brooklyn Bedding LLC

- Avocado Green Brands LLC

- Tuft & Needle (SSB)

- Ashley Furniture Industries LLC

- King Koil Mattress Co.

- Spring Air International

- The Original Mattress Factory

- Leesa Sleep LLC

- GhostBed (Nature's Sleep)

- Bear Mattress

- Cocoon by Sealy

- Zinus Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Housing Starts & Home-Furnishing Spend

- 4.2.2 Rapid Proliferation of "Bed-In-A-Box" D2C Model

- 4.2.3 Growing Incidence of Back-Pain Driving Premium Mattress Demand

- 4.2.4 Product Innovation In Memory-Foam & Hybrid Constructions

- 4.2.5 Anti-Dumping Duties Boosting On-Shore Production

- 4.2.6 Integration of Sleep-Data Platforms With Wellness Insurers

- 4.3 Market Restraints

- 4.3.1 Raw-Material (Foam & Steel) Price Volatility

- 4.3.2 Market Saturation & Longer Replacement Cycles

- 4.3.3 FTC Scrutiny of Tempur-Sealy/Mattress Firm Deal

- 4.3.4 Stricter Disposal Rules For Polyurethane Foam

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

- 4.8 Insights on Consumer Behavior Analysis and Preferences in the Market (key motivational factors, preferred sales channel, demographics, key influencers and decision-makers)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Innerspring / Coil

- 5.1.2 Foam (including memory foam)

- 5.1.3 Latex

- 5.1.4 Hybrid

- 5.1.5 Other Mattress Types

- 5.2 By Mattress Size

- 5.2.1 Single-size Mattress

- 5.2.2 Double-size Mattress

- 5.2.3 Queen-size Mattress

- 5.2.4 King-size Mattress

- 5.2.5 Custom & Specialty Sizes

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Mass Merchandisers

- 5.4.1.2 Specialty Mattress Stores (including exclusive brand outlets)

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 Southeast

- 5.5.4 Southwest

- 5.5.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tempur Sealy International Inc.

- 6.4.2 Serta Simmons Bedding LLC

- 6.4.3 Sleep Number Corporation

- 6.4.4 Purple Innovation Inc.

- 6.4.5 Casper Sleep Inc.

- 6.4.6 Resident (Home of Nectar, DreamCloud)

- 6.4.7 Saatva Inc.

- 6.4.8 Helix Sleep LLC

- 6.4.9 Brooklyn Bedding LLC

- 6.4.10 Avocado Green Brands LLC

- 6.4.11 Tuft & Needle (SSB)

- 6.4.12 Ashley Furniture Industries LLC

- 6.4.13 King Koil Mattress Co.

- 6.4.14 Spring Air International

- 6.4.15 The Original Mattress Factory

- 6.4.16 Leesa Sleep LLC

- 6.4.17 GhostBed (Nature's Sleep)

- 6.4.18 Bear Mattress

- 6.4.19 Cocoon by Sealy

- 6.4.20 Zinus Inc.

7 Market Opportunities & Future Outlook

- 7.1 Smart-Sleep Ecosystems

- 7.2 Sustainable & Circular Materials

- 7.3 Hospitality Re-furnishing Cycle

- 7.4 Untapped B2B Project Contracts