PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937372

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937372

Vietnam Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

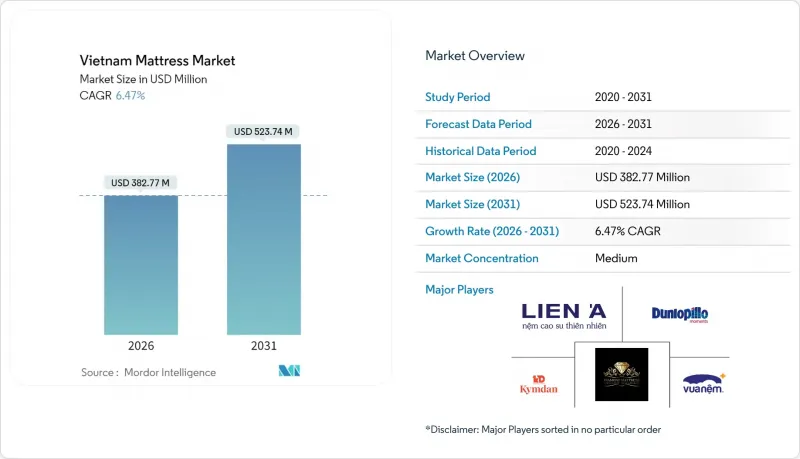

The Vietnam mattress market is expected to grow from USD 359.5 million in 2025 to USD 382.77 million in 2026 and is forecast to reach USD 523.74 million by 2031 at 6.47% CAGR over 2026-2031.

Expanding middle-class incomes, a deepening focus on sleep health, and accelerating hospitality construction together underpin the growth outlook of the Vietnam mattress market. E-commerce's rapid infiltration of Tier-2 and Tier-3 cities widens consumer reach, while tourism-led hotel openings amplify commercial demand. Supply-chain localization and natural-latex sourcing from within ASEAN help manufacturers ease import exposure and comply with new environmental rules. Firms that combine omnichannel retail, certified sustainable materials, and flexible production are positioned to capture the next leg of expansion within the Vietnam mattress market.

Vietnam Mattress Market Trends and Insights

Rising Disposable Incomes & Sleep-Health Awareness

Vietnam's enlarging middle class is directing more of its budget toward wellness categories, and better sleep has turned into a visible lifestyle priority. Consumers now expect an 8-10-year mattress lifespan and willingly pay premiums for certified comfort and durability. Domestic producer Kymdan markets 100% natural-latex models with warranties up to 25 years, validating buyers' readiness for higher upfront costs. Government stimulus that lifts household spending further magnifies this trend. Manufacturers responding with ergonomic designs and low-VOC certifications are capturing loyalty inside the Vietnam mattress market. Health consciousness is driving demand for certified products, with consumers increasingly seeking mattresses with Greenguard and UL certifications for environmental safety and spinal support benefits. The shift toward premium segments creates opportunities for manufacturers to differentiate through advanced materials, ergonomic design, and health-focused marketing strategies that resonate with Vietnam's evolving consumer priorities.

Booming Domestic Hospitality Pipeline

Hotel construction is surging, led by projects such as Tru by Hilton's 14-property rollout and large coastal resorts capable of hosting thousands of guests. Each new room requires multiple mattress sets across its life cycle, directly enlarging commercial-segment volumes. International hotel chains impose rigorous supplier standards, rewarding ISO-certified manufacturers that can meet bulk orders on tight timelines. Developers' preference for queen- and king-size beds is reinforcing growth in larger mattress formats. Central Vietnam, home to many beachfront projects, is emerging as a hotspot for contract procurement. The geographic concentration of hotel developments along Vietnam's central coast positions this region for accelerated mattress market growth, supported by tourism infrastructure investments and improved accessibility.

Fragmented Foam Supply Inflating Input Costs

Vietnam relies heavily on imported polyurethane feedstock, leaving manufacturers susceptible to currency swings and freight disruptions. Small and mid-sized firms often purchase through multiple distributors, accepting mark-ups that compress margins. In contrast, large players such as Pearl Polyurethane Systems doubled local capacity to 20,000 tons per year in 2025, improving negotiation leverage and costs. Until domestic chemical production scales further, foam-price volatility will challenge stable pricing in the Vietnam mattress market. Long-term contracts with upstream suppliers and recycling initiatives offer partial relief. Raw material price volatility affects different mattress segments disproportionately, with budget-conscious consumers becoming more price-sensitive during inflationary periods, potentially slowing market growth in price-competitive segments. The lack of integrated foam production capabilities within Vietnam necessitates import dependency, exposing manufacturers to currency fluctuations and international supply chain disruptions that can rapidly erode profitability margins.

Other drivers and restraints analyzed in the detailed report include:

- Rapid E-commerce Penetration into Tier-2/3 Cities

- Anti-dumping Duties on Chinese Mattresses Redirecting FDI

- Low Replacement Cycles in Rural Areas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Memory-foam models secured a 33.95% Vietnam mattress market share in 2025, mirroring growing recognition of pressure-relief and temperature-adaptation benefits in humid climates. Hybrid designs, blending pocketed coils with foam comfort layers, are forecast to register a 6.76% CAGR through 2031, the fastest among all categories. Traditional innerspring units stay prevalent in budget-sensitive and rural segments, while latex variants leverage Vietnam's abundant rubber supply to cultivate a sustainability narrative. The Vietnam mattress market size for hybrid products is expected to widen as consumers demand balanced support without forgoing contouring comfort. Regulatory pushes toward recyclable components further accelerate interest in latex and modular hybrids.

Continued R&D, including new benchmark testing from Dow and GoodBed, should standardize firmness and durability ratings, informing shopper choices and spurring premium product uptake. Memory-foam manufacturers are adding open-cell structures and gel infusions to enhance airflow within Vietnam's tropical environment. Hybrid players tout motion isolation and edge support, appealing to couples upgrading from economy models. Latex producers promote hypoallergenic properties supported by certifications such as OEKO-TEX Standard 100. As differentiation sharpens, each sub-segment pursues distinct branding to capture its slice of the Vietnam mattress market.

Queen-size units accounted for 34.20% of Vietnam mattress market share in 2025 thanks to the prevalence of two-bedroom apartments in Hanoi and Ho Chi Minh City. King-size demand is rising fastest with a 7.31% CAGR, fueled by income growth and a preference for spacious sleep surfaces among young families. Double and single sizes retain relevance in student housing, worker dormitories, and smaller urban dwellings. Developers of high-end condos report that mattress dimensions influence buyer perceptions of overall unit luxury. Consequently, larger formats are gaining floor-plan allocation in new projects, expanding the Vietnam mattress market size dedicated to king variants.

E-commerce allows distant consumers to order oversized mattresses without local inventory limits, although last-mile delivery still poses staircase and elevator challenges. Some brands now offer roll-packed king sizes that fit service elevators, mitigating logistics friction. Hotels along Vietnam's central coast increasingly specify king-size beds in premium rooms, sustaining bulk procurement. Manufacturers must align production schedules with these size shifts to optimize inventory turns. Overall, mattress dimensions are evolving in step with rising living standards and larger dwelling footprints across the Vietnam mattress market.

The Vietnam Mattress Market Report is Segmented by Product Type (Innerspring/Coil, Foam Including Memory Foam, Latex, Hybrid, Other Mattress Types), Mattress Size (Single-Size, Double-Size, Queen-Size, King-Size, Custom & Specialty Sizes), End User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B/Project), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AEGONO

- Amando

- Dongsuh Furniture

- Dunlopillo Vietnam

- Everpia Everon

- Hava's

- Kim Cương Mattress

- KingKoil

- Kingsdown

- KyMDan

- Lien A

- Ru9

- Serta Simmons

- Tempur Sealy

- Van Thanh

- Vua Nem

- Zinus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes & Sleep-Health Awareness

- 4.2.2 Booming Domestic Hospitality Pipeline

- 4.2.3 Rapid E-Commerce Penetration Into Tier-2/3 Cities

- 4.2.4 Anti-Dumping Duties on Chinese Mattresses Redirecting FDI To Vietnam

- 4.2.5 Shift Toward Asean-Sourced Natural Latex Amid EU Deforestation Regulation

- 4.2.6 Smart-Bed Adoption In Premium Urban Segments

- 4.3 Market Restraints

- 4.3.1 Fragmented Foam-Supply Chain Inflating Input Costs

- 4.3.2 Low Replacement Cycles In Rural Areas

- 4.3.3 Intensifying Price War From Grey-Market Imports

- 4.3.4 Limited Recycling Infrastructure For Used Mattresses

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

- 4.8 Insights on Consumer Behavior Analysis and Preferences in the Market (key motivational factors, preferred sales channel, demographics, key influencers and decision-makers)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Innerspring / Coil

- 5.1.2 Foam (including memory foam)

- 5.1.3 Latex

- 5.1.4 Hybrid

- 5.1.5 Other Mattress Types

- 5.2 By Mattress Size

- 5.2.1 Single-size Mattress

- 5.2.2 Double-size Mattress

- 5.2.3 Queen-size Mattress

- 5.2.4 King-size Mattress

- 5.2.5 Custom & Specialty Sizes

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Mass Merchandisers

- 5.4.1.2 Specialty Mattress Stores (including exclusive brand outlets)

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 Northern Vietnam

- 5.5.2 Central Vietnam

- 5.5.3 Southern Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 AEGONO

- 6.4.2 Amando

- 6.4.3 Dongsuh Furniture

- 6.4.4 Dunlopillo Vietnam

- 6.4.5 Everpia Everon

- 6.4.6 Hava's

- 6.4.7 Kim Cương Mattress

- 6.4.8 KingKoil

- 6.4.9 Kingsdown

- 6.4.10 KyMDan

- 6.4.11 Lien A

- 6.4.12 Ru9

- 6.4.13 Serta Simmons

- 6.4.14 Tempur Sealy

- 6.4.15 Van Thanh

- 6.4.16 Vua Nem

- 6.4.17 Zinus

7 Market Opportunities & Future Outlook

- 7.1 Mattress-As-A-Service Subscription For Urban Millennials

- 7.2 ESG-Certified Supply For Hotel Pipeline on Vietnam's Central Coast