PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937371

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937371

Asia-Pacific Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

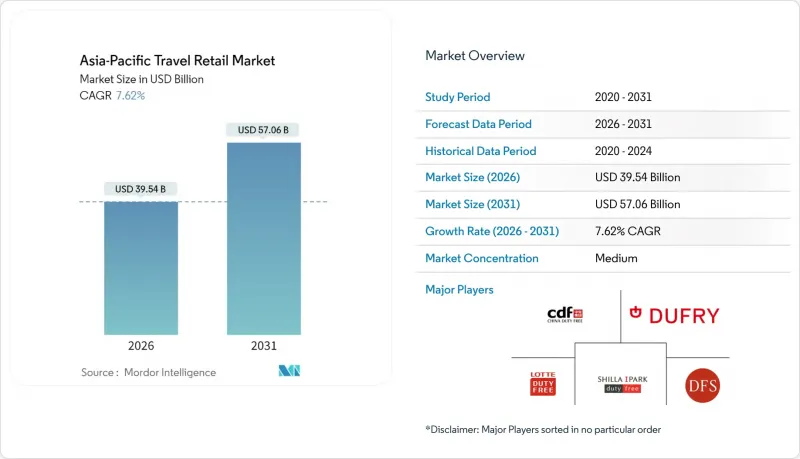

The Asia-Pacific travel retail market is expected to grow from USD 36.74 billion in 2025 to USD 39.54 billion in 2026 and is forecast to reach USD 57.06 billion by 2031 at 7.62% CAGR over 2026-2031.

Strong aviation and rail recovery, liberalized visa regimes, and infrastructure upgrades are expanding passenger volumes and reshaping shopping behaviours toward experiential purchases rather than status-driven luxury. China's visa-free push and India's surging outbound traffic are channelling a new wave of high-propensity shoppers who outspend pre-pandemic cohorts on fragrances, cosmetics, and niche wines. Airport operators are designing dwell-time-rich terminals, while retailers embed click-and-collect platforms that fuse digital discovery with on-site fulfilment. Although currency swings and geopolitical frictions inject short-term volatility, long-run growth fundamentals remain intact as ASEAN duty-free harmonization and high-speed rail investments widen the Asia-Pacific travel retail market's geographic reach.

Asia-Pacific Travel Retail Market Trends and Insights

Surge in Outbound Chinese Tourism After Visa Relaxations

China granted visa-free entry to travellers from 74 nations, resulting in 20.115 million visa-free arrivals in 2024, a 112.3% annual leap . Chinese outbound trips are forecast to approach 130 million by year-end, reviving passenger flows across ASEAN and Pacific gateways. Chinese travellers have consistently demonstrated high spending per trip when traveling abroad. Projections indicate that they are likely to allocate increased discretionary budgets for international travel in 2025, reflecting a strategic shift in their spending behaviour and priorities. Retailers that pivot toward experience-centric bundles, spa vouchers, cultural tours, and chef-led tastings align with shifting preferences away from conspicuous luxury. Secondary destinations such as Da Nang and Cairns benefit from overflow as tier-one hotspots reach capacity, broadening the Asia-Pacific travel retail market footprint.

Expansion of Low-Cost Carriers Across Secondary Airports

Low-cost carriers (LCCs) account for 30% of the total seat capacity in the Asia-Pacific region, demonstrating significant penetration in several domestic markets. This highlights the growing influence of LCCs in shaping the competitive dynamics of the regional aviation industry . New nonstop links between tier-two cities, Lucknow to Kuala Lumpur, Da Nang to Seoul, democratize air travel and direct retail demand toward untapped airports. Secondary hubs offer a cost-effective environment for operators by charging lower concession fees. This enables businesses to test and implement compact store formats and kiosk concepts without incurring the high overhead costs typically associated with premium locations. Shopper profiles skew younger and value-driven, catalysing demand for competitively priced beauty minis, craft snacks, and digital promotions. The geographic dispersion boosts resilience by lowering overreliance on mega-hubs within the Asia-Pacific travel retail market.

High Concession Fees Squeezing Retailer Margins

Market operators are strategically reallocating capital toward secondary gateway locations, leveraging the benefits of lower fee structures and reduced competitive pressures to optimize profitability. Collaborative efforts, such as forming joint ventures with airport authorities and implementing hybrid rent models linked to passenger traffic volumes, are becoming key approaches to effectively balance and mitigate operational risks. Additionally, the adoption of advanced technologies, including AI-driven demand forecasting, self-checkout systems, and robotic stock replenishment processes, is enabling significant reductions in operating costs per square foot while improving operational efficiency. In the Asia-Pacific travel retail market, consolidation dynamics are accelerating as midsize companies actively seek scale expansion to absorb fee-related shocks, enhance resilience, and strengthen their competitive positioning in a rapidly evolving market landscape.

Other drivers and restraints analyzed in the detailed report include:

- Rising Disposable Incomes in Southeast Asia

- Large-Scale Airport & Terminal Expansions (India, Vietnam)

- Stricter Tobacco-Marketing Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fragrances and cosmetics captured 35.94% of 2025 sales, buoyed by livestream tutorials, AR shade-matching kiosks, and travel-exclusive gift sets that convert browsers into buyers. The Asia-Pacific travel retail market share of wines and spirits is climbing fastest at a 12.10% CAGR, fuelled by millennials chasing single-malt whiskies and small-batch gin rarities. Tobacco's share continues to retreat amid compliance headwinds, though limited-edition cigars retain a loyal niche. Food and confectionery thrive on gifting norms-mooncake trios, matcha truffles, bird's-nest snacks-that drive impulse purchases. Fluctuations in the yen and yuan have created opportunities for downtown retailers to strategically leverage duty-free price differentials. This trend has particularly benefited the "other product types" category, which includes electronics, watches, and jewellery, as these products continue to attract consumer demand despite currency volatility. AI-driven forecasting tools refine SKU selections, lifting shelf productivity and preserving working capital, while "Asia only" collaborations elevate discovery appeal inside the Asia-Pacific travel retail market.

The premiumization wave also expands basket sizes as travellers trade up to niche perfumes, clean-label skincare, and single-vineyard wines. Brands build immersive installations, AR fragrance caves, mixology counters, that generate social-media buzz and data capture opportunities. Retailers diversify supplier bases to include artisanal chocolatiers, eco-friendly sunscreen lines, and K-wellness tonics, refreshing the assortment cycle. Category managers measure success not solely by unit velocity but by Instagram impression lift and loyalty-app re-engagement. This fusion of storytelling and analytics cements premium sectors as core engines of Asia-Pacific travel retail market growth.

The Asia-Pacific Travel Retail Market Report Segments the Industry Into Product Type (Fashion and Accessories, Wine & Spirits, and Other), Distribution Channel (Airports, Cruise Liners, and Other), Traveler Demographics(Business Travelers, Leisure Travelers, and Other), and Geography (India, China, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China Duty Free Group (CTGDF)

- Dufry AG

- DFS Group

- Lotte Duty Free

- Shilla Duty Free

- Gebr. Heinemann

- Lagardere Travel Retail

- King Power International (Thailand)

- Ever Rich Duty Free (Taiwan)

- Sunrise Duty Free (China)

- Duty Free Philippines

- Kansai Airports Retail and Services

- Heinemann Asia Pacific

- Sky Connection (Hong Kong)

- JR Duty Free (Japan)

- Auckland Airport Duty Free (ARHL)

- Delhi Duty Free

- Duty Free City (Malaysia Airports)

- DFS Yunnan

- Duty Free City (Malaysia Airports)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in outbound Chinese tourism after visa relaxations

- 4.2.2 Expansion of low-cost carriers across secondary airports

- 4.2.3 Rising disposable incomes and luxury appetite in Southeast Asia

- 4.2.4 Large-scale airport and terminal expansions (India, Vietnam)

- 4.2.5 Pre-order and click-collect platforms boosting conversion

- 4.2.6 ASEAN duty-free allowance harmonisation

- 4.3 Market Restraints

- 4.3.1 High concession fees squeezing retailer margins

- 4.3.2 Stricter tobacco-marketing regulations

- 4.3.3 FX volatility impacting pricing parity

- 4.3.4 "Travel-light" trend reducing impulse purchases

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Bargaining Power of Buyers

- 4.7.5 Threat of Substitutes

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Fashion and Accessories

- 5.1.2 Wine and Spirits

- 5.1.3 Tobacco

- 5.1.4 Food and Confectionary

- 5.1.5 Fragrances and Cosmetics

- 5.1.6 Other Product Types (Stationery, Electronics, Watches, Jewelry, etc.)

- 5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Cruise Liners

- 5.2.3 Railway Stations

- 5.2.4 Other Distribution Channels

- 5.3 By Traveler Demographics

- 5.3.1 Business Travelers

- 5.3.2 Leisure Travelers

- 5.3.3 Visiting Friends and Relatives (VFR)

- 5.3.4 Medical and Wellness Tourists

- 5.3.5 Student Travelers

- 5.4 By Geography

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 Australia

- 5.4.5 South Korea

- 5.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 China Duty Free Group (CTGDF)

- 6.4.2 Dufry AG

- 6.4.3 DFS Group

- 6.4.4 Lotte Duty Free

- 6.4.5 Shilla Duty Free

- 6.4.6 Gebr. Heinemann

- 6.4.7 Lagardere Travel Retail

- 6.4.8 King Power International (Thailand)

- 6.4.9 Ever Rich Duty Free (Taiwan)

- 6.4.10 Sunrise Duty Free (China)

- 6.4.11 Duty Free Philippines

- 6.4.12 Kansai Airports Retail and Services

- 6.4.13 Heinemann Asia Pacific

- 6.4.14 Sky Connection (Hong Kong)

- 6.4.15 JR Duty Free (Japan)

- 6.4.16 Auckland Airport Duty Free (ARHL)

- 6.4.17 Delhi Duty Free

- 6.4.18 Duty Free City (Malaysia Airports)

- 6.4.19 DFS Yunnan

- 6.4.20 Duty Free City (Malaysia Airports)

7 Market Opportunities and Future Outlook

- 7.1 Real-time personalisation via airport Wi-Fi analytics

- 7.2 Duty-free retail expansion on high-speed rail corridors