PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939016

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939016

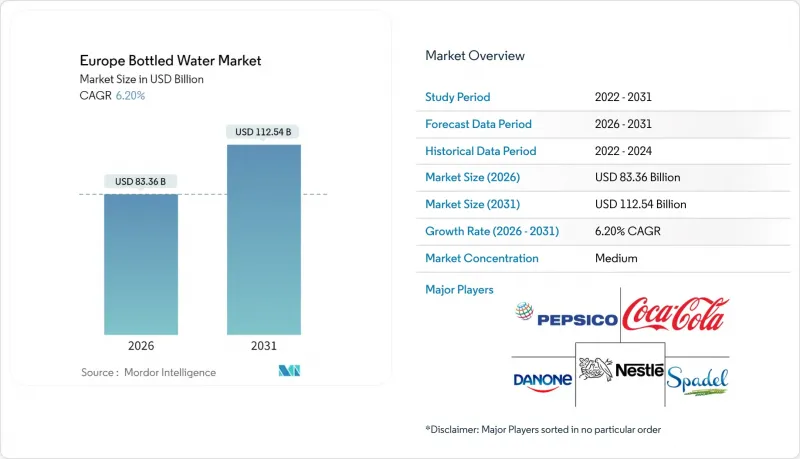

Europe Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe bottled water market size in 2026 is estimated at USD 83.36 billion, growing from 2025 value of USD 78.49 billion with 2031 projections showing USD 112.54 billion, growing at 6.20% CAGR over 2026-2031.

Growth reflects a pronounced shift away from sugary beverages toward functional hydration solutions, reinforced by the European Commission's revised Drinking Water Directive and stronger corporate ESG mandates. Demand concentrates around mineral-rich and electrolyte-enhanced waters, while the EU Single-Use Plastics Directive accelerates rPET adoption and tethered-cap innovation. Deposit-return schemes slated for 2029 reshape collection economics, and smart-packaging technologies such as QR-enabled closures deepen consumer engagement. Competition remains moderate as global majors leverage scale and B-Corp-certified regional players promote provenance and sustainability to differentiate.

Europe Bottled Water Market Trends and Insights

Health-and-Wellness Shift from Sugary Beverages

European dietary guidelines increasingly emphasize water as the primary beverage choice, with the European Commission's Food-Based Dietary Guidelines recommending 1-1.5 liters daily across member states, explicitly favoring water over sugary alternatives. This regulatory endorsement coincides with WHO Europe's 2025 Health Report, highlighting that 1 in 6 people die before age 70 from non-communicable diseases, with cardiovascular conditions and cancer as leading causes, driving consumer behavior toward preventive nutrition choices. The shift manifests in corporate wellness programs, with companies like Pernod Ricard launching "Drink More Water" campaigns reaching over 400 million people online and 9 million through events across 60 countries, demonstrating how beverage companies themselves are pivoting toward hydration advocacy. This transition creates sustained demand for premium bottled water, positioning it as a health-forward alternative to traditional soft drinks. Germany's per capita mineral water consumption reached 124.3 liters in 2023, though declining 4.7% from the previous year, indicating market maturation requiring innovation to maintain growth momentum.

EU Single-Use Plastic Directive Accelerating rPET

The EU's Single-Use Plastics Directive mandates 25% recycled content in PET beverage bottles by 2025, escalating to 30% by 2030, with the new Packaging and Packaging Waste Regulation effective February 11, 2025, harmonizing requirements across member states. Compliance mechanisms vary significantly across member states, with some categorizing requirements per bottle, per producer, or per national output, creating implementation complexity but driving substantial rPET demand. EFSA's updated guidance for post-consumer mechanical PET recycling processes ensures food safety standards while enabling circular economy transitions, with specific contamination level methodologies maintaining bottled water quality integrity. The directive's tethered caps requirement, effective July 2024, initially opposed by major beverage companies, has driven innovation in cap design, including hinged tops and lasso closures, with expectations to prevent 10% of plastic waste on European beaches. Market dynamics show fluctuating rPET demand influenced by economic factors, yet compliance enforcement will create sustained premium pricing for recycled content, fundamentally altering packaging cost structures across the industry.

Environmental Backlash & Refill Culture

The European Environment Agency's circular economy monitoring reveals only a 11.8% circularity rate in 2023 despite rising environmental awareness, with plastic consumption projected to continue increasing and negatively impacting climate change. Consumer behavior shifts toward refillable alternatives gain momentum through municipal initiatives and environmental campaigns, with the European Commission's "Less Plastic Waste Means Cleaner Beaches" campaign highlighting single-use plastic reduction as a priority environmental objective. The deposit return system mandate for single-use plastic bottles by 2029, requiring 90% collection rates, fundamentally alters consumer convenience calculations by adding return logistics to purchase decisions. Eau de Paris's complaint against PFAS producers demonstrates municipal water authorities' proactive stance on water quality, with PFAS detected in 96% of tested municipalities, creating consumer awareness of tap water contamination issues while simultaneously driving demand for certified pure bottled alternatives. The environmental backlash creates market segmentation between sustainability-conscious consumers who favor refillable solutions, and quality-focused consumers who prioritize purity and convenience, requiring differentiated positioning strategies across demographic segments.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization via Mineral-Rich & Electrolyte-Enhanced Waters

- Corporate ESG Procurement of Carbon-Neutral Office Water

- Municipal Tap & Filter Tech Improving Quality Perception

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still Water generated the highest sales, capturing 62.02% of 2025 revenue as the category of everyday hydration. The Europe bottled water market size for Still Water continues to benefit from entrenched consumption habits, national dietary endorsements, and efficient distribution. Yet saturation in mature economies triggers margin pressure, pushing brands toward flavor extensions and light carbonation variants.

Functional Water, expanding at an 8.28% CAGR through 2031, exemplifies where value migrates. The segment monetizes Gen-Z's wellness mindset via electrolytes, botanicals, and adaptogens such as ashwagandha. EFSA-approved novel ingredients open regulatory doors, and Pernod Ricard's global hydration campaign underscores mainstreaming appeal. With most offerings priced at 1.5-2 times plain still water, the Europe bottled water market captures an outsized share of category profit from this niche.

The Europe Bottled Water Market is Segmented by Type (Still Water, Sparkling/Carbonated Water, Flavored Water, Functional Water, Others), Distribution Channel (Off-Trade, On-Trade), Packaging Material (PET Bottles, RPET Bottles, and More), and Geography (United Kingdom, Germany, France, Italy, Spain, Russia, Netherlands, Poland, Switzerland, Sweden, Norway, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle Waters

- Danone Waters

- The Coca-Cola Company

- PepsiCo Inc.

- Spadel SA

- Ferrarelle SpA

- Gerolsteiner Brunnen GmbH & Co. KG

- RheinfelsQuellen H. Hovelmann GmbH & Co. KG

- Highland Spring Group

- Fonti di Vinadio SpA (Acqua Sant Anna)

- Icelandic Glacial

- CG Roxane (Cristaline)

- Aqua Carpatica

- Acqua Minerale San Benedetto SpA

- Harrogate Spring Water

- Agua de Cuevas

- IDS Borjomi Europe

- Badoit

- Apollinaris Brands GmbH

- Evian (brand)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health-and-Wellness Shift from Sugary Beverages

- 4.2.2 EU Single-Use Plastic Directive Accelerating rPET Bottled Water

- 4.2.3 Premiumization via Mineral-Rich & Electrolyte-Enhanced Waters

- 4.2.4 Corporate ESG Procurement of Carbon-Neutral Office Water

- 4.2.5 Smart Packaging (QR/NFC) Enabling Provenance & Engagement

- 4.2.6 Functional & Adaptogenic Water Targeting Gen-Z

- 4.3 Market Restraints

- 4.3.1 Environmental Backlash & Refill Culture

- 4.3.2 Municipal Tap & Filter Tech Improving Quality Perception

- 4.3.3 Freight Cost Inflation from EU Carbon Border Adjustment

- 4.3.4 Subscription Filter Pitchers Cannibalizing Home Consumption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Still Water

- 5.1.2 Sparkling/Carbonated Water

- 5.1.3 Flavored Water

- 5.1.4 Functional Water

- 5.1.5 Others

- 5.2 By Distribution Channel

- 5.2.1 Off-trade

- 5.2.1.1 Supermarkets/Hypermarkets

- 5.2.1.2 Convenience Stores

- 5.2.1.3 Online Retail Stores

- 5.2.1.4 Pharmacies & Health Stores

- 5.2.1.5 Others (Vending machines, discounters)

- 5.2.2 On-trade

- 5.2.2.1 Hotels, Restaurants and Cafes (HoReCa)

- 5.2.2.2 Offices & Institutional

- 5.2.2.3 Sports & Leisure Venues

- 5.2.1 Off-trade

- 5.3 By Packaging Material

- 5.3.1 PET Bottles

- 5.3.2 rPET Bottles

- 5.3.3 Glass Bottles

- 5.3.4 Aluminum Cans & Bottles

- 5.3.5 Carton (Tetra Pak)

- 5.3.6 Others (Bio-based Plastics)

- 5.4 Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Netherlands

- 5.4.8 Poland

- 5.4.9 Switzerland

- 5.4.10 Sweden

- 5.4.11 Norway

- 5.4.12 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Nestle Waters

- 6.4.2 Danone Waters

- 6.4.3 The Coca-Cola Company

- 6.4.4 PepsiCo Inc.

- 6.4.5 Spadel SA

- 6.4.6 Ferrarelle SpA

- 6.4.7 Gerolsteiner Brunnen GmbH & Co. KG

- 6.4.8 RheinfelsQuellen H. Hovelmann GmbH & Co. KG

- 6.4.9 Highland Spring Group

- 6.4.10 Fonti di Vinadio SpA (Acqua Sant Anna)

- 6.4.11 Icelandic Glacial

- 6.4.12 CG Roxane (Cristaline)

- 6.4.13 Aqua Carpatica

- 6.4.14 Acqua Minerale San Benedetto SpA

- 6.4.15 Harrogate Spring Water

- 6.4.16 Agua de Cuevas

- 6.4.17 IDS Borjomi Europe

- 6.4.18 Badoit

- 6.4.19 Apollinaris Brands GmbH

- 6.4.20 Evian (brand)

7 Market Opportunities & Future Outlook