PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939049

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939049

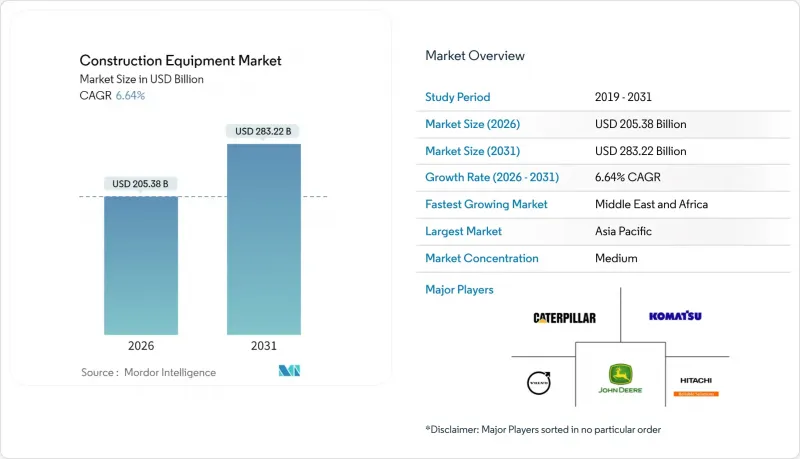

Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The construction equipment market stands at USD 205.38 billion in 2026 and is forecast to climb to USD 283.22 billion by 2031, registering a 6.64% CAGR during the period, underscoring steady gains in market size and profit pools.

Robust government spending on roads, rail, power transmission, and semiconductor fabs underpins demand across earthmoving, material-handling, and concrete machinery. Asia's mega-project pipeline, the electrification push in Europe and North America, and the industry-wide tilt toward rental fleets jointly reinforce a resilient growth outlook. Competitive intensity is sharpening as Chinese OEMs capture share abroad while Western leaders pivot to service-centric offerings and autonomous technologies. The construction equipment market is also shaped by quicker fleet renewal cycles driven by Stage V and EPA Phase 3 regulations, tightening the gap between product and digital service launches.

Global Construction Equipment Market Trends and Insights

Mega-infrastructure Pipelines Across Asia driving Over USD 2 tn Annual Equipment Demand

A committed project pipeline exceeding USD 3.7 trillion is transforming allocation priorities, pulling large dozers, 45-ton excavators, and high-capacity concrete pumps into Asian depots ahead of other regions. Saudi Arabia alone awarded USD 55 billion in projects in 2024, a 57% jump year-on-year, while the UAE lifted awards by 200% to USD 34 billion. OEMs are tailoring sales mixes toward higher horsepower and longer-reach booms, anchoring revenue in the construction equipment market through larger ticket sizes and aftermarket contracts.

U.S. IRA and CHIPS Acts Accelerating Earth-Moving Purchases for On-shoring Projects

Federal incentives for semiconductor fabs, EV plants, and grid upgrades have created a structural pull for 250-500 HP dozers and excavators across the Sun Belt. The American Society of Civil Engineers identifies a USD 3.7 trillion infrastructure gap by 2035, ensuring sustained visibility for OEM order books. Contractors, faced with labor constraints, are leaning toward larger units that compress project schedules and ease per-hour operating budgets.

OEM Lead-time Spikes (Beyond 42 Weeks) Due to Hydraulic Component Shortages

Delivery windows stretch beyond 42 weeks for critical hydraulic valves and pumps, forcing contractors to adjust project phasing. Market leaders increasingly vertically integrate to secure supply, echoing Caterpillar's expanded in-house component machining. Persistent bottlenecks threaten to defer replacement cycles and dampen near-term construction equipment market momentum until inventories normalize.

Other drivers and restraints analyzed in the detailed report include:

- Rental-first Procurement Shift Among Tier-2 Contractors Expanding Utilization Rates

- EU Stage V Emission Caps forcing Rapid Fleet Renewal Toward Hybrid/E-equipment

- Lithium-ion Cell Scarcity Inflating TCO of Electric Heavy Machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators commanded 51.24% construction equipment market share in 2025 and are projected to register a 7.15% CAGR to 2031. Hydraulic efficiency, quick-attach tooling, and telematics integration sustain demand across road-building, utilities, and demolition. Loaders remain second in volume, with wheel loaders favored for paved operations and track loaders for soft terrain. Crane demand follows high-rise and bridge timelines, while graders and rollers maintain road surfaces to millimeter tolerances.

Bulldozers thrive in mining benches where slope stability requires significant drawbar pull, and dump trucks handle hauls beyond 500 meters. Specialty machines, including concrete pumps and trenchers, together hold a significant share of construction equipment market size. Komatsu's hydrogen-powered prototype signals future fuel diversification, though widespread adoption awaits refueling infrastructure expansion .

Internal combustion units accounted for 90.12% of 2025 shipments, yet hybrids battery electric models will rise at 22.16% CAGR as regulations tighten. Hybrid systems pair smaller diesel engines with batteries, cutting fuel by 25-35% and enabling quiet, zero-tailpipe operation for idling and indoor work. Caterpillar's 323 electric excavator delivered lower operating costs on grid-connected redevelopment jobs and logged significant orders by end-2025 .

Globally, hydrogen fuel-cell rigs are operational in limited numbers, primarily in pilot programs across Japan, Germany, and South Korea. JCB is sidestepping the costs associated with fuel cells, aiming to commercialize its hydrogen combustion engine by 2027. The market for zero-emission construction equipment is closely tied to grid capacity and charging infrastructure. As a result, some buyers are leaning towards hybrids, which offer a diesel fallback until a reliable power source is widely available.

The Construction Equipment Market Report is Segmented by Equipment Type (Excavator, Loader, and More), Propulsion Type (Internal Combustion, Hybrid Battery Electric, and More), Equipment Size (Heavy (Above 11 Tons), Medium (6-11 Tons), and More), Power Output (Up To 250 HP, 250 - 500 HP, and More), Application, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific led with 45.80% of the construction equipment market in 2025, underpinned by China's Belt and Road Initiative and India's National Infrastructure Pipeline. Chinese crawler excavator volumes are set to exceed 150,000 units by 2027, more than doubling 2023 output and reinforcing supplier economies of scale. Manufacturers route high-power diesel inventory to Southeast Asia and GCC job sites while shipping compact electric loaders to Japanese and Korean cities.

The Middle East and Africa posts the fastest trajectory at 9.12% CAGR through 2031 as Saudi Arabia's Vision 2030 and the UAE's Dubai Urban Master Plan funnel billions into housing, tourism, and logistics. Project awards jumped significantly in 2024, tightening regional equipment supply and prompting OEMs to stage temporary import yards at Jebel Ali Port. Heat-tolerant battery chemistries and sealed cabin filtration systems are differentiators in the Gulf slice of the construction equipment market.

North America maintains a solid outlook propelled by industrial reshoring and infrastructure revamps backed by the IRA and CHIPS legislation. EPA Phase 3 standards, effective model year 2027, are nudging fleets toward hybrid and electric compact equipment for urban utility work. Rental giants consolidate to secure scale, evidenced by multi-billion-dollar acquisitions that compress dealer networks and elevate access fees.

- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- CNH Industrial (CASE, New Holland)

- Liebherr-International AG

- Bobcat Company

- Kobelco Construction Machinery Co., Ltd.

- SANY Group

- Xuzhou Construction Machinery Group Co., Ltd.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- JCB Limited

- HD Hyundai Infracore Co., Ltd.

- Terex Corporation

- Astec Industries, Inc.

- Kubota Corporation

- Sumitomo (HSC Cranes)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mega-infrastructure Pipelines Across Asia driving Over USD 2 tn Annual Equipment Demand

- 4.2.2 U.S. IRA and CHIPS Acts Accelerating Earth-Moving Purchases for On-shoring Projects

- 4.2.3 Rental-first Procurement Shift Among Tier-2 Contractors Expanding Utilization Rates

- 4.2.4 EU Stage V Emission Caps forcing Rapid Fleet Renewal Toward Hybrid/E-equipment

- 4.2.5 Mineral-rich Africa's EPC Surge for Critical Raw-material Extraction

- 4.2.6 AI-enabled Job-site Automation Boosting ROI of Autonomous Graders and Dozers

- 4.3 Market Restraints

- 4.3.1 OEM Lead-time Spikes (Beyond 42 Weeks) Due to Hydraulic Component Shortages

- 4.3.2 Lithium-ion Cell Scarcity Inflating TCO of Electric Heavy Machinery

- 4.3.3 Persistent Skills Gap Limiting Adoption of Telematics-rich Equipment in LATAM

- 4.3.4 Municipal Noise-abatement Bylaws Restricting Night-time Operation of Diesel Rigs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Equipment Type

- 5.1.1 Excavator

- 5.1.2 Loader

- 5.1.3 Mobile Cranes

- 5.1.4 Motor Graders

- 5.1.5 Bulldozers

- 5.1.6 Road Rollers

- 5.1.7 Dump Trucks

- 5.1.8 Others

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion

- 5.2.2 Hybrid Battery Electric

- 5.2.3 Hydrogen Fuel-Cell

- 5.3 By Equipment Size

- 5.3.1 Heavy ( Above 11 tons)

- 5.3.2 Medium (6-11 tons)

- 5.3.3 Compact/Mini (less than 6 tons)

- 5.4 By Power Output

- 5.4.1 Up to 250 HP

- 5.4.2 250 - 500 HP

- 5.4.3 Above 500 HP

- 5.5 By Application

- 5.5.1 Infrastructure

- 5.5.2 Residential and Commercial Construction

- 5.5.3 Mining and Quarrying

- 5.5.4 Oil and Gas/Pipelines

- 5.5.5 Industrial and Manufacturing

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Sweden

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Deere & Company

- 6.4.4 Hitachi Construction Machinery Co., Ltd.

- 6.4.5 Volvo Construction Equipment

- 6.4.6 CNH Industrial (CASE, New Holland)

- 6.4.7 Liebherr-International AG

- 6.4.8 Bobcat Company

- 6.4.9 Kobelco Construction Machinery Co., Ltd.

- 6.4.10 SANY Group

- 6.4.11 Xuzhou Construction Machinery Group Co., Ltd.

- 6.4.12 Zoomlion Heavy Industry Science & Technology Co., Ltd.

- 6.4.13 JCB Limited

- 6.4.14 HD Hyundai Infracore Co., Ltd.

- 6.4.15 Terex Corporation

- 6.4.16 Astec Industries, Inc.

- 6.4.17 Kubota Corporation

- 6.4.18 Sumitomo (HSC Cranes)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment