PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939652

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939652

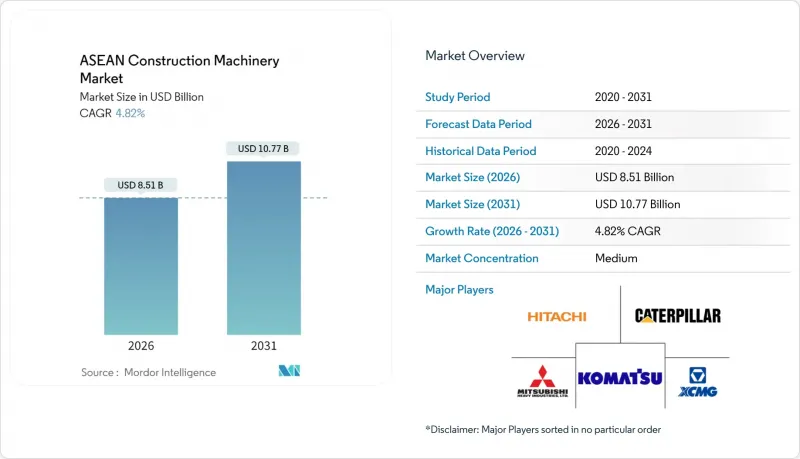

ASEAN Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ASEAN construction machinery market is expected to grow from USD 8.12 billion in 2025 to USD 8.51 billion in 2026 and is forecast to reach USD 10.77 billion by 2031 at 4.82% CAGR over 2026-2031.

The market's momentum reflects an infrastructure super-cycle stretching from Indonesia's new capital city in East Kalimantan to a Thailand-Vietnam high-speed rail corridor. Sustained foreign direct investment into industrial parks, a resurgence in nickel-mining capital expenditure, and accelerating job-site digitalization continue to refresh fleets across every major equipment category. At the same time, Chinese original-equipment manufacturers (OEMs) are expanding rapidly under contractor-localization mandates, reshaping competitive dynamics and price points. Equipment electrification and emerging hydrogen prototypes signal another layer of opportunity as governments tighten emissions regulations and construction firms pursue sustainability credentials. Supply-chain shocks tied to U.S.-China trade frictions and persistent operator shortages remain the principal brakes on growth, but proactive skills-training programs and diversified sourcing strategies are gradually offsetting these risks

ASEAN Construction Machinery Market Trends and Insights

Infrastructure Super-Cycle Driven by Indonesia's IKN Capital-City Build

Groundwork at the Nusantara project is proceeding in phased packages that extend procurement cycles into the mid-2040s. Five private investors have already committed more than Rp 2.4 trillion for 2025 milestones covering lifestyle centers, mixed-use precincts, and essential utilities. Public-sector allocations have surpassed Rp 100 trillion and include road sections designed within a digital-twin framework. Such project breadth sustains order pipelines for excavators, loaders, concrete pumps, and specialist lifting gear while encouraging OEMs to localize component supply. Nonetheless, delayed cement shipments and episodic budget revisions illustrate execution risks that could temper near-term equipment call-offs. Planned public-private-partnership structures are expected to relieve funding pressure by broadening the lender base over the next decade.

Nickel-Mine Boom Fuelling Demand for Ultra-Large Excavators

Indonesia's ascent as the world's leading nickel producer underpins a wave of ultra-large equipment orders. Mass production of 120-ton class EX1200 hydraulic excavators began in November 2024 and is now geared toward both green-field and brown-field mine expansions. The mining equipment fleet is positioned to climb significantly by 2029 as battery-materials demand widens. OEMs are showcasing 100-ton and 150-ton prototypes tailored for laterite ore conditions, while local contractors target double-digit market share gains. With nickel prices rebounding, mines are front-loading capital outlays although tighter environmental audits could require additional technology investments.

High Upfront Capex and Tightening Project-Finance Rates

Interest costs have climbed alongside global rate cycles, lifting hurdle rates for new equipment purchases. Government budget adjustments, most visible in Indonesia where the 2025 infrastructure allocation has narrowed, restrict public-sector tender releases. Highly leveraged state-owned contractors continue to refinance short-dated debt, but profit erosion limits their ability to self-fund machinery. A regional effort to standardize loan documentation seeks to mobilize insurance and pension capital into long-dated infrastructure vehicles, thereby easing financing constraints over the medium term. Banks with large construction portfolios are introducing sustainability-linked loan tranches that reward the uptake of low-emission machinery.

Other drivers and restraints analyzed in the detailed report include:

- Thailand-Vietnam High-Speed Rail Corridor Boosting Cross-Border Equipment Demand

- Strong FDI Inflows into ASEAN Industrial Parks and Sezs

- Shortage of Certified Operators Inflating OPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ASEAN construction equipment market size for excavators amounted to 35.10% of total value in 2025, solidifying the category's lead. High-tonnage models now dominate Indonesian mine specifications, while medium-class units remain omnipresent on road and railway projects. Backhoe loaders, which deliver combined digging and loading capability in congested urban environments, post the fastest 9.86% CAGR as municipalities upgrade drainage and telecom lines. Crawler excavators in the 20-30 tonne band captured more than three-quarters of Indonesian orders, underscoring their versatility within mixed-terrain sites. Loader demand stays resilient on account of port expansions, whereas motor graders and pavers benefit from motorway duplication programs. Telehandlers and dump trucks, although smaller in volume, enjoy niche resilience for industrial-park warehousing and mineral-haul circuits.

Adoption patterns reveal a steady pivot toward integrated control systems, a trend that moves secondary-market valuations in favor of more recent models. Rental companies increasingly bundle telematics subscriptions with monthly rates, incentivizing contractors to opt for connected equipment and thereby enlarging the addressable service revenue pool. Local assemblers, leveraging tariff preferences, extend credit lines that lower acquisition barriers for small contractors and sustain the replacement cycle for primary earth-moving machines.

Earth-moving held 53.72% of ASEAN construction equipment market share and remains the fastest-expanding application at a 4.83% CAGR. Mega-projects such as the Nusantara city build and the cross-border rail corridor require continuous excavation, grading, and hauling across vast footprints. Concrete-road construction benefits from large expressway packages in Vietnam where slip-form pavers reach productivity outputs of 500 meters per day. Material-handling volumes climb as industrial-park tenants import line machinery and prefabricated modules.

Mining support continues to outpace regional averages thanks to sustained investment in nickel extraction, while demolition and recycling activities scale up alongside inner-city redevelopment. Utility-installation works, especially fiber-optic backbones and grid upgrades, leverage compact equipment fitted with advanced detection to minimize service interruptions. Integration of digital twins, especially on smart-city and rail alignments, compresses rework cycles and elevates demand for precision-guided machines. Contractors report 10% to 15% reductions in idle time by exploiting telematics data, reinforcing the case for premium technology packages.

The ASEAN Construction Machinery Market Report is Segmented by Machinery Type (Excavators, Loaders, and More), Application (Earth-Moving, Concrete and Road Construction, and More), End-Use Industry (Residential Construction, Commercial Construction, and More), Propulsion (Diesel, Hybrid, and More), and Country (Indonesia, Thailand, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co.

- XCMG Group

- Sany Heavy Industry

- Liebherr Group

- JCB

- CNH Industrial (CASE and New Holland)

- Volvo Construction Equipment

- Zoomlion Heavy Industry

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Yanmar Co., Ltd.

- Wirtgen Group

- Kubota Corporation

- Sandvik Mining and Rock Tech.

- Terex Corporation

- Sumitomo Construction Machinery

- Manitou Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Super-Cycle Driven by Indonesia's IKN Capital-City Build

- 4.2.2 Nickel-Mine Boom Fuelling Demand for Ultra-Large Excavators

- 4.2.3 Thailand-Vietnam High-Speed Rail Corridor Boosting Cross-Border Equipment Demand

- 4.2.4 Strong FDI Inflows into ASEAN Industrial Parks and Sezs

- 4.2.5 Belt and Road Contractor-Localization Mandates Increasing Chinese OEM Sales

- 4.2.6 Job-Site Digitalization (BIM + 5G Telematics) Accelerating Fleet Renewal

- 4.3 Market Restraints

- 4.3.1 High Upfront Capex and Tightening Project-Finance Rates

- 4.3.2 Shortage of Certified Operators Inflating OPEX

- 4.3.3 Sparse Charging / Hydrogen Refuelling Network Slowing Green-Equipment Uptake

- 4.3.4 China-US Trade Volatility Causing Engine and Parts Supply Shocks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Excavators

- 5.1.2 Loaders

- 5.1.3 Cranes

- 5.1.4 Backhoe Loaders

- 5.1.5 Motor Graders

- 5.1.6 Pavers and Compactors

- 5.1.7 Others (Telehandlers, Dump Trucks, etc.)

- 5.2 By Application

- 5.2.1 Earth-Moving

- 5.2.2 Concrete and Road Construction

- 5.2.3 Material Handling and Logistics

- 5.2.4 Mining Support

- 5.2.5 Demolition and Recycling

- 5.2.6 Utilities Installation

- 5.2.7 Others

- 5.3 By End-Use Industry

- 5.3.1 Residential Construction

- 5.3.2 Commercial Construction

- 5.3.3 Infrastructure / Public Works

- 5.3.4 Mining

- 5.3.5 Oil and Gas

- 5.3.6 Industrial Manufacturing

- 5.3.7 Others

- 5.4 By Propulsion

- 5.4.1 Diesel

- 5.4.2 Hybrid

- 5.4.3 Battery-Electric

- 5.4.4 Hydrogen Fuel-Cell

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Vietnam

- 5.5.4 Philippines

- 5.5.5 Malaysia

- 5.5.6 Singapore

- 5.5.7 Rest of ASEAN (Myanmar, Laos, Cambodia, Brunei)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Hitachi Construction Machinery Co.

- 6.4.4 XCMG Group

- 6.4.5 Sany Heavy Industry

- 6.4.6 Liebherr Group

- 6.4.7 JCB

- 6.4.8 CNH Industrial (CASE and New Holland)

- 6.4.9 Volvo Construction Equipment

- 6.4.10 Zoomlion Heavy Industry

- 6.4.11 Doosan Infracore

- 6.4.12 Hyundai Construction Equipment

- 6.4.13 Kobelco Construction Machinery

- 6.4.14 Yanmar Co., Ltd.

- 6.4.15 Wirtgen Group

- 6.4.16 Kubota Corporation

- 6.4.17 Sandvik Mining and Rock Tech.

- 6.4.18 Terex Corporation

- 6.4.19 Sumitomo Construction Machinery

- 6.4.20 Manitou Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment