PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939069

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939069

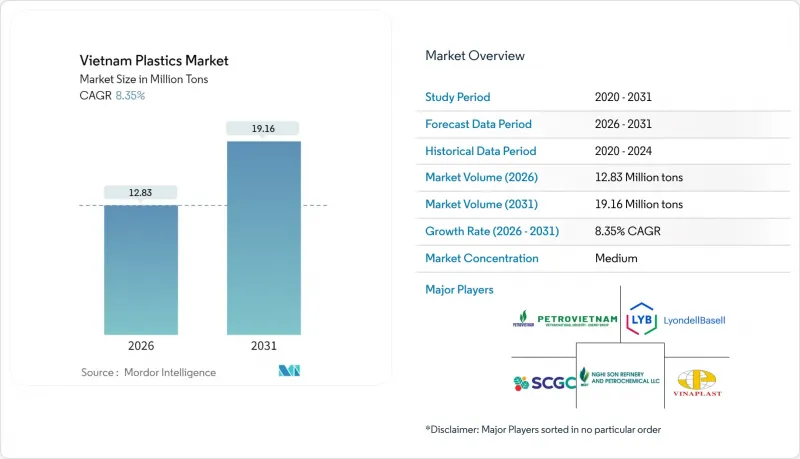

Vietnam Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam Plastics Market size in 2026 is estimated at 12.83 million tons, growing from 2025 value of 11.84 million tons with 2031 projections showing 19.16 million tons, growing at 8.35% CAGR over 2026-2031.

Robust foreign direct investment, aggressive infrastructure outlays, and decisive regulatory modernization converge to position Vietnam as Southeast Asia's fastest-growing plastics hub. Manufacturing relocation from China continues to swell downstream consumption, while construction investments-up 40% year over year in H1 2025-channel steady demand for pipes, profiles, and insulation materials. Local converters prioritize throughput over experimentation, scaling extrusion lines to meet surging orders. Simultaneously, sustainability mandates accelerate bioplastics adoption, nudging resin suppliers to diversify feedstocks and recycle content even as imported naphtha and propylene remain cost-sensitive inputs.

Vietnam Plastics Market Trends and Insights

Robust Growth in Domestic Construction Projects

Infrastructure spending climbed 40% year over year in H1 2025 after disbursement timelines were cut from weeks to 1-3 days. Demand for PVC pipes, insulation boards, and flame-retardant cable trays has soared, reflecting Vietnam's status as a cost-competitive construction center with costs still 60%-65% below Singapore levels. Data center projects outpace factory builds, elevating requirements for halogen-free compounds and heat-resistant engineered resins. Circular 10/2024/TT-BXD mandates quality checks on imported building materials, a policy that favors local converters able to document compliance. Together, these trends funnel volume and value growth into the Vietnam plastics market.

Booming Food-grade & E-commerce Packaging Demand

Vietnam's food processing output reached USD 79.3 billion in 2024, up 7.4%, just as e-commerce adoption leapt across urban centers. As a result, converters face parallel requirements for barrier films that prolong shelf life and lightweight mailers that cut shipping costs. Protective cushioning for electronics-imports of components rose 29.3% through March 2025-adds further pull for cushioning foams and molded inserts. Government preference programs that spotlight locally made packaging tilt procurement toward domestic suppliers, encouraging capital upgrades in printing, lamination, and multilayer extrusion lines.

Heavy Dependence on Imported Naphtha and Propylene

Vietnam imported more than 5.5 million tons of plastic feedstock in the first 7 months of 2025, largely from China, South Korea, and Taiwan. SCG's Long Son complex came online in August 2025 with a 1.4 million tons capacity, yet it still covers only a slice of domestic demand. Feedstock expenses, 60%-70% of output cost, remain tethered to global oil swings, eroding price competitiveness when crude spikes. Planned ethane upgrades worth USD 700 million will narrow the gap, but cost parity with gas-advantaged Gulf producers remains elusive.

Other drivers and restraints analyzed in the detailed report include:

- Rising Foreign Direct Investment in Downstream Resin Conversion

- Surge in Automotive & Electronics Relocation to Vietnam

- Escalating Environmental Activism Against Single-use Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional plastics retained 51.10% of the Vietnam Plastics market share in 2025, anchored by polyethylene and polypropylene grades used in everyday packaging, pipes, and molded parts. These products benefit from mature supply chains and low unit costs, ensuring continued volume leadership. Engineering plastics, including polycarbonate and polyamide, are gaining traction in electronics lines that ship high-brightness OLED(Organic Light Emitting Diode) displays and optical modules. Polyurethanes ride the construction boom, serving sandwich panels and furniture cushioning.

Bioplastics, though still a niche, are set to grow at a 12.55% CAGR through 2031 as brand owners chase sustainability targets and new regulations unlock demand. Agricultural residues supply potential starch inputs, yet scaling remains hindered by certification hurdles and premium pricing. Still, pilot programs led by international apparel groups showcase Vietnam as a future biopolymer production site, signaling a possible inflection after 2027.

The Vietnam Plastics Market Report is Segmented by Type (Traditional Plastics, Engineering Plastics, and Bioplastics), Technology (Blow Molding, Extrusion, Injection Molding, and Other Technologies), Application (Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Housewares, Furniture and Bedding, and Other Applications). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- AGC Inc.

- Billion Industrial Holding Limited

- Far Eastern New Century Corporation

- Hyosung Chemical

- LyondellBasell Industries Holdings B.V.

- NAN YA PLASTICS CORPORATION

- NSRP LLC

- SCG Chemicals Public Company Limited

- SKC

- Toray Industries Inc.

- Vietnam Oil and Gas Group

- Vietnam Polystyrene Co. Ltd

- Vinaplast

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Growth in Domestic Construction Projects

- 4.2.2 Booming Food-grade & E-commerce Packaging Demand

- 4.2.3 Rising Foreign Direct Investment in Downstream Resin Conversion

- 4.2.4 Surge in Automotive & Electronics Relocation to Vietnam

- 4.2.5 Government Incentives for Recycled-content Resins

- 4.3 Market Restraints

- 4.3.1 Heavy Dependence on Imported Naphtha and Propylene

- 4.3.2 Escalating Environmental Activism Against Single-use Plastics

- 4.3.3 Rising Competition from Bio-based Substitutes in FMCG

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

- 4.6 Raw Material Analysis

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 Polystyrene

- 5.1.1.4 Poly Vinyl Chloride

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyurethanes

- 5.1.2.2 Fluoropolymers

- 5.1.2.3 Polyamides

- 5.1.2.4 Polycarbonates

- 5.1.2.5 Styrene Copolymers (ABS and SAN)

- 5.1.2.6 Thermoplastic Polyesters

- 5.1.2.7 Other Engineering Plastics

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 By Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 Billion Industrial Holding Limited

- 6.4.3 Far Eastern New Century Corporation

- 6.4.4 Hyosung Chemical

- 6.4.5 LyondellBasell Industries Holdings B.V.

- 6.4.6 NAN YA PLASTICS CORPORATION

- 6.4.7 NSRP LLC

- 6.4.8 SCG Chemicals Public Company Limited

- 6.4.9 SKC

- 6.4.10 Toray Industries Inc.

- 6.4.11 Vietnam Oil and Gas Group

- 6.4.12 Vietnam Polystyrene Co. Ltd

- 6.4.13 Vinaplast

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment