PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939075

South-East Asia (SEA) Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

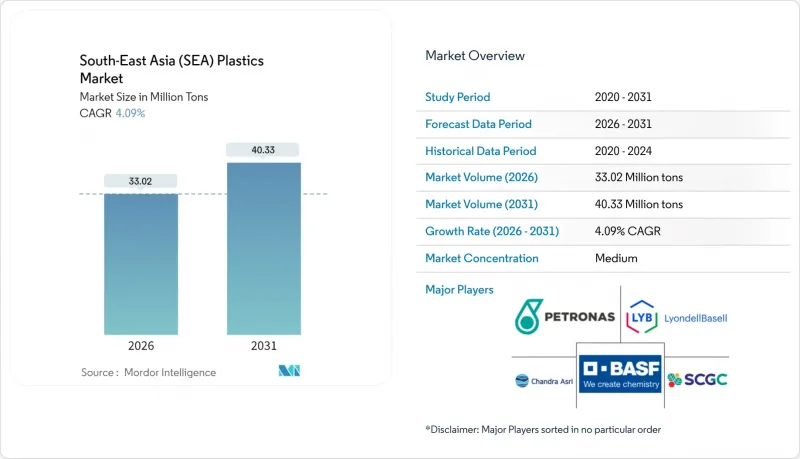

The South-East Asia Plastics market is expected to grow from 31.70 million tons in 2025 to 33.02 million tons in 2026 and is forecast to reach 40.33 million tons by 2031 at 4.09% CAGR over 2026-2031.

Growth rests on rising consumer spending, expanding export-oriented manufacturing, and steady infrastructure outlays that keep processors operating at high utilization rates. Local capacity additions trim import dependence and feedstock security, while regulatory momentum toward circular-economy practices forces producers to upgrade technology and invest in recycling. Indonesia's investment boom and Vietnam's rapid factory build-out underpin volume gains, but all major ASEAN members are channeling incentives into downstream petrochemicals to secure regional supply chains. Digital manufacturing initiatives-from real-time process monitoring to predictive maintenance-are also widening productivity differentials, reinforcing the cost advantages of large, integrated operators.

South-East Asia (SEA) Plastics Market Trends and Insights

Rising Demand from Food and Beverage Packaging

Accelerating urban lifestyles and sustained middle-class growth are intensifying demand for convenience foods and ready-to-drink beverages, prompting converters to raise runs of multi-layer films and rigid PET containers. Vietnam has attracted FDI since 2024 in packaging as global brand owners establish supply hubs to serve ASEAN and export markets. Regulators are tightening food-contact norms-Thailand now requires ISO 22000 certification on all packaging that touches edibles-nudging processors toward higher-spec barrier resins and antimicrobial additives. Shelf-life extension initiatives cascade through retail chains, boosting polypropylene and polyethylene grades engineered for oxygen and moisture resistance. With grocery e-commerce swelling, stakeholder pressure for lightweight yet puncture-resistant formats is spurring rapid material substitution toward high-modulus blends that enable downgauging without compromising integrity.

Rapid Downstream Capacity Additions Across Indonesia and Vietnam

Large-scale crackers and polymer plants coming online between 2023-2025 redraw intraregional trade flows. Vietnam's Long Son complex added 1.65 million t/y of ethylene capacity in late 2023, providing domestic processors with feedstock security previously sourced from Northeast Asia. Indonesia is seeing more than 2 million t/y of extra monomer output as TPPI debottlenecks its aromatics train and Lotte Chemical inaugurates a 1 million t/y cracker in 2H 2025. Coinciding with China's petrochemical overcapacity, these projects position the South-East Asia plastics market as an alternative supply platform for global converters seeking tariff diversification. State incentives-tax holidays on projects exceeding USD 500 million and streamlined permitting inside special economic zones-have shortened build-out schedules and lowered hurdle rates, encouraging regional processors to lock in long-term offtake contracts.

Stringent Anti-Plastic Regulations and Bans

Thailand's plastic bag decree, effective March 2025, mandates biodegradable additives and minimum thickness thresholds, raising input costs for shopping-bag producers by 15-20%. Singapore widened its plastic-waste import ban in January 2025, squeezing regional recyclers that relied on cross-border scrap inflows. Malaysia's forthcoming Extended Producer Responsibility (EPR) law shifts financial responsibility for collection and recycling to manufacturers starting in 2026, an obligation that favors scale players able to absorb compliance spend. These measures threaten single-use categories, forcing converters to pivot toward reusable and compostable options to keep shelf space.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Commerce-Led Flexible Packaging Needs

- Infrastructure Push Boosting Construction Plastics

- Feedstock Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional grades-polyethylene, polypropylene, and PVC-held a 63.05% share of the South-East Asia plastics market in 2025, supported by scale economics in packaging and consumer goods applications. Several brownfield line extensions in Indonesia and Vietnam lift aggregate regional polyolefin nameplate capacity and keep resin pricing competitive versus imports.

Engineering plastics remain niche in volume terms yet strategically important, capturing contracts in automotive under-the-hood parts and electronics housings where heat resistance and dimensional stability drive specification. Local compounders are investing in glass-fiber reinforced nylon and PBT blends to satisfy OEM localization targets. Regulatory push for electric vehicle adoption could accelerate demand for flame-retardant grades compliant with UL 94 V-0 standards.

Bioplastics are climbing at a 4.42% CAGR, the fastest within the South-East Asia plastics market, yet cost premiums and limited infrastructure for industrial composting temper penetration. Thailand's cassava-based bio-ethylene plant, built by SCG Chemicals, supplies converters with bio-PE that meets EN 13432 compostability, widening material choice for brand owners seeking differentiated sustainability credentials. Malaysia's palm oil innovation fund backs PHAs and PBS, though commercialization schedules hinge on feedstock certification thresholds under EU deforestation rules.

The South-East Asia Plastics Market Report is Segmented by Type (Traditional Plastics, Engineering Plastics, and Bioplastics), Technology (Injection Molding, Blow Molding, and More), Application (Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, and More), and Geography (Indonesia, Thailand, Malaysia, Vietnam, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Plastic Resin Manufacturers

- Plastic Product Manufacturers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from food and beverage packaging

- 4.2.2 Rapid downstream capacity additions across Indonesia and Vietnam

- 4.2.3 Surge in e-commerce-led flexible packaging needs

- 4.2.4 Infrastructure push boosting construction plastics

- 4.2.5 Government-backed petro-chemical SEZ pipelines

- 4.3 Market Restraints

- 4.3.1 Stringent anti-plastic regulations and bans

- 4.3.2 Feedstock price volatility

- 4.3.3 Shortage of skilled labor in engineering-grade plastics

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 By Technology

- 5.2.1 Injection Molding

- 5.2.2 Blow Molding

- 5.2.3 Extrusion

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Indonesia

- 5.4.2 Thailand

- 5.4.3 Malaysia

- 5.4.4 Vietnam

- 5.4.5 Philippines

- 5.4.6 Singapore

- 5.4.7 Rest of South-East Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Plastic Resin Manufacturers

- 6.4.1.1 AGC Chemicals Vietnam Co., Ltd.

- 6.4.1.2 BASF

- 6.4.1.3 Dow

- 6.4.1.4 DuPont

- 6.4.1.5 Indorama Ventures

- 6.4.1.6 JG Summit Petrochemical Corp

- 6.4.1.7 Kaneka (Malaysia) Sdn Bhd

- 6.4.1.8 LyondellBasell

- 6.4.1.9 Nan Ya Plastics (Formosa)

- 6.4.1.10 NPC Alliance Corp

- 6.4.1.11 PETRONAS Chemicals Group Berhad

- 6.4.1.12 Philippine Resins Industries

- 6.4.1.13 PRefChem

- 6.4.2 Plastic Product Manufacturers

- 6.4.2.1 Ampac Holdings

- 6.4.2.2 An Phat Holdings

- 6.4.2.3 An Trung Industries

- 6.4.2.4 Binh Minh Plastic

- 6.4.2.5 Cholon Plastic Co. Ltd.

- 6.4.2.6 City Long (Cambodia) Co., Ltd.

- 6.4.2.7 Dongsung

- 6.4.2.8 Duy Tan Plastics Corporation

- 6.4.2.9 LOTTE Chemical Titan

- 6.4.2.10 Polyplastics Co., Ltd.

- 6.4.2.11 PT Chandra Asri Petrochemical Tbk

- 6.4.2.12 SCG Chemicals PCL

- 6.4.2.13 Thai Formosa Plastic Industry Co., Ltd.

- 6.4.1 Plastic Resin Manufacturers

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment