PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939578

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939578

Thailand Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

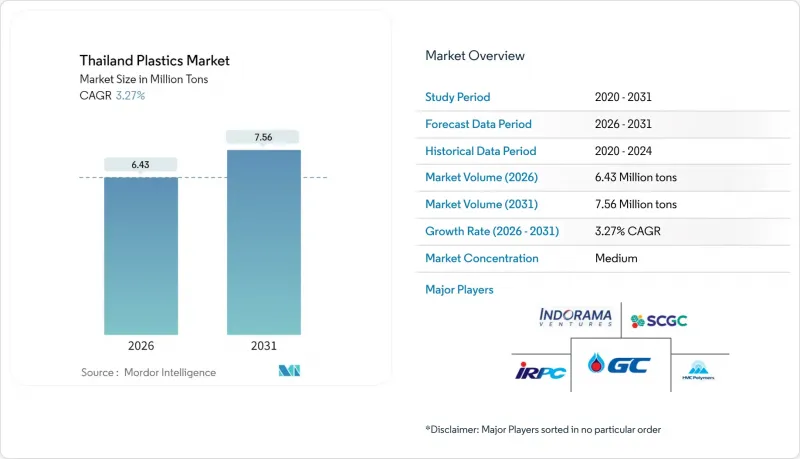

Thailand Plastics Market size in 2026 is estimated at 6.43 million tons, growing from 2025 value of 6.23 million tons with 2031 projections showing 7.56 million tons, growing at 3.27% CAGR over 2026-2031.

This moderate headline growth conceals a decisive shift toward low-carbon feedstocks, circular economy practices, and specialty applications that lift margins even as commodity spreads tighten. Traditional resins dominate volumes, yet a rapid pivot to biopolymers is underway because joint ventures are unlocking bio-ethylene and PLA capacity at scale. Demand momentum remains strongest in food, beverage, and e-commerce packaging, but the emergence of an electric-vehicle supply chain and large-scale infrastructure projects creates fresh pull for engineering resins and high-performance compounds. Intensifying Chinese oversupply, volatile naphtha costs, and stricter waste regulations pressure margins; firms that diversify feedstocks and invest in recycling infrastructure are best placed to protect returns in the Thailand plastics market.

Thailand Plastics Market Trends and Insights

Rising Demand from Food and Beverage Packaging

Domestic beverage consumption continues to expand, locking in steady packaging tonnage. New food-contact standards effective March 2025 encourage converters to adopt recyclable and heat-resistant formulations that command premium pricing. Beverage exports to neighboring Cambodia and Vietnam add incremental volumes, and food-delivery growth has more than doubled since the pandemic, generating multiple plastic items per order. Rising temperatures, rapid urbanization, and a tourism rebound sustain packaging intensity in the Thailand plastics market. Demand for rigid containers grows in parallel with the personal-care segment, where mid-single-digit sales growth of cosmetics and health products boosts specialized packaging uptake.

Increasing Plastics Use in Building and Construction

Government spending across over 150 infrastructure projects underwrites long-run demand for PVC pipes, insulation, and roofing sheets. The Plastic Roads initiative, which incorporates up to five tons of recycled material per kilometer, signals a policy pivot toward circular construction practices that enlarge the addressable market for recycled resin. More than 800 mid- and large-size manufacturers now integrate digital ordering tools and low-carbon processes to satisfy green-building specifications. An expected 1 million new jobs linked to megaprojects will spur residential and commercial builds, reinforcing demand for plastic building products even as energy inflation and cheap Chinese imports squeeze margins.

Stricter Single-Use-Plastic Bans and Taxes

Thailand's plastic-waste roadmap phases out imports from January 2025 and tightens quality rules for food-contact articles. Urban centers such as Bangkok generate 1,800 metric tons of single-use waste daily, prompting authorities to fast-track levies and labeling mandates that raise compliance costs for converters. Additional legislation under the Draft Industrial Waste Management Act introduces a dedicated fund to remediate environmental impacts and imposes stricter disposal rules on hazardous scrap. Producers in the Thailand plastics market must invest in certified recyclable or compostable alternatives and enhance traceability systems or face penalties. These rules initially restrict disposable items but ultimately catalyze demand for higher-value sustainable resins.

Other drivers and restraints analyzed in the detailed report include:

- Lightweighting Needs in Automotive and EV Components

- Bio-Based Polymer Joint Ventures

- Polypropylene and Polyethylene Oversupply and Low-Cost Imports from China

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional resins retained 70.55% of Thailand's plastics market share in 2025 thanks to entrenched infrastructure, scale economics, and diversified end-use exposure. Among them, polyethylene and polypropylene anchor packaging, automotive, and construction demand, while PET has grown beyond bottles into technical yarns and tire fabrics. HMC Polymers surpassed THB 25 billion in sales in 2023, illustrating the continuing commercial relevance of commodity grades. Engineering resins such as polyamides and polycarbonates post mid-single-digit demand gains tied to electronics assembly and EV power-train applications.

Biopolymers are the fastest-expanding category, progressing at a 5.53% CAGR and lifted by the 200,000-ton bio-ethylene venture and the 75,000-ton PLA expansion. Mainstream producers now trial chemical-recycling routes and circular naphtha streams to future-proof their asset bases and preserve relevance under new food-contact rules. The competitive gap narrows as conventional suppliers license bio-based processes, while newcomers differentiate through carbon-footprint declarations and compostability certifications.

The Thailand Plastics Report is Segmented by Type (Traditional Plastics, Engineering Plastics, and Bioplastics), Application (Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Furniture and Bedding, and Other Applications). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Covestro AG

- HMC Polymers Thailand

- Indorama Ventures Public Company Limited

- INEOS Styrolution Group GmbH

- IRPC Public Company Limited

- PTT Global Chemical Public Company Limited

- SCG Chemicals Co. Ltd

- Thai Plastic Industries Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Food and Beverage Packaging

- 4.2.2 Increasing Plastics Use in Building and Construction

- 4.2.3 Lightweighting Needs in Automotive and EV Components

- 4.2.4 Rapid E-Commerce Growth Boosting Protective Packaging

- 4.2.5 Bio-Based Polymer Joint Ventures (E.G., SCGC, Braskem)

- 4.3 Market Restraints

- 4.3.1 Stricter Single-Use-Plastic Bans and Taxes

- 4.3.2 Crude-Oil/Naphtha Price Volatility

- 4.3.3 PP and PE Oversupply and Low-Cost Imports from China

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyvinyl Chloride (PVC)

- 5.1.1.4 Polystyrene (PS)

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 Polyamides (PA)

- 5.1.2.3 Polycarbonates (PC)

- 5.1.2.4 Styrene Copolymers (ABS and SAN)

- 5.1.2.5 Polybutylene Terephthalate (PBT)

- 5.1.2.6 Polymethyl Methacrylate (PMMA)

- 5.1.2.7 Other Engineering Plastics

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Electrical and Electronics

- 5.2.3 Building and Construction

- 5.2.4 Automotive and Transportation

- 5.2.5 Furniture and Bedding

- 5.2.6 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Covestro AG

- 6.4.2 HMC Polymers Thailand

- 6.4.3 Indorama Ventures Public Company Limited

- 6.4.4 INEOS Styrolution Group GmbH

- 6.4.5 IRPC Public Company Limited

- 6.4.6 PTT Global Chemical Public Company Limited

- 6.4.7 SCG Chemicals Co. Ltd

- 6.4.8 Thai Plastic Industries Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment