PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939105

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939105

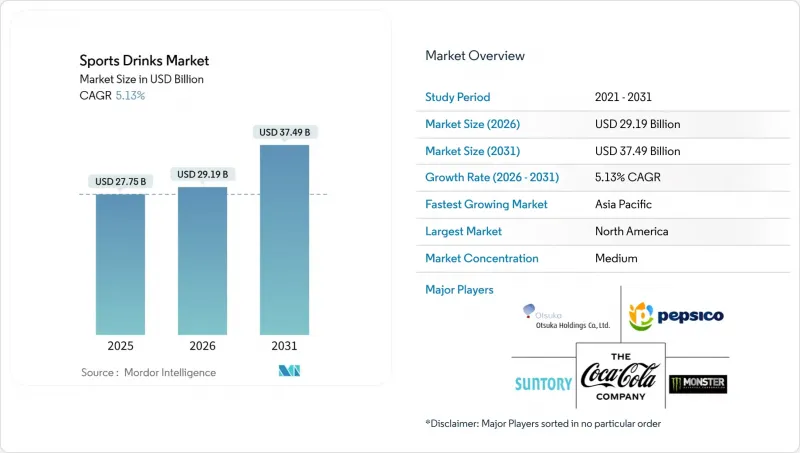

Sports Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The sports drinks market size in 2026 is estimated at USD 29.23 billion, growing from 2025 value of USD 27.79 billion with 2031 projections showing USD 37.62 billion, growing at 5.17% CAGR over 2026-2031.

The market has shifted from an athlete-centric focus to a broader consumer base, driven by the increasing emphasis on everyday wellness, rising fitness club memberships, and a steady stream of functional product launches. Urbanization and higher disposable incomes, particularly in the Asia-Pacific geography, have boosted demand for convenient hydration solutions. Additionally, global event sponsorships continue to enhance brand visibility. Corporate wellness initiatives, smartphone-based workout applications, and connected fitness devices are further promoting in-exercise hydration, increasing the frequency of sports drink consumption. Meanwhile, clean-label formulations, reduced sugar content, and eco-friendly packaging appeal to health-conscious consumers who prioritize ingredient transparency and environmental sustainability. Advances in aseptic technology on the supply side have minimized the need for chemical preservatives, enabling premium natural product offerings in geographies with temperature-sensitive conditions.

Global Sports Drinks Market Trends and Insights

Rising Participation in Sports and Physical Activities

Global sports participation rates are steadily increasing, with fitness club memberships rising among demographic groups previously less targeted by traditional sports drink marketing. The Asia-Pacific region is at the forefront of this shift, with a growing number of younger individuals emphasizing daily hydration. This trend underscores a market opportunity that extends beyond competitive athletics. Strategic partnerships further highlight the commercial implications of this development. For example, Gatorade's exclusive agreement with Anytime Fitness Philippines in May 2024 integrates the brand into numerous gym locations. Similarly, Red Bull's partnership with F45 Training Australia in March 2025 targets the high-intensity interval training segment. The shift from occasional consumption during organized sports to regular hydration across diverse physical activities significantly expands the total addressable market, influencing product formulations, packaging sizes, and distribution strategies. In 2023, 78.8% of Americans (242 million) participated in physical or sports activities, an increase of 2.2% or 5 million from the previous year. Winter sports participation grew by 22%, team sports by 10.8%, and pickleball surged by 51.8%. Inactivity dropped to its lowest level, at 21.2% .

Growing Demand for Hydration and Electrolyte Replenishment

Advancements in the scientific understanding of hydration physiology are driving increased consumer demand for targeted electrolyte formulations. This marks a shift from the traditional focus on generic sports drinks to products offering specific functional benefits. For instance, Gatorade's September 2024 launch of Hydration Booster highlights this trend. The electrolyte powder is designed to support everyday hydration needs rather than being exclusively aimed at high-intensity athletic performance. This development reflects growing consumer awareness of factors such as electrolyte balance, sodium-potassium ratios, and osmolality levels. Additionally, consumers are increasingly seeking products that align with their individual health goals, such as improved hydration for daily activities, recovery after moderate exercise, or maintaining electrolyte levels during illness. It also creates opportunities for brands to emphasize functional benefits backed by scientific credibility, moving beyond athlete endorsements to engage a wider audience.

Shelf-life Challenges with Natural and Preservative-free Products

Natural ingredient formulations face inherent stability challenges that limit their distribution reach and add complexity to supply chains, particularly in tropical climates where temperature fluctuations can accelerate product degradation. Sidel's aseptic PET technology provides a solution for sensitive beverages, addressing these challenges effectively. Market demand for such sensitive products is expected to grow significantly by 2024. However, adopting this technical solution requires considerable investment in specialized filling equipment and cold-chain logistics, which creates substantial barriers for smaller brands striving to maintain preservative-free positioning. This challenge is especially evident in emerging markets, where infrastructure limitations and cost sensitivity restrict the adoption of advanced preservation technologies, forcing brands to make difficult choices between maintaining natural positioning and ensuring market accessibility.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Distribution Channels, Including Online Retail

- Development of Sugar-Free and Low-Calorie Variants

- Regulatory Complexities and Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isotonic formulations are anticipated to account for 52.58% of the market share in 2025, reflecting their widespread acceptance among consumers. These solutions are designed to match the osmolality of human plasma, ensuring efficient absorption and hydration. Their popularity underscores the growing awareness of the importance of balanced electrolyte solutions for maintaining hydration and performance. This segment continues to dominate as it caters to a broad range of consumers seeking effective hydration solutions for everyday and moderate physical activities.

On the other hand, the hypertonic segment is projected to grow at a CAGR of 6.62%, driven by increasing demand from consumers engaging in intense training sessions or operating in extreme environmental conditions. Scientific research supports this trend, with studies demonstrating the superior performance of hypertonic solutions in endurance activities lasting over 90 minutes. In contrast, hypotonic formulations are recognized for their ability to provide rapid rehydration during moderate exercise. Additionally, electrolyte-enhanced water has carved out a niche in the wellness market, appealing to individuals seeking functional hydration benefits without the association with sports-specific branding.

PET bottles are anticipated to maintain a significant market share of 56.42% in 2025. This dominance is attributed to their well-established supply chains and widespread consumer familiarity, which have made them a preferred choice for packaging. On the other hand, aseptic packages are emerging as the fastest-growing segment, with a robust CAGR of 6.78%. This growth is primarily driven by rising concerns about sustainability and the increasing demand for optimizing shelf life, particularly for sensitive formulations. For instance, isotonic drinks benefit significantly from the extended shelf life provided by aseptic packaging, eliminating the need for preservatives while maintaining product quality.

Glass bottles continue to hold a premium position in the market, appealing to consumers seeking high-end packaging. However, their heavier weight and logistical challenges pose limitations to efficient distribution. Meanwhile, metal cans are gaining traction due to their superior recyclability and ability to retain temperature effectively. Companies like Ball Corporation are leading the way in sustainability efforts, achieving an average recycled content of 74% in their products and setting an ambitious target of reaching a 90% global recycling rate by 2030.

The Sports Drinks Market Report is Segmented by Soft Drink Type (Electrolyte-Enhanced Water, Hypertonic, Hypotonic, and More), Packaging Type (Aseptic Packages, Metal Can, and More), Distribution Channel (On-Trade, and Off-Trade), Functionality (Pre-Workout, Intra-Workout, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

North America is anticipated to maintain a substantial 37.72% market share in 2025, reflecting the region's strong brand loyalty and well-established distribution networks. This stability underscores the maturity of the market and the deep-rooted trust consumers place in existing brands. In contrast, Asia-Pacific is emerging as the fastest-growing region, with an impressive CAGR of 6.23%. This growth is being driven by increasing disposable incomes and a heightened focus on health and wellness among diverse demographic groups. Within this dynamic region, China plays a pivotal role, holding more than half of the regional energy drink market share, which highlights its dominance. Japan's functional beverage market is also noteworthy, with sports drinks contributing significantly to the overall market. Meanwhile, South Korea's health beverage market has shown remarkable growth between 2018 and 2023, and this positive trend is expected to continue through 2026. This growth is supported by the market's emphasis on premium product positioning and advancements in functional innovation, as reported by the Korea Food Industry Association .Europe, North America, the Middle East and Africa, and Southeast Asia offer diverse growth opportunities for businesses operating in the beverage market. Europe, while experiencing moderate growth due to market maturity and regulatory complexities, is making significant progress in sustainability. This focus on sustainability is fostering innovations in packaging and clean-label product positioning. A prime example is Coca-Cola HBC's introduction of Powerade in three new European markets, which achieved mid-teens volume growth. This success was further supported by its association with the Paris 2024 Olympics as the official drink, showcasing the region's ability to combine market maturity with forward-thinking innovation.

In Southeast Asia, Indonesia has witnessed notable developments, such as the launch of F&N's 100PLUS ACTIVE in May 2024. This product reached 22,000 outlets within just two months, driven by an aggressive and well-executed distribution strategy. Similarly, in Thailand, Thai Drinks is targeting Gen Z consumers, achieving a 15% growth rate compared to the 12% market average by leveraging digital marketing and premium positioning strategies. The Middle East and Africa are also emerging as promising markets, with infrastructure development and urbanization accelerating the adoption of modern retail channels. These factors are creating a favorable environment for the growth of health and wellness beverages, presenting substantial opportunities for market players to expand their presence and cater to evolving consumer preferences.

- PepsiCo, Inc.

- The Coca-Cola Company

- Otsuka Holdings Co., Ltd.

- Monster Beverage Corporation

- Abbott Laboratories

- Suntory Holdings Limited

- Keurig Dr Pepper Inc.

- Congo Brands

- ThaiBev PCL

- Nongfu Spring Co., Ltd.

- Carabao Group PCL

- AJE Group

- Seven & i Holdings Co., Ltd.

- Britvic plc

- Red Bull GmbH

- Danone S.A.

- Science in Sport PLC

- OSHEE Polska Sp. z o.o.

- Nestle S.A.

- Ajinomoto Co., Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising participation in sports and physical activities

- 4.2.2 Growing demand for hydration and electrolyte replenishment

- 4.2.3 Expansion of distribution channels, including online retail

- 4.2.4 Development of sugar-free and low-calorie variants

- 4.2.5 Growing trend of active lifestyles and fitness club memberships

- 4.2.6 Increasing demand for clean-label and natural ingredient products

- 4.3 Market Restraints

- 4.3.1 Shelf-life challenges with natural and preservative-free products

- 4.3.2 Regulatory complexities and compliance requirements

- 4.3.3 Consumer concerns over artificial colors, flavors, and additives

- 4.3.4 Environmental concerns related to packaging and waste

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Soft Drink Type

- 5.1.1 Isotonic

- 5.1.2 Hypertonic

- 5.1.3 Hypotonic

- 5.1.4 Electrolyte-Enhanced Water

- 5.1.5 Protein-based Sport Drinks

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Metal Can

- 5.2.4 Aseptic packages

- 5.2.5 Disposable Cups

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarket/Hypermarket

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Specialty Stores

- 5.3.2.4 Online Retail

- 5.3.2.5 Other Distribution Channels

- 5.4 By Functionality

- 5.4.1 Pre-Workout

- 5.4.2 Intra-Workout

- 5.4.3 Post-Workout

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo, Inc.

- 6.4.2 The Coca-Cola Company

- 6.4.3 Otsuka Holdings Co., Ltd.

- 6.4.4 Monster Beverage Corporation

- 6.4.5 Abbott Laboratories

- 6.4.6 Suntory Holdings Limited

- 6.4.7 Keurig Dr Pepper Inc.

- 6.4.8 Congo Brands

- 6.4.9 ThaiBev PCL

- 6.4.10 Nongfu Spring Co., Ltd.

- 6.4.11 Carabao Group PCL

- 6.4.12 AJE Group

- 6.4.13 Seven & i Holdings Co., Ltd.

- 6.4.14 Britvic plc

- 6.4.15 Red Bull GmbH

- 6.4.16 Danone S.A.

- 6.4.17 Science in Sport PLC

- 6.4.18 OSHEE Polska Sp. z o.o.

- 6.4.19 Nestle S.A.

- 6.4.20 Ajinomoto Co., Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK