PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939674

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939674

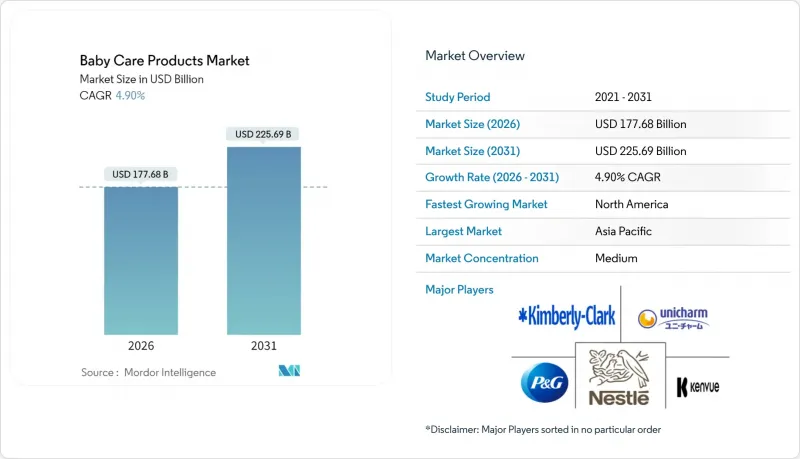

Baby Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The baby care products market size in 2026 is estimated at USD 177.68 billion, growing from 2025 value of USD 169.38 billion with 2031 projections showing USD 225.69 billion, growing at 4.90% CAGR over 2026-2031.

Established market leaders are enhancing their operating margins by launching clean-label product extensions that cater to the growing consumer demand for transparency and safety. Meanwhile, new entrants are leveraging social commerce platforms to effectively engage with first-time parents, creating personalized and interactive shopping experiences. Parents are placing an increasing emphasis on their babies' health, hygiene, and safety, driving the demand for natural, premium-quality baby care products that comply with stringent regulatory standards. Confidence in government safety frameworks, such as the FDA's updated regulations for infant formula, is raising industry-wide quality benchmarks and encouraging investments in clinical validation to ensure product efficacy and safety. The rising number of working mothers has further amplified the need for convenient, ready-to-use baby care solutions that save time and simplify daily routines. To remain competitive amidst pricing pressures, the market is witnessing significant ingredient innovations, combining plant-based substrates with biotech-derived actives to deliver effective and sustainable solutions. Additionally, the adoption of an omnichannel purchasing model, which includes subscription-based diaper services and same-day grocery deliveries, is transforming inventory management practices and marketing strategies, enabling companies to meet evolving consumer expectations more efficiently.

Global Baby Care Products Market Trends and Insights

Concerns over infant hygiene and health

Parents' growing awareness of infant vulnerabilities is driving demand for products with superior safety features and clinical validation. The FDA has implemented stricter regulations on infant formulas, requiring enhanced testing protocols, nutritional adequacy, and facility registrations. These regulations, detailed under 21 CFR Parts 106 and 107, have enhanced industry standards. This regulatory rigor benefits manufacturers with strong quality systems while creating challenges for smaller players. According to the Consumer Product Safety Commission, scrutiny of infant products has increased, with new safety standards for nursing pillows and infant support cushions highlighting a broader focus on safety. "Safety Standards for Infant Products." 2024. Additionally, pediatric healthcare providers are increasingly recommending specific product categories, shifting consumer decisions from being price-driven to recommendation-based. In high-mortality regions, infections such as sepsis, diarrhea, and pneumonia, often caused by inadequate hygiene and sanitation, remain leading causes of infant deaths. In 2024, the CIA - The World Factbook reported an infant mortality rate of 53.7 deaths per thousand live births in Nigeria during the first year of life . This highlights the critical need for educational initiatives, safe baby care products, clean birthing practices, and broader public health reforms to prevent infection-related deaths.

Premiumization of baby care SKUs

Parents are increasingly prioritizing baby care products that emphasize safety, efficacy, and high-quality, often organic or plant-based ingredients. Their readiness to invest more in premium formulations is driving growth across categories like skin care, toiletries, and baby food. By adopting premium positioning strategies, brands are reaping higher margins, as parents willingly pay a premium for perceived quality and safety. This trend is underscored by organic certifications, claims of clinical testing, and initiatives in sustainable packaging, all justifying price premiums of 20-40% over conventional options. The premiumization effect is especially notable in developed markets, buoyed by disposable income levels that allow for discretionary spending on infant care. For instance, per capita personal income in the United States was USD 108,233 in 2024, according to the US Department of Commerce . A case in point is Bobbie Labs, which, in April 2025, rolled out the first USDA organic whole milk infant formula, catering to parents leaning towards organic over conventional options. Market dynamics are increasingly favoring brands that effectively communicate scientific validation and ingredient transparency, fostering brand loyalty and encouraging repeat purchases.

Potential health concerns related to chemical residues

Growing consumer concerns over chemical residues, coupled with heightened regulatory scrutiny, are significantly restricting market growth, particularly in conventional product categories. A notable example is the European Chemicals Agency's classification of borate and talc as Category 1B carcinogens, which has led to their planned ban in cosmetic products by 2027. This regulatory action underscores how safety concerns can render entire ingredient categories obsolete. As a result, manufacturers are compelled to reformulate their products, which involves substantial costs for additional testing and navigating disruptions across their supply chains. The rise of social media platforms and advocacy group campaigns has further amplified consumer awareness of the potential risks associated with chemical residues. This growing awareness is driving demand for cleaner and safer product formulations, often pressuring manufacturers to act even before regulatory mandates are enforced. For established brands with legacy formulations, these developments pose significant challenges. They must invest heavily in research and development to meet evolving consumer expectations and regulatory standards, while also facing the risk of losing market share during the transition period. The shift toward cleaner formulations is not only reshaping product development strategies but also redefining competitive dynamics within the market.

Other drivers and restraints analyzed in the detailed report include:

- Growing infant population

- Preference for organic and chemical-free products

- Falling birth-rates in OECD nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Baby Food and Beverages hold a 42.72% market share in 2025, highlighting parents' focus on ensuring nutritional security over discretionary care products. This segment's dominance is driven by essential purchasing patterns and regulations that enforce specific nutritional standards for infant formulas and complementary foods. On the other hand, Baby Skin Care is the fastest-growing segment, with a 6.57% CAGR projected through 2031. This growth is propelled by premiumization trends and increased awareness of infant skin sensitivities. The rise in skin care reflects a broader shift in consumer preferences, as parents increasingly acknowledge the specialized needs of their infants' skin development. Baby Hair Care continues to grow steadily, supported by gentle formulations and the use of natural ingredients. Meanwhile, Baby Toiletries includes both high-volume staples like diapers and premium bath products, with the latter offering higher profit margins.

The regulatory environment plays a critical role in shaping product development across categories. For example, FDA requirements for nutritional adequacy in infant formulas not only ensure product safety but also create barriers for new entrants. Within toiletries, Bath and Fragrances capitalize on sensory marketing and gift-giving occasions, enabling premium pricing. Diapers and Wipes represent the largest volume segment in toiletries, with subscription models and sustainability initiatives addressing environmental concerns. Innovation trends vary significantly across product categories: food and beverages focus on organic certifications and nutritional improvements, while care products emphasize gentle formulations and dermatological testing. These dynamics indicate a continued division between essential nutrition products with stable demand and premium care products experiencing accelerated growth.

Conventional and synthetic ingredients hold a 72.90% market share in 2025. Their dominance is driven by established supply chains, cost efficiencies, and a proven safety record, ensuring accessibility for the mass market. This leadership highlights the practicalities of global manufacturing scale and regulatory processes that favor well-documented synthetic ingredients over emerging natural options. Meanwhile, organic and natural ingredients are experiencing growth, with a 6.35% CAGR projected through 2031. This trend reflects a steady shift in consumer preferences toward cleaner formulations, despite their higher costs. The United States Department of Agriculture National Organic Program certification standards further support this growth by providing regulatory clarity and enhancing consumer confidence in product claims.

Conventional ingredients excel in product consistency, shelf stability, and manufacturing efficiency, which are critical for global distribution. Synthetic ingredients range from traditional chemical compounds to advanced biotechnology-derived components, both offering superior performance. Organic and natural alternatives face challenges such as supply chain constraints and seasonal availability, which limit scalability. However, they command premium pricing that offsets higher raw material costs. The distinction between ingredient segments is increasingly blurred as manufacturers develop hybrid formulations that combine synthetic base ingredients with organic active compounds. These innovations deliver products that balance performance, safety, and natural appeal. Regulatory compliance also plays a significant role in ingredient selection. For example, the European Union's restrictions on certain synthetic compounds have accelerated the adoption of natural ingredients in European markets.

The Baby Care Products Market Report is Segmented by Product Type (Baby Skin Care, Baby Hair Care, and More), Age Group (Infants 0-1 Year, Toddlers 1-3 Years), Distribution Channel (Supermarkets/Hypermarkets, and Mores), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America holds a leading 35.20% market share in 2025, reflecting its high disposable incomes, strong preference for premium products, and a regulatory framework that effectively balances innovation with consumer protection. The region's advanced healthcare systems not only endorse products but also support a well-established retail infrastructure that caters to both traditional and modern distribution channels. Increasing consumer sophistication drives demand for organic certifications, clinical testing validations, and sustainable packaging, all of which command premium pricing. The FDA's oversight of infant formulas and the CPSC's safety standards for infant products ensure product quality, fostering consumer trust while creating significant entry barriers. Digital parenting trends are particularly prominent in North America, where high internet penetration and widespread social media usage drive online product discovery and the growth of direct-to-consumer brands.

Asia-Pacific is experiencing rapid growth, with a projected 5.35% CAGR through 2031, fueled by strong demographic and economic factors. The region's massive population of 4.3 billion, representing 60% of the global total, offers a substantial market opportunity despite varying fertility rates across subregions. Accelerating urbanization is driving lifestyle changes that favor packaged baby care products over traditional alternatives, while a growing middle class increases purchasing power for premium products. The region's technological adoption trends favor smart baby products and e-commerce, with countries like China and South Korea leading the way in digital integration, influencing global product development priorities.

Europe remains strategically significant, not only as a market but also as a regulatory leader, shaping global product standards and driving demand for organic and sustainable products, particularly in the premium segment. The European Chemicals Agency's proactive stance on chemical safety, including restrictions on talc and microplastics, underscores the region's focus on compliance and safety. Europe's emphasis on environmental sustainability drives innovation in biodegradable packaging and natural ingredient formulations, which are subsequently adopted in global markets. Meanwhile, South America and the Middle East and Africa present emerging opportunities, supported by favorable demographics. However, these regions face challenges such as diverse economic conditions, distribution infrastructure limitations, and regulatory complexities. While urbanization trends and demographic dividends offer growth potential, issues like product affordability and supply chain development influence market entry strategies and product positioning.

- Procter and Gamble Co.

- Kimberly-Clark Corp.

- Kenvue

- Unicharm Corp.

- Nestle S.A.

- Danone S.A.

- Abbott Laboratories

- Royal FrieslandCampina N.V.

- Unilever PLC

- Himalaya Global Holdings Ltd.

- Beiersdorf AG

- Expanscience Labs (Mustela)

- Artsana S.p.A. (Chicco)

- Honasa Consumer Ltd. (Mamaearth)

- The Honest Company Inc.

- Pigeon Corp.

- Kao Corp.

- Dabur India Ltd.

- Meiji Holdings Co. Ltd.

- Abena A/S (Bambo Nature)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Concerns over infant hygiene and health

- 4.2.2 Premiumisation of baby care SKUs

- 4.2.3 Growing infant population

- 4.2.4 Preference for organic and chemical-free products

- 4.2.5 Innovations in product fferings

- 4.2.6 Digital parenting influence

- 4.3 Market Restraints

- 4.3.1 Potential health concerns related to chemical residues

- 4.3.2 Stringent regulatory environment

- 4.3.3 Falling birth-rates in OECD nations

- 4.3.4 Complexity of ingredient formulations

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Baby Skin Care

- 5.1.2 Baby Hair Care

- 5.1.3 Baby Toiletries

- 5.1.3.1 Bath and Fragrances

- 5.1.3.2 Diapers and Wipes

- 5.1.4 Baby Food and Beverages

- 5.2 By Ingredient Type

- 5.2.1 Organic / Natural

- 5.2.2 Conventional / Synthetic

- 5.3 By Age Group

- 5.3.1 Infants (0-1 Year)

- 5.3.2 Toddlers (1-3 Years)

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets / Hypermarkets

- 5.4.2 Pharmacies / Drug Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Procter and Gamble Co.

- 6.4.2 Kimberly-Clark Corp.

- 6.4.3 Kenvue

- 6.4.4 Unicharm Corp.

- 6.4.5 Nestle S.A.

- 6.4.6 Danone S.A.

- 6.4.7 Abbott Laboratories

- 6.4.8 Royal FrieslandCampina N.V.

- 6.4.9 Unilever PLC

- 6.4.10 Himalaya Global Holdings Ltd.

- 6.4.11 Beiersdorf AG

- 6.4.12 Expanscience Labs (Mustela)

- 6.4.13 Artsana S.p.A. (Chicco)

- 6.4.14 Honasa Consumer Ltd. (Mamaearth)

- 6.4.15 The Honest Company Inc.

- 6.4.16 Pigeon Corp.

- 6.4.17 Kao Corp.

- 6.4.18 Dabur India Ltd.

- 6.4.19 Meiji Holdings Co. Ltd.

- 6.4.20 Abena A/S (Bambo Nature)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK