PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939733

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939733

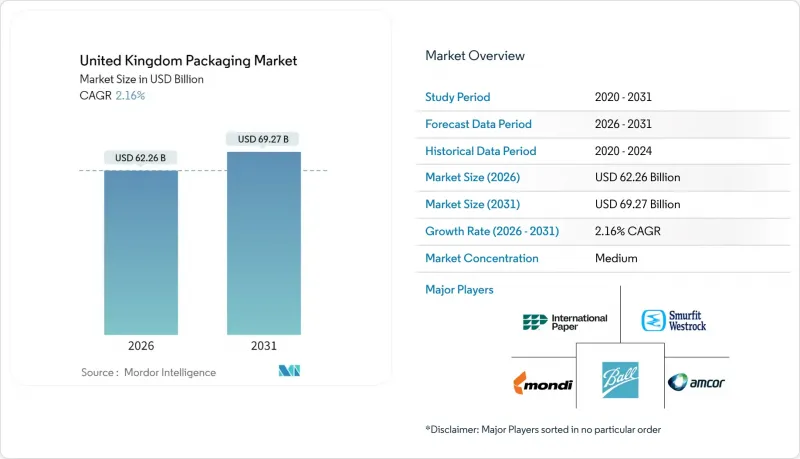

United Kingdom Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United Kingdom packaging market size in 2026 is estimated at USD 62.26 billion, growing from 2025 value of USD 60.94 billion with 2031 projections showing USD 69.27 billion, growing at 2.16% CAGR over 2026-2031.

Current momentum reflects a mature yet steadily evolving landscape shaped by post-Brexit border rules, tighter environmental mandates, e-commerce acceleration and pronounced cost inflation. Structural adjustments under the Border Target Operating Model raised compliance workloads and stretched lead times, prompting producers to localize inputs and automate customs documentation. Parallel expansion of the United Kingdom Plastic Packaging Tax and full roll-out of Extended Producer Responsibility sharpened the focus on recyclability, driving rapid substitution toward paper, mono-material plastics and bio-based films. Flexible formats gained share as online retail reached 31.3% of national sales, and value-added printing capabilities helped brands target niche audiences cost-effectively. Consolidation continued, highlighted by International Paper's USD 7.54 billion acquisition of DS Smith, which created the region's largest corrugated supplier but intensified antitrust scrutiny.

United Kingdom Packaging Market Trends and Insights

Rising E-commerce Driven Demand for Corrugated and Flexible Mailers

Online retail sales surged to 31.3% of national turnover in 2024, lifting shipment volumes for corrugated boxes and flexible mailers by 23%. Quick-commerce operators such as Getir stimulated single-portion packaging that combines tamper evidence with thermal integrity. Amazon's automated packing lines cut packaging material intensity 15% and accelerated outbound throughput, setting new efficiency benchmarks. Subscription models from HelloFresh amplified demand for returnable insulation, while marketplace sellers gravitated toward right-sized mailers that curb dimensional-weight charges. These developments support continued expansion of corrugated and flexible formats within the United Kingdom packaging market.

Shift Toward Recyclable and Biobased Materials Due to United Kingdom Plastic Tax

The Plastic Packaging Tax extension in 2024 imposed a GBP 200 (USD 263) per-tonne levy on polymers lacking 30% recycled content, encouraging a 35% jump in reclaimed feedstock adoption. Unilever achieved 50% recycled plastic in United Kingdom personal-care lines, while Nestle pledged fully recyclable solutions by 2025. Rising virgin resin differentials 18% above recycled inputs favor vertically integrated recyclers. Average compliance outlays reached GBP 2.3 million (USD 3.02 million) for large converters, prompting capital flows into wash-flake capacity and chemical recycling pilots. Sustainability requirements therefore accelerate material portfolio realignment across the United Kingdom packaging market.

High Raw-Material Price Volatility for Resins and Paper

Polyethylene resin prices jumped 22% in 2024, while recycled paper climbed 18% on energy cost spikes and supply constraints. Mondi's United Kingdom operations reported 340-basis-point margin erosion, triggering downstream price hikes that tempered demand elasticity. Converters raised safety-stock thresholds 25-30% to secure continuity, yet carrying costs strained working capital. Energy-intensive extrusion lines curtailed output during peak tariff windows, underscoring volatility as a short-term drag on the United Kingdom packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization and Luxury Packaging Demand from Millennials and Tourism

- Growing FMCG Private Label Expansion in Discount Channels Requiring Cost-Efficient Packaging

- Strict United Kingdom Regulations on Single-Use Plastics and Extended Producer Responsibility Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic accounted for 48.02% of the United Kingdom packaging market share in 2025, underpinned by its versatility across food, beverage and personal-care categories. Rigid PET bottle light-weighting shaved 25% material mass over the decade while integration of post-consumer resin boosted recycled content credibility. Yet tightening tax thresholds and retailer zero-plastic pledges pivot growth toward paper, which delivers the fastest 4.62% CAGR through 2031 on expanding e-commerce corrugated volumes. The United Kingdom packaging market size for paper substrates will continue to widen as mono-material designs simplify curbside recycling.

Glass and metal regained relevance in premium drinks due to infinite recyclability and high perceived quality, contributing 3.2% and 4.1% respective annual growth. Beverage can volumes surged as craft breweries exploited aluminum's light weight and rapid chilling properties, offsetting higher input costs via volume efficiencies. Meanwhile, bio-polymer films entered specialty applications where compostability commands price premiums. These shifts indicate that plastic's leadership persists but erodes marginally as sustainability criteria increasingly influence material selection within the United Kingdom packaging market.

The United Kingdom Packaging Market Report is Segmented by Packaging Type (Plastic, Paper, Container Glass, Metal Cans), Packaging Format (Flexible, Rigid), End-Use Industry (Food, Beverage, Pharmaceuticals, Personal Care, Industrial, E-Commerce). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- International Paper Company

- Smurfit WestRock

- Amcor plc

- Mondi plc

- Ball Corporation

- Crown Holdings Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Graphic Packaging International LLC

- Greif Inc.

- Silgan Holdings Inc.

- AptarGroup Inc.

- Huhtamaki Oyj

- Tetra Pak International SA

- CAN-PACK UK Ltd.

- Ardagh Group S.A.

- RPC Group Ltd.

- Klckner Pentaplast Ltd.

- Coveris Holdings S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising e Commerce driven demand for corrugated and flexible mailers

- 4.2.2 Shift towards recyclable and biobased materials due to United Kingdom Plastic Tax

- 4.2.3 Premiumization and luxury packaging demand from millennials and tourism

- 4.2.4 Growing FMCG private label expansion in discount channels requiring cost-efficient packaging

- 4.2.5 Growth of dark kitchens and quick commerce creating single-portion packaging needs

- 4.2.6 Adoption of digital printing for short runs enabling customization for SME brands

- 4.3 Market Restraints

- 4.3.1 High raw-material price volatility for resins and paper

- 4.3.2 Strict United Kingdom regulations on single-use plastics and Extended Producer Responsibility costs

- 4.3.3 Supply-chain disruptions post-Brexit impacting imported packaging components

- 4.3.4 Labor shortages in manufacturing and logistics escalating operational costs

- 4.4 Industry Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Plastic Packaging

- 5.1.1.1 By Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.1.1.1 Polyethylene (PE)

- 5.1.1.1.1.1.2 Polypropylene (PP)

- 5.1.1.1.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.1.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.1.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.1.1.1.6 Other Material Types

- 5.1.1.1.1.2 By Product Type

- 5.1.1.1.1.2.1 Bottles and Jars

- 5.1.1.1.1.2.2 Caps and Closures

- 5.1.1.1.1.2.3 Trays and Containers

- 5.1.1.1.1.2.4 Other Product Types

- 5.1.1.1.1.3 By End-use Industry

- 5.1.1.1.1.3.1 Food

- 5.1.1.1.1.3.2 Beverage

- 5.1.1.1.1.3.3 Pharmaceutical

- 5.1.1.1.1.3.4 Cosmetics and Personal Care

- 5.1.1.1.1.3.5 Industrial

- 5.1.1.1.1.3.6 Other End-use Industry

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.2 Flexible Plastic Packaging

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.2.1.1 Polyethylene (PE)

- 5.1.1.1.2.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.1.2.1.3 Cast Polypropylene (CPP)

- 5.1.1.1.2.1.4 Other Material Types

- 5.1.1.1.2.2 By Product Type

- 5.1.1.1.2.2.1 Pouches and Bags

- 5.1.1.1.2.2.2 Films and Wraps

- 5.1.1.1.2.2.3 Other Product Types

- 5.1.1.1.2.3 By End-use Industry

- 5.1.1.1.2.3.1 Food

- 5.1.1.1.2.3.2 Beverage

- 5.1.1.1.2.3.3 Pharmaceutical

- 5.1.1.1.2.3.4 Cosmetics and Personal Care

- 5.1.1.1.2.3.5 Industrial

- 5.1.1.1.2.3.6 Other End-use Industry

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.2 By Product Type

- 5.1.1.2.1 Bottles and Jars

- 5.1.1.2.2 Pouches and Bags

- 5.1.1.2.3 Bulk-Grade Products

- 5.1.1.2.4 Other Product Types

- 5.1.1.3 By End-use Industry

- 5.1.1.3.1 Food

- 5.1.1.3.2 Beverages

- 5.1.1.3.3 Cosmetics and Personal Care

- 5.1.1.3.4 Pharamceuticals

- 5.1.1.3.5 Industrial

- 5.1.1.3.6 Other End-use Industry

- 5.1.1.1 By Type

- 5.1.2 Paper Packaging

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Folding Carton

- 5.1.2.1.2 Corrugated Boxes

- 5.1.2.1.3 Liquid Paperboard

- 5.1.2.1.4 Other Product Type

- 5.1.2.2 By End-use Industry

- 5.1.2.2.1 Food

- 5.1.2.2.2 Beverages

- 5.1.2.2.3 E-commerce

- 5.1.2.2.4 Other End-use Industry

- 5.1.2.1 By Product Type

- 5.1.3 Container Glass

- 5.1.3.1 By Color

- 5.1.3.1.1 Green

- 5.1.3.1.2 Amber

- 5.1.3.1.3 Flint

- 5.1.3.1.4 Other Colors

- 5.1.3.2 By End-use Industry

- 5.1.3.2.1 Food

- 5.1.3.2.2 Beverage

- 5.1.3.2.2.1 Alcoholic

- 5.1.3.2.2.2 Non-Alcoholic

- 5.1.3.2.3 Personal Care and Cosmetics

- 5.1.3.2.4 Pharmaceuticals (excluding Vials and Ampoules)

- 5.1.3.2.5 Perfumery

- 5.1.3.1 By Color

- 5.1.4 Metal Cans and Containers

- 5.1.4.1 By Material Type

- 5.1.4.1.1 Steel

- 5.1.4.1.2 Aluminum

- 5.1.4.2 By Product Type

- 5.1.4.2.1 Cans

- 5.1.4.2.2 Drums and Barrels

- 5.1.4.2.3 Caps and Closures

- 5.1.4.2.4 Other Product Type

- 5.1.4.3 By End-use Industry

- 5.1.4.3.1 Food

- 5.1.4.3.2 Beverage

- 5.1.4.3.3 Chemicals and Petroleum

- 5.1.4.3.4 Industrial

- 5.1.4.3.5 Paints and coatings

- 5.1.4.3.6 Other End-use Industry

- 5.1.4.1 By Material Type

- 5.1.1 Plastic Packaging

- 5.2 By Packaging Format

- 5.2.1 Flexible

- 5.2.2 Rigid

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Industrial

- 5.3.6 E-commerce

- 5.3.7 Other End-use Industry

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core segments, Financials as available, Strategic information, Market rank/share for key companies, Products and Services, and Recent developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit WestRock

- 6.4.3 Amcor plc

- 6.4.4 Mondi plc

- 6.4.5 Ball Corporation

- 6.4.6 Crown Holdings Inc.

- 6.4.7 Sealed Air Corporation

- 6.4.8 Sonoco Products Company

- 6.4.9 Graphic Packaging International LLC

- 6.4.10 Greif Inc.

- 6.4.11 Silgan Holdings Inc.

- 6.4.12 AptarGroup Inc.

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Tetra Pak International SA

- 6.4.15 CAN-PACK UK Ltd.

- 6.4.16 Ardagh Group S.A.

- 6.4.17 RPC Group Ltd.

- 6.4.18 Klckner Pentaplast Ltd.

- 6.4.19 Coveris Holdings S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment