PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940685

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940685

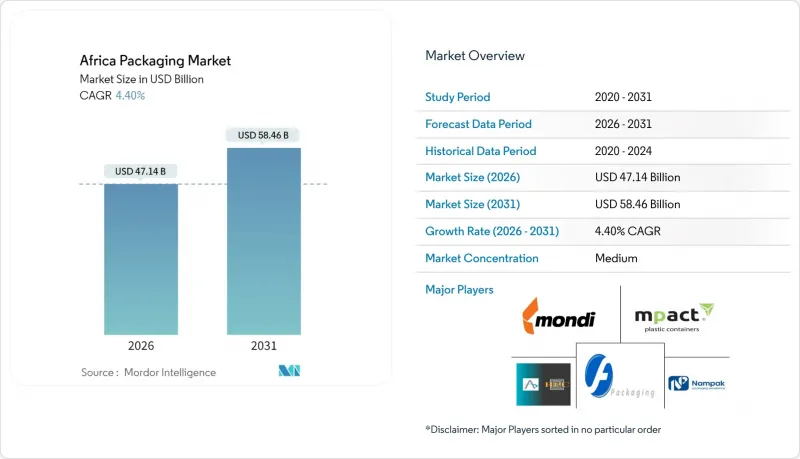

Africa Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa packaging market is expected to grow from USD 45.15 billion in 2025 to USD 47.14 billion in 2026 and is forecast to reach USD 58.46 billion by 2031 at 4.4% CAGR over 2026-2031.

This steady trajectory stems from rising urban populations, expanding e-commerce activity, and active policy support for sustainability across the continent. Rapid urbanization is reshaping consumer habits toward branded, portion-controlled goods, while modern retail chains and digital commerce channels are deepening demand for flexible packs that optimize shelf life and logistics. Government bans on single-use plastics are creating immediate substitution opportunities for paper-based formats, even as plastic retains the biggest share. Infrastructure investments by global beverage and automotive brands are also lifting demand for primary, secondary, and tertiary packs that comply with Extended Producer Responsibility programs. Supply-chain localization efforts-triggered by chronic port congestion- are prompting brand owners to source materials closer to end markets, shortening lead times and stabilizing input costs.

Africa Packaging Market Trends and Insights

Growing Urban Middle Class Boosting FMCG Consumption

Africa's cities are projected to add 700 million residents by 2050, channeling purchasing power toward processed foods and branded personal-care items. As household incomes rise, consumers prefer packaged goods that promise hygiene, convenience, and longer shelf life. Flexible pouches and unit-dose sachets cater to portion control while meeting affordability thresholds. Retailers are expanding private-label assortments that demand consistent pack specifications across borders, accelerating regional standardization. The African Continental Free Trade Agreement is smoothing cross-border flows, encouraging converters to install wider web presses and extrusion lines that can serve multiple countries from one hub. Consequently, the Africa packaging market is experiencing higher order volumes for lightweight laminates and barrier films tailored to shelf-stable groceries.

E-commerce Packaging Demand Surge

Digital commerce is forecast to reach USD 72 billion by 2026, growing 25% annually and underpinning a distinct logistics chain that elevates secondary and tertiary packaging needs. Online orders endure more touch points than store-delivered goods, compelling brand owners to specify corrugated shippers with reinforced edges, void fill, and tamper-evident closures. Mobile-money prevalence, notably in Kenya, sustains cash-on-delivery models that require parcels to withstand multiple handling events before payment confirmation. SMEs now leverage regional B2B marketplaces that move industrial spares and agricultural inputs, expanding demand for protective wraps and bubble mailers. Sustainability remains top of mind, spurring the uptake of mono-material mailers that meet recyclability targets without sacrificing drop-test performance. These intertwined dynamics add headroom for the Africa packaging market as converters diversify into custom-printed e-commerce sleeves and return-ready envelopes.

Volatile Polymer and Paper Pulp Prices

Benchmark polypropylene prices have whipsawed since 2024 as West-African currencies weakened and freight surcharges mounted. While Nigeria's 900,000-tonne Dangote complex offers regional supply security, exports capture premium margins overseas, muting domestic price relief. Paperboard markets are likewise pressured by forestry caps in Gabon and mill curtailments in Cameroon, shrinking local furnish availability. Such volatility erodes converter margins and complicates annual price-adjustment negotiations with brand owners. Some flexible-film producers are substituting calcium-carbonate fillers to trim resin content, but property trade-offs limit usage to low-barrier SKUs. The resulting cost-pass-through risk subtracts up to 0.7 percentage points from the Africa packaging market's near-term CAGR forecast.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Modern Retail Chains Across Africa

- Government Bans on Single-Use Plastics Driving Alternative Materials

- Power-Supply Instability Increasing Plant OPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic packaging retained 43.62% Africa packaging market share in 2025 on the back of cost-efficiency and versatility in bottles, pouches and thermoformed trays. PET and PP formats remained vital for carbonated beverages and personal-care items owing to clarity and drop resistance. Yet the segment faces escalating compliance costs as Extended Producer Responsibility levies expand, prompting fast-moving consumer-goods companies to pre-qualify paper substitutions for takeaway food wraps and carrier bags. Paperboard, while holding a smaller baseline, is slated for a 6.05% CAGR, the fastest within Africa packaging market, as folding cartons and corrugated cases satisfy both regulatory and brand-sustainability mandates. Metal cans and glass bottles occupy resilient niches in beer, energy drinks and pharmaceuticals, benefitting from inertness and existing recycling loops. However, limited glass furnace capacity outside South Africa and Egypt constrains rapid share gains. Polyolefin producers navigate this landscape by marketing down-gauged films and tethered-cap innovations that align with litter-reduction rules. Collectively, these shifts indicate that while plastics will continue to dominate volumes, incremental value creation in the Africa packaging market will migrate toward fiber and hybrid structures that meet end-of-life criteria without compromising product protection.

The complementary dynamics of barrier performance, cost and policy shape converter investment decisions. Corrugated board plants are upgrading to die-cutters capable of making e-commerce shippers with crash-lock bottoms, serving both domestic SMEs and multinational fulfillment centers. Meanwhile, regional resin distributors are offering long-term supply contracts pegged to Brent crude in a bid to de-risk volatility for high-volume users. On the R&D front, academia-industry consortia in South Africa are testing sugarcane-based bio-PE films that can run on existing extrusion lines, aiming to localize feedstock and reinforce circularity narratives. These initiatives underscore an era of portfolio diversification that will gradually recalibrate material splits within the Africa packaging industry over the next five years.

The Africa Packaging Market Report is Segmented by Packaging Type (Plastic, Paper, Container Glass, Metal Cans), Packaging Format (Rigid, Flexible), End-Use Industry (Food, Beverage, Pharmaceuticals, Personal Care, Industrial, E-Commerce), and Geography (Egypt, Nigeria, Kenya, South Africa, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Mondi plc

- Nampak Ltd

- Mpact Ltd

- Tetra Pak International SA

- Sealed Air Corp.

- Constantia Flexibles Group GmbH

- Consol Holdings (Pty) Ltd

- Astrapak Ltd (RPC Packaging Holdings Ltd)

- Foster Packaging International (Pty) Ltd

- East African Packaging Industries Ltd

- Bonpak (Pty) Ltd

- Huhtamaki Oyj

- Ardagh Group SA

- Smurfit WestRock

- Novus Holdings Ltd

- Greif Inc.

- Sonoco Products Company

- Frigoglass SAIC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing urban middle class boosting FMCG consumption

- 4.2.2 E-commerce packaging demand surge

- 4.2.3 Expansion of modern retail chains across Africa

- 4.2.4 Government bans on single-use plastics driving alternative materials

- 4.2.5 Rise of cold-chain logistics for fresh produce exports

- 4.2.6 Automotive CKD imports requiring protective tertiary packaging

- 4.3 Market Restraints

- 4.3.1 Volatile polymer and paper pulp prices

- 4.3.2 Power - supply instability increasing plant OPEX

- 4.3.3 Port congestion delaying raw-material inflows

- 4.3.4 Inadequate recycling infrastructure limiting rPET uptake

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 The Impact of Macroeconomic Factors on the Market

- 4.9 Investment Analysis

- 4.10 Overview of the Global Packaging Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Plastic Packaging

- 5.1.1.1 By Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.1.1.1 Polyethylene (PE)

- 5.1.1.1.1.1.2 Polypropylene (PP)

- 5.1.1.1.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.1.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.1.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.1.1.1.6 Other Material Types

- 5.1.1.1.1.2 By Product Type

- 5.1.1.1.1.2.1 Bottles and Jars

- 5.1.1.1.1.2.2 Caps and Closures

- 5.1.1.1.1.2.3 Trays and Containers

- 5.1.1.1.1.2.4 Other Product Types

- 5.1.1.1.1.3 By End-use Industry

- 5.1.1.1.1.3.1 Food

- 5.1.1.1.1.3.2 Beverage

- 5.1.1.1.1.3.3 Pharmaceutical

- 5.1.1.1.1.3.4 Cosmetics and Personal Care

- 5.1.1.1.1.3.5 Industrial

- 5.1.1.1.1.3.6 Other End-use Industry

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.2 Flexible Plastic Packaging

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.2.1.1 Polyethylene (PE)

- 5.1.1.1.2.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.1.2.1.3 Cast Polypropylene (CPP)

- 5.1.1.1.2.1.4 Other Material Types

- 5.1.1.1.2.2 By Product Type

- 5.1.1.1.2.2.1 Pouches and Bags

- 5.1.1.1.2.2.2 Films and Wraps

- 5.1.1.1.2.2.3 Other Product Types

- 5.1.1.1.2.3 By End-use Industry

- 5.1.1.1.2.3.1 Food

- 5.1.1.1.2.3.2 Beverage

- 5.1.1.1.2.3.3 Pharmaceutical

- 5.1.1.1.2.3.4 Cosmetics and Personal Care

- 5.1.1.1.2.3.5 Industrial

- 5.1.1.1.2.3.6 Other End-use Industry

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.2 By Product Type

- 5.1.1.2.1 Bottles and Jars

- 5.1.1.2.2 Pouches and Bags

- 5.1.1.2.3 Bulk-Grade Products

- 5.1.1.2.4 Other Product Types

- 5.1.1.3 By End-use Industry

- 5.1.1.3.1 Food

- 5.1.1.3.2 Beverages

- 5.1.1.3.3 Cosmetics and Personal Care

- 5.1.1.3.4 Pharamceuticals

- 5.1.1.3.5 Industrial

- 5.1.1.3.6 Other End-use Industry

- 5.1.1.1 By Type

- 5.1.2 Paper Packaging

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Folding Carton

- 5.1.2.1.2 Corrugated Boxes

- 5.1.2.1.3 Liquid Paperboard

- 5.1.2.1.4 Other Product Type

- 5.1.2.2 By End-use Industry

- 5.1.2.2.1 Food

- 5.1.2.2.2 Beverages

- 5.1.2.2.3 E-commerce

- 5.1.2.2.4 Other End-use Industry

- 5.1.2.1 By Product Type

- 5.1.3 Container Glass

- 5.1.3.1 By Color

- 5.1.3.1.1 Green

- 5.1.3.1.2 Amber

- 5.1.3.1.3 Flint

- 5.1.3.1.4 Other Colors

- 5.1.3.2 By End-use Industry

- 5.1.3.2.1 Food

- 5.1.3.2.2 Beverage

- 5.1.3.2.2.1 Alcoholic

- 5.1.3.2.2.2 Non-Alcoholic

- 5.1.3.2.3 Personal Care and Cosmetics

- 5.1.3.2.4 Pharmaceuticals (excluding Vials and Ampoules)

- 5.1.3.2.5 Perfumery

- 5.1.3.1 By Color

- 5.1.4 Metal Cans and Containers

- 5.1.4.1 By Material Type

- 5.1.4.1.1 Steel

- 5.1.4.1.2 Aluminum

- 5.1.4.2 By Product Type

- 5.1.4.2.1 Cans

- 5.1.4.2.2 Drums and Barrels

- 5.1.4.2.3 Caps and Closures

- 5.1.4.2.4 Other Product Type

- 5.1.4.3 By End-use Industry

- 5.1.4.3.1 Food

- 5.1.4.3.2 Beverage

- 5.1.4.3.3 Chemicals and Petroleum

- 5.1.4.3.4 Industrial

- 5.1.4.3.5 Paints and coatings

- 5.1.4.3.6 Other End-use Industry

- 5.1.4.1 By Material Type

- 5.1.1 Plastic Packaging

- 5.2 By Packaging Format

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.3 By End-Use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Industrial

- 5.3.6 E-commerce

- 5.3.7 Other End-use Industry

- 5.4 By Country

- 5.4.1 Egypt

- 5.4.2 Nigeria

- 5.4.3 Kenya

- 5.4.4 South Africa

- 5.4.5 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 Nampak Ltd

- 6.4.4 Mpact Ltd

- 6.4.5 Tetra Pak International SA

- 6.4.6 Sealed Air Corp.

- 6.4.7 Constantia Flexibles Group GmbH

- 6.4.8 Consol Holdings (Pty) Ltd

- 6.4.9 Astrapak Ltd (RPC Packaging Holdings Ltd)

- 6.4.10 Foster Packaging International (Pty) Ltd

- 6.4.11 East African Packaging Industries Ltd

- 6.4.12 Bonpak (Pty) Ltd

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Ardagh Group SA

- 6.4.15 Smurfit WestRock

- 6.4.16 Novus Holdings Ltd

- 6.4.17 Greif Inc.

- 6.4.18 Sonoco Products Company

- 6.4.19 Frigoglass SAIC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment