PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939742

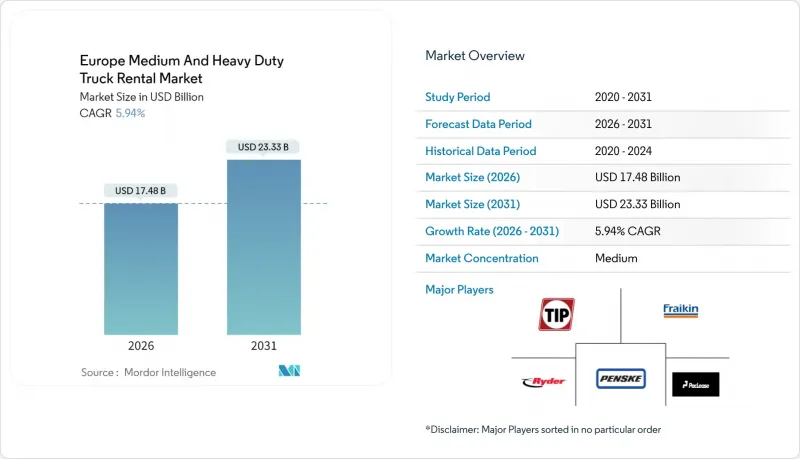

Europe Medium And Heavy Duty Truck Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Medium & Heavy-Duty Truck Rental market size in 2026 is estimated at USD 17.48 billion, growing from 2025 value of USD 16.50 billion with 2031 projections showing USD 23.33 billion, growing at 5.94% CAGR over 2026-2031.

This acceleration rests on rising e-commerce freight volumes, stringent emissions policy that favors outsourced fleets, and a preference for operating-expense models during an elevated interest-rate climate. Growth is further amplified by digital booking platforms that compress transaction times and broaden customer reach, while electrification pilots reduce technology-risk barriers for end users. Heavy-duty vehicles dominate demand because they maximize payload economics on core European corridors, yet medium-duty and electric options are gaining attention as cities expand zero-emission zones.

Europe Medium And Heavy Duty Truck Rental Market Trends and Insights

E-Commerce-Led Surge in Flexible Freight Capacity

Intensified online retail has lifted freight offers on the TIMOCOM spot marketplace by 92% year-over-year, pushing the freight-to-capacity ratio past 70% for most of 2024 . Carriers and 3PLs lean on short-term rentals to absorb peak season spikes without adding permanent assets. The postal and parcel segment alone is expanding at a notable CAGR, a pace that tightens utilization for every Europe Medium & Heavy-Duty Truck Rental market operator. Retailers also use rentals to pilot new regional hubs before committing capital, supporting a structurally higher baseline for fleet flexibility. As Easter shifts to April in 2025, a fresh swell of ad-hoc demand is expected to reinforce short-term leasing's momentum.

Cost-Avoidance Focus Amid High Interest-Rate Cycle

European Central Bank tightening pushed corporate truck loan costs above 4% in early 2025 before easing to 3.61% mid-year, levels that still exceed pre-2022 norms . Smaller fleets, therefore, treat rentals as a defensive operating expense hedge against asset depreciation. Spot transport prices climbed year-over-year in Q4 2024, an uptick driven by fuel and carbon surcharges that further validate variable-cost models. Medium-duty users exhibit the sharpest shift as residual-value uncertainty compounds financing risk. Variable-term contracts and marketplace pricing now underpin many private-label distribution networks, broadening the addressable pool for Europe's Medium & Heavy-Duty Truck Rental market providers.

Residual-Value Volatility of Diesel Assets

Used heavy-duty truck prices slid in 2023 model-year units and 2021 models by mid-2025, underscoring the depreciation risk tied to looming emissions regulations. Rental companies that rely on resale markets to refresh fleets face compressed margins when diesel values sag faster than scheduled de-fleet cycles allow. Operators adopt shorter holding periods and hedge with diversified propulsion mixes, yet outright replacement remains capital-intensive. Accelerated depreciation further deters traditional ownership, indirectly expanding rental demand; however, it simultaneously tightens profit pools for rental providers that maintain large diesel inventories.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Euro 7 Norms Favoring Rental Over Ownership

- Subsidized E-Truck Pilots De-Risking Rental Adoption

- Driver Shortages Limiting Utilization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Offline channels still controlled 72.48% of the European Medium & Heavy-Duty Truck Rental market share in 2025, as relationship-based contracts remain the norm for long-term leasing. Nevertheless, online portals are scaling quickly at a 7.77% CAGR as customers prefer 24/7 self-service dashboards, transparent rates, and instantaneous vehicle availability. Rental operators deploy integrated APIs that sync inventory with shipper transportation-management systems, reducing manual quote cycles from hours to minutes. Subscription-style pricing, digital document signatures, and embedded insurance options further reinforce platform convenience.

The growth of online booking also sharpens competitive boundaries: digital-native platforms leverage lower transaction costs to reach small haulers historically served by local agencies. Legacy firms counter with omnichannel strategies that blend self-service ordering for standardized units and human account management for complex projects. As a result, the European Medium & Heavy-Duty Truck Rental market witnesses a twin-track model in which high-volume short-term demand migrates online while bespoke contracts persist offline. Over the forecast window, digital engagement is expected to raise fleet utilization through better visibility, thereby unlocking capacity without proportional asset growth.

Long-term leasing controlled 61.72% of the European Medium & Heavy-Duty Truck Rental market share in 2025 and enjoys economies of scale that keep daily costs low for shippers with predictable routes. Yet short-term contracts, expanding at 8.49% CAGR, flourish in industries characterized by seasonal peaks, project-based work, or rapid e-commerce surges. The flexibility premium can reach 15-20% over equivalent long-term day rates, but shippers willingly absorb that markup to sidestep idle-fleet risk.

As Euro 7 compliance costs loom, more operators opt for trial periods with next-generation vehicles, a dynamic that feeds short-term leasing pipelines. Rental companies employ dynamic pricing algorithms to maximize yield on scarce capacity during holiday or harvest surges, widening revenue per unit. Conversely, long-term deals contribute stable cash flows, underpinning fleet-expansion capex. Balancing these streams requires robust demand forecasting and asset re-allocation strategies, cementing analytics as a competitive differentiator across the European Medium & Heavy-Duty Truck Rental market.

The Europe Medium & Heavy-Duty Truck Rental Market Report is Segmented by Booking Type (Offline Booking and Online Booking), Rental Type (Short-Term Leasing and Long-Term Leasing), Truck Class (Medium-Duty (7. 5-16t) and Heavy-Duty (Above 16t)), End-User Industry (General Freight and 3PL, Construction and Infrastructure, and More), Propulsion Type, and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TIP Group

- Fraikin SAS

- Ryder System Inc.

- Penske Truck Leasing

- PACCAR Leasing Company

- Heisterkamp Transportation Solutions

- Easy Rent Truck & Trailer GmbH

- Mercedes-Benz CharterWay

- Scania Group

- Scania Group

- SIXT SE

- Enterprise Flex-E-Rent

- Dawsongroup Truck & Trailer

- Dawsongroup Truck & Trailer

- DKV Mobility

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce-Led Surge in Flexible Freight Capacity

- 4.2.2 Cost-Avoidance Focus Amid High Interest-Rate Cycle

- 4.2.3 Stricter Euro 7 Norms Favoring Rental Over Ownership

- 4.2.4 Subsidized E-Truck Pilots De-Risking Rental Adoption

- 4.2.5 OEM "Truck-as-a-Service" Roll-Outs

- 4.2.6 Cross-Border Carbon Tolls Amplifying Seasonal Demand Swings

- 4.3 Market Restraints

- 4.3.1 Residual-Value Volatility of Diesel Assets

- 4.3.2 Driver Shortages Limiting Utilization

- 4.3.3 Grid-Connection Delays for Depot Chargers

- 4.3.4 Digital Freight Platforms' Asset-Light Competition

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Booking Type

- 5.1.1 Offline Booking

- 5.1.2 Online Booking

- 5.2 By Rental Type

- 5.2.1 Short-term Leasing

- 5.2.2 Long-term Leasing

- 5.3 By Truck Class

- 5.3.1 Medium-Duty (7.5-16 t)

- 5.3.2 Heavy-Duty (Above 16 t)

- 5.4 By End-user Industry

- 5.4.1 General Freight and 3PL

- 5.4.2 Construction and Infrastructure

- 5.4.3 Retail and FMCG

- 5.4.4 Postal, Parcel and E-commerce

- 5.4.5 Waste and Municipal Services

- 5.5 By Propulsion Type

- 5.5.1 Diesel

- 5.5.2 Battery-Electric

- 5.5.3 LNG / CNG

- 5.5.4 Hybrid

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Netherlands

- 5.6.7 Poland

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TIP Group

- 6.4.2 Fraikin SAS

- 6.4.3 Ryder System Inc.

- 6.4.4 Penske Truck Leasing

- 6.4.5 PACCAR Leasing Company

- 6.4.6 Heisterkamp Transportation Solutions

- 6.4.7 Easy Rent Truck & Trailer GmbH

- 6.4.8 Mercedes-Benz CharterWay

- 6.4.9 Scania Group

- 6.4.10 Scania Group

- 6.4.11 SIXT SE

- 6.4.12 Enterprise Flex-E-Rent

- 6.4.13 Dawsongroup Truck & Trailer

- 6.4.14 Dawsongroup Truck & Trailer

- 6.4.15 DKV Mobility

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment