PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940800

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940800

Vietnam Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

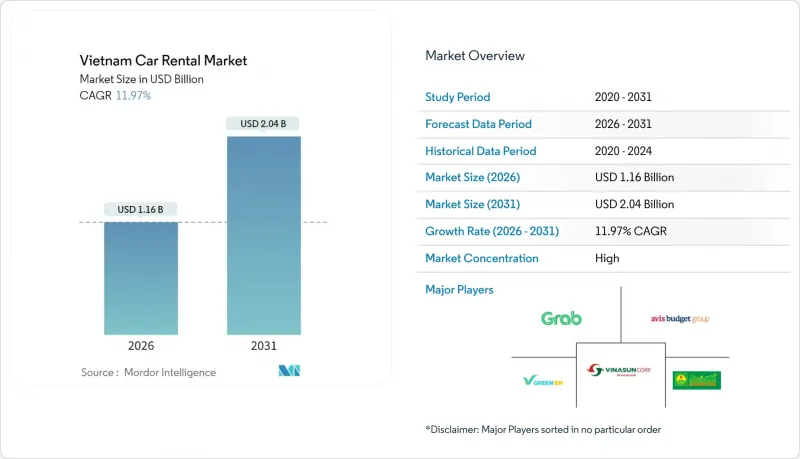

Vietnam car rental market size in 2026 is estimated at USD 1.16 billion, growing from 2025 value of USD 1.04 billion with 2031 projections showing USD 2.04 billion, growing at 11.97% CAGR over 2026-2031.

Growing leisure and business travel, rapid urbanization, and the government's clean-mobility agenda underpin this expansion. International arrivals jumped 68.3% during the last four months of 2024, and domestic tourism spending now exceeds pre-pandemic levels, lifting short-term rental volumes. Rising disposable incomes among Vietnam's 13%-strong middle class have spurred demand for premium, self-drive options. Digitization further fuels growth as online platforms streamline booking, payment, and fleet utilization while widening market visibility. Finally, the push for electrification-anchored by registration-fee waivers through 2027 and a rapidly scaling public charging network-creates a distinct competitive space where electric mobility services coexist with traditional rental offerings.

Vietnam Car Rental Market Trends and Insights

Tourism Rebound Drives Leisure Rentals

International visitor arrivals rose 68.3% during the first four months of 2024. The leisure surge translates directly into higher weekend and holiday bookings as travelers opt for self-drive journeys across Ha Long Bay, the Central Highlands, and the Mekong Delta. Vietnam's 2025-2026 national campaign for sustainable tourism dovetails with rental firms' plans to electrify fleets, aligning customer preference for eco-friendly choices with policy incentives. Extended public holidays and a growing culture of road trips among urban families sustain year-round demand. Rental operators increase fleet availability in peak vacation corridors, using dynamic pricing to capture seasonal spikes. As travel rebounds, occupancy ratios of short-term fleets have already returned to pre-pandemic peaks, lifting per-vehicle profitability.

Rising Disposable Incomes Among the Middle Class

Vietnam's middle class reached 13% of the population in 2023 and continues to expand, driving a retail sales increase of 8.5% year-on-year through early 2024. Higher disposable income unlocks new demand for premium rental categories-from SUVs to luxury sedans-where clients prioritize vehicle condition, brand cachet, and concierge-level service. Rising affluence also broadens the user base for weekend getaways, turning self-drive trips into mainstream recreation rather than occasional indulgence. To differentiate offerings, rental firms respond with tiered loyalty programs, smartphone-based vehicle unlock, and complimentary add-ons like child seats. Premium demand encourages importers to expedite the arrival of luxury models despite high tariffs, creating a more diverse fleet mix. Ultimately, income gains cushion price elasticity, allowing operators to pass on cost inflation from tariffs or fleet upgrades without eroding volumes.

Urban Congestion and Limited Parking in Major Cities

Ho Chi Minh City commuters lose more hours annually to congestion, eroding rental vehicle productivity and inflating fuel costs. Parking shortages, especially in District 1 and Hanoi's Old Quarter, lead to high overnight storage fees that operators must absorb or pass on. Policy moves such as Hanoi's proposed gasoline-vehicle restrictions from 2030 inject uncertainty about fleet composition planning. While the ITS program promises future relief, near-term congestion forces rental companies to adopt telematics-enabled routing and penalty clauses for late returns. Customer satisfaction suffers when pickups are delayed or parking surcharges appear, nudging price-sensitive users toward alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward App-Based and Online Bookings

- Government Smart-Mobility Sandbox Projects

- Sparse EV-Charging Network Outside Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online channels underpinned 59.88% of the Vietnam car rental market share in 2025, spotlighting the country's rapid pivot to e-commerce. Mobile penetration above 160% enables travelers to secure vehicles minutes before pickup, while integrated e-wallets accelerate checkout. The segment's anticipated 13.12% CAGR reflects convenience and cost efficiency, as digital platforms slash branch overheads and support dynamic pricing algorithms that lift utilization. Offline counters, holding 40.12%, still serve older demographics and corporate bookings requiring bespoke terms. Yet branch-based models face margin compression as foot traffic declines, prompting legacy firms to hybridize with click-and-collect services.

Traditional agencies leverage concierge experiences and personalized itinerary planning to retain loyalty, whereas online newcomers court price-sensitive segments with flash discounts and user-generated reviews. Platform operators invest in encryption and compliance certifications to preserve trust as regulatory frameworks around data privacy and payment security harden. The Vietnam car rental market benefits from this competition as service quality, fleet transparency, and post-trip feedback loops improve.

Short-term rentals controlled 61.10% of the Vietnam car rental market size in 2025, buoyed by tourism rebound and growing corporate travel. Weekend trippers and business visitors embrace day-based contracts that avoid the hassles of ownership, congestion charges, and parking scarcity. Utilization peaks during public holidays such as Tet and Reunification Day, compelling firms to pre-position vehicles at airports and tourist hotspots. The segment's 13.05% CAGR outlook remains tied to Vietnam's projected 6-million-visitor milestone in 2026 and robust domestic vacation culture.

Long-term rentals, with 38.90% share, anchor revenue stability for operators. Corporate clients, expats, and diplomatic missions favor monthly contracts bundled with full-service maintenance, enabling predictable budgeting. IFRS 16 accelerates the shift, pushing fleets toward operational leases. Providers deploy telematics to monitor mileage caps and preventative servicing, safeguarding residual value. As foreign direct investment climbs and manufacturing parks proliferate, long-term rental demand spreads from traditional centers into provinces such as Quang Ninh and Dong Nai, diversifying geographic exposure.

The Report Covers the Car Rental Industry in Vietnam. The Market is Segmented by Booking Type (Online and Offline), Rental Duration (Short-Term and Long-Term), Application Type (Tourism and Leisure, Daily Commuting and Corporate and Expat Mobility), Vehicle Propulsion (Internal Combustion Engine, and More), and by End-User (Individual and Corporate). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vietnam Sun Corporation (Vinasun)

- Mai Linh Group

- Green & Smart Mobility JSC (GSM)

- Grab Holdings Inc.

- Gojek Vietnam

- Avis Budget Group

- Enterprise Holdings

- Hertz Corporation

- Sixt SE

- Saigon Car Rental Co. Ltd.

- Thuexe.vn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism Rebound Drives Leisure Rentals

- 4.2.2 Rising Disposable Incomes Among Middle Class

- 4.2.3 Shift Toward App-Based and Online Bookings

- 4.2.4 Electrification Push Via Green-and-Smart Mobility (GSM)

- 4.2.5 Corporate Fleet Outsourcing Post-IFRS 16

- 4.2.6 Government Smart-Mobility Sandbox Projects

- 4.3 Market Restraints

- 4.3.1 Dominance of Low-Cost Ride-Hailing and Motorbikes

- 4.3.2 High Vehicle Import Tariffs and Registration Fees

- 4.3.3 Urban Congestion and Limited Parking in Major Cities

- 4.3.4 Sparse EV-Charging Network Outside Tier-1 Cities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Booking Type

- 5.1.1 Online

- 5.1.2 Offline

- 5.2 By Rental Duration

- 5.2.1 Short-term (Less than 30 days)

- 5.2.2 Long-term (Above 30 days)

- 5.3 By Application Type

- 5.3.1 Tourism and Leisure

- 5.3.2 Daily Commuting

- 5.3.3 Corporate and Expat Mobility

- 5.4 By Vehicle Propulsion

- 5.4.1 Internal-Combustion Engine (ICE)

- 5.4.2 Battery-Electric Vehicle (BEV)

- 5.4.3 Hybrid Electric Vehicle (HEV/PHEV)

- 5.5 By End-user

- 5.5.1 Individual

- 5.5.2 Corporate

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Vietnam Sun Corporation (Vinasun)

- 6.4.2 Mai Linh Group

- 6.4.3 Green & Smart Mobility JSC (GSM)

- 6.4.4 Grab Holdings Inc.

- 6.4.5 Gojek Vietnam

- 6.4.6 Avis Budget Group

- 6.4.7 Enterprise Holdings

- 6.4.8 Hertz Corporation

- 6.4.9 Sixt SE

- 6.4.10 Saigon Car Rental Co. Ltd.

- 6.4.11 Thuexe.vn

7 Market Opportunities & Future Outlook