PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940625

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940625

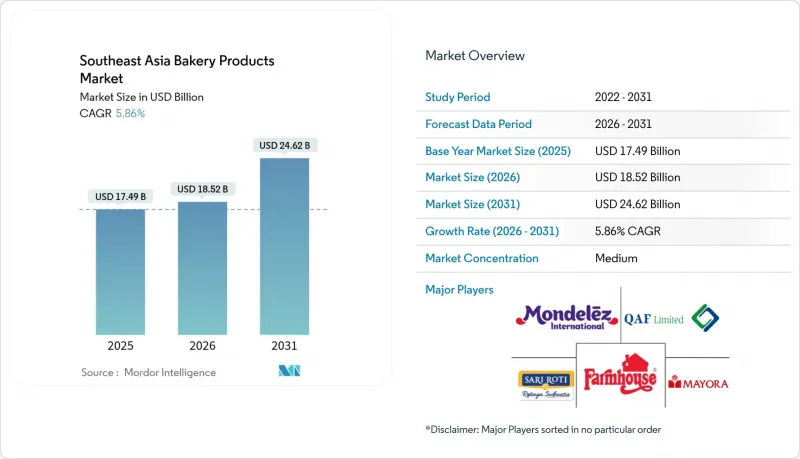

Southeast Asia Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Southeast Asia bakery products market size in 2026 is estimated at USD 18.52 billion, growing from 2025 value of USD 17.49 billion with 2031 projections showing USD 24.62 billion, growing at 5.86% CAGR over 2026-2031.

Demographic momentum, higher disposable incomes, and a visible tilt toward Western-style consumption in urban centers underpin this expansion. The market's steady uptrend also mirrors the deepening middle-class footprint across Indonesia, Vietnam, and the Philippines, where consumers increasingly balance indulgence with wellness cues in daily food choices. Domestic baked-goods manufacturers are scaling production in step with modern retail rollouts, while global brands leverage franchising to accelerate store counts. At the same time, supply-side efficiencies from regional flour-milling investments and diversified wheat sourcing temper cost volatility and sharpen margins for large and mid-sized players.

Southeast Asia Bakery Products Market Trends and Insights

Growing Penetration of Modern Grocery Retail Formats

Supermarket and hypermarket footprints continue to widen across large metros and tier-2 cities, giving packaged bread and pastry brands premium shelf space and stable refrigeration. The modern-trade channel's organized layout enhances product visibility, enables date-coded inventory rotation, and supports value-added features such as resealable packaging. As retail chains refine planograms, in-store bakeries flourish by coupling fresh aromas with impulse-driven displays. Large chains also extend private-label lines, offering affordability while standardizing quality benchmarks that smaller traditional outlets struggle to match. The broader retail formalization trend, therefore, remains a structural engine for the Southeast Asia bakery products market.

Rapid Rise of Video-Commerce for Impulse Bakery Purchases

Live-stream commerce blends entertainment with instant purchasing, allowing bakers to demonstrate product freshness and craftsmanship in real time. With smartphone penetration exceeding 80% in urban pockets, consumers gravitate to short, interactive sessions that showcase limited-edition cakes, seasonal cookies, or buy-one-get-one bundles. Integrated payment gateways eliminate checkout friction, while last-mile couriers deliver within hours, sustaining product integrity and spontaneous satisfaction. Brands that invest in charismatic hosts and on-screen baking theatrics capture new audiences at lower customer-acquisition costs compared with traditional advertising. Consequently, video-commerce's experiential pull is enlarging the consumer base for the Southeast Asia bakery products market.

Volatile Wheat Import Prices Amid El Nino Freight Spikes

Shipping-lane disruptions have inflated container rates, adding unplanned cost layers to imported wheat destined for Indonesia, the Philippines, and Vietnam. Since local grain alternatives remain limited, millers pass on at least part of the burden to bakeries, pressuring the shelf prices of staple bread. Retail promotions and pack-downs mitigate volume erosion, yet margin squeeze persists for smaller manufacturers with thin working capital. Hedging strategies and diversified supplier contracts partly offset risk, but near-term volatility continues to weigh on the Southeast Asia bakery products market.

Other drivers and restraints analyzed in the detailed report include:

- Flour-Milling Expansion and Wheat-Source Diversification

- Digital Micro-Retail and Health-Focused Reformulations

- Certification, Logistics, and Fiscal Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cakes, pastries, and sweet pies commanded 42.10% of the Southeast Asia bakery products market in 2025, lifting celebratory sales around festivals and personal milestones. Local chains replicate European patisserie aesthetics while overlaying familiar flavors such as pandan and durian, keeping relevance high. Concurrently, crackers and savoury biscuits post the fastest volume gains, propelled by 7.26% CAGR expectations amid snack-on-the-go lifestyles and portion-control preferences. Manufacturers combine multigrain bases with reduced-sugar glazing to widen appeal, and e-commerce bundles encourage pantry stocking for remote work routines. Regional exporters also target halal-certified savoury biscuits to serve Muslim diaspora channels in the Middle East, reinforcing outbound opportunities for the Southeast Asia bakery products market.

Rising health consciousness steers reformulation toward high-fiber, gut-friendly inclusions such as beta-glucan-rich barley and inulin. Brands emphasize digestive comfort and blood-sugar moderation on front-of-pack labels to secure premium shelf prices. Gluten-free ranges, once niche, now attract mainstream curiosity, especially in Singapore and Thailand, where affluent consumers trial novel grains. Co-branding with specialty ingredient suppliers boosts perceived credibility. These dynamics suggest the crackers segment will keep outpacing the broader Southeast Asia bakery products market while indulgent cakes retain a stable, albeit slower, value base.

The Southeast Asia Bakery Products Market Report is Segmented by Product Type (Bread, Sweet Biscuits, Crackers & Savoury Biscuits, and More), Form (Fresh, Frozen)distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty Stores & Artisanal Bakeries, Online Retail Stores, Other Channels), and Geography (Indonesia, Malaysia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Nippon Indosari Corpindo Tbk (Sari Roti)

- President Bakery PCL

- Mighty Bakery Sdn Bhd

- Mondel?z International Inc.

- QAF Ltd (Gardenia KL Sdn Bhd)

- Variety Foods International Co. Ltd

- Lotte Confectionery Co. Ltd

- Universal Robina Corp.

- PPB Group Bhd (FFM & Massimo)

- CP All PCL (Bakery Brands)

- SPC Samlip Co. Ltd

- Mayora Indah Tbk

- BreadTalk Group Ltd

- CJ Foodville (Tous les Jours)

- Yamazaki Baking Co. Ltd

- Monde Nissin Corp.

- Pan de Manila Foods Inc.

- J.CO Donuts & Coffee

- Tip Top Bread Factory (Myanmar)

- Khong Guan Biscuit Factory (Singapore)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing penetration of modern grocery retail formats

- 4.2.2 Rapid rise of video-commerce for impulse bakery purchases

- 4.2.3 Flour?milling capacity expansions lowering input costs

- 4.2.4 Micro-retail digitalisation enabling rural reach

- 4.2.5 Health-oriented reformulations (high-fibre, gut-health)

- 4.2.6 Government push for wheat import diversification

- 4.3 Market Restraints

- 4.3.1 Volatile wheat import prices amid El Nio freight spikes

- 4.3.2 Halal-certification bottlenecks for new SKUs

- 4.3.3 Tight cold-chain infrastructure for frozen dough

- 4.3.4 Rising sugar-tax discussions in Thailand & Malaysia

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Bread

- 5.1.2 Sweet Biscuits

- 5.1.3 Crackers & Savoury Biscuits

- 5.1.4 Cakes, Pastries & Sweet Pies

- 5.1.5 Morning Goods

- 5.1.6 Others

- 5.2 By Form

- 5.2.1 Fresh

- 5.2.2 Frozen

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets / Hypermarkets

- 5.3.2 Convenience / Grocery Stores

- 5.3.3 Specialty Stores & Artisanal Bakeries

- 5.3.4 Online Retail Stores

- 5.3.5 Other Channels

- 5.4 By Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Philippines

- 5.4.4 Singapore

- 5.4.5 Thailand

- 5.4.6 Vietnam

- 5.4.7 Myanmar

- 5.4.8 Rest of Southeast Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 PT Nippon Indosari Corpindo Tbk (Sari Roti)

- 6.4.2 President Bakery PCL

- 6.4.3 Mighty Bakery Sdn Bhd

- 6.4.4 Mondel?z International Inc.

- 6.4.5 QAF Ltd (Gardenia KL Sdn Bhd)

- 6.4.6 Variety Foods International Co. Ltd

- 6.4.7 Lotte Confectionery Co. Ltd

- 6.4.8 Universal Robina Corp.

- 6.4.9 PPB Group Bhd (FFM & Massimo)

- 6.4.10 CP All PCL (Bakery Brands)

- 6.4.11 SPC Samlip Co. Ltd

- 6.4.12 Mayora Indah Tbk

- 6.4.13 BreadTalk Group Ltd

- 6.4.14 CJ Foodville (Tous les Jours)

- 6.4.15 Yamazaki Baking Co. Ltd

- 6.4.16 Monde Nissin Corp.

- 6.4.17 Pan de Manila Foods Inc.

- 6.4.18 J.CO Donuts & Coffee

- 6.4.19 Tip Top Bread Factory (Myanmar)

- 6.4.20 Khong Guan Biscuit Factory (Singapore)

7 Market Opportunities and Future Outlook