PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940771

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940771

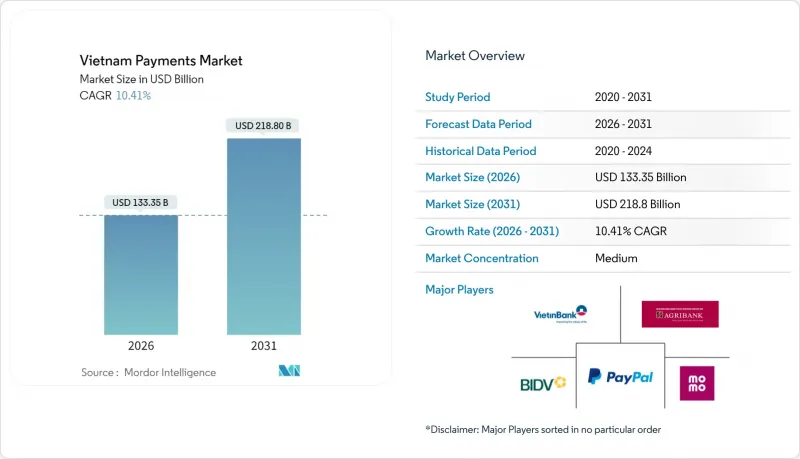

Vietnam Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam payment market is expected to grow from USD 120.78 billion in 2025 to USD 133.35 billion in 2026 and is forecast to reach USD 218.8 billion by 2031 at 10.41% CAGR over 2026-2031.

Robust e-commerce growth, proliferating real-time rails, and a sustained push from the State Bank of Vietnam (SBV) to achieve 80% cashless transactions by 2030 continue to accelerate adoption. Digital wallets still command the largest share yet account-to-account (A2A) transfers now post the quickest gains as consumers migrate toward VietQR-enabled instant payments. Retail remains the biggest end-user group, but healthcare is growing faster thanks to electronic medical record mandates that embed digital payments into patient workflows. Policy clarity and open-API rules lower entry barriers, intensifying rivalry among local wallets, universal banks, and global card networks. Taken together, these forces position the Vietnam payment market to outpace every other major economy in Southeast Asia through 2030.

Vietnam Payments Market Trends and Insights

Rising E-commerce and M-commerce Penetration

Vietnamese consumers have shifted decisively toward mobile shopping, with app-based checkouts accounting for a majority of online transactions in 2025. Social-commerce storefronts embedded inside Zalo, Facebook, and TikTok simplify one-click purchasing, reducing reliance on browser redirects.Payment providers therefore prioritize API-first architectures that slot easily into these platforms, ensuring high authorization rates and frictionless consumer journeys. Companies such as ZaloPay now bundle seller dashboards, logistics booking, and BNPL options to defend transaction share from cash-on-delivery. As smartphone ownership exceeds 80% in major urban clusters, the Vietnam payment market embeds directly into daily social media use, closing the gap between browsing and buying.

Government Cashless-Economy Programs

The SBV's National Payment Strategy aims for 80% cashless transactions by 2030, buttressed by Decree 52/2024 that standardizes security, data localization, and interoperability. Mobile Money pilots, capped at VND 10 million balances, enrolled 8.8 million users in 2024-72% located in rural provinces underserved by brick-and-mortar banks. These pilots demonstrate that simplified KYC tied to mobile phone numbers can unlock latent demand outside the top cities. By requiring ISO 20022 messaging for all new rails and mandating open APIs, regulators align Vietnam with wider ASEAN standards and give domestic firms a springboard for cross-border scale.

Entrenched Cash Culture in Rural Provinces

Cash remains dominant in remote areas where patchy network coverage and low smartphone adoption hamper digital migration. Agricultural households in the Mekong Delta favor tangible currency that aligns with irregular harvest income, and many merchants resist transaction fees that accompany card or wallet acceptance. SBV-driven digital literacy programs and telecom rollouts aim to narrow the gap, yet cultural preferences and concerns over data privacy slow progress. Even so, Mobile Money's rapid uptake hints that low-friction, phone-number-based services can gradually displace cash if reinforced by agent networks and bill-payment use cases.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Real-time Payment Rails

- Social-commerce Payments via Zalo/Meta Ecosystems

- Limited E-wallet and QR Code Interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital wallets captured 36.12% of Vietnam payment market share in 2025 on the back of MoMo's 69% and ZaloPay's 44% user penetration. However, A2A payments are forecast to grow at an 11.64% CAGR, buoyed by VietQR's 85% merchant reach and NAPAS 247's 8.9 billion annual transactions. This migration toward real-time bank transfers reduces top-up friction and merchant MDRs, making wallets compete on value-added services instead of closed-loop balance storage. Vietnam payment market size for A2A flows is projected to more than double by 2031 as consumers trust direct bank connections and enjoy instant refunds and charge-back parity.

POS card usage still accounts for significant volume, with debit acceptance at 95% of stores, but credit still lags because prudential capital rules deter aggressive card issuance. Cash-on-delivery retains around 30% share of rural e-commerce checkouts, though this proportion erodes each year as Mobile Money expands. Decree 52/2024's enhanced authentication rules play to the strengths of established banks that already comply with multifactor protocols, accelerating wallet-to-bank substitution. By 2030, analysts expect wallets to act primarily as orchestration layers, routing payments to real-time rails beneath rather than holding user deposits.

Vietnam Payments Market is Segmented by Mode of Payment (Point of Sale (Card Payments, Digital Wallet, Cash), Online Sale (Card Payments, Digital Wallet)) and by End-User Industries (Retail, Entertainment, Healthcare, Hospitality). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- VietinBank (Joint Stock Commercial Bank for Industry and Trade of Vietnam)

- Vietnam Bank for Agriculture and Rural Development (Agribank)

- Bank for Investment and Development of Vietnam (BIDV)

- PayPal Holdings Inc.

- M Service JSC (MoMo)

- Samsung Electronics Co., Ltd. (Samsung Pay)

- Online Mobile Services JSC (VTC Pay)

- Vietnam Payment Solution JSC (VNPAY)

- Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank)

- Zion JSC (ZaloPay)

- National Payment Corporation of Vietnam (NAPAS)

- Military Commercial Joint Stock Bank (MBBank)

- Global Online Financial Solutions Ltd. (Timo Digital Bank)

- Sea Ltd. (ShopeePay)

- VNPT Media Corp. (VNPT Pay)

- Orient Commercial Joint Stock Bank (OCB OMNI)

- Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank)

- G-Group JSC (Gpay e-wallet)

- Grab Holdings Ltd. (GrabPay)

- Vietnam Prosperity JSC Bank (VPBank - Yolo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising e-commerce and m-commerce penetration

- 4.2.2 Government cashless-economy programmes

- 4.2.3 Expansion of real-time payment rails (Napas 247, VNPay QR)

- 4.2.4 Social-commerce payments via Zalo/Meta ecosystems

- 4.2.5 Embedded finance in super-apps (Grab, Gojek)

- 4.2.6 SME supply-chain digitisation and B2B e-invoicing

- 4.3 Market Restraints

- 4.3.1 Entrenched cash culture in rural provinces

- 4.3.2 Limited e-wallet and QR code interoperability

- 4.3.3 Escalating A2A payment fraud and regulatory throttling

- 4.3.4 Data-sovereignty hurdles for foreign PSPs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Industry Stakeholder Analysis

- 4.10 Evolution of the Payments Landscape

- 4.11 Key Cashless-Transaction Trends

- 4.12 Impact of Macroeconomic Factors on Payments

- 4.13 Investment Analysis

- 4.14 Case Studies and Use-Cases

- 4.15 Demographic and Banking-Access Analysis

- 4.16 Customer-Experience Convergence

- 4.17 Cash Displacement and Contactless Rise

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Mode of Payment

- 5.1.1 Point of Sale

- 5.1.1.1 Debit Card Payments

- 5.1.1.2 Credit Card Payments

- 5.1.1.3 Account-to-Account (A2A) Payments

- 5.1.1.4 Digital Wallet

- 5.1.1.5 Cash

- 5.1.1.6 Other PoS Modes

- 5.1.2 Online Sale

- 5.1.2.1 Debit Card Payments

- 5.1.2.2 Credit Card Payments

- 5.1.2.3 Account-to-Account (A2A) Payments

- 5.1.2.4 Digital Wallet

- 5.1.2.5 Cash-on-Delivery

- 5.1.2.6 Other Online Modes

- 5.1.1 Point of Sale

- 5.2 By End-User Industry

- 5.2.1 Retail

- 5.2.2 Entertainment

- 5.2.3 Hospitality

- 5.2.4 Healthcare

- 5.2.5 Transport and Logistics

- 5.2.6 Other Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VietinBank (Joint Stock Commercial Bank for Industry and Trade of Vietnam)

- 6.4.2 Vietnam Bank for Agriculture and Rural Development (Agribank)

- 6.4.3 Bank for Investment and Development of Vietnam (BIDV)

- 6.4.4 PayPal Holdings Inc.

- 6.4.5 M Service JSC (MoMo)

- 6.4.6 Samsung Electronics Co., Ltd. (Samsung Pay)

- 6.4.7 Online Mobile Services JSC (VTC Pay)

- 6.4.8 Vietnam Payment Solution JSC (VNPAY)

- 6.4.9 Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank)

- 6.4.10 Zion JSC (ZaloPay)

- 6.4.11 National Payment Corporation of Vietnam (NAPAS)

- 6.4.12 Military Commercial Joint Stock Bank (MBBank)

- 6.4.13 Global Online Financial Solutions Ltd. (Timo Digital Bank)

- 6.4.14 Sea Ltd. (ShopeePay)

- 6.4.15 VNPT Media Corp. (VNPT Pay)

- 6.4.16 Orient Commercial Joint Stock Bank (OCB OMNI)

- 6.4.17 Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank)

- 6.4.18 G-Group JSC (Gpay e-wallet)

- 6.4.19 Grab Holdings Ltd. (GrabPay)

- 6.4.20 Vietnam Prosperity JSC Bank (VPBank - Yolo)

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment