PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940896

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940896

United States Mattress Bases - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

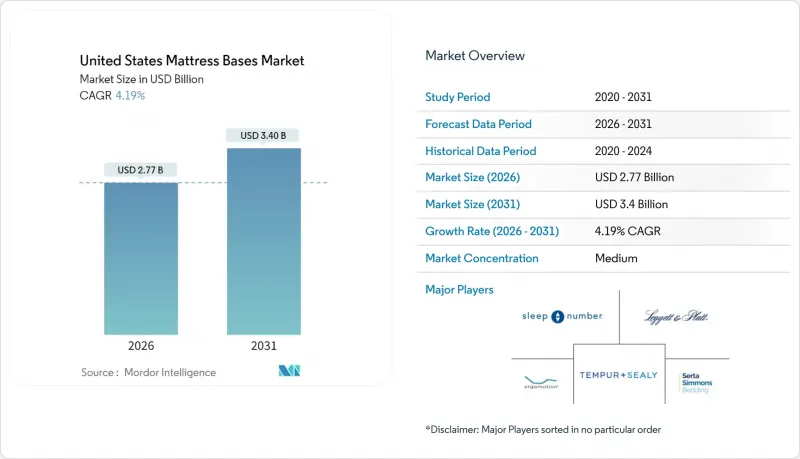

The United States Mattress Bases Market size in 2026 is estimated at USD 2.77 billion, growing from 2025 value of USD 2.66 billion with 2031 projections showing USD 3.4 billion, growing at 4.19% CAGR over 2026-2031.

The growth outpaces overall United States furniture growth and underscores the category's defensive demand profile. Demographic aging, rising wellness awareness, and technology-driven premiumization collectively power the United States bed bases market, insulating it from furniture's typical cyclical swings while simultaneously opening incremental revenue pools. Smart-home connectivity allows adjustable bases to command 30-40% price premiums, enabling manufacturers to offset cost inflation and protect margins without sacrificing volume. Supply-chain diversification, including vertical integration and automation, has improved lead-time reliability, giving domestic producers a speed-to-market edge that Chinese imports struggle to replicate. Regionally, growth gravitates toward the South's favorable demographics and the West's technology-centric consumer base, together fostering a structural shift in geographic revenue mix.

United States Mattress Bases Market Trends and Insights

Aging United States Population Driving Demand for Adjustable Bases

America's 65-plus cohort is expanding quickly, and by 2030 every baby boomer will have crossed that threshold, creating a large addressable market that prioritizes therapeutic sleep solutions. Higher retiree disposable income supports willingness to pay for massage, zero-gravity, and sleep-tracking functions that elevate comfort and perceived wellness benefits. Health insurers increasingly reimburse medically prescribed adjustable bases, normalizing what was once a niche medical device into a mainstream household purchase. Florida, Arizona, and North Carolina report above-average penetration rates as retirees converge in warmer, tax-advantaged states and upgrade entire bedroom suites alongside the base purchase. Home-health providers and sleep clinics now act as referral partners, funneling pre-qualified consumers into premium adjustable-base offerings that command higher margins for manufacturers.

Rising Penetration of E-commerce Mattress-in-a-Box Bundles

Online mattress penetration surpassed 15% in 2025, and bundling strategies that add a compatible base at checkout have lifted average order values while solving sizing or compatibility concerns for digital shoppers. Compressed-packaging innovations cut last-mile freight costs by nearly 60%, enabling direct-to-consumer brands to ship bases profitably, even to rural ZIP codes that previously required costly white-glove logistics. Data analytics lets retailers map mattress firmness choices to ideal base types, driving attach rates that now exceed 25% for leading e-tailers. West Coast and Northeast metros show the highest online conversion thanks to younger, mobile-first households comfortable buying furniture sight unseen. As virtual-reality room planners mature, the friction of imagining scale and fit declines further, widening the digital funnel for the United States bed bases market.

Inflation-Driven Postponement of Big-Ticket Furniture Purchases

Furniture and bedding CPI climbed 4.2% year-over-year in 2024, and households earning below median income delayed non-essential spending, extending replacement cycles for existing bases. Credit-card APRs moved above 21%, squeezing financing options that historically softened upfront cost friction for larger-ticket furniture. Retailers responded with deeper discounts and extended 0% financing windows, but margin compression limited product-innovation funds, risking stagnation in entry-level assortments. The value channel benefited as consumers traded down, pressuring mid-range domestic makers most exposed to price-sensitive customers. Inflation pressures are expected to loosen by 2027, yet the short-term drag still trims 0.9 percentage points from the United States bed bases market CAGR forecast.

Other drivers and restraints analyzed in the detailed report include:

- Lifestyle-Related Back-Pain Prevalence Boosting Premium Upgrades

- Mainstream Shift Toward Platform Beds in Urban Apartments

- Supply-Chain Volatility in Lumber and Steel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Adjustable bases owned 40.96% share of the United States bed bases market in 2025, underscoring their strong fit with demographic aging and wellness positioning. Smart-home integration and biometric monitoring justify 30-40% price premiums, boosting segment profitability even as material costs rise. Platform designs attract urban Millennials seeking minimalist aesthetics and easier assembly in small spaces, but traditional consumers still gravitate toward elevated sleep surfaces. Box-spring systems persist in middle America where price and furniture familiarity dominate purchase considerations, yet their relevance is waning as mattress technology shifts toward foam and hybrid constructions. Specialty mechanisms, including Murphy and sofa-sleeper transformations, occupy niche volumes yet reinforce the category's innovation cachet by stretching functional boundaries.

Adjustable bases are set to record a 5.05% CAGR through 2031, adding an incremental USD 248 million to the United States bed bases market size as technology diffusion moves features from high-end to mass-premium tiers. Platform adoption will remain robust in coastal metros, yet nationwide share gains moderate as suburban home sizes expand post-pandemic. Box-spring volumes slide in tandem with coil-spring mattress declines, and replacement demand becomes the primary revenue stream rather than new household formation. Slat foundations retain a steady presence among value shoppers and European-influenced design aficionados that prefer flexible support. Looking ahead, AI-driven motion presets and automatic anti-snore adjustments could become mainstream differentiators that further consolidate adjustable-base leadership.

Wood captured 60.55% of the United States bed bases market share in 2025 thanks to its warm aesthetics, renewable sourcing narrative, and compatibility with virtually every interior style. Certification programs such as FSC and SFI reassure eco-conscious buyers, and engineered wood laminates broaden design possibilities while containing costs. Conversely, metal foundations capitalize on supply-chain predictability and structural strength, enabling ultrathin silhouettes that resonate with industrial and modern decors. Steel's recyclability speaks to sustainability-minded shoppers, and powder-coat advances deliver color customization that rivals wood stain variety. Composite and hybrid frames remain minor today but open doors to moisture-resistant or lightweight constructions for RV, marine, and high-humidity applications.

Metal's 4.63% CAGR through 2031 reflects both pricing resilience amid lumber volatility and the rising popularity of adjustable mechanisms that require metal substructures. Wood still dominates rural and traditional markets, yet sourcing constraints and Canadian softwood duties introduce cost uncertainties that steel sidesteps. Demand for hybrid metal-wood designs that combine the warmth of timber with the strength of steel grows among design-forward consumers. Manufacturers experiment with bamboo-based panels and recycled-plastic composites to hedge material risk and differentiate sustainability credentials. Over time, the material mix will diversify, but wood's emotional appeal and heritage craftsmanship suggest it will retain the largest slice of the United States bed bases market well beyond 2031.

The United States Mattress Bases Market Report is Segmented by Base Type (Platform, Box Spring, Slats, Adjustable, Other Bases), Material (Wood, Metal, Other Materials), Size (Full Size, Twin Size, Twin-XL Size, Queen Size, King Size, Special Size), End User (Residential, Commercial), Distribution Channel (Offline, Online), and Geography (Northeast, Midwest, South, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Leggett & Platt, Incorporated

- Tempur Sealy International, Inc.

- Serta Simmons Bedding, LLC

- Sleep Number Corporation

- Ergomotion Inc.

- Reverie (Ascion LLC)

- Rize Home (Mantua Manufacturing Co.)

- Glideaway (GDI)

- Corsicana Mattress Company

- Purple Innovation, Inc.

- Kingsdown, Inc.

- Classic Brands LLC

- Ashley Furniture Industries, Inc.

- Boyd Sleep

- Malouf Companies

- Saatva Inc.

- Casper Sleep Inc.

- IKEA Group (U.S.)

- King Koil Mattress Co.

- Southerland, Inc.

- Nectar Sleep (Resident Home)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging U.S. Population Driving Demand For Adjustable Bases

- 4.2.2 Rising Penetration of E-Commerce Mattress-In-A-Box Bundles

- 4.2.3 Lifestyle-Related Back-Pain Prevalence Boosting Premium Base Upgrades

- 4.2.4 Mainstream Shift Toward Platform Beds In Urban Apartments

- 4.2.5 Accelerated Hotel Refurbishment Cycles Post-Covid

- 4.2.6 Integration of Smart-Home Connectivity In High-End Bases

- 4.3 Market Restraints

- 4.3.1 Inflation-Driven Postponement Of Big-Ticket Furniture Purchases

- 4.3.2 Supply-Chain Volatility In Lumber And Steel

- 4.3.3 Fire-Safety Regulatory Uncertainty For Upholstered Bases

- 4.3.4 Low-Cost Imports Eroding Domestic Mid-Range Segments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Insights into the Latest Trends and Innovations in the Market

- 4.9 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Base Type

- 5.1.1 Platform

- 5.1.2 Box Spring

- 5.1.3 Slats

- 5.1.4 Adjustable

- 5.1.5 Other Bases

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Other Materials

- 5.3 By Size

- 5.3.1 Full Size

- 5.3.2 Twin Size

- 5.3.3 Twin-XL Size

- 5.3.4 Queen Size

- 5.3.5 King Size

- 5.3.6 Special Size (California King)

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Distribution Channel

- 5.5.1 Offline

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Stores

- 5.5.1.3 Other Distribution Channels

- 5.5.2 Online

- 5.5.1 Offline

- 5.6 By Region

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Leggett & Platt, Incorporated

- 6.4.2 Tempur Sealy International, Inc.

- 6.4.3 Serta Simmons Bedding, LLC

- 6.4.4 Sleep Number Corporation

- 6.4.5 Ergomotion Inc.

- 6.4.6 Reverie (Ascion LLC)

- 6.4.7 Rize Home (Mantua Manufacturing Co.)

- 6.4.8 Glideaway (GDI)

- 6.4.9 Corsicana Mattress Company

- 6.4.10 Purple Innovation, Inc.

- 6.4.11 Kingsdown, Inc.

- 6.4.12 Classic Brands LLC

- 6.4.13 Ashley Furniture Industries, Inc.

- 6.4.14 Boyd Sleep

- 6.4.15 Malouf Companies

- 6.4.16 Saatva Inc.

- 6.4.17 Casper Sleep Inc.

- 6.4.18 IKEA Group (U.S.)

- 6.4.19 King Koil Mattress Co.

- 6.4.20 Southerland, Inc.

- 6.4.21 Nectar Sleep (Resident Home)

7 Market Opportunities & Future Outlook

- 7.1 Emerging Smart & Connected Base Solutions

- 7.2 Sustainability & Circular Materials Opportunities

- 7.3 Untapped Commercial Segments (Healthcare, Student Housing, RVs)