Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685920

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685920

Africa Sports Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 208 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

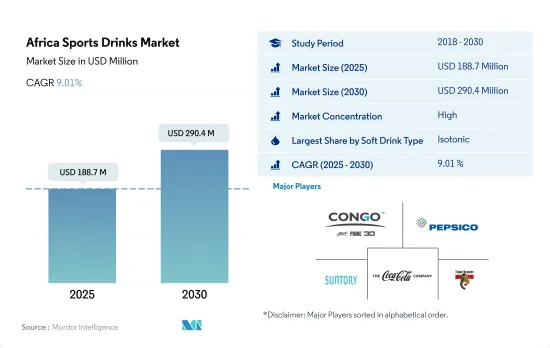

The Africa Sports Drinks Market size is estimated at 188.7 million USD in 2025, and is expected to reach 290.4 million USD by 2030, growing at a CAGR of 9.01% during the forecast period (2025-2030).

Isotonic sports drinks led the market due to the increasing sports participation population across the region

- The sports drink market in the region is witnessing robust growth, primarily driven by the rising number of individuals engaging in sports activities like athletics, bodybuilding, weightlifting, and cycling. For instance, in 2022, South Africa recorded a health and fitness club membership of 2.4 million. This surge in sports participation translated into a notable 14.66% growth in sports drink sales in 2023 compared to 2021.

- In 2023, isotonic drinks dominated the market, commanding over 50% share in the region. These drinks, designed to fuel and hydrate the body during intense workouts, mirror the carbohydrate concentrations found in the human body. With the region's strong sports culture and emphasis on physical activity, isotonic sports drinks have become a preferred choice among Africans.

- As the sports culture continues to flourish in the region, the demand for electrolyte-enhanced water is poised to rise. These drinks play a crucial role in maintaining optimal electrolyte balance, especially during physical exertion, intense workouts, or in hot and humid conditions when electrolyte loss is heightened. Notably, the segment witnessed a significant 13.36% volume growth in 2023 compared to 2020.

- Protein-based sports drinks have witnessed a surge in popularity, particularly among athletes and fitness enthusiasts. These drinks offer multiple benefits, such as aiding muscle tissue repair and regeneration, especially when consumed post-activity. In terms of value, the segment showcased a noteworthy CAGR of 7.38% from 2018 to 2023.

Brands are actively engaging with customers on social platforms, which is expected to drive growth in the region

- The sports drink market is growing steadily in the region. It registered a growth rate of 26.9% by value from 2020 to 2023. The demand for sports drinks is rising rapidly in Africa due to multiple reasons, such as the rising young population who perceive such drinks to be a part of daily consumption. The number of youths is rising in Africa; for instance, 49.79% of Africa's total population were aged between 18 and 64 years in 2022. Brands are actively engaged with their customers on platforms such as Twitter, Instagram, and Facebook, and the greater the number of fan followers, the greater it builds trust among consumers.

- Nigeria holds the major market share in the region. It has registered a growth rate of 51.2% by value from 2020 to 2023 in the sports drink market. The increased population involved in sports and physical activities is driving the sports drink market. Increasing concerns about health and fitness among the young generation are driving the market players to produce products with nutritional benefits and low-calorie products. Some of the popular sports drinks in the country are Lucozade, Red Bull, Power Horse, Monster Energy Drink, and Fearless Energy Drink.

- In Africa, players are launching new and innovative flavors, which are projected to drive the market between 2024 and 2030. It is projected to register a CAGR of 8.90% by value from 2024 to 2028. Monster Energy South Africa added a new flavor to its Juice Monster range, namely Monster Mariposa, in 2022. Similarly, Prime Hydration launched five new flavors of its Energy Drinks product. More specifically, the company launched flavors such as coconut, lime, Grapefruit, and tropical punch in April 2023.

Africa Sports Drinks Market Trends

Growing interest towards sports drinks made from natural ingredients is driving the market growth

- In 2022, there were more than 8.5 million (25%) sports drink consumers in South Africa (adult population +15 years). Also, the consumption of sports drinks can be primarily ascribed to the surge in consumer inclination toward physical well-being and an increase in the number of fitness centers and health clubs.

- Consumers in the region are seeking out brands that are made with whole ingredients with a growing interest in the origin of the product. Consumers pay attention to clean labels and ingredients used in sports drinks. In 2022, 52% of the consumers in the African region claimed that they always look for clean labels while shopping.

- With the growing demand for healthy beverages, sports drink manufacturers in the region experienced a surge in their sales. The fluctuation in the sports drinks price is connected with the rise and fall in the prices of its raw materials.

- Consumers' preference for sugar-free sports drinks is gaining popularity in the region due to the health effects of high-sugar intake drinks. In 2022, 28% of consumers in South Africa paid for fewer sugary drinks and claimed that they were reducing their sugar and calorie intake. More than a quarter of South Africans live with obesity, ranking the country among the top 20% of the most obese nations in the world.

Africa Sports Drinks Industry Overview

The Africa Sports Drinks Market is fairly consolidated, with the top five companies occupying 79.14%. The major players in this market are Congo Brands, PepsiCo, Inc., Suntory Holdings Limited, The Coca-Cola Company and Tiger Brands Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49303

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Buying Behaviour

- 4.2 Innovations

- 4.3 Brand Share Analysis

- 4.4 Regulatory Framework

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Soft Drink Type

- 5.1.1 Electrolyte-Enhanced Water

- 5.1.2 Hypertonic

- 5.1.3 Hypotonic

- 5.1.4 Isotonic

- 5.1.5 Protein-based Sport Drinks

- 5.2 Packaging Type

- 5.2.1 Aseptic packages

- 5.2.2 Metal Can

- 5.2.3 PET Bottles

- 5.3 Sub Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Retail

- 5.3.3 Specialty Stores

- 5.3.4 Supermarket/Hypermarket

- 5.3.5 Others

- 5.4 Country

- 5.4.1 Egypt

- 5.4.2 Nigeria

- 5.4.3 South Africa

- 5.4.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aje Group

- 6.4.2 BOS Brands (Pty) Ltd

- 6.4.3 Congo Brands

- 6.4.4 Ekhamanzi Springs (Pty) Ltd

- 6.4.5 Kingsley Beverages Limited

- 6.4.6 Oshee Polska Sp. Z.O.O.

- 6.4.7 PepsiCo, Inc.

- 6.4.8 Suntory Holdings Limited

- 6.4.9 The Coca-Cola Company

- 6.4.10 Thirsti Water (Pty) Ltd

- 6.4.11 Tiger Brands Ltd.

7 KEY STRATEGIC QUESTIONS FOR SOFT DRINK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.