PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906936

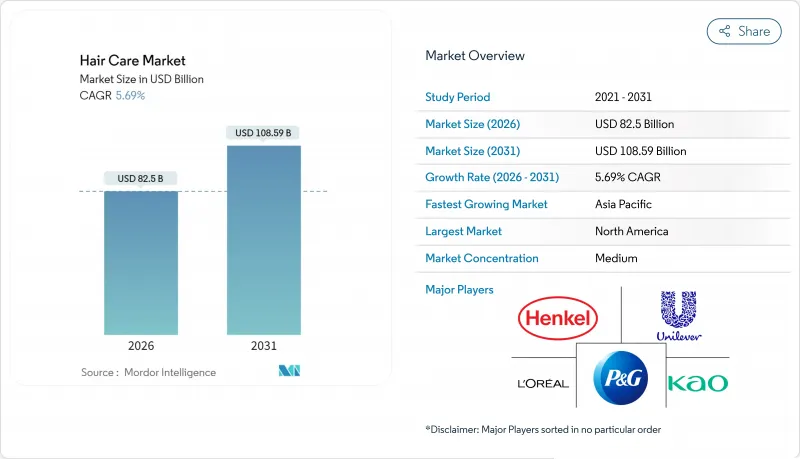

Hair Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Hair care market size in 2026 is estimated at USD 82.5 billion, growing from 2025 value of USD 78.06 billion with 2031 projections showing USD 108.59 billion, growing at 5.69% CAGR over 2026-2031.

This growth is primarily driven by the increasing awareness among consumers regarding the ingredients used in hair care products, the implementation of stricter safety regulations, and the rising popularity of salon-quality hair care routines that can be performed at home. These factors are encouraging consumers to invest in high-quality products that align with their preferences and safety standards. Companies that can quickly adapt to new allergen restrictions, provide evidence of clinical efficacy, and incorporate artificial intelligence (AI) diagnostics into their offerings are successfully capturing a larger share of premium consumer spending. At the same time, consolidation among multinational corporations is creating significant entry barriers for smaller, independent competitors. However, opportunities continue to emerge in niche areas such as scalp health, ingestible supplements, and clean formulations, which cater to evolving consumer demands. Despite these opportunities, the market faces certain challenges, including rising compliance costs due to regulatory requirements, inflationary pressures on raw material prices, and growing consumer fatigue with subscription-based models. Nevertheless, these challenges are outweighed by the structural demand for preventive wellness solutions and personalized hair care experiences, which continue to drive the market forward.

Global Hair Care Market Trends and Insights

Ingredient-conscious consumers prefer sulfate-free, silicone-free, and low-toxicity premium hair care products

Clean beauty mandates are reshaping formulation priorities as consumers increasingly scrutinize ingredient labels with the same attention previously given to food products. The United States Food and Drug Administration (FDA) Modernization of Cosmetics Regulation Act, effective from July 2024, requires manufacturers to substantiate product safety, register facilities, and report adverse events. This regulation raises the entry barrier for brands lacking comprehensive toxicology data . Brands such as Living Proof and Briogeo have adapted to this shift by promoting sulfate-free and silicone-free formulations, appealing to health-conscious millennials and Generation Z consumers who associate synthetic polymers with scalp irritation and environmental concerns. The natural and organic personal care market is experiencing moderate annual growth; however, premium hair care segments within this category are achieving double-digit growth. This growth is driven by the positioning of botanical actives, such as niacinamide, peptides, and hyaluronic acid, as science-backed alternatives to traditional silicones. Additionally, state-level restrictions in California and New York on formaldehyde-releasing preservatives and certain phthalates are accelerating reformulation efforts. These regulations are prompting brands to invest in preservative systems that ensure shelf stability while avoiding regulatory or consumer pushback. Ingredient transparency has transitioned from a niche demand to a baseline expectation, distinguishing premium brands from mass-market competitors.

Increased awareness of pollution and Ultraviolet damage drives demand for protective hair care products

Urban pollution and ultraviolet exposure are increasingly important concerns for consumers living in densely populated Asian cities. Particulate matter and ozone contribute to the degradation of hair cuticles and accelerate color fading. The anti-pollution ingredients market for personal care is growing as brands focus on incorporating chelating agents, antioxidants, and film-forming polymers to protect hair from environmental damage. In China and India, where air quality indices often exceed World Health Organization (WHO) guidelines, there is a rising demand for pre-shampoo treatments and leave-in serums that aim to neutralize free radicals and prevent heavy metal deposition on the hair shaft. Similarly, Japan's beauty market, which has traditionally emphasized ultraviolet protection in skincare, is now extending this focus to hair care. Brands are introducing sprays and oils containing sun protection factor (SPF)-equivalent filters to prevent photo-oxidation of melanin. In the Middle East, where consumers face intense solar radiation and arid climates, there is a growing preference for products that combine hydration and ultraviolet defense. This has led to the development of hybrid formulations that include ingredients such as argan oil, vitamin E, and ultraviolet absorbers. The regulatory landscape for ultraviolet filters in hair care remains fragmented, as approvals vary by jurisdiction. Furthermore, the International Fragrance Association's 51st amendment, which introduced 48 new restricted materials, is indirectly influencing formulation decisions for protective products.

High salon service costs reducing visit frequency and premium treatment adoption

Premium salon treatments, such as bond-repair sessions, keratin smoothing, and balayage coloring, are priced at a premium per visit. This often makes them inaccessible to middle-income consumers, prompting a shift toward at-home alternatives or lower-tier salons. Olaplex's professional channel sales experienced a decline in the fourth quarter of 2024, reflecting reduced salon traffic and the challenges faced by stylists in justifying premium add-ons in a cost-conscious environment. Independent salons, which held the majority structural share in 2024, are under pressure as rising labor costs and extended intervals between client visits from six weeks to eight or ten weeks compress margins. Chained salons are responding to these challenges by introducing membership models that bundle services at discounted rates. However, these programs reduce per-visit revenue and shift profitability toward retail product sales. The United States Bureau of Labor Statistics (BLS) Producer Price Index for hair preparations reached 154.277 in March 2025, up from a base of 100 in June 2007. This increase highlights sustained input cost inflation, which salons find difficult to pass on to price-sensitive consumers . Economic stagnation in Europe and uneven post-pandemic recovery in the Asia-Pacific region are further widening the affordability gap, particularly in markets where salon services are considered discretionary luxuries rather than routine maintenance. In response, brands are introducing professional-quality retail lines to help consumers extend salon results at home. However, this strategy risks undermining the professional channel that originally established their credibility.

Other drivers and restraints analyzed in the detailed report include:

- Professional-grade treatments like bond-repair and keratin boost salon applications and maintenance product demand

- High usage of hair coloring services increases visits and sales of color-care products

- Stringent regulations increasing compliance and reformulation costs for cosmetic ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hair care services accounted for 72.88% of the market share in 2025, highlighting the continued significance of salons in offering professional treatments such as coloring, keratin smoothing, and bond-repair applications. However, hair care products are expected to grow at a compound annual growth rate (CAGR) of 7.21% through 2031, surpassing the growth of services as consumers increasingly maintain salon results at home using shampoos, conditioners, and serums. The professional channel has shown signs of weakness, with Olaplex's professional sales declining by 27.1% in the fourth quarter of 2024, indicating a structural shift toward retail and direct-to-consumer channels that provide greater convenience and lower per-use costs.

In response, salons are focusing on upselling take-home products during service appointments and bundling professional treatments with retail kits that include color-care shampoos, bond-repair boosters, and styling oils. The emergence of hybrid models, where salons operate as both service providers and product retailers, is blurring the distinction between revenue streams and enabling stylists to capture a larger share of consumer spending.

The Hair Care Market is Segmented by Revenue Stream (Hair Care Products, and Hair Care Services), End Use (Male, and Female), Structure (Chained Salons, and Independent Salons), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America emerged as the leading segment, capturing 38.20% of the market share in 2025. This dominance is attributed to high per-capita spending on salon services, the widespread adoption of bond-repair and keratin treatments, and mature distribution networks that span professional, specialty retail, and direct-to-consumer channels. The implementation of the United States Food and Drug Administration (FDA) Modernization of Cosmetics Regulation Act in July 2024 is reshaping the competitive landscape. This regulation introduces requirements such as facility registration, adverse event reporting, and safety substantiation, which favor established brands with robust regulatory affairs capabilities. Additionally, L'Oreal's acquisition of Color Wow in June 2025 strengthens its color-care portfolio in the region, while Unilever's purchase of Nutrafol in January 2025 positions the company to address the needs of 114 million United States consumers experiencing hair health issues.

The Asia-Pacific region will emerge as the fastest-growing segment, boasting a compound annual growth rate of 6.95% through 2031. This surge is largely attributed to urbanization, increasing disposable incomes, and a growing inclination towards Korean and Japanese-inspired multi-step hair care routines. In India, the beauty and personal care market is on an upward trajectory, outpacing global averages and carving out a significant slice of the worldwide cosmetics pie. Within this landscape, hair care and color cosmetics are leading the charge . The Indian market stands out for its innovative fusion of traditional Ayurvedic elements, like neem and turmeric, with contemporary actives such as peptides and hyaluronic acid. This distinctive blend presents a golden opportunity for brands adept at marrying heritage with modern science. Concurrently, both China and Japan are rapidly embracing scalp-health products and anti-pollution solutions, a shift largely spurred by concerns over urban air quality and a growing consumer consciousness regarding environmental challenges.

Other regions, such as Europe, are navigating a complex regulatory environment. The European Union has expanded its fragrance allergen list from 26 to 82 substances and is enforcing Regulation 1003/2014 on isothiazolinone preservatives and Regulation 2021/850 on titanium dioxide and salicylic acid. These mandates are driving reformulation cycles that benefit multinational brands with dedicated research and development teams, while smaller indie brands face challenges in absorbing compliance costs. L'Oreal's EUR 4 billion (USD 4.6 billion) acquisition of Kering's beauty division in October 2025, which includes 50-year exclusive licenses for Gucci, Bottega Veneta, and Balenciaga, underscores aggressive consolidation efforts aimed at capturing the luxury and prestige segments.

- L'Oreal S.A.

- Unilever PLC

- The Procter & Gamble Company

- Henkel AG & Co. KGaA

- Kao Corporation

- Coty Inc.

- Shiseido Company, Ltd.

- Revlon Inc.

- Johnson & Johnson

- Dabur India Ltd.

- Amorepacific Corp.

- Estee Lauder

- Aveda

- Living Proof Inc.

- Olaplex Holdings

- Virtue Labs

- Giovanni Cosmetics, Inc.

- Moroccanoil Inc.

- Briogeo Hair Care

- Forest Essentials

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ingredient-conscious consumers prefer sulfate-free, silicone-free, and low-toxicity premium hair care products

- 4.2.2 Increased awareness of pollution and Ultraviolet damage drives demand for protective hair care products

- 4.2.3 Professional-grade treatments like bond-repair and keratin boost salon applications and maintenance product demand

- 4.2.4 High usage of hair coloring services increases visits and sales of color-care products

- 4.2.5 Personalization through scalp analysis and AI supports customized product regimens and services

- 4.2.6 Subscription models for hair care products enhance recurring revenue streams for businesses

- 4.3 Market Restraints

- 4.3.1 High salon service costs reducing visit frequency and premium treatment adoption

- 4.3.2 Stringent regulations increasing compliance and reformulation costs for cosmetic ingredients

- 4.3.3 Rising costs of specialty ingredients and sustainable materials compressing profit margins

- 4.3.4 Consumer skepticism increasing demand for clinical proof and prolonging decision cycles

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Revenue Stream

- 5.1.1 Hair Care Products

- 5.1.2 Hair Care Services

- 5.2 By End Use

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Structure

- 5.3.1 Chained Salons

- 5.3.2 Independent Salons

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Chile

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Turkey

- 5.4.5.6 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Unilever PLC

- 6.4.3 The Procter & Gamble Company

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Kao Corporation

- 6.4.6 Coty Inc.

- 6.4.7 Shiseido Company, Ltd.

- 6.4.8 Revlon Inc.

- 6.4.9 Johnson & Johnson

- 6.4.10 Dabur India Ltd.

- 6.4.11 Amorepacific Corp.

- 6.4.12 Estee Lauder

- 6.4.13 Aveda

- 6.4.14 Living Proof Inc.

- 6.4.15 Olaplex Holdings

- 6.4.16 Virtue Labs

- 6.4.17 Giovanni Cosmetics, Inc.

- 6.4.18 Moroccanoil Inc.

- 6.4.19 Briogeo Hair Care

- 6.4.20 Forest Essentials

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK