PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851217

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851217

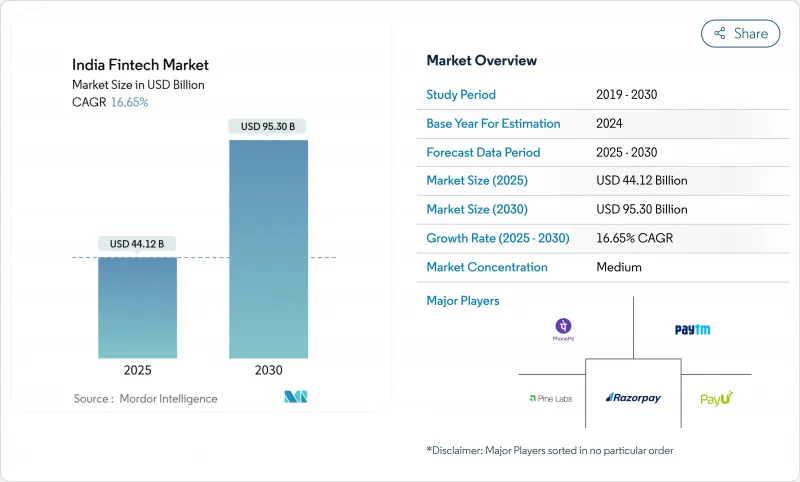

India Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India fintech market is valued at USD 44.12 billion in 2025 and is forecasted to advance to USD 95.30 billion by 2030, translating into a solid 16.65% CAGR during 2025-2030.

Consistent government backing, inexpensive mobile data, and seamless digital public infrastructure such as UPI and Aadhaar are widening access, compressing delivery costs, and encouraging product innovation. Rapid gains in smartphone penetration continue to expand the total addressable population, while millennial and Gen-Z wealth creation fuels demand for investment and credit products that are digital first. Competition remains intense as payments-led super-apps move laterally into lending, insurance, and wealth, and as specialist challengers carve profitable niches in premium credit, gig-worker finance, and cross-border payments. Rising participation from Tier II and Tier III cities, together with international UPI linkages, signals a structural broadening of growth opportunities across customer segments and geographies.

India Fintech Market Trends and Insights

Government-Built Digital Public Infrastructure Accelerating Mass-Market Adoption

Monthly UPI volumes exceeded 15 billion in November 2024, moving USD 280 billion in value. Aadhaar-enabled eKYC has cut onboarding costs from USD 15-20 to USD 0.5, allowing providers to serve low-income users profitably. More than 508 million Indians now access formal financial services through the JAM trinity, enlarging the India fintech market pool for payments, lending, and insurance. Direct benefit transfers delivered over USD 427 billion have entrenched digital rails in everyday transactions. The open, interoperable architecture reduces integration friction for private players, which in turn spurs product launches and cross-sector collaborations.

Account Aggregator Framework Unlocking Data-Driven Credit

Since its launch in 2021, the AA system has enabled consent-based sharing of verified financial records, allowing lenders to score borrowers who lack formal histories. By 2025, it is set to channel credit flows nearing USD 300 billion to MSMEs and retail customers. The ability to pull utility-bill and transaction data cuts approval times and lowers default risk, underpinning the expansion of digital lending platforms within the India fintech market. Policy makers view AA as a cornerstone for future digital credit rails that balance innovation with consumer protection.

RBI's Stricter Digital-Lending & FLDG Norms Raising Compliance Cost

Regulations issued in 2022 and updated in 2023 require direct fund flows between borrowers and regulated entities, detailed APR disclosures, and caps on default-loss guarantees at 5% of loan portfolios. Compliance spending has climbed 15-20%, squeezing smaller lenders. Cooling-off windows and data-storage mandates have prompted revisions to short-term products, slowing expansion plans and trimming profitability in the India fintech market.

Other drivers and restraints analyzed in the detailed report include:

- Embedded-Finance Demand from E-commerce and the Gig Economy

- Formalization of MSMEs Post-GST: Creating New Demand Pools

- Zero-MDR Policy Compressing Payment-Gateway Profit Pools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments accounted for 42.9% of India's fintech market share in 2024, underpinned by 131 billion UPI transactions in FY24. Continued smartphone adoption and merchant acceptance are expected to keep the segment on a high-growth track, even as revenue models shift toward value-added services. Industry incumbents deepen engagement by layering credit, insurance, and wealth products, thereby lengthening user lifecycles and raising per-customer margins. Competitive intensity remains elevated as global tech giants, banks, and home-grown players fight for daily transaction flow.

Neobanking is projected to post a 19.62% CAGR through 2030, the fastest among all propositions. Digital-only challengers partner with licensed banks to offer full-stack mobile accounts, automated budgeting, and alternative lending for freelancers and MSMEs. As regulatory frameworks mature and APIs standardize, neobanks expand beyond urban elites into vernacular interfaces and segment-specific offerings. The widening customer base, combined with low overheads, positions neobanks to steadily lift their contribution to the India fintech market size.

The India Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Paytm (One97 Communications Ltd)

- PhonePe Pvt Ltd

- Razorpay Software Pvt Ltd

- Pine Labs Pvt Ltd

- PayU Payments Pvt Ltd

- BharatPe (Resilient Innovations Pvt Ltd)

- MobiKwik (One MobiKwik Systems Ltd)

- PolicyBazaar (PB Fintech Ltd)

- Zerodha Broking Ltd

- Upstox (RKSV Securities India Pvt Ltd)

- Groww (Nextbillion Technology Pvt Ltd)

- Cred Financial Technologies Pvt Ltd

- Slice (GaragePreneurs Internet Pvt Ltd)

- KreditBee (Finnov Pvt Ltd)

- Lendingkart Finance Ltd

- Capital Float (Axio Digital)

- NeoGrowth Credit Pvt Ltd

- Navi Technologies Ltd

- Jupiter (Amica Finance Pvt Ltd)

- NIYO Solutions Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-Built Digital Public Infrastructure (UPI, Aadhaar, OCEN) Accelerating Mass-Market Adoption

- 4.2.2 Account Aggregator Framework Unlocking Data-Driven Credit Underwriting

- 4.2.3 Embedded-Finance Demand from E-commerce & Gig-Economy Platforms

- 4.2.4 Formalization of MSMEs post-GST Creating New SME Fintech Demand Pools

- 4.2.5 Millennial & Gen-Z Wealth Creation Driving Low-Cost Robo-Advisory Uptake

- 4.2.6 Cross-Border UPI Linkages (e.g., Singapore, UAE) Opening New Remittance Revenues

- 4.3 Market Restraints

- 4.3.1 RBI's Stricter Digital-Lending & FLDG Norms Raising Compliance Cost

- 4.3.2 Zero-MDR Policy Compressing Payment-Gateway Profit Pools

- 4.3.3 Escalating Cyber-Fraud Incidents Undermining Consumer Trust

- 4.3.4 Post-2022 Funding Winter Constraining Scale-Up Capital

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Paytm (One97 Communications Ltd)

- 6.4.2 PhonePe Pvt Ltd

- 6.4.3 Razorpay Software Pvt Ltd

- 6.4.4 Pine Labs Pvt Ltd

- 6.4.5 PayU Payments Pvt Ltd

- 6.4.6 BharatPe (Resilient Innovations Pvt Ltd)

- 6.4.7 MobiKwik (One MobiKwik Systems Ltd)

- 6.4.8 PolicyBazaar (PB Fintech Ltd)

- 6.4.9 Zerodha Broking Ltd

- 6.4.10 Upstox (RKSV Securities India Pvt Ltd)

- 6.4.11 Groww (Nextbillion Technology Pvt Ltd)

- 6.4.12 Cred Financial Technologies Pvt Ltd

- 6.4.13 Slice (GaragePreneurs Internet Pvt Ltd)

- 6.4.14 KreditBee (Finnov Pvt Ltd)

- 6.4.15 Lendingkart Finance Ltd

- 6.4.16 Capital Float (Axio Digital)

- 6.4.17 NeoGrowth Credit Pvt Ltd

- 6.4.18 Navi Technologies Ltd

- 6.4.19 Jupiter (Amica Finance Pvt Ltd)

- 6.4.20 NIYO Solutions Pvt Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment