PUBLISHER: Roots Analysis | PRODUCT CODE: 1737061

PUBLISHER: Roots Analysis | PRODUCT CODE: 1737061

Advanced Wound Care Market Distribution by Type of Advanced Wound Care Product, Type of Advanced Wound Care Dressing, Type of Wound Healing Medical Device, Type of End User and Key Geographical Regions

ADVANCED WOUND CARE MARKET: OVERVIEW

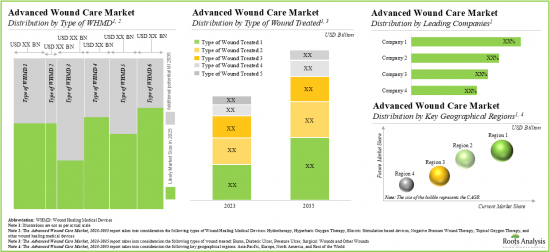

As per Roots Analysis, the global advanced wound care market is estimated to grow from USD 11.57 billion in the current year to USD 20.21 billion by 2035, at a CAGR of 5.20% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Advanced Wound Care Product

- Advanced Wound Care Dressings

- Bioengineered Skins and Dermal Substitutes

- Wound Healing Medical Devices

Type of Advanced Wound Care Dressing

- Foam Dressings

- Antimicrobial Dressings

- Hydrogel Dressings

- Hydrocolloid Dressings

- Alginate Dressings

- Composite Dressings

- Other Type of Wound Care Dressings

Type of Bioengineered Skins and Dermal Substitute

- Allografts

- Autografts

- Extracellular Matrices

- Growth Factors

- Other Dermal Substitutes

Type of Wound Healing Medical Device

- Negative Pressure Wound Therapy

- Hyperbaric Oxygen Therapy

- Topical Oxygen Therapy

- Hydrotherapy

- Electric Stimulation Therapy

- Skin Closure Systems / Adhesives

- Other Wound Healing Medical Devices

Type of Wound Treated

- Acute Wounds

- Chronic Wounds

Type of Acute Wound Treated

- Surgical Wounds

- Burns

- Other Acute Wounds

Type of Chronic Wound Treated

- Venous Ulcers

- Diabetic Ulcers

- Pressure Ulcers

- Other Chronic Wounds

- Type of End Users

- Hospital Care

- Home Care / Door to Door Services

- Other Types of End Users

Key Geographical Regions

- North America

- Europe

- Asia-Pacific and Rest of the World

ADVANCED WOUND CARE MARKET: GROWTH AND TRENDS

The rising prevalence of chronic diseases has resulted in an increase in the associated co-morbidities, including wounds, mental health disorders, vascular disorders, sensory impairments, and others. Among these, the management of wounds has emerged as a critical aspect within the healthcare sector. Presently, more than 15 million individuals worldwide are suffering from various types of wounds, generating a healthcare expenditure of more than USD 31 billion. In the US alone, Medicare beneficiaries spend more than USD 50 billion annually on wound treatment and management. Apart from the economic implications, wound management also imposes a burden on the physiological aspects of health. For instance, individuals experience a decline in quality of life by 2.5% due to the presence of associated wounds. With the rise in the geriatric population, which is prone to wounds and chronic disease conditions, the management of wounds has emerged as a paramount focal point within the healthcare sector. Several companies have developed and are developing advanced wound care products to overcome these challenges.

Further, in order to increase the adoption of advanced wound care products, stakeholders are actively integrating wound care products with automation tools, artificial intelligence and machine learning. These initiatives have led to the development of smart bandages and mobile-operated wound care products. Consequently, the wound care market is expected to gain widespread popularity in the coming years.

ADVANCED WOUND CARE MARKET: KEY INSIGHTS

The report delves into the current state of the advanced wound care market and identifies potential growth opportunities within the industry. Some key findings from the report include:

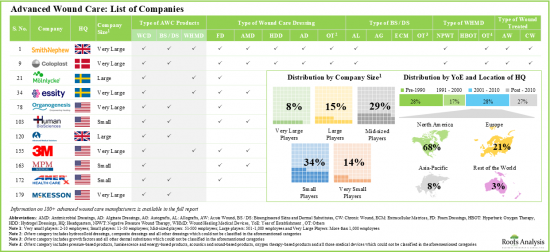

- Currently, more than 180 companies claim to manufacture various types of advanced wound care products; of these, more than 60% of players are headquartered in North America.

- 43% of companies manufacturing advanced wound care products offer advanced wound care dressings; around 85% of these companies offer dressings to treat both acute and chronic wounds.

- In pursuit of building a competitive edge, companies are actively expanding their existing capabilities to enhance their respective offerings and comply with evolving industry benchmarks.

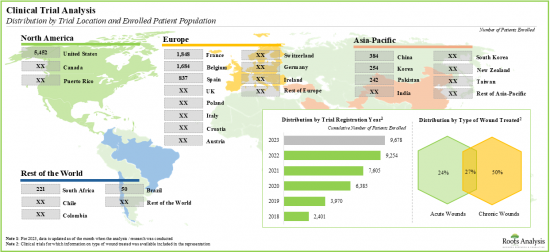

- Since 2018, over 135 clinical trials have been registered to evaluate the efficacy of various advanced wound care products; 50% of these studies are being conducted across different sites in the US.

- In recent years, the domain has witnessed a significant growth in partnership activity; majority of the deals involved acquisitions by players located in the US.

- Driven by the rising prevalence of chronic wounds and a growing number of geriatric populations, the market for advanced wound care products is poised to witness significant growth in the foreseen future.

- The advanced wound care market is projected to grow at a CAGR of 5.20%; in the long term, the majority of the revenues are likely to be generated by players manufacturing advanced wound care dressings.

- The projected market opportunity is anticipated to be well-distributed across different types of wound-healing medical devices, types of wounds treated and key geographical regions.

ADVANCED WOUND CARE MARKET: KEY SEGMENTS

Wound Care Dressings Segment Occupy the Largest Share of the Advanced Wound Care Market

Based on the type of advanced wound care product, the market is segmented into advanced wound care products, wound care dressings, bioengineered skin and dermal substitutes, and wound healing medical devices. At present, the wound care dressings segment holds the maximum (~60%) share of the global advanced wound care market. Additionally, the bioengineered skins and dermal substitutes segment is likely to grow at a faster pace compared to the other segments.

By Type of Advanced Wound Care Dressing, Composite Dressings is the Fastest Growing Segment of the Global Advanced Wound Care Market During the Forecast Period

Based on the type of advanced wound care dressing, the market is segmented into foam dressings, antimicrobial dressings, alginate dressings, hydrogel dressings, hydrocolloid dressings, composite dressings and other types of wound care dressings. Currently, the foam dressings segment captures the highest proportion (~30%) of the global advanced wound care market. It is worth highlighting that the advanced wound care market for the composite dressings segment is likely to grow at a relatively higher CAGR.

Allografts Segment Occupies the Largest Share of the Advanced Wound Care Market by Type of Bioengineered Skin and Dermal Substitute

Based on the type of bioengineered skin and dermal substitute, the market is segmented into allografts, autografts, extracellular matrices, growth factors and other dermal substitutes. At present, the allografts segment holds the maximum share (~50%) of the advanced wound care market. In addition, the anticipated approvals of xenografts, tissue constructs, and bioengineered skin products will likely drive the extracellular matrices segment to grow at a relatively higher CAGR.

By Type of Wound Healing Medical Devices, the Topical Oxygen Therapy Segment is the Fastest Growing Segment of the Advanced Wound Care Market During the Forecast Period

Based on the type of wound healing medical devices, the market is segmented into negative pressure wound therapy, hyperbaric oxygen therapy, topical oxygen therapy, hydrotherapy, electric stimulation therapy and other wound healing medical devices. Currently, negative pressure wound therapy segment captures the highest proportion (~50%) of the advanced wound care market. Further, it is worth highlighting that the advanced wound care market for topical oxygen therapy is likely to grow at a relatively higher CAGR.

Chronic Wounds Segment Account for the Largest Share of the Global Advanced Wound Care Market

Based on the type of wound treated, the market is segmented into acute wounds and chronic wounds. Currently, chronic wounds segment holds the maximum share (~80%) of the global advanced wound care market. This trend is likely to remain the same in the coming years.

By the Type of Acute Wound Treated, the Surgical Wounds Segment is Likely to Dominate the Advanced Wound Care Market

Based on the type of acute wound treated, the market is segmented into surgical wounds, burns and other acute wounds. At present the surgical wounds segment holds the maximum share of the advanced wound care market. Additionally, the burns segment is expected to show the highest growth potential during the forecast period, growing at a higher CAGR (7.0%), compared to the other segments.

The Venous Ulcers Segment by Type of Chronic Wound Treated Occupies the Largest Share of the Advanced Wound Care Market

Based on the type of chronic wound treated, the market is segmented into diabetic ulcers, pressure ulcers, venous ulcers and other chronic wounds. Whilst the venous ulcers segment is expected to be the primary driver of the overall market, it is worth highlighting that the global advanced wound care market for pressure ulcers segment is likely to grow at a relatively higher CAGR of 6.5%.

Currently, the Hospital Care Segment Holds the Largest Share of the Advanced Wound Care Market

Based on end users, the global market is segmented into hospital care, home / door to door services and other types of end users. Currently, the hospital care segment holds the largest market share (~50%). However, the advanced wound care market for home care / door to door services is expected to witness substantial growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, North America (45%) dominates the advanced wound care market and accounts for the largest revenue share.

Example Players in the Advanced Wound Care Market

- 3M

- Arthrex

- Advanced Medical Solutions

- Cardinal Health

- Coloplast

- Convatec

- DeRoyal

- Ethicon

- Essity

- Fidia Farmaceutici

- Integra Life Sciences

- Medline Industries

- Molnlycke Healthcare

- Organogenesis

- RTI Surgical

- Smith+Nephew

- Zimmer Biomet

ADVANCED WOUND CARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global advanced wound care market, focusing on key market segments, including [A] type of advanced wound care product, [B] type of advanced wound care dressing, [C] type of bioengineered skins and dermal substitute, [D] type of wound healing medical device, [E] type of wound treated, [F] type of acute wound treated, [G] type of chronic wound treated, [H] type of end users and [I] key geographical regions.

- Advanced Wound Care Product Manufacturers Market Landscape: A comprehensive evaluation of advanced wound care companies, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of advanced wound care product, [E] type of advanced wound care dressing, [F] type of bioengineered skin and dermal substitute, [G] type of wound healing medical device, [H] type of wound treated, [I] type of acute wound treated and [J] type of chronic wound treated.

- Company Competitiveness Analysis: A comprehensive competitive analysis of advanced wound care companies, examining factors, such as [A] supplier strength and [B] company competitiveness.

- Company Profiles of Advance Wound Care Dressing Manufacturers: In-depth profiles of key players engaged in the development of advance wound care dressings, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio, and [D] recent developments and [E] an informed future outlook.

- Company Profiles of Bioengineered Skins and Dermal Substitute Manufacturers: In-depth profiles of key players engaged in the development of bioengineered skins and dermal substitutes, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio, and [D] recent developments and [E] an informed future outlook.

- Company Profiles of Wound Healing Medical Device Manufacturers: In-depth profiles of key players engaged in the development of wound healing medical devices, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio, and [D] recent developments and [E] an informed future outlook.

- Clinical Trial Analysis: An insightful analysis of clinical trials related to advanced wound care products, based on several parameters, such as [A] trial registration year, [B] trial phase, [C] trial status, [D] type of wound treated, [E] type of wound care product, [F] trial purpose, [G] age group, [H] type of sponsor, [I] most active player, [J] enrolled patient population, and [K] key geographical regions.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the advanced wound care market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] purpose of partnership, [D] type of partner, [E] most active players (in terms of the number of partnerships signed) and [F] geographical distribution of partnership activity.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Chapter Overview

- 1.2. Project Objectives

- 1.3. Scope of the Report

- 1.4. Inclusions and Exclusions

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2.RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Considerations

- 2.6.1. Demographics

- 2.6.2. Economic Factors

- 2.6.3. Government Regulations

- 2.6.4. Supply Chain

- 2.6.5. COVID Impact / Related Factors

- 2.6.6. Market Access

- 2.6.7. Healthcare Policies

- 2.6.8. Industry Consolidation

- 2.7. Key Market Segmentations

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Wound Care

- 5.3. Types of Wounds and Injuries

- 5.3.1. Acute Wounds

- 5.3.2. Chronic Wounds

- 5.4. Need for Advanced Wound Care Solutions

- 5.5. Types of Advanced Wound Care Solutions

- 5.5.1. Wound Care Dressings

- 5.5.2. Bioengineered Skins and Dermal Substitutes

- 5.5.3. Wound Healing Medical Devices

- 5.6. Advantages of Advanced Wound Care Products

- 5.7. Future Perspectives

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Advanced Wound Care Product Manufacturers Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters (Region)

- 6.2.4. Analysis by Location of Headquarters (Country)

- 6.2.5. Analysis by Year of Establishment and Location of Headquarters

- 6.2.6. Analysis by Type of Advanced Wound Care Product

- 6.2.6.1. Wound Care Dressing Landscape

- 6.2.6.1.1. Analysis by Type of Wound Care Dressing

- 6.2.6.1.2. Analysis by Type of Wound Treated

- 6.2.6.1.3. Analysis by Type of Acute Wound Treated

- 6.2.6.1.4. Analysis by Type of Chronic Wound Treated

- 6.2.6.2. Bioengineered Skins and Dermal Substitutes Landscape

- 6.2.6.2.1. Analysis by Type of Bioengineered Skin and Dermal Substitute

- 6.2.6.2.2. Analysis by Type of Wound Treated

- 6.2.6.2.3. Analysis by Type of Acute Wound Treated

- 6.2.6.2.4. Analysis by Type of Chronic Wound Treated

- 6.2.6.3. Wound Healing Medical Devices Landscape

- 6.2.6.3.1. Analysis by Type of Wound Healing Medical Device

- 6.2.6.3.2. Analysis by Type of Wound Treated

- 6.2.6.3.3. Analysis Type of Acute Wound Treated

- 6.2.6.3.4. Analysis Type of Chronic Wound Treated

- 6.2.6.1. Wound Care Dressing Landscape

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis

- 7.4.1. Wound Care Dressing Manufacturer

- 7.4.1.1. Players based in North America

- 7.4.1.2. Players based in Europe

- 7.4.1.3. Players based in Asia-Pacific and Rest of the World

- 7.4.2. Bioengineered Skins and Dermal Substitute Manufacturer

- 7.4.2.1. Players based in North America

- 7.4.2.2. Players based in Europe, Asia-Pacific and Rest of the World

- 7.4.3. Wound Healing Medical Device Manufacturers

- 7.4.3.1. Players based in North America

- 7.4.3.2. Players based in Europe, Asia-Pacific and Rest of the World

- 7.4.1. Wound Care Dressing Manufacturer

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. 3M

- 8.2.1. Company Overview

- 8.2.2. Financial Information

- 8.2.3. Advanced Wound Care Portfolio

- 8.2.4. Recent Developments and Future Outlook

- 8.3. Coloplast

- 8.3.1. Company Overview

- 8.3.2. Financial Information

- 8.3.3. Advanced Wound Care Portfolio

- 8.3.4. Recent Developments and Future Outlook

- 8.4. Ethicon (a subsidiary of Johnson & Johnson)

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. Advanced Wound Care Portfolio

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Fidia Farmaceutici

- 8.5.1. Company Overview

- 8.5.2. Financial Information

- 8.5.3. Advanced Wound Care Portfolio

- 8.5.4. Recent Developments and Future Outlook

- 8.6. Molnlycke Healthcare

- 8.6.1. Company Overview

- 8.6.2. Financial Information

- 8.6.3. Advanced Wound Care Portfolio

- 8.6.4. Recent Developments and Future Outlook

- 8.7. Smith+Nephew

- 8.7.1. Company Overview

- 8.7.2. Financial Information

- 8.7.3. Advanced Wound Care Portfolio

- 8.7.4. Recent Developments and Future Outlook

- 8.8. Zimmer Biomet

- 8.8.1. Company Overview

- 8.8.2. Financial Information

- 8.8.3. Advanced Wound Care Portfolio

- 8.8.4. Recent Developments and Future Outlook

- 8.9. Other Leading Players

- 8.9.1. Advanced Medical Solutions

- 8.9.1.1. Company Overview

- 8.9.1.2. Advanced Wound Care Portfolio

- 8.9.2. Arthrex

- 8.9.2.1. Company Overview

- 8.9.2.2. Advanced Wound Care Portfolio

- 8.9.3. Cardinal Health

- 8.9.3.1. Company Overview

- 8.9.3.2. Advanced Wound Care Portfolio

- 8.9.4. Convatec

- 8.9.4.1. Company Overview

- 8.9.4.2. Advanced Wound Care Portfolio

- 8.9.5. DeRoyal

- 8.9.5.1. Company Overview

- 8.9.5.2. Advanced Wound Care Portfolio

- 8.9.6. Essity

- 8.9.6.1. Company Overview

- 8.9.6.2. Advanced Wound Care Portfolio

- 8.9.7. Integral Life Sciences

- 8.9.7.1. Company Overview

- 8.9.7.2. Advanced Wound Care Portfolio

- 8.9.8. Medline Industries

- 8.9.8.1. Company Overview

- 8.9.8.2. Advanced Wound Care Portfolio

- 8.9.9. Organogenesis

- 8.9.9.1. Company Overview

- 8.9.9.2. Advanced Wound Care Portfolio

- 8.9.10. RTI Surgical

- 8.9.10.1. Company Overview

- 8.9.10.2. Advanced Wound Care Portfolio

- 8.9.1. Advanced Medical Solutions

9. CLINICAL TRIAL ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Advanced Wound Care: Clinical Trial Analysis

- 9.3.1. Analysis by Trial Registration Year

- 9.3.1.1. Analysis by Trial Registration Year and Enrolled Patient Population

- 9.3.2. Analysis by Trial Phase

- 9.3.2.1. Analysis by Trial Phase and Enrolled Patient Population

- 9.3.3. Analysis by Trial Status

- 9.3.3.1. Analysis by Trial Status and Enrolled Patient Population

- 9.3.4. Analysis by Type of Wound Treated

- 9.3.5. Analysis by Type of Wound Care Product

- 9.3.6. Analysis by Trial Focus Area

- 9.3.7. Analysis by Age Group of Enrolled Patients

- 9.3.8. Analysis by Type of Sponsor / Collaborator

- 9.3.9. Most Active Player: Analysis by Number of Trials

- 9.3.10. Analysis by Geography

- 9.3.11. Analysis by Trial Registration Year and Geography

- 9.3.12. Analysis by Geography and Enrolled Patient Population

- 9.3.1. Analysis by Trial Registration Year

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Advanced Wound Care: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Year and Type of Partnership

- 10.3.4. Analysis by Purpose of Partnership

- 10.3.5. Analysis by Type of Partner

- 10.3.6. Analysis by Year of Partnership and Type of Partner

- 10.3.7. Most Active Player: Analysis by Number of Partnerships

- 10.3.8. Analysis by Geography

- 10.3.8.1. Local and International Agreements

- 10.3.8.2. Intracontinental and Intercontinental Agreements

11. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 11.1. Chapter Overview

- 11.2. Market Drivers

- 11.3. Market Restraints

- 11.4. Market Opportunities

- 11.5. Market Challenges

- 11.6. Conclusion

12. GLOBAL ADVANCED WOUND CARE MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Global Advanced Wound Care Market, Historical Trend (Since 2019) and Forecasted Estimates (Till 2035)

- 12.3.1. Scenario Analysis

- 12.3.1.1. Conservative Scenario

- 12.3.1.2. Optimistic Scenario

- 12.3.1. Scenario Analysis

- 12.4. Key Market Segmentations

13. GLOBAL ADVANCED WOUND CARE MARKET, BY TYPE OF ADVANCED WOUND CARE PRODUCT

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Forecast Methodology

- 13.3. Advanced Wound Care Market: Distribution by Type of Advanced Wound Care Product

- 13.3.1. Advanced Wound Care Market for Wound Care Dressings: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.3.2. Advanced Wound Care Market for Bioengineered Skins and Dermal Substitutes: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.3.3. Advanced Wound Care Market for Wound Healing Medical Devices: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.4. Data Triangulation and Validation

14. ADVANCED WOUND CARE MARKET, BY TYPE OF WOUND CARE DRESSING

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Forecast Methodology

- 14.3. Advanced Wound Care Market: Distribution by Type of Wound Care Dressing

- 14.3.1. Advanced Wound Care Market for Foam Dressings: Forecasted Estimates (Till 2035)

- 14.3.2. Advanced Wound Care Market for Antimicrobial Dressings: Forecasted Estimates (Till 2035)

- 14.3.3. Advanced Wound Care Market for Alginate Dressings: Forecasted Estimates (Till 2035)

- 14.3.4. Advanced Wound Care Market for Hydrogel Dressings: Forecasted Estimates (Till 2035)

- 14.3.5. Advanced Wound Care Market for Hydrocolloid Dressings: Forecasted Estimates (Till 2035)

- 14.3.6. Advanced Wound Care Market for Composite Dressings: Forecasted Estimates (Till 2035)

- 14.3.7. Advanced Wound Care Market for Other Types of Wound Care Dressings: Forecasted Estimates (Till 2035)

- 14.4. Data Triangulation and Validation

15. ADVANCED WOUND CARE MARKET, BY BIOENGINEERED SKINS AND DERMAL SUBSTITUTE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Forecast Methodology

- 15.3. Advanced Wound Care Market: Distribution by Type of Bioengineered Skin and Dermal Substitute

- 15.3.1. Advanced Wound Care Market for Allografts: Forecasted Estimates (Till 2035)

- 15.3.2. Advanced Wound Care Market for Autografts: Forecasted Estimates (Till 2035)

- 15.3.3. Advanced Wound Care Market for Extracellular Matrices: Forecasted Estimates (Till 2035)

- 15.3.4. Advanced Wound Care Market for Growth Factors: Historical Trends (Forecasted Estimates (Till 2035)

- 15.3.5. Advanced Wound Care Market for Other Dermal Substitutes: Forecasted Estimates (Till 2035)

- 15.4. Data Triangulation and Validation

16. ADVANCED WOUND CARE MARKET: DISTRIBUTION BY TYPE OF WOUND HEALING MEDICAL DEVICE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Forecast Methodology

- 16.3. Advanced Wound Care Market: Distribution by Type of Wound Healing Medical Device

- 16.3.1. Advanced Wound Care Market for Negative Pressure Wound Therapy: Forecasted Estimates (Till 2035)

- 16.3.2. Advanced Wound Care Market for Hyperbaric Oxygen Therapy: Forecasted Estimates (Till 2035)

- 16.3.3. Advanced Wound Care Market for Topical Oxygen Therapy: Forecasted Estimates (Till 2035)

- 16.3.4. Advanced Wound Care Market for Hydrotherapy: Forecasted Estimates (Till 2035)

- 16.3.5. Advanced Wound Care Market for Electric Stimulation Therapy: Forecasted Estimates (Till 2035)

- 16.3.6. Advanced Wound Care Market for Skin Closure Systems / Adhesives: Forecasted Estimates (Till 2035)

- 16.3.7. Advanced Wound Care Market for Other Types of Wound Healing Medical Devices: Forecasted Estimates (Till 2035)

- 16.4. Data Triangulation and Validation

17. ADVANCED WOUND CARE MARKET, BY TYPE OF WOUND TREATED

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Forecast Methodology

- 17.3. Advanced Wound Care Market: Distribution by Type of Wound Treated

- 17.3.1. Advanced Wound Care Market for Acute Wounds: Forecasted Estimates (Till 2035)

- 17.3.2. Advanced Wound Care Market for Chronic Wounds: Forecasted Estimated (Till 2035)

- 17.4. Data Triangulation and Validation

18. ADVANCED WOUND CARE MARKET, BY TYPE OF ACUTE WOUND TREATED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Forecast Methodology

- 18.3. Advanced Wound Care Market: Distribution by Types of Acute Wound Treated

- 18.3.1. Advanced Wound Care Market for Surgical Wounds: Forecasted Estimates (Till 2035)

- 18.3.2. Advanced Wound Care Market for Burns: Forecasted Estimated (Till 2035)

- 18.3.3. Advanced Wound Care Market for Other Types of Acute Wounds: Forecasted Estimated (Till 2035)

- 18.4. Data Triangulation and Validation

19. ADVANCED WOUND CARE MARKET, BY TYPE OF CHRONIC WOUND TREATED

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Forecast Methodology

- 19.3. Advanced Wound Care Market: Distribution by Type Chronic Wound Treated

- 19.3.1. Advanced Wound Care Market for Diabetic Ulcers: Forecasted Estimates (Till 2035)

- 19.3.2. Advanced Wound Care Market for Venous Ulcers: Forecasted Estimated (Till 2035)

- 19.3.3. Advanced Wound Care Market for Pressure Ulcers: Forecasted Estimated (Till 2035)

- 19.3.4. Advanced Wound Care Market for Other Types of Chronic Wounds: Forecasted Estimated (Till 2035)

- 19.4. Data Triangulation and Validation

20. ADVANCED WOUND CARE MARKET, BY TYPE OF END USER

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Forecast Methodology

- 20.3. Advanced Wound Care Market: Distribution by Type of End User

- 20.3.1. Advanced Wound Care Market for Hospital Care: Forecasted Estimates (Till 2035)

- 20.3.2. Advanced Wound Care Market for Home Care / Door to Door Services: Forecasted Estimates (Till 2035)

- 20.3.3. Advanced Wound Care Market for Other Types of End Users: Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. ADVANCED WOUND CARE MARKET, BY KEY GEOGRAPHICAL REGIONS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Forecast Methodology

- 21.3. Advanced Wound Care Market: Distribution by Key Geographical Regions

- 21.3.1. Advanced Wound Care Market in North America: Forecasted Estimates (Till 2035)

- 21.3.1.1. Advanced Wound Care Market in the US: Forecasted Estimates (Till 2035)

- 21.3.1.2. Advanced Wound Care Market Canada: Forecasted Estimates (Till 2035)

- 21.3.2. Advanced Wound Care Market in Europe: Forecasted Estimates (Till 2035)

- 21.3.2.1. Advanced Wound Care Market in Germany: Forecasted Estimates (Till 2035)

- 21.3.2.2. Advanced Wound Care Market in France: Forecasted Estimates (Till 2035)

- 21.3.2.3. Advanced Wound Care Market in the UK: Forecasted Estimates (Till 2035)

- 21.3.2.4. Advanced Wound Care Market in Spain: Forecasted Estimates (Till 2035)

- 21.3.2.5. Advanced Wound Care Market in Italy: Forecasted Estimates (Till 2035)

- 21.3.3. Advanced Wound Care Market in Asia-Pacific and Rest of the World: Forecasted Estimates (Till 2035)

- 21.3.3.1. Advanced Wound Care Market in China: Forecasted Estimates (Till 2035)

- 21.3.3.2. Advanced Wound Care Market in Japan: Forecasted Estimates (Till 2035)

- 21.3.3.3. Advanced Wound Care Market in Brazil: Forecasted Estimates (Till 2035)

- 21.3.3.4. Advanced Wound Care Market in Australia: Forecasted Estimates (Till 2035)

- 21.3.3.5. Advanced Wound Care Market in South Korea: Forecasted Estimates (Till 2035)

- 21.3.3.6. Advanced Wound Care Market in Israel: Forecasted Estimates (Till 2035)

- 21.3.1. Advanced Wound Care Market in North America: Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. CONCLUSION

23. APPENDIX 1: TABULATED DATA

24. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Advanced Wound Care Products Manufacturers: Information on Year of Establishment, Company Size, Location of Headquarters and Type of Product Offered

- Table 6.2 Advanced Wound Care Product Manufacturers: Information on Type of Wound Care Dressing

- Table 6.3 Wound Care Dressing Manufacturers: Information on Type of Wound Treated

- Table 6.4 Bioengineered Skins and Dermal Substitutes Manufacturers: Information on Type of Bioengineered Skin and Dermal Substitute

- Table 6.5 Bioengineered Skins and Dermal Substitutes Manufacturers: Information on Type of Wound Treated

- Table 6.6 Wound Healing Medical Device Manufacturers: Information on Type of Wound Healing Medical Device

- Table 6.7 Wound Healing Medical Device Manufacturers: Distribution by Type of Wound Treated

- Table 8.1 Advanced Wound Care Products Manufacturers: List of Companies Profiled

- Table 8.2 3M: Company Overview

- Table 8.3 3M: Advanced Wound Care Portfolio

- Table 8.4 3M: Recent Developments and Future Outlook

- Table 8.5 Coloplast: Company Overview

- Table 8.6 Coloplast: Advanced Wound Care Portfolio

- Table 8.7 Coloplast: Recent Developments and Future Outlook

- Table 8.8 Ethicon (a subsidiary of Johnson & Johnson): Company Overview

- Table 8.9 Ethicon (a subsidiary of Johnson & Johnson): Advanced Wound Care Portfolio

- Table 8.10 Fidia Farmaceutici: Company Overview

- Table 8.11 Fidia Farmaceutici: Advanced Wound Care Portfolio

- Table 8.12 Molnlycke Health Care: Company Overview

- Table 8.13 Molnlycke Health Care: Advanced Wound Care Portfolio

- Table 8.14 Molnlycke Health Care: Recent Developments and Future Outlook

- Table 8.15 Smith+Nephew: Company Overview

- Table 8.16 Smith+Nephew: Advanced Wound Care Portfolio

- Table 8.17 Smith+Nephew: Recent Developments and Future Outlook

- Table 8.18 Zimmer Biomet: Company Overview

- Table 8.19 Zimmer Biomet: Advanced Wound Care Portfolio

- Table 8.20 Smith+Nephew: Recent Developments and Future Outlook

- Table 8.21 Advanced Wound Care Manufacturers: List of Companies Profiled (Tabulated Profiles)

- Table 8.22 Advanced Medical Solutions: Company Overview

- Table 8.23 Advanced Medical Solutions: Advanced Wound Care Portfolio

- Table 8.24 Arthrex: Company Overview

- Table 8.25 Arthrex: Advanced Wound Care Portfolio

- Table 8.26 Cardinal Health: Company Overview

- Table 8.27 Cardinal Health: Advanced Wound Care Portfolio

- Table 8.28 Convatec: Company Overview

- Table 8.29 Convatec: Advanced Wound Care Portfolio

- Table 8.30 DeRoyal: Company Overview

- Table 8.31 DeRoyal: Advanced Wound Care Portfolio

- Table 8.32 Essity: Company Overview

- Table 8.33 Essity: Advanced Wound Care Portfolio

- Table 8.34 Integra Life Sciences: Company Overview

- Table 8.35 Integral Life Sciences: Advanced Wound Care Portfolio

- Table 8.36 Medline Industries: Company Overview

- Table 8.37 Medline Industries: Advanced Wound Care Portfolio

- Table 8.38 Organogenesis: Company Overview

- Table 8.39 Organogenesis: Advanced Wound Care Portfolio

- Table 8.40 RTI Surgical: Company Overview

- Table 8.41 RTI Surgical: Advanced Wound Care Portfolio

- Table 10.1 Advanced Wound Care: List of Partnerships and Collaborations

- Table 12.1 Advanced Wound Care Market: Distribution by Leading Companies

- Table 23.1 Advanced Wound Care Manufacturers: Distribution by Year of Establishment

- Table 23.2 Advanced Wound Care Manufacturers: Distribution by Company Size

- Table 23.3 Advanced Wound Care Manufacturers: Distribution by Location of Headquarters (Region)

- Table 23.4 Advanced Wound Care Manufacturers: Distribution by Location of Headquarters (Country)

- Table 23.5 Advanced Wound Care Manufacturers: Distribution by Year of Establishment and Location of Headquarters (Region)

- Table 23.6 Advanced Wound Care Product Manufacturers: Distribution by Type of Advanced Wound Care Products

- Table 23.7 Wound Care Dressing Manufacturers: Distribution by Type of Wound Care Dressing

- Table 23.8 Wound Care Dressing Manufacturers: Distribution by Type of Wound Treated

- Table 23.9 Wound Care Dressing Manufacturers: Distribution by Type of Acute Wound Treated

- Table 23.10 Wound Care Dressing Manufacturers: Distribution by Type of Chronic Wound Treated

- Table 23.11 Bioengineered and Dermal Substitute Manufacturers: Distribution by Type of Bioengineered Skin and Dermal Substitute

- Table 23.12 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Wound Treated

- Table 23.13 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Acute Wound Treated

- Table 23.14 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Chronic Wound Treated

- Table 23.15 Wound Healing Medical Device Manufacturers: Distribution by Type Wound Healing Medical Device

- Table 23.16 Wound Healing Medical Device Manufacturers: Distribution by Type Wound Treated

- Table 23.17 Wound Healing Medical Device Manufacturers: Distribution by Type Acute Wound Treated

- Table 23.18 Wound Healing Medical Device Manufacturers: Distribution by Type Chronic Wound Treated

- Table 23.19 3M: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 23.20 Coloplast: Annual Revenues, FY 2018 Onwards (DKK Billion)

- Table 23.21 Johnson & Johnson: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 23.22 Fidia Farmaceutici: Annual Revenues, FY 2018 Onwards (EUR Million)

- Table 23.23 Molnlycke Healthcare: Annual Revenues, FY 2018 Onwards (EUR Billion)

- Table 23.24 Smith + Nephew: Annual Revenues FY 2018 Onwards (USD Billion)

- Table 23.25 Zimmer Biomet: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 23.26 Clinical Trial Analysis: Cumulative Year-wise Trend

- Table 23.27 Clinical Trial Analysis: Distribution of Trial Registration Year and Enrolled Patient Population

- Table 23.28 Clinical Trial Analysis: Distribution by Trial Phase

- Table 23.29 Clinical Trial Analysis: Distribution by Trial Phase and Enrolled Patient Population

- Table 23.30 Clinical Trial Analysis: Distribution by Trial Status

- Table 23.31 Clinical Trial Analysis: Distribution by Trial Status and Trial Registration Year

- Table 23.32 Clinical Trial Analysis: Distribution by Type of Wound Treated

- Table 23.33 Clinical Trial Analysis: Distribution by Type of Wound Care Product

- Table 23.34 Clinical Trial Analysis: Distribution by Trial Focus Area

- Table 23.34 Clinical Trial Analysis: Distribution by Trial Focus Area

- Table 23.35 Clinical Trial Analysis: Distribution by Age Group of Enrolled Patients

- Table 23.36 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 23.37 Most Active Players: Distribution by Number of Clinical Trials

- Table 23.38 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Table 23.39 Clinical Trial Analysis: Distribution by Trial Registration Year and Geography

- Table 23.40 Clinical Trial Analysis: Distribution of Patients Enrolled by Geography

- Table 23.41 Partnerships and Collaborations: Cumulative Year-Wise Trend

- Table 23.42 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 23.43 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 23.44 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Table 23.45 Partnerships and Collaborations: Distribution by Type of Partner

- Table 23.46 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Table 23.47 Most Active Players: Distribution by Number of Partnerships

- Table 23.48 Partnerships and Collaboration: Local and International Agreements

- Table 23.49 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 23.50 Advanced Wound Care Market, Historical Trends (Since 2019) (USD Billion)

- Table 23.51 Advanced Wound Care Market, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.52 Advanced Wound Care Market: Distribution by Type of Advanced Wound Care Product

- Table 23.53 Advanced Wound Care Market for Wound Care Dressings, Historical Trends (Since 2019) (USD Billion)

- Table 23.54 Advanced Wound Care Market for Wound Care Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.55 Advanced Wound Care Market for Bioengineered Skins and Dermal Substitutes, Historical Trends (Since 2019) (USD Billion)

- Table 23.56 Advanced Wound Care Market for Bioengineered Skins and Dermal Substitutes, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.57 Advanced Wound Care Market for Wound Healing Medical Devices, Historical Trends (Since 2019) (USD Billion)

- Table 23.58 Advanced Wound Care Market for Wound Healing Medical Devices, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.59 Advanced Wound Care Market: Distribution by Type of Wound Care Dressing

- Table 23.60 Advanced Wound Care Market for Foam Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.61 Advanced Wound Care Market for Antimicrobial Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.62 Advanced Wound Care Market for Hydrogel Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.63 Advanced Wound Care Market for Hydrocolloid Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.64 Advanced Wound Care Market for Alginate Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.65 Advanced Wound Care Market for Composite Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.66 Advanced Wound Care Market for Other Types of Wound Care Dressings, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.67 Advanced Wound Care Market: Distribution by Type of Bioengineered Skin and Dermal Substitute

- Table 23.68 Advanced Wound Care Market for Allografts, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.69 Advanced Wound Care Market for Autografts, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.70 Advanced Wound Care Market for Extracellular Matrices, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.71 Advanced Wound Care Market for Growth Factors, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.72 Advanced Wound Care Market for Other Dermal Substitutes, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.73 Advanced Wound Care Market: Distribution by Type of Wound Healing Medical Device

- Table 23.74 Advanced Wound Care Market for Negative Pressure Wound Therapy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.75 Advanced Wound Care Market for Topical Oxygen Therapy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.76 Advanced Wound Care Market for Hyperbaric Oxygen Therapy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.77 Advanced Wound Care Market for Hydrotherapy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.78 Advanced Wound Care Market for Electric Stimulation Therapy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.79 Advanced Wound Care Market for Other Types of Wound Healing Medical Devices, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.80 Advanced Wound Care Market: Distribution by Type of Wound Treated

- Table 23.81 Advanced Wound Care Market for Acute Wounds, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.82 Advanced Wound Care Market for Chronic Wounds, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.83 Advanced Wound Care Market: Distribution by Type of Acute Wound Treated

- Table 23.84 Advanced Wound Care Market for Surgical Wounds, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.85 Advanced Wound Care Market for Burns, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.86 Advanced Wound Care Market for Other Types of Acute Wounds, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.87 Advanced Wound Care Market: Distribution by Type of Chronic Wound Treated

- Table 23.88 Advanced Wound Care Market for Venous Ulcers, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.89 Advanced Wound Care Market for Diabetic Ulcers, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.90 Advanced Wound Care Market for Pressure Ulcers, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.91 Advanced Wound Care Market for Other Types of Chronic Wounds, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.92 Advanced Wound Care Market: Distribution by Type of End User

- Table 23.93 Advanced Wound Care Market for Hospital Care, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.94 Advanced Wound Care Market for Home Care / Door to Door Services, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.95 Advanced Wound Care Market for Other Types of End Users, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion

- Table 23.96 Advanced Wound Care Market: Distribution by Key Geographical Regions

- Table 23.97 Advanced Wound Care Market in North America, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.98 Advanced Wound Care Market in the US, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.99 Advanced Wound Care Market in Canada, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.100 Advanced Wound Care Market in Europe, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.101 Advanced Wound Care Market in Germany, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.102 Advanced Wound Care Market in France, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.103 Advanced Wound Care Market in the UK, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.104 Advanced Wound Care Market in Italy, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.105 Advanced Wound Care Market in Spain, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.106 Advanced Wound Care Market in Asia-Pacific and Rest of the World, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.107 Advanced Wound Care Market in China, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.108 Advanced Wound Care Market in Japan, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.109 Advanced Wound Care Market in Brazil, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.110 Advanced Wound Care Market in Australia, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.111 Advanced Wound Care Market in South Korea, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.112 Advanced Wound Care Market in Israel, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentations

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Advanced Wound Care Product Manufacturers Landscape

- Figure 4.2 Executive Summary: Clinical Trial Analysis

- Figure 4.3 Executive Summary: Partnerships and Collaborations

- Figure 4.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 5.1 Types of Wounds and Injuries

- Figure 5.2 Types of Advanced Wound Care Dressings

- Figure 5.3 Types of Bioengineered Skins and Dermal Substitutes

- Figure 5.4 Types of Wound Healing Medical Devices

- Figure 6.1 Advanced Wound Care Product Manufacturers: Distribution by Year of Establishment

- Figure 6.2 Advanced Wound Care Product Manufacturers: Distribution by Company Size

- Figure 6.3 Advanced Wound Care Product Manufacturers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Advanced Wound Care Product Manufacturers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Advanced Wound Care Product Manufacturers: Distribution by Year of Establishment and Location of Headquarters

- Figure 6.6 Advanced Wound Care Product Manufacturers: Distribution by Type of Advanced Wound Care Product

- Figure 6.7 Wound Care Dressing Manufacturers: Distribution by Type of Wound Care Dressing

- Figure 6.8 Wound Care Dressing Manufacturers: Distribution by Type of Wound Treated

- Figure 6.9 Wound Care Dressing Manufacturers: Distribution by Type of Acute Wound Treated

- Figure 6.10 Wound Care Dressing Manufacturers: Distribution by Type of Chronic Wound Treated

- Figure 6.11 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Bioengineered Skin and Dermal Substitute

- Figure 6.12 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Wound Treated

- Figure 6.13 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Acute Wound Treated

- Figure 6.14 Bioengineered Skin and Dermal Substitute Manufacturers: Distribution by Type of Chronic Wound Treated

- Figure 6.15 Advanced Wound Care Manufacturers: Distribution by Type of Wound Healing Medical Device

- Figure 6.16 Wound Healing Medical Devices Manufacturers: Distribution by Type of Wound Treated

- Figure 6.17 Wound Healing Medical Device Manufacturers: Distribution by Type of Acute Wound Treated

- Figure 6.18 Wound Healing Medical Devices Manufacturers: Distribution by Type of Chronic Wound Treated

- Figure 7.1 Company Competitiveness Analysis: Wound Care Dressings Manufacturers in North America

- Figure 7.2 Company Competitiveness Analysis: Wound Care Dressings Manufacturers in Europe

- Figure 7.3 Company Competitiveness Analysis: Wound Care Dressings Manufacturers in Asia-Pacific and Rest of the World

- Figure 7.4 Company Competitiveness Analysis: Bioengineered Skins and Dermal Substitutes Manufacturers in North America

- Figure 7.5 Company Competitiveness Analysis: Bioengineered Skins and Dermal Substitutes Manufacturers in Europe, Asia-Pacific and Rest of the World

- Figure 7.6 Company Competitiveness Analysis: Wound Healing Medical Devices Manufacturers in North America

- Figure 7.7 Company Competitiveness Analysis: Wound Healing Medical Devices Manufacturers in Europe, Asia-Pacific and Rest of the World

- Figure 8.1 3M: Annual Revenues, FY 2018 Onwards (USD Billion)

- Figure 8.2 Coloplast: Annual Revenues, FY 2018 Onwards (DKK Billion)

- Figure 8.3 Johnson & Johnson: Annual Revenues, FY 2018 Onwards (USD Billion)

- Figure 8.4 Fidia Faramaceutici: Annual Revenues, FY 2018 Onwards (EUR Million)

- Figure 8.5 Molnlycke Healthcare: Annual Revenues, FY 2018 Onwards (EUR Billion)

- Figure 8.6 Smith+Nephew: Annual Revenues, FY 2018 Onwards (USD Billion)

- Figure 8.7 Zimmer Biomet: Annual Revenues, FY 2018 Onwards (USD Billion)

- Figure 9.1 Clinical Trial Analysis: Cumulative Year-wise Trend

- Figure 9.2 Clinical Trial Analysis: Distribution of Trial Registration Year and Enrolled Patient Population

- Figure 9.3 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 9.4 Clinical Trial Analysis: Distribution by Trial Phase and Enrolled Patient Population

- Figure 9.5 Clinical Trial Analysis: Distribution by Trial Status

- Figure 9.6 Clinical Trial Analysis: Distribution by Trial Status and Enrolled Patient Population

- Figure 9.7 Clinical Trial Analysis: Distribution by Type of Wound Treated

- Figure 9.8 Clinical Trial Analysis: Distribution by Type of Wound Care Product

- Figure 9.9 Clinical Trial Analysis: Distribution by Trial Purpose

- Figure 9.10 Clinical Trial Analysis: Distribution by Age Group of Enrolled Patients

- Figure 9.11 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Figure 9.12 Most Active Players: Distribution by Number of Clinical Trials

- Figure 9.13 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Figure 9.14 Clinical Trial Analysis: Distribution by Trial Registration Year and Geography

- Figure 9.15 Clinical Trial Analysis: Distribution of Patients Enrolled by Geography

- Figure 10.1 Partnerships and Collaborations: Cumulative Year-Wise Trend

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 10.4 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Figure 10.5 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 10.6 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Figure 10.7 Most Active Players: Distribution by Number of Partnerships

- Figure 10.8 Partnerships and Collaboration: Local and International Agreements

- Figure 10.9 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 11.1 Advanced Wound Care: Market Drivers

- Figure 11.2 Advanced Wound Care: Market Restraints

- Figure 11.3 Advanced Wound Care: Market Opportunities

- Figure 11.4 Advanced Wound Care: Market Challenges

- Figure 12.1 Global Advanced Wound Care Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 12.2 Global Advanced Wound Care Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 12.3 Global Advanced Wound Care Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 13.1 Advanced Wound Care Market: Distribution by Type of Advanced Wound Care Product

- Figure 13.2 Advanced Wound Care Market for Wound Care Dressings, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 13.3 Advanced Wound Care Market for Bioengineered Skins and Dermal Substitutes, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 13.4 Advanced Wound Care Market for Wound Healing Medical Devices, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.1 Advanced Wound Care Market: Distribution by Type of Wound Care Dressing

- Figure 14.2 Advanced Wound Care Market for Foam Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.3 Advanced Wound Care Market for Antimicrobial Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.4 Advanced Wound Care Market for Alginate Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.5 Advanced Wound Care Market for Hydrogel Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.6 Advanced Wound Care Market for Hydrocolloid Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.7 Advanced Wound Care Market for Composite Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.8 Advanced Wound Care Market for Other Types of Wound Care Dressings, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.1 Advanced Wound Care Market: Distribution by Type of Bioengineered Skins and Dermal Substitute

- Figure 15.2 Advanced Wound Care Market for Allografts, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.3 Advanced Wound Care Market for Autografts, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.4 Advanced Wound Care Market for Extracellular Matrices, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.5 Advanced Wound Care Market for Growth Factors, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.6 Advanced Wound Care Market for Other Dermal Substitutes, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.1 Advanced Wound Care Market: Distribution by Type of Wound Healing Medical Device

- Figure 16.2 Advanced Wound Care Market for Negative Pressure Wound Therapy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.3 Advanced Wound Care Market for Topical Oxygen Therapy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.4 Advanced Wound Care Market for Hyperbaric Oxygen Therapy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.5 Advanced Wound Care Market for Hydrotherapy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.6 Advanced Wound Care Market for Electric Stimulation Therapy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.7 Advanced Wound Care Market for Skin Closure Systems / Adhesives, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.8 Advanced Wound Care Market for Other Types of Wound Healing Medical Devices, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.1 Advanced Wound Care Market: Distribution by Type of Wound Treated

- Figure 17.2 Advanced Wound Care Market for Acute Wounds, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.3 Advanced Wound Care Market for Chronic Wounds, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.1 Advanced Wound Care Market: Distribution by Type of Acute Wound Treated

- Figure 18.2 Advanced Wound Care Market for Surgical Wounds, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Advanced Wound Care Market for Burns, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.4 Advanced Wound Care Market for Other Types of Acute Wounds, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Advanced Wound Care Market: Distribution by Type of Chronic Wound Treated

- Figure 19.2 Advanced Wound Care Market for Diabetic Ulcers, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Advanced Wound Care Market for Venous Ulcers, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Advanced Wound Care Market for Pressure Ulcers, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Advanced Wound Care Market for Other Types of Chronic Wounds, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Advanced Wound Care Market: Distribution by Type of End User

- Figure 20.2 Advanced Wound Care Market for Hospital Care, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Advanced Wound Care Market for Home Care / Door to Door Services, Forecasted

- Figure 21.1 Advanced Wound Care Market: Distribution by Key Geographical Region

- Figure 21.2 Advanced Wound Care Market in North America, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Advanced Wound Care Market in the US, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.4 Advanced Wound Care Market in Canada, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.5 Advanced Wound Care Market in Europe, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.6 Advanced Wound Care Market in Germany, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.7 Advanced Wound Care Market in France, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.8 Advanced Wound Care Market in the UK, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.9 Advanced Wound Care Market in Spain, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.10 Advanced Wound Care Market in Italy, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.11 Advanced Wound Care Market in Asia-Pacific and Rest of the World, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.12 Advanced Wound Care Market in China, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.13 Advanced Wound Care Market in Japan, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.14 Advanced Wound Care Market in Brazil, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.15 Advanced Wound Care Market in Australia, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.16 Advanced Wound Care Market in South Korea, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.17 Advanced Wound Care Market in Israel, Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.1 Conclusion: Advanced Wound Care Market Landscape

- Figure 22.2 Conclusion: Clinical Trial Analysis

- Figure 22.3 Conclusion: Partnerships and Collaborations

- Figure 22.4 Conclusion: Market Sizing and Opportunity Analysis (I/II)

- Figure 22.5 Conclusion: Market Sizing and Opportunity Analysis (II/II)