PUBLISHER: Roots Analysis | PRODUCT CODE: 1821508

PUBLISHER: Roots Analysis | PRODUCT CODE: 1821508

Biologics Contract Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Service(s) Offered, Biologic Manufactured, Expression System Used, Scale of Operation, Company Size, and Key Geographical Regions

Biologics Contract Manufacturing Market: Overview

As per Roots Analysis, the global biologics contract manufacturing market is estimated to grow from USD 23.8 billion in the current year to USD 55.0 billion by 2035, at a CAGR of 8.8% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Service Offered

- API Manufacturing

- FDF Manufacturing

Type of Biologic Manufactured

- Antibodies

- Cell Therapies

- Vaccines

- Other Biologics

Type of Expression System Used

- Mammalian

- Microbial

- Others

Scale of Operation

- Preclinical / Clincal

- Commercial

Company Size

- Small

- Mid-sized

- Large and Very Large

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Biologics Contract Manufacturing Market: Growth and Trends

The biologics contract manufacturing sector has seen significant growth in recent years due to the several benefits offered by biological products, such as specificity, efficacy and safety. It is worth mentioning that the biopharmaceutical industry has witnessed a shift from small-molecule drugs to complex biologics like monoclonal antibodies, vaccines, cell and gene therapies, and biosimilars. In fact, the USFDA approved over 50 biological products (including monoclonal antibodies and recombinant proteins) in 2024. This growing pipeline of new therapies, coupled with the increasing number of biologics approvals, drives the demand for external manufacturing capacity.

Despite the success of biopharmaceutical products, producing biologics is technically challenging and requires significant capital investment in specialized facilities, equipment, and expertise, such as long development timelines, regulatory and compliance-related issues, and inconsistencies related to the quality attributes of the final product. As a result, an increasing number of biopharmaceutical drug developers are relying on contract manufacturers for comprehensive solutions, encompassing bioprocess development and optimization. With outsourcing becoming increasingly recognized as a practical and advantageous business model in this sector, substantial market growth for biologics contract manufacturing is expected throughout the forecast period.

Biologics Contract Manufacturing Market: Key Insights

The report delves into the current state of the biologics contract manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Currently, more than 305 contract manufacturing organizations (CMOs) are engaged in the production of biologics; over 90% of such players provide FDF manufacturing services.

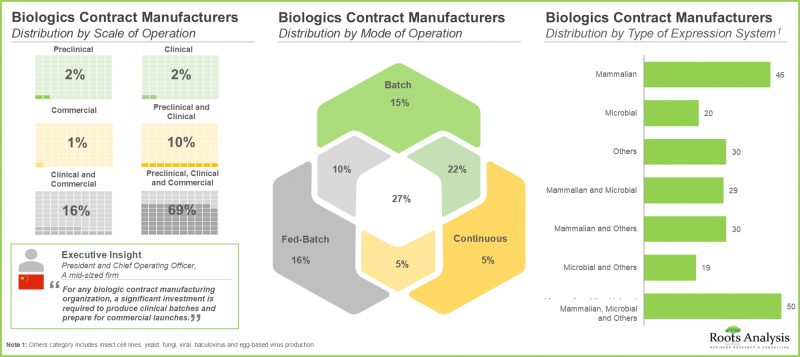

- Around 70% of the stakeholders operate at all scales of operation to cater to the diverse needs of customers; notably, mammalian cell-based expression systems have emerged as a popular choice among CMOs.

- The competition among service providers that claim to be focused on the niche and upcoming drug classes is fierce; it is primarily influenced by the success of several blockbuster therapies in the recent past.

- In the past decade, a shift in trend has been observed in the biopharmaceutical contract manufacturing industry as more players have set up their manufacturing facilities in developing regions across Asia-Pacific.

- Over the last five years, more than 695 deals have been inked by biologics CMOs; most of the collaborations were inked for the manufacturing of vaccines, antibodies and cell therapies.

- In order to maintain a competitive edge and establish themselves as one-stop-shops, players are expanding their existing capabilities and service portfolios; the domain has witnessed over 135 mergers and acquisitions.

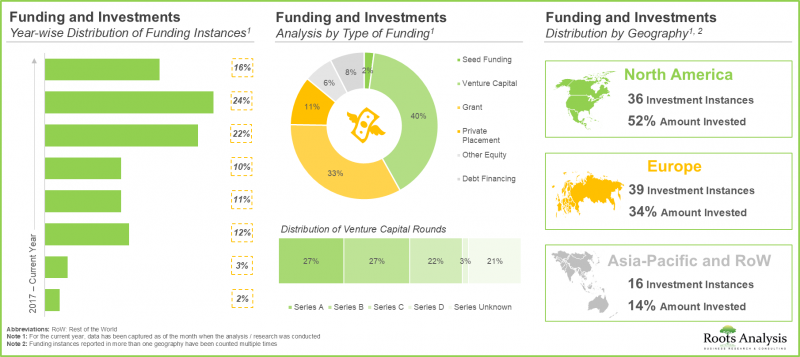

- Considering the enormous opportunities associated with biologics contract manufacturing, investors have actively extended funds, amounting to USD 7.5 billion, across more than 90 funding instances in the past eight years.

- Driven by the growing demand, CMOs have made elaborate investments to expand their existing capacities and capabilities, primarily for niche biologics; this trend is most pronounced in the US and China.

- More than 215 initiatives were undertaken by big pharma players; more than 80% of such initiatives were focused on partnerships and expansions.

- Though the existing installed capacity is sufficient to meet the current annual demand for biologics, we anticipate that CMOs are likely to invest in installing incremental capacity to meet the long-term demand.

- The global installed biopharmaceutical contract manufacturing capacity is spread across various geographies; notably, large players account for 80% of the total capacity.

- With the growing pipeline of biologics and the increased preference for outsourcing, the biopharmaceutical contract manufacturing services market is anticipated to witness steady growth in the foreseen future.

- As more developers outsource various aspects of their respective manufacturing operations, we expect the biologics CMOs market to grow at an annualized rate of 8.8% in the coming decade.

Biologics Contract Manufacturing Market: Key Segments

Contract Manufacturing Market for API is Likely to Dominate the Biologics Contract Manufacturing Market During the Forecast Period

Based on the type of service(s) offered, the market is segmented into API and FDF. It is worth highlighting that majority of the current biologics contract manufacturing market is captured by APIs. This can be attributed to the fact that manufacturing of biopharmaceuticals API demand significant capital investments, which include facility costs (development and maintenance), material costs, labor costs and a number of other ancillary expenses. Therefore, stakeholders rely on the expertise of CMOs for API production.

Cell Therapies is the Fastest Growing Segment of the Biologics Contract Manufacturing Market During the Forecast Period

Based on the type of biologic manufactured, the market is segmented into antibodies, cell therapies, vaccines and other biologics. It is worth highlighting the antibodies capture the maximum share within the biopharmaceutical contract manufacturing market. This can be attributed to the fact that more than 100 antibodies have been approved across the globe and an increasing number of clinical trials related to antibodies are also underway.

Mammalian Expression System is Expected to Capture the Highest Share of the Biologics Contract Manufacturing Market During the Forecast Period

Based on the type of expression system used, the market is segmented into mammalian, microbial and others. It is worth highlighting that currently, the market is likely to be driven by revenues generated through biopharmaceutical projects employing mammalian expression systems. This can be attributed to the higher usage of such systems owing to their high protein yielding ability, enhanced folding and post-translational modifications, and improved batch-to-batch uniformity.

By Scale of Operation, Commercial Scale is Likely to Dominate the Biologics Contract Manufacturing Market During the Forecast Period

Based on the scale of operation, the market is segmented into preclinical / clinical and commercial scale. The commercial scale manufacturing segment is projected to be the primary driver of the overall market. Further, it is worth highlighting that the biologics manufacturing market at preclinical / clinical scale is likely to grow at a relatively higher CAGR.

Large and Very Large Companies Hold Maximum Share within the Biologics Manufacturing Market

Based on company size, the market is segmented into small companies, mid-sized, and large and very large companies. While large and very large companies account for a relatively higher market share, it is worth highlighting that the biologics contract manufacturing market for small companies is likely to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. It is worth highlighting that over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Biologics Contract Manufacturing Market

- AGC Biologics

- Boehringer Ingelheim

- Catalent

- Cell Therapies

- Charles River Laboratories

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Kemwell Biopharma

- Lonza

- Miltenyi Biotec

- Minaris Regenerative Medicine

- Samsung Biologics

- Sandoz

- Vetter Pharma

- Wuxi Biologics

Primary Research Overview

- The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Chief Executive Officer, Company A

- Chief Executive Officer and Co-Founder, Company B

- Chief Technical Officer, Cell and Gene Therapy, Company C

- President, Company D

- Senior Director, Global Strategic Marketing, Company E

- Senior Director of Commercial Strategy and Market Insights, Company F

- Global Head of Sales and Marketing and Head of Business Development (Germany), Company G

- Business Development Manager, Company H

- Manager Marketing and Sales, Company I

Biologics Contract Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features a thorough analysis of the global biologics contract manufacturing market, in terms of the key market segments, including [A] type of service(s) offered, [B] type of biologic manufactured, [C] type of expression system used, [D] scale of operation, [E] company size and [F] key geographical regions.

- Market Landscape: An in-depth assessment of the companies involved in biologics contract manufacturing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of service offered, [E] type of biologic manufactured, [F] scale of operation, [G] type of expression systems used, [H] type of bioreactor used and [I] mode of operation of bioreactor.

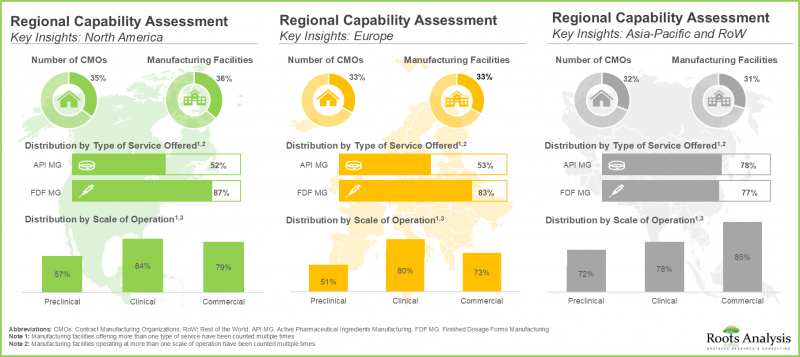

- Regional Capability Analysis: A comprehensive analysis of biopharmaceutical manufacturing facilities established across the key geographical regions, such as [A] North America [B] Europe [C] Asia-Pacific, and [D] rest of the world.

- Company Profiles: Detailed profiles of key service providers across North America, Europe and Asia-Pacific engaged in the biologics contract manufacturing market, focused on parameters such as [A] company overview, [B] financial information (if available), [C] service portfolio, [D] manufacturing facilities and [E] recent developments and an informed future outlook.

- Case Study - Niche Pharmaceutical Sectors: A comprehensive evaluation of the primary enablers within this industry, highlighting specific niche products such as [A] antibody-drug conjugates (ADCs), [B] bispecific antibodies, [C] cell therapies, [D] gene therapies, and [E] viral vectors.

- Case Study - In-house Manufacturing: A detailed review of various factors that need to be taken into consideration by biopharmaceutical developers while deciding whether to manufacture their respective products in-house or engage the services of a biologics CMO.

- Make Versus Buy Framework: An elaborate study of the various biopharmaceutical-focused manufacturing initiatives undertaken by top big pharma players, highlighting trends across various parameters, such as [A] number of initiatives, [B] year of initiative, [C] purpose of initiative, [D] type of initiative, [E] scale of operation and [F] type of biologic manufactured.

- Partnerships and Collaborations: An in-depth analysis of the recent collaborations within the biologics contract manufacturing market, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of biologic manufactured, [D] therapeutic area, [E] most active players and [F] regional distribution of partnership activity that have taken place in this industry.

- Mergers and Acquisitions: A detailed analysis of the various mergers and acquisitions that have taken place within this industry, based on several relevant parameters, [A] such as year of agreement, [B] type of deal, [C] geographical location of companies, [D] type of acquisition, [E] type of biologic manufactured and [F] key value drivers.

- Recent Expansions: A detailed analysis of expansion initiatives undertaken by biologics CMO, during the period along with information on several relevant parameters, such as [A] year of expansion, [B] purpose of expansion, [C] type of biologic manufactured and [D] location of expanded facility.

- Recent Developments: An analysis of the recent developments within the biologics contract manufacturing market, highlighting information on the [A] funding investments made and [B] information on the technology advancements related to biomanufacturing.

- Capacity Analysis: An estimate of the overall installed capacity for the manufacturing of biopharmaceuticals, highlighting the distribution of the available capacity, based on [A] size of manufacturer, [B]type of expression system used and [C] geography.

- Demand Analysis: An informed estimate of the annual demand for biologics, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- Total Cost of Ownership: A detailed analysis of the total cost of ownership for biologics CMO.

- SWOT Analysis: A discussion on affiliated trends, key drivers and challenges, under an elaborate SWOT analysis, which are likely to impact the industry's evolution.

- Case Study - Virtual Pharmaceutical Companies: A case study on the virtual business model concept, along with its role in the overall biopharmaceutical industry.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

1.1. Biopharmaceutical Contract Manufacturing Market Overview

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Biopharmaceuticals

- 5.3. Expression Systems for Biopharmaceuticals

- 5.3.1. Insect Expression Systems

- 5.3.2. Mammalian Expression Systems

- 5.3.3. Microbial Expression Systems

- 5.3.3.1. Bacterial Expression Systems

- 5.3.3.2. Fungal Expression Systems

- 5.3.3.3. Yeast Expression Systems

- 5.3.4. Plant Expression Systems

- 5.3.5. Mammalian versus Microbial Expression Systems

- 5.4. Manufacturing Process of Biopharmaceuticals

- 5.4.1. Upstream Processing

- 5.4.2. Fermentation

- 5.4.3. Downstream Processing

- 5.5. Overview of Contract Manufacturing

- 5.6. Need for Outsourcing Biopharmaceutical Manufacturing Operations

- 5.6.1. Commonly Outsourced Manufacturing Operations for Biopharmaceuticals

- 5.6.2. Advantages of Outsourcing Biopharmaceutical Manufacturing Operations

- 5.6.3. Risks and Challenges Associated with Outsourcing Biopharmaceutical Manufacturing Operations

- 5.7. Key Considerations While Selecting a Contract Manufacturing Partner

- 5.8. Future Perspectives

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Biopharmaceutical Contract Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Type of Service Offered

- 6.2.5. Analysis by Type of Biologic Manufactured

- 6.2.6. Analysis by Scale of Operation

- 6.2.7. Analysis by Type of Expression System Used

- 6.2.8. Analysis by Type of Bioreactor Used

- 6.2.9. Analysis by Mode of Operation of Bioreactor

7. REGIONAL CAPABILITY ANALYSIS

- 7.1. Chapter Overview

- 7.2. Key Assumptions and Parameter

- 7.3. Overview of Biopharmaceutical Contract Manufacturing Facilities

- 7.3.1. Analysis by Type of Service Offered

- 7.3.2. Analysis by Scale of Operation

- 7.4. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in North America

- 7.5. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in Europe

- 7.6. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in Asia-Pacific

- 7.7. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in Rest of the World

8. BIOPHARMACEUTICAL CONTRACT MANUFACTURING IN NORTH AMERICA

- 8.1. Chapter Overview

- 8.2. Biopharmaceutical Contract Manufacturing in the US: Regulatory Scenario

- 8.3. Leading Biopharmaceutical CMOs in North America

- 8.3.1. AGC Biologics

- 8.3.1.1. Company Overview

- 8.3.1.2. Service Portfolio

- 8.3.1.2.1. Process Development

- 8.3.1.2.2. cGMP Manufacturing

- 8.3.1.2.3. Quality and Regulatory Services

- 8.3.1.2.4. Process Validation

- 8.3.1.3. Financial Information

- 8.3.1.4. Manufacturing Facilities

- 8.3.1.5. Recent Developments and Future Outlook

- 8.3.2. Catalent

- 8.3.2.1. Company Overview

- 8.3.2.2. Service Portfolio

- 8.3.2.2.1. Cell Line Development

- 8.3.2.2.2. Biomanufacturing

- 8.3.2.2.3. ADCs and Bioconjugates Manufacturing

- 8.3.2.2.4. Biosimilars Development and Manufacturing

- 8.3.2.2.5. Fill / Finish Solutions and Delivery Services

- 8.3.2.2.6. Analytical Services

- 8.3.2.3. Clinical Supply Services

- 8.3.2.4. Financial Information

- 8.3.2.5. Manufacturing Facilities

- 8.3.2.6. Recent Developments and Future Outlook

- 8.3.3. FUJIFILM Diosynth Biotechnologies

- 8.3.3.1. Company Overview

- 8.3.3.2. Service Portfolio

- 8.3.3.2.1. Strain Development

- 8.3.3.2.2. Process Development

- 8.3.3.2.3. cGMP Manufacturing

- 8.3.3.2.4. Analytical Solutions

- 8.3.3.3. Financial Information

- 8.3.3.4. Manufacturing Facilities

- 8.3.3.5. Recent Developments and Future Outlook

- 8.3.4. KBI Biopharma

- 8.3.4.1. Company Overview

- 8.3.4.2. Service Portfolio

- 8.3.4.2.1. Process Development

- 8.3.4.2.2. Analytical Development

- 8.3.4.2.3. GMP Manufacturing

- 8.3.4.2.4. Clinical Cell Therapy Support

- 8.3.4.3. Manufacturing Facilities

- 8.3.4.4. Recent Developments and Future Outlook

- 8.3.5. Charles River Laboratories

- 8.3.5.1. Company Overview

- 8.3.5.2. Service Portfolio

- 8.3.5.2.1. Cell Sourcing

- 8.3.5.2.2. Cell and Gene Therapy Solutions

- 8.3.5.2.3. Biologics Testing Solutions

- 8.3.5.2.4. Avian Vaccine Services

- 8.3.5.2.5. QC Microbial Solutions

- 8.3.5.2.6. Scientific and Regulatory Advisory Services

- 8.3.5.3. Financial Information

- 8.3.5.4. Manufacturing Facilities

- 8.3.5.5. Recent Developments and Future Outlook

- 8.3.1. AGC Biologics

- 8.4. Other Leading Biopharmaceutical CMOs in North America

- 8.4.1. Cytiva

- 8.4.1.1. Company Overview

- 8.4.2. Patheon

- 8.4.2.1. Company Overview

- 8.4.3. Piramal Pharma Solutions

- 8.4.3.1. Company Overview

- 8.4.1. Cytiva

9. BIOPHARMACEUTICAL CONTRACT MANUFACTURING IN EUROPE

- 9.1. Chapter Overview

- 9.2. Biopharmaceutical Contract Manufacturing in Europe: Regulatory Scenario

- 9.2.1. EMA's cGMP Regulations

- 9.3. Leading Biopharmaceutical CMOs in Europe

- 9.3.1. Boehringer Ingelheim (BioXcellence)

- 9.3.1.1. Company Overview

- 9.3.1.2. Service Portfolio

- 9.3.1.2.1. Process Development

- 9.3.1.2.1.1. Expression Systems

- 9.3.1.2.1.2. Upstream Technology

- 9.3.1.2.1.3. Downstream Technology

- 9.3.1.2.1.4. Other Process Development Services

- 9.3.1.2.2. Quality Assurance

- 9.3.1.2.3. Fill / Finish Services

- 9.3.1.2.1. Process Development

- 9.3.1.3. Financial Information

- 9.3.1.4. Manufacturing Facilities

- 9.3.1.5. Recent Developments and Future Outlook

- 9.3.2. Lonza

- 9.3.2.1. Company Overview

- 9.3.2.2. Service Portfolio

- 9.3.2.3. Manufacturing Services

- 9.3.2.4. Financial Information

- 9.3.2.5. Manufacturing Facilities

- 9.3.2.6. Recent Developments and Future Outlook

- 9.3.3. Sandoz

- 9.3.3.1. Company Overview

- 9.3.3.2. Service Portfolio

- 9.3.3.3. Financial Information

- 9.3.3.4. Manufacturing Facilities

- 9.3.3.5. Recent Developments and Future Outlook

- 9.3.4. Vetter Pharma

- 9.3.4.1. Company Overview

- 9.3.4.2. Service Portfolio

- 9.3.4.3. Manufacturing Facilities

- 9.3.4.4. Recent Developments and Future Outlook

- 9.3.5. Miltenyi Biotec

- 9.3.5.1. Company Overview

- 9.3.5.2. Service Portfolio

- 9.3.5.3. Manufacturing Facilities

- 9.3.5.4. Recent Developments and Future Outlook

- 9.3.1. Boehringer Ingelheim (BioXcellence)

- 9.4. Other Leading Biopharmaceutical CMOs in Europe

- 9.4.1. Novasep

- 9.4.1.1. Company Overview

- 9.4.2. Olon

- 9.4.2.1. Company Overview

- 9.4.3. Rentschler Biopharma

- 9.4.3.1. Company Overview

- 9.4.1. Novasep

10. BIOPHARMACEUTICAL CONTRACT MANUFACTURING IN ASIA-PACIFIC AND REST OF THE WORLD

- 10.1. Chapter Overview

- 10.2. Biopharmaceutical Contract Manufacturing in China

- 10.2.1. Biopharmaceutical Contract Manufacturing in China: Regulatory Scenario

- 10.3. Leading Biopharmaceutical CMOs in China

- 10.3.1. WuXi Biologics

- 10.3.1.1. Company Overview

- 10.3.1.2. Service Portfolio

- 10.3.1.2.1. Discovery Services

- 10.3.1.2.2. Development Services

- 10.3.1.2.3. Testing Services

- 10.3.1.2.4. Clinical Manufacturing Services

- 10.3.1.3. Financial Information

- 10.3.1.4. Manufacturing Facilities

- 10.3.1.5. Recent Developments and Future Outlook

- 10.3.1. WuXi Biologics

- 10.4. Biopharmaceutical Contract Manufacturing in India

- 10.4.1. Biopharmaceutical Contract Manufacturing in India: Regulatory Scenario

- 10.5. Leading Biopharmaceutical CMOs in India

- 10.5.1. Kemwell Biopharma

- 10.5.1.1. Company Overview

- 10.5.1.2. Service Portfolio

- 10.5.1.2.1. Development Services for Biopharmaceuticals

- 10.5.1.2.2. Manufacturing Services for Biopharmaceuticals

- 10.5.1.3. Manufacturing Facilities

- 10.5.1.4. Recent Developments and Future Outlook

- 10.5.1. Kemwell Biopharma

- 10.6. Biopharmaceutical Contract Manufacturing in Japan

- 10.6.1. Biopharmaceutical Contract Manufacturing in Japan: Regulatory Scenario

- 10.7. Leading Biopharmaceutical CMOs in Japan

- 10.7.1. Minaris Regenerative Medicine

- 10.7.1.1. Company Overview

- 10.7.1.2. Service Portfolio

- 10.7.1.2.1. Manufacturing Development Services

- 10.7.1.2.2. GMP Manufacturing

- 10.7.1.3. Manufacturing Facilities

- 10.7.1.4. Recent Developments and Future Outlook

- 10.7.1. Minaris Regenerative Medicine

- 10.8. Biopharmaceutical Contract Manufacturing in South Korea

- 10.8.1. Biopharmaceutical Contract Manufacturing in South Korea: Regulatory Scenario

- 10.9. Leading Biopharmaceutical CMOs in South Korea

- 10.9.1. Samsung Biologics

- 10.9.1.1. Company Overview

- 10.9.1.2. Service Portfolio

- 10.9.1.2.1. Process Development

- 10.9.1.2.2. Analytical Services

- 10.9.1.2.3. cGMP Manufacturing Services

- 10.9.1.2.4. Aseptic Fill / Finish Services

- 10.9.1.2.5. Quality Services

- 10.9.1.3. Financial Information

- 10.9.1.4. Manufacturing Facilities

- 10.9.1.5. Recent Developments and Future Outlook

- 10.9.1. Samsung Biologics

- 10.10. Biopharmaceutical Contract Manufacturing in Australia

- 10.10.1. Biopharmaceutical Contract Manufacturing in Australia: Regulatory Scenario

- 10.11. Leading Biopharmaceutical CMOs in Australia

- 10.11.1. Cell Therapies

- 10.11.1.1. Company Overview

- 10.11.1.2. Service Portfolio

- 10.11.1.3. Manufacturing Facilities

- 10.11.1.4. Recent Developments and Future Outlook

- 10.11.1. Cell Therapies

- 10.12. Other Leading Biopharmaceutical CMOs in Asia-Pacific and Rest of the World

- 10.12.1. AcuraBio (Formerly Known as Luina Bio)

- 10.12.1.1. Company Overview

- 10.12.2. Celltrion

- 10.12.2.1. Company Overview

- 10.12.3. Takara Bio

- 10.12.3.1. Company Overview

- 10.12.1. AcuraBio (Formerly Known as Luina Bio)

11. NICHE BIOPHARMACEUTICAL SECTORS

- 11.1. Chapter Overview

- 11.2. Bispecific Antibodies

- 11.2.1. Approved and Clinical Bispecific Antibody Therapeutics: Overall Market Landscape

- 11.2.2. Bispecific Antibodies: Pipeline Analysis

- 11.2.2.1. Analysis by Phase of Development

- 11.2.2.2. Analysis by Target Indication

- 11.2.3. Bispecific Antibody Therapeutics: Technology Platforms

- 11.2.4. Key Considerations for Manufacturing and Associated Challenges

- 11.2.5. Role of CMOs in Offering Services for Bispecific Antibodies

- 11.2.5.1. CMOs Offering Services for Bispecific Antibodies

- 11.3. Antibody Drug Conjugates (ADCs)

- 11.3.1. Components of ADCs

- 11.3.1.1. Antibody

- 11.3.1.2. Cytotoxin

- 11.3.1.3. Linker

- 11.3.2. Antibody Drug Conjugates (ADCs): Pipeline Analysis

- 11.3.2.1. Analysis by Status of Development

- 11.3.2.2. Analysis by Target Disease Indication

- 11.3.2.3. Most Active Players: Analysis by Number of Therapies

- 11.3.3. Antibody Drug Conjugate Developers

- 11.3.4. Manufacturing Process

- 11.3.1. Components of ADCs

- 11.4. Cell Therapies

- 11.4.1. Cell Therapies: Overall Market Landscape

- 11.4.2. Overview of Cell Therapy Manufacturing

- 11.4.2.1. Cell Therapy Manufacturing Models

- 11.4.2.1.1. Centralized Manufacturing

- 11.4.2.1.2. Decentralized Manufacturing

- 11.4.2.1. Cell Therapy Manufacturing Models

- 11.4.3. Key Challenges for Manufacturing Cell Therapies

- 11.4.4. Key Factors Impacting Cell Therapy Manufacturing

- 11.4.4.1. Characterization

- 11.4.4.2. Cost of Goods

- 11.4.4.3. Automation of Cell Therapy Manufacturing

- 11.4.5. Cell Therapies: Pipeline Analysis

- 11.4.5.1. Analysis by Type of Cell Manufactured

- 11.4.6. Stem Cell Therapies: Analysis by Phase of Development

- 11.4.7. T-Cell Therapies: Analysis by Phase of Development

- 11.4.8. Role of CMOs in Offering Services for Cell Therapies

- 11.4.8.1. CMOs Offering Services for Cell Therapies

- 11.5. Gene Therapies

- 11.5.1. Gene Therapies: Pipeline Analysis

- 11.5.1.1. Analysis by Stage of Development

- 11.5.1.2. Analysis by Phase of Development

- 11.5.1.3. Analysis by Type of Vector Used

- 11.5.1.3.1. Clinical Pipeline

- 11.5.1.3.2. Preclinical Pipeline

- 11.5.1.4. Analysis by Therapeutic Area

- 11.5.1.4.1. Clinical and Commercial Pipeline

- 11.5.1.4.2. Preclinical Pipeline

- 11.5.2. Role of CMOs in Offering Services for Gene Therapies

- 11.5.2.1. CMOs Offering Services for Gene Therapies

- 11.5.1. Gene Therapies: Pipeline Analysis

- 11.6. Viral Vectors

- 11.6.1. Viral Vectors: Pipeline Analysis

- 11.6.1.1. Analysis by Location of Viral Vectors Manufacturing Facilities

- 11.6.1.2. Analysis by Type of Viral Vector Manufactured

- 11.6.2. Role of CMOs in Offering Services for Viral Vectors

- 11.6.2.1. CMOs Offering Services for Viral Vectors

- 11.6.1. Viral Vectors: Pipeline Analysis

- 11.7. Plasmid DNA

- 11.7.1. Plasmid DNA: Pipeline Analysis

- 11.7.1.1. Analysis by Location of Manufacturing Facilities

- 11.7.2. Role of CMOs in Offering Services for Plasmid DNA

- 11.7.2.1. CMOs Offering Services for Plasmid DNA

- 11.7.1. Plasmid DNA: Pipeline Analysis

12. CASE STUDY: OUTSOURCING OF BIOSIMILARS

- 12.1. Chapter Overview

- 12.2. Overview of Biosimilars

- 12.3. Development Stages of Biosimilars

- 12.4. Regulatory Requirements for Licensing of Biosimilars

- 12.5. Need for Outsourcing Manufacturing Operations

- 12.6. Impact of Biosimilars on the Global Contract Manufacturing Market

- 12.6.1. Biosimilars: Historical Trend of FDA Approvals

- 12.7. Biosimilars Contract Manufacturing Service Providers

- 12.8. Challenges Associated with Outsourcing of Biosimilar Manufacturing Operations

13. CASE STUDY: COMPARISON OF SMALL AND LARGE MOLECULE DRUGS / THERAPIES

- 13.1. Chapter Overview

- 13.2. Small Molecule and Large Molecule Drugs / Therapies

- 13.2.1. Comparison of General Characteristics

- 13.2.2. Comparison of Key Specifications

- 13.2.3. Comparison of Manufacturing Process

- 13.2.4. Comparison of Key Manufacturing Challenges

14. CASE STUDY: IN-HOUSE MANUFACTURING

- 14.1. Chapter Overview

- 14.2. In-House Manufacturing

- 14.2.1. Benefits Associated with In-House Manufacturing

- 14.2.2. Risks Associated with In-House Manufacturing

- 14.3. Outsourcing Trends in the Biopharmaceutical Industry

- 14.3.1. Types of Outsourcing Partners

- 14.4. Manufacturing Approaches Used for Approved Biologics

- 14.5. Choosing the Right Strategy: In-House Manufacturing versus Outsourcing

15. MAKE VERSUS BUY DECISION MAKING FRAMEWORK

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Parameters

- 15.3. Biopharmaceutical Contract Manufacturers: Make versus Buy Decision Making

- 15.3.1. Scenario 1

- 15.3.2. Scenario 2

- 15.3.3. Scenario 3

- 15.3.4. Scenario 4

- 15.4. Conclusion

16. BIG PHARMA INITIATIVES

- 16.1. Chapter Overview

- 16.2. Biopharmaceutical Related Initiatives by Big Pharmaceutical Players

- 16.2.1. Analysis by Number of Initiatives

- 16.2.2. Analysis by Year of Initiative

- 16.2.3. Analysis by Purpose of Initiative

- 16.2.4. Analysis by Type of Initiative

- 16.2.4.1. Analysis by Type of Partnership

- 16.2.4.2. Analysis by Type of Expansion

- 16.2.5. Analysis by Scale of Operation

- 16.2.6. Analysis by Type of Biologic Manufactured

- 16.2.7. Analysis of Big Pharma Players by Year of Initiative

- 16.2.8. Analysis of Big Pharma Players by Purpose of Initiative

- 16.2.9. Analysis by Year and Type of Initiative

- 16.2.10. Analysis of Big Pharma Players by Region of Expansion

- 16.2.11. Analysis of Big Pharma Players by Type of Biologic Manufactured

17. PARTNERSHIPS AND COLLABORATIONS

- 17.1. Chapter Overview

- 17.2. Partnership Models

- 17.3. Biopharmaceutical Contract Manufacturing: Partnerships and Collaborations

- 17.3.1. Analysis by Year of Partnership

- 17.3.2. Analysis by Type of Partnership

- 17.3.3. Analysis by Year and Type of Partnership

- 17.3.4. Analysis by Type of Biologic Manufactured

- 17.3.5. Analysis by Year of Partnership and Type of Biologic Manufactured

- 17.3.6. Analysis by Type of Partnership and Type of Biologic Manufactured

- 17.3.7. Analysis by Scale of Operation

- 17.3.8. Analysis by Therapeutic Area

- 17.3.9. Most Active Players: Analysis by Number of Partnerships

- 17.3.10. Analysis by Geography

- 17.3.10.1. Local and International Agreements

- 17.3.10.2. Intracontinental and Intercontinental Agreements

18. MERGERS AND ACQUISITIONS

- 18.1. Chapter Overview

- 18.2. Merger and Acquisition Models

- 18.3. Biopharmaceutical Contract Manufacturing: Mergers and Acquisitions

- 18.3.1. Cumulative Year-wise Trend of Mergers and Acquisitions

- 18.3.2. Analysis by Type of Acquisition

- 18.3.3. Analysis by Geography

- 18.3.3.1. Local and International Mergers and Acquisitions

- 18.3.3.2. Intracontinental and Intercontinental Mergers and Acquisitions

- 18.3.3.3. Year-wise Trend in North America, Europe and Asia-Pacific

- 18.3.4. Most Active Acquirers: Analysis by Number of Acquisitions

- 18.3.5. Analysis by Key Value Drivers

- 18.3.6. Analysis by Year of Acquisition and Key Value Drivers

- 18.3.7. Analysis by Type of Biologic Manufactured

- 18.3.8. Analysis by Key Value Drivers and Type of Biologic Manufactured

- 18.4. Key Acquisitions: Deal Multiples

- 18.4.1. Year-wise Trend of Deal Multiple Amount

19. RECENT EXPANSIONS

- 19.1. Chapter Overview

- 19.2. Biopharmaceutical Contract Manufacturing: Recent Expansions

- 19.2.1. Analysis by Year of Expansion

- 19.2.2. Analysis by Purpose of Expansion

- 19.2.3. Analysis by Year and Purpose of Expansion

- 19.2.4. Analysis by Type of Biologic Manufactured

- 19.2.5. Analysis by Purpose of Expansion and Type of Biologic Manufactured

- 19.2.6. Analysis by Location of Expanded Facility

- 19.2.7. Most Active Players: Analysis by Number of Recent Expansions

- 19.2.8. Analysis by Purpose of Expansion and Location of Expanded Facility

- 19.2.9. Analysis by Amount Invested

- 19.2.10. Recent Expansions: Scenarios

20. RECENT DEVELOPMENTS

- 20.1. Chapter Overview

- 20.2. Types of Funding

- 20.3. Biopharmaceutical Contract Manufacturing: Funding and Investment Analysis

- 20.3.1. Analysis by Year of Funding

- 20.3.2. Analysis by Amount Invested

- 20.3.3. Analysis by Type of Funding

- 20.3.4. Analysis by Year and Type of Funding

- 20.3.5. Analysis of Funding Instances and Amount Invested by Geography (Continent)

- 20.3.6. Analysis of Funding Instances and Amount Invested by Geography (Country)

- 20.3.7. Most Active Players: Analysis by Number of Funding Instances

- 20.3.8. Most Active Players: Analysis by Total Amount Raised

- 20.3.9. Leading Investors: Analysis by Number of Funding Instances

- 20.3.10. Leading Investors: Analysis by Total Amount Raised

- 20.4. Technological Advancements

- 20.4.1. Single-Use Technology

- 20.4.2. Process Analytical Technology (PAT)

- 20.4.3. Continuous Processing

- 20.4.4. Quality by Design (QbD) in Bio-processing

- 20.4.5. Modular / Podular Biopharma Facilities

21. CAPACITY ANALYSIS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Biopharmaceutical Contract Manufacturing: Global Installed Capacity

- 21.3.1. Analysis by Company Size

- 21.3.2. Analysis by Type of Expression System Used

- 21.3.3. Analysis by Geography

- 21.3.3.1. Analysis of Biopharmaceutical Contract Manufacturing Capacity in North America

- 21.3.3.2. Analysis of Biopharmaceutical Contract Manufacturing Capacity in Europe

- 21.3.3.3. Analysis of Biopharmaceutical Contract Manufacturing Capacity in Asia-Pacific

- 21.3.3.4. Analysis of Biopharmaceutical Contract Manufacturing Capacity in Rest of the World

- 21.4. Concluding Remarks

22. DEMAND ANALYSIS

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Global Demand for Biopharmaceuticals

- 22.4. Global Demand for Emerging Novel Biologics

- 22.4.1. Global Demand for ADC Therapeutics

- 22.4.2. Global Demand for Cell Therapy Manufacturing

23. TOTAL COST OF OWNERSHIP FOR BIOPHARMACEUTICAL CONTRACT MANUFACTURING ORGANIZATIONS

- 23.1. Chapter Overview

- 23.2. Key Parameters

- 23.3. Assumptions and Methodology

- 23.4. Total Cost of Ownership (Sample Dataset)

- 23.5. Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, Y0-Y20

- 23.5.1. Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations: Analysis by CAPEX, Y0

- 23.5.2. Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations: Analysis by OPEX, Y1-Y20

- 23.6. Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations, Y0-Y20

- 23.6.1. Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations: Analysis by CAPEX, Y0

- 23.6.2. Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations: Analysis by OPEX, Y1-Y20

24. GLOBAL BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Global Biopharmaceutical Contract Manufacturing Market, Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 24.3.1. Scenario Analysis

- 24.3.1.1. Conservative Scenario

- 24.3.1.2. Optimistic Scenario

- 24.3.1. Scenario Analysis

- 24.4. Key Market Segmentations

25. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE OF SERVICE OFFERED

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Service Offered, 2018, Current Year and 2035

- 25.3.1. API Manufacturing: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 25.3.2. FDF Manufacturing: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 25.4. Data Triangulation and Validation

26. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE OF BIOLOGIC MANUFACTURED

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Biologic Manufactured, 2018, Current Year and 2035

- 26.3.1. Antibodies: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 26.3.2. Cell Therapies: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 26.3.3. Vaccines: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 26.3.4. Other Biologics: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 26.4. Data Triangulation and Validation

27. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY TYPE OF EXPRESSION SYSTEM USED

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Expression System Used, 2018, Current Year and 2035

- 27.3.1. Mammalian Expression Systems: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 27.3.2. Microbial Expression Systems: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 27.3.3. Other Expression Systems: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 27.4. Data Triangulation and Validation

28. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Scale of Operation, 2018, Current Year and 2035

- 28.3.1. Preclinical / Clinical Operations: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 28.3.2. Commercial Operations: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COMPANY SIZE

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Company Size, 2018, Current Year and 2035

- 29.3.1. Small Companies: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 29.3.2. Mid-sized Companies: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 29.3.3. Large and Very Large Companies: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 29.4. Data Triangulation and Validation

30. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY GEOGRAPHY

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Geography, 2018, Current Year and 2035

- 30.3.1. North America: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.1.1. US: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.1.2. Canada: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2. Europe: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.1. Italy: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.2. Germany: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.3. France: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.4. Spain: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.5. UK: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.2.6. Rest of Europe: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3. Asia-Pacific: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3.1. China: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3.2. India: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3.3. South Korea: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3.4. Japan: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.3.5. Rest of Asia-Pacific: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.4. Latin America: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.5. Middle East and North Africa: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.3.1. North America: Historical Trends (Since 2018) and Forecasted Estimates (till 2035)

- 30.4. Data Triangulation and Validation

31. BIOPHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY LEADING PLAYERS

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Biopharmaceutical Contract Manufacturing Market: Distribution by Leading Players

- 31.4. Data Triangulation and Validation

32. CASE STUDY: VIRTUAL PHARMACEUTICAL COMPANIES

- 32.1. Chapter Overview

- 32.2. Historical Evolution of the Virtual Business Model

- 32.3. Virtual Pharmaceutical Companies as a Subset of the Overall Biopharmaceutical Industry

- 32.4. Advantages Associated with Outsourcing Operations to Virtual Service Providers

- 32.5. Key Challenges Associated with Outsourcing Operations to Virtual Service Providers

33. SWOT ANALYSIS

- 33.1. Chapter Overview

- 33.2. Strengths

- 33.3. Weaknesses

- 33.4. Opportunities

- 33.5. Threats

- 33.6. Comparison of SWOT Factors

- 33.7. Conclusion

34. FUTURE OF THE BIOPHARMACEUTICAL CMO MARKET

- 34.1. Chapter Overview

- 34.2. Outsourcing Activities to Witness Significant Growth in the Coming Years

- 34.3. Shift from One-time Contracts to Strategic Partnerships

- 34.4. Integration / Adoption of New and Innovative Technologies

- 34.4.1. Single-use Bioreactors

- 34.4.2. Novel Bioprocess Techniques

- 34.4.3. Bioprocess Automation

- 34.5. Focus on Niche Therapeutic Areas

- 34.6. Growing Biosimilars Market to Contribute to the Growth of the Contract Services Segment

- 34.7. Capability Expansion by CMOs to become One-Stop-Shops

- 34.8. Offshoring Outsourcing Activities to Maximize Profits and Expand Existing Capacities

- 34.9. Increase in Financial Inflow and Outsourcing Budgets

- 34.10. Challenges Faced by Sponsors and Service Providers

- 34.10.1. Concerns Related to Single-use Systems

- 34.10.2. Issues Related to Capacity Fluctuations

- 34.11. Concluding Remarks

35. CONCLUSION

36. EXECUTIVE INSIGHTS

- 36.1. Chapter Overview

- 36.2. Company A

- 36.2.1. Company Snapshot

- 36.2.2. Interview Transcript: Chief Executive Officer

- 36.3. Company B

- 36.3.1. Company Snapshot

- 36.3.2. Interview Transcript: Chief Executive Officer And Co-Founder

- 36.4. Company C

- 36.4.1. Company Snapshot

- 36.4.2. Interview Transcript: Chief Technical Officer, Cell And Gene Therapy

- 36.5. Company D

- 36.5.1. Company Snapshot

- 36.5.2. Interview Transcript: President and Chief Operating Officer

- 36.6. Company E

- 36.6.1. Company Snapshot

- 36.6.2. Interview Transcript: Senior Director Of Global Strategic Marketing

- 36.7. Company F

- 36.7.1. Company Snapshot

- 36.7.2. Interview Transcript:Senior Director of Commercial Strategy and Market Insights

- 36.8. Company G

- 36.8.1. Company Snapshot

- 36.8.2. Interview Transcript:Global Head of Sales and Marketing and Head of Business Development (Germany)

- 36.9. Company H

- 36.9.1. Company Snapshot

- 36.9.2. Interview Transcript: Business Development Manager

- 36.10. Company I

- 36.10.1. Company Snapshot

- 36.10.2. Interview Transcript: Manager Marketing and Sales

37. APPENDIX I: TABULATED DATA

38. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

39. APPENDIX III: DETAILS OF PARTNERSHIPS AND COLLABORATIONS

List of Tables

- Table 5.1 Mammalian versus Microbial Expression Systems

- Table 6.1 List of Biopharmaceutical Contract Manufacturers

- Table 6.2 Biopharmaceutical Contract Manufacturers: Information on Type of Service Offered

- Table 6.3 Biopharmaceutical Contract Manufacturers: Information on Type of Biologic Manufactured

- Table 6.4 Biopharmaceutical Contract Manufacturers: Information on Scale of Operation

- Table 6.5 Biopharmaceutical Contract Manufacturers: Information on Type of Expression System Used

- Table 6.6 Biopharmaceutical Contract Manufacturers: Information on Type of Bioreactor Used

- Table 6.7 Biopharmaceutical Contract Manufacturers: Information on Mode of Operation of Bioreactor

- Table 7.1 List of Biopharmaceutical Contract Manufacturing Facilities in North America

- Table 7.2 List of Biopharmaceutical Contract Manufacturing Facilities in Europe

- Table 7.3 List of Biopharmaceutical Contract Manufacturing Facilities in Asia-Pacific

- Table 7.4 List of Biopharmaceutical Contract Manufacturing Facilities in Rest of the World

- Table 8.1 AGC Biologics: Company Overview

- Table 8.2 AGC Biologics: Biologics Manufacturing Facilities

- Table 8.3 AGC Biologics: Recent Developments and Future Outlook

- Table 8.4 Catalent: Company Overview

- Table 8.5 Catalent: Biologics Manufacturing Facilities

- Table 8.6 Catalent: Recent Developments and Future Outlook

- Table 8.7 FUJIFILM Diosynth Biotechnologies: Company Overview

- Table 8.8 FUJIFILM Diosynth Biotechnologies: Biologics Manufacturing Facilities

- Table 8.9 FUJIFILM Diosynth Biotechnologies: Recent Developments and Future Outlook

- Table 8.10 KBI Biopharma: Company Overview

- Table 8.11 KBI Biopharma: Biologics Manufacturing Facilities

- Table 8.12 KBI Biopharma: Recent Developments and Future Outlook

- Table 8.13 Charles River Laboratories: Company Overview

- Table 8.14 Charles River Laboratories: Biologics Manufacturing Facilities

- Table 8.15 Charles River Laboratories: Recent Developments and Future Outlook

- Table 8.16 Cytiva: Company Overview

- Table 8.17 Patheon: Company Overview

- Table 8.18 Piramal Pharma Solutions: Company Overview

- Table 9.1 FDA Quality Agreements and EMA cGMP Regulations: A

- Table 9.2 Boehringer Ingelheim:

- Table 9.3 Boehringer Ingelheim:

- Table 9.4 Boehringer Ingelheim: Recent Developments and Future Outlook

- Table 9.5 Lonza: Company Overview

- Table 9.6 Lonza: Biologics Manufacturing Facilities

- Table 9.7 Lonza: Recent Developments and Future Outlook

- Table 9.8 Sandoz: Company Overview

- Table 9.9 Sandoz: Biologics Manufacturing Facilities

- Table 9.10 Sandoz: Recent Developments and Future Outlook

- Table 9.11 Vetter Pharma: Company Overview

- Table 9.12 Vetter Pharma: Biologics Manufacturing Facilities

- Table 9.13 Vetter Pharma: Recent

- Table 9.14 Miltenyi Biotec: Company Overview

- Table 9.15 Miltenyi Biotec: Biologics Manufacturing Facilities

- Table 9.16 Miltenyi Biotec: Recent Developments and Future Outlook

- Table 9.17 Novasep: Company Overview

- Table 9.18 Olon: Company Overview

- Table 9.19 Rentschler Biopharma: Company Overview

- Table 10.1 WuXi Biologics: Company Overview

- Table 10.2 Wuxi Biologics: Biologics Manufacturing Facilities

- Table 10.3 WuXi Biologics: Recent Developments and Future Outlook

- Table 10.4 Kemwell Biopharma: Company Overview

- Table 10.5 Kemwell Biopharma: Recent Developments and Future Outlook

- Table 10.6 Minaris Regenerative Medicine: Company Overview

- Table 10.7 Minaris Regenerative Medicine: Biologics Manufacturing Facilities

- Table 10.8 Minaris Regenerative Medicine: Recent Developments and Future Outlook

- Table 10.9 Samsung BioLogics: Company Overview

- Table 10.10 Samsung BioLogics: Biologics Manufacturing Facilities

- Table 10.11 Samsung BioLogics: Recent Developments and Future Outlook

- Table 10.12 Cell Therapies: Company Overview

- Table 10.13 Cell Therapies: Recent Developments and Future Outlook

- Table 10.14 AcuraBio: Company Overview

- Table 10.15 Celltrion: Company Overview

- Table 10.16 Takara Bio: Company Overview

- Table 11.1 Bispecific Antibody Therapeutics: Information on Drug Candidate, Developer, Phase of Development and Target Antigen

- Table 11.2 Bispecific Antibody Therapeutics: Information on Clinical Drug Candidates, Target Indications, Therapeutic Areas and Disease Segment

- Table 11.3 Bispecific Antibody Therapeutics: List of Technology Platforms

- Table 11.4 Bispecific Antibody Contract Manufacturers: List of Companies

- Table 11.5 Commonly Used Cytotoxins for ADC Therapeutics

- Table 11.6 Occupational Exposure Limit Bands, Safebridge Consultants

- Table 11.7 Antibody Drug Conjugates: Information on Drug Candidates, Developers, Status of Development, Target Disease Indications and

- Table 11.8 Antibody Drug Conjugate Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 11.9 ADC Contract Manufacturers: List of Companies

- Table 11.10 Cell-based Therapies: Applications

- Table 11.11 Cell-based Therapies: Commercialized Products,

- Table 11.12 Key Cell Therapy Manufacturing Steps

- Table 11.13 Advantages and Disadvantages of Centralized and Decentralized Manufacturing Models

- Table 11.14 Cell Therapy Manufacturing (Industry Players): Information on Type of Cell Manufactured

- Table 11.15 Cell Therapy Contract Manufacturers: List of Companies

- Table 11.16 Gene Therapy Contract Manufacturers: List of Companies

- Table 11.17 Vector and Gene Therapy Manufacturers (Non-Industry players): Information on Type of Vector Manufactured

- Table 11.18 Viral Vectors Contract Manufacturers: List of Companies

- Table 11.19 Plasmid DNA Manufacturing Service Providers: Information on Location of Manufacturing Facility

- Table 11.20 Plasmid DNA Contract Manufacturers: List of Companies

- Table 12.1 List of Biosimilars Contract Manufacturing Service Providers

- Table 13.1 Small Molecules and Large Molecules: Strengths and Weaknesses

- Table 13.2 Small Molecules and Large Molecules: Comparison of Key Characteristics

- Table 13.3 Small Molecules and Large Molecules: Comparison of Development Characteristics

- Table 14.1 List of FDA Approved

- Table 16.1 Big Pharma Initiatives: List of Biopharmaceutical Manufacturing Initiatives

- Table 17.1 Biopharmaceutical Contract Manufacturing: List of Partnerships and Collaborations, Since 2019

- Table 17.2 Partnerships and Collaborations: Information on Type of Biologic Manufactured

- Table 18.1 Biopharmaceutical Contract Manufacturing: List of Mergers and Acquisitions, Since 2015

- Table 18.2 Mergers and Acquisitions: Information on Key Value Drivers and Type of Biologic Manufactured

- Table 18.3 Mergers and Acquisitions: Information on Deal Multiples, Since 2015

- Table 19.1 Biopharmaceutical Contract Manufacturing: List of Recent Expansions, Since 2016

- Table 20.1 Biopharmaceutical Contract Manufacturing: List of Funding and Investments, Since 2016

- Table 20.2 Funding and Investment Analysis: Summary of Investments

- Table 20.3 Funding and Investment Analysis: Summary of Venture Capital Funding

- Table 21.1 Biopharmaceutical Contract Manufacturers: Information on Capacity (Sample Data Set)

- Table 21.2 Capacity Analysis: Average Capacity per Category (Sample Data Set)

- Table 21.3 Capacity Analysis: Average Capacity for Mammalian Expression Systems (Sample Data Set)

- Table 21.4 Capacity Analysis: Average Capacity for Microbial Expression Systems (Sample Data Set)

- Table 21.5 Capacity Analysis: Average Capacity for Other Expression Systems (Sample Data Set)

- Table 21.6 Capacity Analysis: Global Production Capacity

- Table 22.1 Annual Biomanufacturing Capacity, till 2035 (Million Liters)

- Table 23.1 Total Cost of Ownership: Sample Dataset for Mid-sized Companies

- Table 23.2 Total Cost of Ownership: Sample Dataset for Large / Very Large Companies

- Table 31.1 List of Leading Biopharmaceutical Contract Manufacturing Companies

- Table 32.1 List of Virtual Biopharmaceutical Companies

- Table 36.1 RoslinCT: Key Highlights

- Table 36.2 Jafral Biosolutions: Key Highlights

- Table 36.3 Discovery Life Sciences: Key Highlights

- Table 36.4 Bioworkshops: Key Highlights

- Table 36.5 Aldevron: Key Highlights

- Table 36.6 Resilience: Key Highlights

- Table 36.7 Minaris Regenerative Medicine: Key Highlights

- Table 36.8 53Biologics: Key Highlights

- Table 36.9 Richter-Helm BioLogics: Key Highlights

- Table 37.1 Biopharmaceutical Contract Manufacturers: Distribution by Year of Establishment

- Table 37.2 Biopharmaceutical Contract Manufacturers: Distribution by Company Size

- Table 37.3 Biopharmaceutical Contract Manufacturers: Distribution by Location of Headquarters (Region)

- Table 37.4 Biopharmaceutical Contract Manufacturers: Distribution by Location of Headquarters (Country)

- Table 37.5 Biopharmaceutical Contract Manufacturers: Distribution by Year of Establishment, Company Size and Location of Headquarters (Region)

- Table 37.6 Biopharmaceutical Contract Manufacturers: Distribution by Type of Service Offered

- Table 37.7 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured

- Table 37.8 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Location of Headquarters (Region)

- Table 37.9 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Company Size

- Table 37.10 Biopharmaceutical Contract Manufacturers: Distribution by Scale of Operation

- Table 37.11 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Scale of Operation

- Table 37.12 Biopharmaceutical Contract Manufacturers: Distribution by Type of Expression System Used

- Table 37.13 Biopharmaceutical Contract Manufacturers: Distribution by Type of Expression System Used and Location of Headquarters (Region)

- Table 37.14 Biopharmaceutical Contract Manufacturers: Distribution by Type of Bioreactor Used

- Table 37.15 Biopharmaceutical Contract Manufacturers: Distribution by Mode of Operation of Bioreactor

- Table 37.16 Regional Distribution of Biopharmaceutical Contract Manufacturing Facilities

- Table 37.17 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Type of Service Offered

- Table 37.18 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Scale of Operation

- Table 37.19 AGC Biologics: Annual Revenues, Since FY 2018 (JPY Billion)

- Table 37.20 Catalent: Annual Revenues, Since FY-2018 (USD Billion)

- Table 37.21 FUJIFILM Diosynth Biotechnologies: Annual Revenues, Since FY 2018 (JPY Billion)

- Table 37.22 FUJIFILM Holdings: Annual Revenues by Business Divisions, Current Year (JPY Billion)

- Table 37.23 Charles River Laboratories: Annual Revenues, Since FY 2018 (USD Billion)

- Table 37.24 Boehringer Ingelheim: Annual Revenues, Since FY 2018 (EUR Billion)

- Table 37.25 Lonza: Annual Revenues, Since FY 2018 (CHF Billion)

- Table 37.26 Lonza: Annual Revenues by Business Divisions (CHF Billion)

- Table 37.27 Sandoz: Annual Revenues, Since FY 2018 (USD Billion)

- Table 37.28 Wuxi Biologics: Annual Revenues, Since FY 2018 (RMB Billion)

- Table 37.29 Samsung Biologics: Annual Revenues, Since FY 2018 (KRW Billion)

- Table 37.30 Approved and Clinical Bispecific Antibody Therapeutics: Distribution by Phase of Development

- Table 37.31 Approved and Clinical Bispecific Antibody Therapeutics: Distribution by Target Indication

- Table 37.32 Antibody Drug Conjugates: Distribution by Status of Development

- Table 37.33 Antibody Drug Conjugates: Distribution by Target Disease Indication

- Table 37.34 Most Active Players: Distribution by Number of Therapies

- Table 37.35 Cell Therapy Manufacturing (Industry Players): Distribution by Type of Cell Manufactured

- Table 37.36 Cell Therapy Manufacturing (Industry Players): Distribution by Type of Immune Cell Manufactured

- Table 37.37 Cell Therapy Manufacturing (Industry Players): Distribution by Type of Stem Cell Manufactured

- Table 37.38 Stem Cell Therapies: Distribution by Phase of Development

- Table 37.39 T-Cell Therapies: Distribution by Phase of Development

- Table 37.40 Gene Therapies: Distribution by Stage of Development

- Table 37.41 Gene Therapies: Distribution by Phase of Development

- Table 37.42 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Table 37.43 Early-stage Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Table 37.44 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Table 37.45 Early-Stage Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Table 37.46 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Viral Vector Manufacturing Facilities (Continent-wise)

- Table 37.47 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Type of Vector Manufactured

- Table 37.48 Plasmid DNA Manufacturers: Distribution by Location of Manufacturing Facility

- Table 37.49 Biosimilars: Historical Trend of FDA Approvals, Since 2015

- Table 37.50 Small Molecule and Large Molecule Drugs: Historical Trend of FDA Approval, 2005-2022

- Table 37.51 Big Pharma Initiatives: Distribution of Players by Number of Biopharmaceutical Contract Manufacturing Focused Initiatives

- Table 37.52 Big Pharma Initiatives: Cumulative Year-wise Trend, Since 2005

- Table 37.53 Big Pharma Initiatives: Distribution by Purpose of Initiative

- Table 37.54 Big Pharma Initiatives: Distribution by Type of Initiative

- Table 37.55 Big Pharma Initiatives: Distribution by Type of Partnership

- Table 37.56 Big Pharma Initiatives: Distribution by Type of Expansion

- Table 37.57 Big Pharma Initiatives: Distribution by Scale of Operation

- Table 37.58 Big Pharma Initiatives: Distribution by Type of Biologic Manufactured

- Table 37.59 Big Pharma Initiatives: Distribution of Players by Purpose of Initiative

- Table 37.60 Big Pharma Initiatives: Distribution by Year and Type of Initiative

- Table 37.61 Big Pharma Initiatives: Distribution of Players by Region of Expansion

- Table 37.62 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2019

- Table 37.63 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 37.64 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 37.65 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured

- Table 37.66 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Biologic Manufactured

- Table 37.67 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured and Geography

- Table 37.68 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Biologic Manufactured

- Table 37.69 Partnerships and Collaborations: Distribution by Scale of Operation

- Table 37.70 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 37.71 Most Active Players: Distribution by Number of Partnerships

- Table 37.72 Partnerships and Collaborations: Local and International Agreements

- Table 37.73 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 37.74 Mergers and Acquisitions: Year-Wise Cumulative Trend, Since 2015

- Table 37.75 Mergers and Acquisitions: Distribution by Type of Acquisition

- Table 37.76 Local and International Mergers and Acquisitions

- Table 37.77 Intracontinental and Intercontinental Mergers and Acquisitions

- Table 37.78 Mergers and Acquisitions: Year-Wise Trend in North America, Europe and Asia-Pacific, Since 2015

- Table 37.79 Most Active Acquirers: Distribution by Number of Acquisitions

- Table 37.80 Mergers and Acquisitions: Distribution by Key Value Drivers

- Table 37.81 Mergers and Acquisitions: Distribution by Year of Acquisition and Key Value Drivers

- Table 37.82 Mergers and Acquisitions: Distribution by Type of Biologic Manufactured

- Table 37.83 Mergers and Acquisitions: Distribution by Key Value Drivers and Type of Biologic Manufactured

- Table 37.84 Mergers and Acquisitions: Year-Wise Trend of Deal Multiple Amount (USD Million)

- Table 37.85 Recent Expansions: Cumulative Year-wise Trend, Since 2016

- Table 37.86 Recent Expansions: Distribution by Purpose of Expansion

- Table 37.87 Recent Expansions: Distribution by Year and Purpose of Expansion

- Table 37.88 Recent Expansions: Distribution by Type of Biologic Manufactured

- Table 37.89 Recent Expansions: Distribution by Purpose of Expansion and Type of Biologic Manufactured

- Table 37.90 Recent Expansions: Distribution by Location of Expanded Facility

- Table 37.91 Most Active Players: Distribution by Number of Recent Expansions

- Table 37.92 Recent Expansions: Distribution by Purpose of Expansion and Location of Expanded Facility

- Table 37.93 Recent Expansions: Distribution by Amount Invested (USD Million)

- Table 37.94 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2016

- Table 37.95 Funding and Investment Analysis: Cumulative Year-wise Trend by Amount Invested, Since 2016 (USD Million)

- Table 37.96 Funding and Investment Analysis: Distribution of Funding Instances by Type of Funding

- Table 37.97 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 37.98 Funding and Investment Analysis: Distribution by Year and Type of Funding

- Table 37.99 Funding and Investment Analysis: Distribution of Funding Instances and Total Amount Invested by Geography (Continent) (USD Million)

- Table 37.100 Funding and Investment Analysis: Distribution of Funding Instances and Total Amount Invested by Geography (Country) (USD Million)

- Table 37.101 Most Active Players: Distribution by Number of Funding Instances

- Table 37.102 Most Active Players: Distribution by Total Amount Raised (USD Million)

- Table 37.103 Leading Investors: Distribution by Number of Funding Instances

- Table 37.104 Leading Investors: Distribution by Amount Invested (USD Million)

- Table 37.105 Biopharmaceutical Contract Manufacturers: Global Production Capacity by Company Size

- Table 37.106 Biopharmaceutical Contract Manufacturers: Global Production Capacity by Type of Expression System Used

- Table 37.107 Biopharmaceutical Contract Manufacturers: Global Production Capacity by Location of Manufacturing Facilities

- Table 37.108 Biopharmaceutical Contract Manufacturing Capacity in North America

- Table 37.109 Biopharmaceutical Contract Manufacturing Capacity in Europe

- Table 37.110 Biopharmaceutical Contract Manufacturing Capacity in Asia-Pacific

- Table 37.111 Biopharmaceutical Contract Manufacturing Capacity in Rest of the World

- Table 37.112 Global Demand for Biopharmaceuticals, till 2035 (in kilograms)

- Table 37.113 Global Demand for ADC Therapeutics, till 2035 (in kilograms)

- Table 37.114 Global Demand for Cell Therapies, till 2035 (in terms of Number of Patients)

- Table 37.115 Global Demand for Cell Therapies, till 2035 (Billion Cells)

- Table 37.116 Total Cost of Ownership: Capital Expenditures (CAPEX)

- Table 37.117 Total Cost of Ownership: Operational Expenditures (OPEX)

- Table 37.118 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, Y0-Y20 (USD Million)

- Table 37.119 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, Y0: Distribution by CAPEX (USD Million)

- Table 37.120 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, Y1-Y20: Distribution by OPEX (USD Million)

- Table 37.121 Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations, Y0-Y20 (USD Million)

- Table 37.122 Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations, Y0: Distribution by CAPEX (USD Million)

- Table 37.123 Total Cost of Ownership for Large / Very Large Biopharmaceutical Contract Manufacturing Organizations, Y1-Y20: Distribution by OPEX (USD Million)

- Table 37.124 Global Biopharmaceutical Contract Manufacturing Market, Historical Trends (Since 2018)

- Table 37.125 Global Biopharmaceutical Contract Manufacturing Market, Forecasted Estimates (till 2035), Base Scenario (USD Billion)

- Table 37.126 Global Biopharmaceutical Contract Manufacturing Market, Forecasted Estimates (till 2035), Conservative Scenario (USD Billion)

- Table 37.127 Global Biopharmaceutical Contract Manufacturing Market, Forecasted Estimates (till 2035), Optimistic Scenario (USD Billion)

- Table 37.128 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Service Offered, 2018, Current Year and 2035 (USD Billion)

- Table 37.129 Biopharmaceutical Contract Manufacturing Market for API Manufacturing, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.130 Biopharmaceutical Contract Manufacturing Market for FDF Manufacturing, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.131 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Biologic Manufactured, 2018, Current Year and 2035 (USD Billion)

- Table 37.132 Biopharmaceutical Contract Manufacturing Market for Antibodies, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.133 Biopharmaceutical Contract Manufacturing Market for Cell Therapies, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.134 Biopharmaceutical Contract Manufacturing Market for Vaccines, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.135 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Expression System Used, 2018, Current Year and 2035 (USD Billion)

- Table 37.136 Biopharmaceutical Contract Manufacturing Market for Mammalian Expression Systems, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.137 Biopharmaceutical Contract Manufacturing Market for Microbial Expression Systems, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.138 Biopharmaceutical Contract Manufacturing Market for Other Expression Systems, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.139 Biopharmaceutical Contract Manufacturing Market: Distribution by Scale of Operation, 2018, Current Year and 2035 (USD Billion)

- Table 37.140 Biopharmaceutical Contract Manufacturing Market for Preclinical / Clinical Operations, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.141 Biopharmaceutical Contract Manufacturing Market for Commercial Operations, Historical Trends (Since 2018 and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.142 Biopharmaceutical Contract Manufacturing Market: Distribution by Company Size, 2018, Current Year and 2035 (USD Billion)

- Table 37.143 Biopharmaceutical Contract Manufacturing Market for Small Companies, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.144 Biopharmaceutical Contract Manufacturing Market for Mid-sized Companies, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.145 Biopharmaceutical Contract Manufacturing Market for Large and Very Large Companies, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.146 Biopharmaceutical Contract Manufacturing Market: Distribution by Geography, 2018, Current Year and 2035 (USD Billion)

- Table 37.147 Biopharmaceutical Contract Manufacturing Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.148 Biopharmaceutical Contract Manufacturing Market in the US, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.149 Biopharmaceutical Contract Manufacturing Market in Canada, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.150 Biopharmaceutical Contract Manufacturing Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.151 Biopharmaceutical Contract Manufacturing Market in Italy, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.152 Biopharmaceutical Contract Manufacturing Market in Germany, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.153 Biopharmaceutical Contract Manufacturing Market in France, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD

- Table 37.154 Biopharmaceutical Contract Manufacturing Market in Spain, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.155 Biopharmaceutical Contract Manufacturing Market in the UK, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.156 Biopharmaceutical Contract Manufacturing Market in Rest of Europe, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.157 Biopharmaceutical Contract Manufacturing Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.158 Biopharmaceutical Contract Manufacturing Market in China, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.159 Biopharmaceutical Contract Manufacturing Market in India, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.160 Biopharmaceutical Contract Manufacturing Market in South Korea, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.161 Biopharmaceutical Contract Manufacturing Market in Japan, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.162 Biopharmaceutical Contract Manufacturing Market in Rest of Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.163 Biopharmaceutical Contract Manufacturing Market in Latin America, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.164 Biopharmaceutical Contract Manufacturing Market in Middle East and North Africa, Historical Trends (Since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Table 37.165 Biopharmaceutical Contract Manufacturing Market: Distribution by Leading Players (USD Billion)

- Table 37.166 Overall Share of Virtual Biopharmaceutical Companies in the Biopharmaceutical Market (USD Billion)

- Table 37.167 Overall Share of Virtual Biopharmaceutical Companies in the Biopharmaceutical Contract Manufacturing Market in 2023 (USD Billion)

- Table 37.168 Global Biopharmaceuticals Market: Distribution of Number of FDA Approvals by Year, 2005-2023

- Table 39.1 Biopharmaceutical Contract Manufacturing: List of Partnerships and Collaborations, 2015 - 2018

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentation

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Overall Market Landscape

- Figure 4.2 Executive Summary: Regional Capability Analysis

- Figure 4.3 Executive Summary: Partnerships and Collaborations

- Figure 4.4 Executive Summary: Mergers and Acquisitions

- Figure 4.5 Executive Summary: Recent Expansions