PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892847

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892847

Private LTE Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

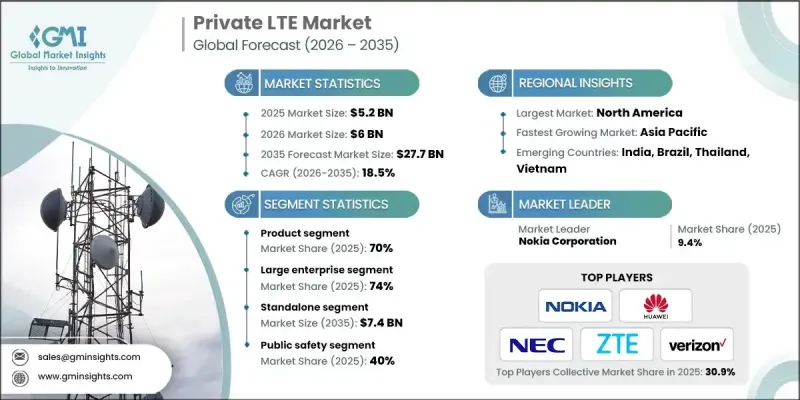

The Global Private LTE Market was valued at USD 5.2 billion in 2025 and is estimated to grow at a CAGR of 18.5% to reach USD 27.7 billion by 2035.

The surge is driven by increasing adoption of industrial automation, robotics, and real-time monitoring, which demand highly reliable and deterministic wireless networks. With massive growth in IoT deployments across factories, utilities, energy, and logistics, enterprises are seeking scalable, high-performance networks that ensure quality of service (QoS) and seamless mobility management. Shared spectrum frameworks and localized licensing are reducing barriers to entry, allowing small and midsize enterprises (SMEs) to deploy cost-effective private LTE solutions without relying solely on traditional mobile network operators. Industry 4.0 initiatives are accelerating investment in connectivity, with private LTE emerging as the preferred technology for predictive maintenance, workforce mobility, and edge-driven operational intelligence. Enterprises concerned with cybersecurity, data sovereignty, and regulatory compliance increasingly rely on private LTE for on-premises traffic control, access management, and secure data processing.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.2 Billion |

| Forecast Value | $27.7 Billion |

| CAGR | 18.5% |

The large enterprise segment accounted for a 74% share in 2025 and is expected to reach USD 15.7 billion by 2035. Large organizations dominate private LTE rollouts due to their extensive multi-site operations, technological sophistication, and financial capacity to acquire licensed spectrum and deploy large-scale networks globally.

The public safety segment held a 40% share in 2025 and is anticipated to grow at a CAGR of 15.3% through 2035. Government and emergency response agencies are adopting private LTE to replace outdated communication systems, ensuring mission-critical connectivity with high reliability and availability. These networks support real-time data transfer, video streaming, and coordinated responses to emergencies, enabling faster disaster recovery and operational efficiency.

U.S. Private LTE Market was valued at USD 2.4 billion in 2025. Access to spectrum via CBRS (Citizens Broadband Radio Service) is facilitating easier deployment of customized private LTE networks, expanding adoption among SMEs, and supporting innovation in manufacturing, healthcare, utilities, and logistics sectors.

Key players in the Global Private LTE Market include Affirmed Networks, Boingo, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Mavenir Systems, Inc., NEC Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Verizon, and ZTE Corporation. Companies in the Global Private LTE Market are strengthening their position by investing heavily in next-generation LTE and 5G technologies to enhance network performance and reliability. Strategic partnerships with industrial, manufacturing, and government sectors enable wider adoption and integration into critical infrastructure. Expanding presence in emerging regions, developing scalable and cost-effective deployment models, and offering end-to-end solutions with robust security features enhance market reach.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Network model

- 2.2.4 Organization size

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growing industrial automation demand

- 3.2.1.3 Expansion of IoT and connected assets

- 3.2.1.4 Increasing data security and sovereignty requirements

- 3.2.1.5 Growing adoption of shared and localized spectrum

- 3.2.1.6 Rising need for reliable connectivity in remote sites

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial deployment and integration costs

- 3.2.2.2 Spectrum availability and regulatory complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion across industrial IoT ecosystems

- 3.2.3.2 Growth of managed and hosted network models

- 3.2.3.3 Integration with edge computing and AI

- 3.2.3.4 Adoption in smart cities and public infrastructure

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - FCC Part 96 (CBRS Rules)

- 3.4.1.2 Canada - ISED Localized Licensing Framework

- 3.4.2 Europe

- 3.4.2.1 UK - Ofcom Local/Shared Licensing

- 3.4.2.2 Germany - BNetzA Campus/Local Licences

- 3.4.2.3 France - ARCEP Local Spectrum Window

- 3.4.2.4 Italy - Local/Campus Spectrum Allocation Framework

- 3.4.2.5 Spain - Private Mobile Network Spectrum Provision (26 GHz / Mid-Band)

- 3.4.3 Asia Pacific

- 3.4.3.1 China - MIIT Enterprise Private Network Licensing Programs

- 3.4.3.2 Japan - MIC Local 5G / Private Radio Station Licences

- 3.4.3.3 India - DoT/TRAI Captive Private Network Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil - ANATEL Private Network Authorizations

- 3.4.4.2 Mexico - IFT Limited-Use / Private Spectrum Concessions

- 3.4.4.3 Argentina - ENACOM Private Network Licensing Model

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - TDRA Private Telecom Services Licensing

- 3.4.5.2 South Africa - ICASA Private/Local Spectrum Policies

- 3.4.5.3 Saudi Arabia - CITC Private Network Licensing OptionsPorter's analysis

- 3.4.1 North America

- 3.5 PESTEL analysis

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Cost breakdown analysis

- 3.7.1 Development cost structure

- 3.7.2 R&D cost analysis

- 3.7.3 Marketing & sales costs

- 3.8 Advantages of LTE for private wireless networks

- 3.9 Working/Architecture of Private LTE

- 3.10 Patent analysis

- 3.11 Case study

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Future market outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 (USD Mn, Number of Nodes)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Infrastructure

- 5.2.1.1 Evolved Packet Core (EPC)

- 5.2.1.2 Backhaul

- 5.2.1.3 eNodeB

- 5.2.2 Device

- 5.2.2.1 Smartphones

- 5.2.2.2 Handheld Terminals

- 5.2.2.3 Vehicular Routers

- 5.2.2.4 IoT Modules

- 5.2.1 Infrastructure

- 5.3 Service

- 5.3.1 Consulting & Training

- 5.3.2 Integration & Maintenance

- 5.3.3 Managed Service

Chapter 6 Market Estimates & Forecast, By Network Model, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 Hybrid

- 6.4 Managed/Hosted

Chapter 7 Market Estimates & Forecast, By Organization Size, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 SMEs

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Public safety

- 8.3 Defense

- 8.4 Mining

- 8.5 Transportation

- 8.6 Energy

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Number of Nodes)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.3.10 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Nokia Corporation

- 10.1.2 Ericsson

- 10.1.3 Huawei Technologies Co., Ltd.

- 10.1.4 Cisco Systems, Inc.

- 10.1.5 Samsung Electronics Co. Ltd.

- 10.1.6 ZTE Corporation

- 10.1.7 Verizon Business

- 10.1.8 AT&T Business

- 10.1.9 NEC Corporation

- 10.1.10 HPE (Aruba Networks)

- 10.1.11 Motorola Solutions

- 10.1.12 Siemens

- 10.2 Regional Players

- 10.2.1 Boingo Wireless

- 10.2.2 BT Group

- 10.2.3 Telefonica

- 10.2.4 Orange Business Services

- 10.2.5 Vodafone Business

- 10.2.6 Deutsche Telekom / T-Systems

- 10.2.7 Rakuten Symphony

- 10.2.8 KT Corporation

- 10.2.9 Reliance Jio

- 10.3 Emerging / Disruptor Players

- 10.3.1 Mavenir Systems, Inc.

- 10.3.2 Celona

- 10.3.3 JMA Wireless

- 10.3.4 Baicells Technologies

- 10.3.5 Airspan Networks

- 10.3.6 Federated Wireless

- 10.3.7 Radisys

- 10.3.8 Druid Software