PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913461

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913461

Silanes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

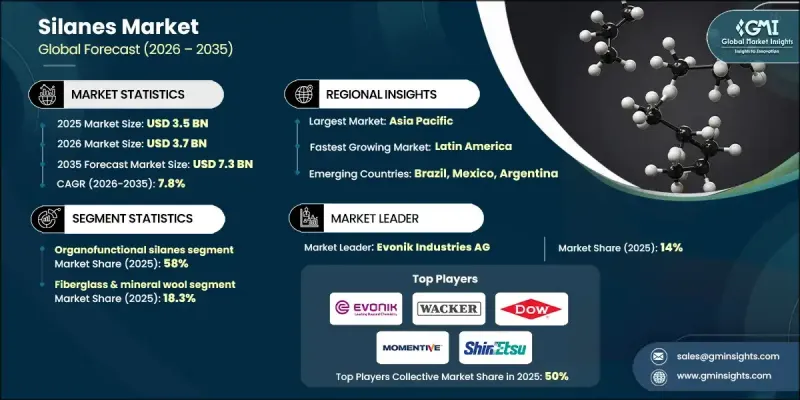

The Global Silanes Market was valued at USD 3.5 billion in 2025 and is estimated to grow at a CAGR of 7.8% to reach USD 7.3 billion by 2035.

Market performance is improving alongside the recovery of construction, automotive, and electronics manufacturing activities, which has strengthened demand for silane-modified materials across multiple industrial value chains. Rising investments in infrastructure and industrial output have increased the use of silane-enhanced sealants, coatings, and reinforced composites in structural, transportation, and electrical applications. Regulatory pressure to reduce emissions has encouraged manufacturers to develop low-emission, solvent-reduced, and metal-free formulations, accelerating innovation in silane chemistry. Growing adoption of organofunctional silanes as surface modifiers, adhesion promoters, and advanced material precursors is further supporting market expansion. Demand is also being reinforced by increased production of high-performance electronic components and advanced packaging technologies, which require high-purity silanes compatible with precision manufacturing environments. In parallel, applications in transportation, renewable energy, and industrial composites continue to drive consistent consumption as manufacturers prioritize durability, bonding efficiency, and long-term material performance.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 7.8% |

The organofunctional silanes segment accounted for 58% share in 2025 and is expected to grow at a CAGR of 8% through 2035. While other silane types continue to serve as essential intermediates in silicon-based chemistry, organofunctional grades are increasingly favored for their versatility across coatings, electronics, and specialty material systems.

The fiberglass and mineral wool segment held 18.3% share in 2025 and is forecast to expand at a CAGR of 6.1% by 2035. Silanes play a critical role in enhancing bonding strength, moisture resistance, and mechanical stability across insulation, coating, and composite applications.

U.S. Silanes Market reached USD 609.2 million in 2025, supported by strong demand from construction materials, electronics manufacturing, and composite applications, alongside continued investment in infrastructure modernization and high-performance materials.

Key companies operating in the Global Silanes Market include Dow Inc., Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Evonik Industries AG, Elkem ASA, Momentive Performance Materials Inc., Gelest, Inc., Siltech Corporation, PCC SE, Nitrochemie AG, China National Bluestar (Group) Co., Ltd., Jiangxi Chenguang New Materials Co., Ltd., and Nanjing Shuguang Chemical Group Co., Ltd. Companies in the Silanes Market are strengthening their market position by investing in product innovation focused on low-emission and high-purity formulations. Strategic capacity expansions and process optimization are being used to ensure supply stability and cost efficiency. Many players are aligning their portfolios with regulatory requirements by developing environmentally compliant solutions. Collaboration with downstream manufacturers is helping accelerate application-specific customization and long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding electronics, semiconductors and displays production

- 3.2.1.2 Growth of construction and infrastructure coatings

- 3.2.1.3 Rising use of reinforced plastics and composites

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental and health concerns around some silanes

- 3.2.2.2 Dependence on upstream chlorosilane, silicon supply

- 3.2.3 Market opportunities

- 3.2.3.1 Renewable energy, cable and grid modernization

- 3.2.3.2 Lightweight automotive and EV component adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Halosilanes / hydride functional silanes

- 5.2.1 Chlorosilanes

- 5.2.2 Alkylsilanes

- 5.2.3 Hydrosilanes

- 5.3 Organofunctional silanes

- 5.3.1 Amino silanes

- 5.3.2 Epoxy silanes

- 5.3.3 Vinyl silanes

- 5.3.4 Methacryloxy silanes

- 5.3.5 Sulfur silanes

- 5.3.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fiberglass & mineral wool

- 6.3 Paints & coatings

- 6.4 Polyolefin compounds

- 6.5 Adhesives & sealants

- 6.6 Sol-gel system

- 6.7 Fillers & pigments

- 6.8 Foundry & foundry resin

- 6.9 Silicones

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Evonik Industries AG

- 8.2 Wacker Chemie AG

- 8.3 Momentive Performance Materials Inc.

- 8.4 Dow Inc.

- 8.5 Shin-Etsu Chemical Co., Ltd.

- 8.6 Elkem ASA (Elkem Silicones)

- 8.7 PCC SE

- 8.8 Gelest, Inc.

- 8.9 Nitrochemie AG

- 8.10 Jiangxi Chenguang New Materials Co., Ltd.

- 8.11 Nanjing Shuguang Chemical Group Co., Ltd.

- 8.12 China National Bluestar (Group) Co., Ltd.

- 8.13 Siltech Corporation