PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642086

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642086

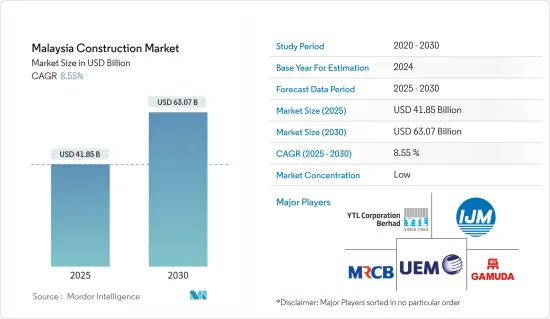

Malaysia Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Malaysia Construction Market size is estimated at USD 41.85 billion in 2025, and is expected to reach USD 63.07 billion by 2030, at a CAGR of 8.55% during the forecast period (2025-2030).

Key Highlights

- The construction industry in Malaysia continued to grow in 2023, with the total value of projects realized amounting to MYR 54.71 billion (USD 11.47 billion) between January and October.

- The private sector spearheaded the recovery from COVID-19 lockdowns and became the main driver of construction growth. Some key private sector projects that contributed to this recovery were high-rise residential projects with mixed-use ideas, supply chain optimization-driven fast-track industrial projects, and data center developments.

- While the civil sector accounted for the majority of government-initiated projects, it slowed down over time, mainly due to government control and prudent spending. However, the government has made significant strides toward improving public transportation and economic development in the region through various national infrastructure projects.

- The projects include the 5G network roll-out, which will cater to the growing demand for data centers across the Asia-Pacific region, and the MRT extension, which is projected to create thousands of jobs during the construction phase. Public transportation projects have sparked a wave of transit-oriented projects in Klang Valley, as well as along the intercity railway links, catalyzing real estate revitalization in the surrounding areas.

- The New Industrial Master Plan (NIMP) 2030 launched by the Government of Malaysia aims to transform Malaysia's manufacturing industry into a high value, technology-based and globally competitive sector by 2030. The NIMP calls for the establishment of new industrial parks and the construction and modernisation of infrastructure to facilitate the development of the manufacturing sector.

Malaysia Construction Market Trends

Residential Construction Driving the Market

Construction activity in Malaysia has increased for the fifth consecutive quarter, although the growth rate has slowed in the second quarter of 2023.

- According to data from the Department of Statistics Malaysia (DOSM), the value of work done in the construction sector rose by 8.1% year-on-year to MYR 32.4 billion (USD 7.05 billion) from April to June 2023.

- The growth in construction output was primarily driven by increased work in the residential sector, which saw a rebound and a 6.9% year-on-year expansion. Additionally, special trade activities experienced a faster rise of 9.8% year-on-year.

- However, civil engineering, which makes up the largest proportion of the sector's output, grew at a slower rate of 10.4% year-on-year.

- The growth was the slowest in four quarters, mainly because of the higher base due to the value of work done being more or less the same, hovering around MYR 12.1 billion (USD 2.59 billion) in the three quarters to Q2-2023.

- By project owners, private sector output, which accounted for 63.1% of total output, rose faster by 17.3% (Q1 2023: +10.6%), while the progress of construction project developments under the government recorded zero growth (1Q 2023: +6.1%) or unchanged from Q1 of 2023.

Increase in Infrastructure Construction Activities Driving Growth

The construction sector in Malaysia has seen a dramatic expansion, with 9,144 projects launched as of September 2023. The projects represent MYR 63 billion (USD 13.21 billion) of private investment and MYR 84 billion (USD 17.61 billion) of government investment. 91% of the projects were handled by local contractors, demonstrating their expertise in developing Malaysia's infrastructure.

According to budget-2024 Malaysia, the government plans to implement several large-scale projects such as Penang LRT, Sabah and Sarawak Link Road, and the reinstatement of LRT 3. These projects are part of Malaysia's MYR 90 billion (USD 18.87 billion) development expenditure budget for 2024.

- The Penang Technology Park Lithium Battery Separator Plant project consists of the construction of a 4 billion square meter (4 billion sq. m) lithium battery separators plant in Penang. The plant will be located on 26.7 hectares of land and will have a production capacity of 4 billion square meters per annum of wet-process and coated separators. The construction of the plant began in the fourth quarter of 2023 and is planned to be completed in the third quarter of 2025. This project is intended to meet the increasing demand for polyimide batteries in the region. Once operational, the project will be one of the first in the region and will be the largest low-carbon separator plant in ASEAN.

- Sedenak JH1 Data Center Campus project consists of the development of a 150 MW data center campus located on a 12.5 ha plot of land in JB (Johor Bahru). The construction started in the 4th quarter of 2023 and will be finished in the 4th quarter of 2025. Once completed, the Data Center (DC) campus will become one of Southeast Asia's largest data center campuses to meet the infrastructure requirements of customers in the region.

- The China Communication Construction Company (CCCC) is spearheading Malaysia's largest infrastructure endeavor, the East Coast Rail Link. Leveraging cutting-edge Chinese technology, CCCC is setting a new pace, laying tracks at a rate three times faster than traditional methods.

Malaysia Construction Industry Overview

The Malaysian construction market is less competitive due to major international players holding a large share of the total market. Furthermore, the residential and transport construction sectors have a huge potential for growth during the forecasted period, which stimulates opportunities for other market players. Some of the major players in Malaysia's Construction Market are YTL Corporation Berhad, IJM Corporation Berhad, Gamuda Berhad, UEM Group Berhad, and Malaysian Resources Corporation Berhad.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Economic and Construction Market Scenario

- 4.2 Technological Innovations in the Construction Sector

- 4.3 Impact of Government Regulations and Initiatives on the Industry

- 4.4 Review and Commentary on the Extent of Malaysia Vision 2020

- 4.5 Comparison of Key Industry Metrics of Malaysia with Other ASEAN Countries

- 4.6 Comparison of Construction Cost Metrics of Malaysia with Other ASEAN Countries

- 4.7 Impact of COVID-19 on the Market

- 4.8 Market Dynamics

- 4.8.1 Market Drivers

- 4.8.1.1 Rise in Demand for Residential Property

- 4.8.1.2 Increase in Infrastructure Projects

- 4.8.2 Market Restraints

- 4.8.2.1 Increase in Cost of Raw Materials

- 4.8.3 Market Oppurtunities

- 4.8.1 Market Drivers

- 4.9 Value Chain/Supply Chain Analysis

- 4.10 Industry Attractiveness - Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Buyers/Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Sector

- 5.1.1 Commercial Construction

- 5.1.2 Residential Construction

- 5.1.3 Industrial Construction

- 5.1.4 Infrastructure (Transportation) Construction

- 5.1.5 Energy and Utilities Construction

- 5.2 By Construction Type

- 5.2.1 Additions

- 5.2.2 Demolition and New Construction

6 COMPETITIVE LANDSCAPE

- 6.1 Market Overview

- 6.2 Company Profiles

- 6.2.1 YTL Corporation Berhad

- 6.2.2 IJM Corporation Berhad

- 6.2.3 Gamuda Berhad

- 6.2.4 UEM Group Berhad

- 6.2.5 Malaysian Resources Corporation Berhad

- 6.2.6 WCT Holdings Berhad

- 6.2.7 WCE Holdings Berhad

- 6.2.8 Hock Seng Lee Berhad

- 6.2.9 Mudajaya Group Berhad

- 6.2.10 Muhibbah Engineering (M) Bhd*

7 FUTURE OF THE MARKET

8 APPENDIX