Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693464

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693464

Asia-Pacific Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 541 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

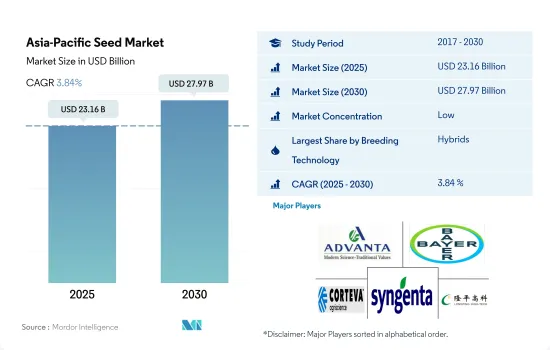

The Asia-Pacific Seed Market size is estimated at 23.16 billion USD in 2025, and is expected to reach 27.97 billion USD by 2030, growing at a CAGR of 3.84% during the forecast period (2025-2030).

Hybrids dominate the Asia-Pacific seed market due to their ability to produce higher yields and resistance to biotic and abiotic stresses

- In Asia-Pacific, hybrid seeds dominated the seed market, with a share of 70.2% in 2022 in terms of value. Out of the total hybrid seed market value, row crops accounted for an 87.1% share, whereas vegetables accounted for 12.9% in 2022.

- The hybrid segment has a major share because of higher productivity, wider adaptability, and a high degree of resistance to biotic and abiotic stresses. In cotton, hybrids give 50% more yield than conventional varieties. The wider adaptability of hybrids is mainly due to their high buffering capacity to environmental fluctuations. Thus, the demand for hybrid seeds is expected to increase during the forecast period.

- In 2022, among the row crop hybrids, transgenic hybrids accounted for 24.2% of the market share. This is attributed to their ability to produce better yields. Non-transgenic hybrids accounted for 75.8% of the market value.

- Among hybrids, insect-resistant transgenic hybrids dominate the transgenic seed market, accounting for a share of 84.4% of the market share value in 2022. Crops with insect-resistant traits approved for cultivation in the region are corn, cotton, and rice.

- Open-pollinated varieties and hybrid derivatives held a market share of 29.8% in 2022 in Asia-Pacific in terms of value. In countries such as India, the government is actively promoting locally bred open-pollinated varieties by capping the prices that international seed companies can charge to help increase the usage of OPVs.

- The increased availability of hybrids and improved OPVs resulted in many advantages, such as yield improvement and availability of seeds at an affordable price. These factors are estimated to drive the growth of the Asia-Pacific seed market during the forecast period.

The various government initiatives and schemes to support agriculture in the region and the growing demand for hybrids are driving the market

- In Asia-Pacific, China dominated the seed market, which accounted for 54.4% of the market in terms of value, followed by India at 15.7%, Japan at 5.5%, Pakistan at 3.8%, and Indonesia at 3.7% in 2022.

- China encourages multinational seed companies to enter the domestic market as they bring new development concepts and technology into the country, spread new technologies and propagation methods, and promote industrial rationalization. These factors are anticipated to drive the Chinese seed market at a CAGR of 2.9% during the forecast period.

- In India, to support the development of the seed industry, the Government of India launched many schemes, such as the Seed Village Program, Integrated Scheme on Oilseeds, transport subsidy on the movement of seeds to the North Eastern States in India, and hybrid rice seed production, which support the cost of production, distribution, and transportation. These factors are anticipated to drive the Indian seed market at a CAGR of 5.5% during the forecast period.

- In Japan, urban agriculture is developing as a new trend in agriculture. The demand for fresh vegetables is spurred by health-conscious consumers across the country. As agricultural land faces constraints, urban agriculture, such as indoor farming and vertical farming practices, has been scaling up operations to address the shortage of domestically grown vegetables.

- The Australian market is anticipated to be the fastest-growing seed market in the region, registering a CAGR of 6.0% during the forecast period. This is mainly attributed to the growing cultivation area in the country and the growing demand.

- The various government initiatives supporting agriculture in the region are anticipated to drive the market during the forecast period.

Asia-Pacific Seed Market Trends

The increasing demand for row crops in the region, combined with the high export potential of row crops, is driving the row crop area

- In the Asia-Pacific region, row crops dominated the total cultivated acreage in 2022, which accounted for more than 95.0% of the total cultivated area in 2022. The primary row crops cultivated in the region include rice, wheat, corn, sunflower, soybean, and other grains and cereals. In 2022, grains and cereals dominated the row crop acreage with a significant share of about 68.0%. This domination of grains and cereals is due to their substantial regional production output.

- The area under grains cereals accounted for 67.4 million hectares in 2022, in which rice held the major share in acreage in Asia. This is because high temperatures and abundant rainfall during the summer and monsoon seasons have provided ideal conditions for rice growing in Asia. Millets are mostly grown in the regions of India, China, and Pakistan. India is the world's leading producer of millet.

- * The overall row crop acreage increased by about 8.9% between 2017 and 2022. This is due to the growing demand for row crops in the region, and crops such as rice and wheat are staple food crops in most countries in the region. Moreover, in countries such as China and India, governments promote agriculture through various schemes such as the National Food Security Mission (NFSM) in India.

- China and India are the major row crop exporting countries in the region. In 2022, India exported about 22.2 million tons of rice during the same year. The overall rice cultivated area in the region is anticipated to increase by about 6.7% and reach 154.2 million hectares by the end of the forecast period. This is due to the growing demand and the high export potential of rice. The growing demand for row crops is anticipated to drive the acreage during the forecast period.

Increasing demand for fodder in livestock farming is driving the usage of hybrid forage seeds having disease resistant, wider adaptability, and early maturity traits

- Alfalfa and forage corn are the major forage crops because of their benefits to livestock rearing, such as more digestibility and high protein. They also allow farmers to attain greater yields without sacrificing quality. Wider adaptability for alfalfa was the largest adopted trait as there have been weather changes, high demand for early maturity, and low lignin content in a single product to minimize the usage of different inputs.

- The most common and harmful fungal diseases of alfalfa are fusarium and brown spot. They can reduce the productivity of plants by 30% or more. Therefore, the demand for alfalfa varieties with disease-resistant traits increases for alfalfa growers to achieve higher productivity. Additionally, alfalfa with low lignin traits is cultivated in Japan as the low-lignin trait alfalfa is highly digestible, and it offers a 15-20% increase in yield. Therefore, the demand for alfalfa with low lignin traits is expected to increase in the region during the forecast period.

- Forage corn with high yield potential, drought tolerance, disease tolerance, early maturity, and lodging tolerance traits are in high demand. Among these traits, the early maturity trait had the largest share as it has a high demand in the livestock industry. To meet this demand, the growers cultivate the crop in the off-season and reduce the cultivating period to normal cultivation by 1-2 weeks than normal cultivation. For instance, Land O' Lakes provides about 44 products with drought tolerance and early maturity traits.

- To prevent the increasing losses from diseases and increase productivity in a shorter period, the seeds with traits such as disease resistance, early maturity, and drought tolerance are fueling the market's growth.

Asia-Pacific Seed Industry Overview

The Asia-Pacific Seed Market is fragmented, with the top five companies occupying 20.27%. The major players in this market are Advanta Seeds - UPL, Bayer AG, Corteva Agriscience, Syngenta Group and Yuan Longping High-Tech Agriculture Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92527

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.1.2 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa & Forage Corn

- 4.2.2 Cabbage & Lettuce

- 4.2.3 Rice & Corn

- 4.2.4 Tomato & Chilli

- 4.2.5 Wheat & Cotton

- 4.3 Breeding Techniques

- 4.3.1 Row Crops & Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Type

- 5.3.1 Row Crops

- 5.3.1.1 Fiber Crops

- 5.3.1.1.1 Cotton

- 5.3.1.1.2 Other Fiber Crops

- 5.3.1.2 Forage Crops

- 5.3.1.2.1 Alfalfa

- 5.3.1.2.2 Forage Corn

- 5.3.1.2.3 Forage Sorghum

- 5.3.1.2.4 Other Forage Crops

- 5.3.1.3 Grains & Cereals

- 5.3.1.3.1 Corn

- 5.3.1.3.2 Rice

- 5.3.1.3.3 Sorghum

- 5.3.1.3.4 Wheat

- 5.3.1.3.5 Other Grains & Cereals

- 5.3.1.4 Oilseeds

- 5.3.1.4.1 Canola, Rapeseed & Mustard

- 5.3.1.4.2 Soybean

- 5.3.1.4.3 Sunflower

- 5.3.1.4.4 Other Oilseeds

- 5.3.1.5 Pulses

- 5.3.1.5.1 Pulses

- 5.3.2 Vegetables

- 5.3.2.1 Brassicas

- 5.3.2.1.1 Cabbage

- 5.3.2.1.2 Carrot

- 5.3.2.1.3 Cauliflower & Broccoli

- 5.3.2.1.4 Other Brassicas

- 5.3.2.2 Cucurbits

- 5.3.2.2.1 Cucumber & Gherkin

- 5.3.2.2.2 Pumpkin & Squash

- 5.3.2.2.3 Other Cucurbits

- 5.3.2.3 Roots & Bulbs

- 5.3.2.3.1 Garlic

- 5.3.2.3.2 Onion

- 5.3.2.3.3 Potato

- 5.3.2.3.4 Other Roots & Bulbs

- 5.3.2.4 Solanaceae

- 5.3.2.4.1 Chilli

- 5.3.2.4.2 Eggplant

- 5.3.2.4.3 Tomato

- 5.3.2.4.4 Other Solanaceae

- 5.3.2.5 Unclassified Vegetables

- 5.3.2.5.1 Asparagus

- 5.3.2.5.2 Lettuce

- 5.3.2.5.3 Okra

- 5.3.2.5.4 Peas

- 5.3.2.5.5 Spinach

- 5.3.2.5.6 Other Unclassified Vegetables

- 5.3.1 Row Crops

- 5.4 Country

- 5.4.1 Australia

- 5.4.2 Bangladesh

- 5.4.3 China

- 5.4.4 India

- 5.4.5 Indonesia

- 5.4.6 Japan

- 5.4.7 Myanmar

- 5.4.8 Pakistan

- 5.4.9 Philippines

- 5.4.10 Thailand

- 5.4.11 Vietnam

- 5.4.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Bejo Zaden BV

- 6.4.5 Corteva Agriscience

- 6.4.6 East-West Seed

- 6.4.7 Groupe Limagrain

- 6.4.8 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.9 Syngenta Group

- 6.4.10 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.