PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687864

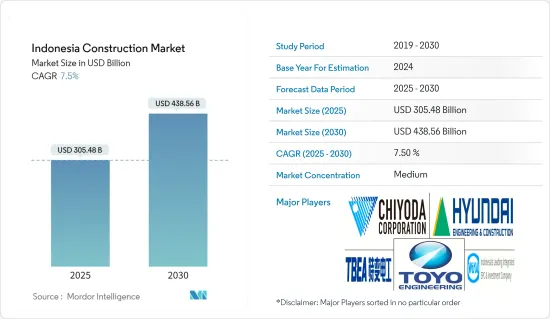

Indonesia Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia Construction Market size is estimated at USD 305.48 billion in 2025, and is expected to reach USD 438.56 billion by 2030, at a CAGR of 7.5% during the forecast period (2025-2030).

The Indonesian government has significantly funded infrastructure projects such as roads, bridges, airports, seaports, and railways. These projects are part of a national effort to improve connectivity, reduce logistical costs, and increase economic development across the board. Indonesia welcomes foreign investment in the construction sector, with companies worldwide participating in several projects. The diversity and competitiveness of the market are brought to bear through partnerships and collaboration among domestic and foreign companies.

As of December 2023, to tackle one of Indonesia's most important growth challenges, the high cost and underdeveloped revenue intermediation, the US and Indonesian governments joined forces on a USD 649 million investment from the Millennium Challenge Corporation. Indonesia's Infrastructure and Finance Compact will address enhancing infrastructure financing, particularly transport and logistics infrastructure, and growing access to finance for micro, small, and medium-sized enterprises.

Due to population growth, urbanization, and an expanding middle class, demand for residential property is rising in urban and rural areas. The result has been a surge in the construction of houses. In 2023, the Indonesian government announced plans to boost the real estate market by implementing the value-added tax and the IDR 4 million (USD 252) administration fee for low-income home buyers.

Indonesia Construction Market Trends

Growth of Infrastructural Plans Drives the Construction Market In Indonesia

As demand for such services continues to rise in Indonesia, more data centers will soon be built there. Indonesia is on track to overtake Singapore as Southeast Asia's second-largest public cloud market. The country is already home to major cloud providers like Google Cloud, AWS, Microsoft Azure, and Alibaba Cloud.

Equinix is currently trying to jump on board in Indonesia. In order to establish its International Business Exchange (IBX) data center in Jakarta, the tech company is expected to invest USD 74 million. The expansion is anticipated to make it possible for businesses in Indonesia and beyond to use its reliable platform to link and connect the basic infrastructure that underpins their operations.

The Indonesian government also allocated a budget of IDR 422.7 trillion (USD 27.01 billion) from the 2024 state budget, its largest infrastructure budget in five years, to work on infrastructure projects. This represented a growth rate of 5.8% over the 2023 infrastructure budget realization forecast, amounting to IDR 399.6 billion (USD 25.54 billion).

Increased Involvement of State-owned Enterprises (SOEs) Driving the Market

More than 50% of construction roles are awarded to established Indonesian state-owned enterprises (SOEs) and companies such as Wijaya Karya, Adhi Karya Waskita Karya, and Pembangunan Perumahan. These SOEs are involved in major infrastructure projects across the market, such as the Patimban Deep-Sea Port in West Java or work relating to the Jakarta Mass Rapid Transit System.

Under the National Medium-Term Development Plan (2020-2024 RPJMN), the government plans to invest IDR 6 quadrillion (USD 412 billion) in developing transport, industrial, energy, and housing infrastructure projects by 2024.

Indonesia Incorporated Day was held on January 24, 2024, at Nusa Dua in Bali, Indonesia. The event was co-organized by the Indonesian Ministry of Foreign Affairs (MoFAD), the Ministry of State of Enterprises (SOE), and PT BNI. The objective of the Indonesia Incorporated Day was to promote cooperation between the government, private sector, SOEs, and micro, small, and medium enterprises to achieve the goal of Indonesia Going Global.

Indonesia Construction Industry Overview

The Indonesian construction market is expected to be competitive and more cohesive with the presence of major local and international players. Key players in the market are PT CiputraDevelopment Tbk, PT PakuwonJati Tbk, PT Alam Sutera Realty Tbk, PT SummareconAgung Tbk, PT Agung PodomoroLand Tbk, and many others. The Indonesian construction market is expected to present opportunities for growth during the forecast period, which is anticipated to drive market competition. The market is fragmented, as many new entrants are focusing on bagging projects to strengthen their positions among the market's key players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Economic and Construction Market Scenario

- 4.2 Technological Innovations in the Construction Sector

- 4.3 Impact of Government Regulations and Initiatives on the Industry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government Policies and Regulatory Support

- 5.1.2 Tourism and Hospitality Sector Growth

- 5.2 Restraints

- 5.2.1 Financial and Funding Challenges

- 5.3 Opportunities

- 5.3.1 Affordable Housing Development

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Commercial Construction

- 6.1.2 Residential Construction

- 6.1.3 Industrial Construction

- 6.1.4 Infrastructure (Transportation) Construction

- 6.1.5 Energy and Utilities Construction

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 PT CiputraDevelopment Tbk

- 7.2.2 PT PakuwonJati Tbk

- 7.2.3 PT Alam Sutera Realty Tbk

- 7.2.4 PT SummareconAgung Tbk

- 7.2.5 PT Agung PodomoroLand Tbk

- 7.2.6 PT Jaya Real Property Tbk

- 7.2.7 SinarMas Land

- 7.2.8 PT Metropolitan Kentjana Tbk

- 7.2.9 PT Bumi Serpong Damai Tbk

- 7.2.10 PT PuradeltaLestari Tbk*

8 FUTURE OF THE CONSTRUCTION SECTOR IN INDONESIA

9 APPENDIX