Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686286

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686286

Spain Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 333 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

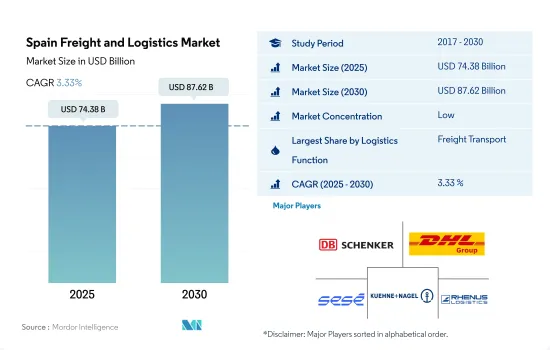

The Spain Freight and Logistics Market size is estimated at 74.38 billion USD in 2025, and is expected to reach 87.62 billion USD by 2030, growing at a CAGR of 3.33% during the forecast period (2025-2030).

Rising infrastructure development leads to the smooth flow of goods in the domestic territory, leading to vehicle sales

- In June 2024, Spain allocated USD 2.47 billion to enhance rail infrastructure in its northern regions as part of the Master Plan for the Atlantic Corridor. This initiative aims to connect major Western European cities, including Lisbon, Madrid, Paris, Strasbourg, Mannheim, and Le Havre. The funding is part of a broader USD 3.09 billion investment in Asturias, with USD 2.35 billion for EU projects to be completed by 2030, and USD 744.95 million overseen by Spain's Ministry of Transport for infrastructure developments, targeting completion by 2050.

- Spain is also steadfast in its commitment to meeting the Sustainable Development Goals for 2030, with a targeted investment of USD 116.84 billion. A key player in freight transportation, Spain's maritime industry is actively embracing environmental initiatives. For instance, in November 2022, Maersk Spain embarked on developing a clean fuel to power future ships, aligning with global decarbonization efforts. In a significant move, Maersk Spain inked a collaboration pact with the Spanish government, aiming for large-scale green fuel production in the country. The production of green methanol will involve an investment of USD 10.67 billion.

Spain Freight and Logistics Market Trends

Developing transport and storage sector fueled by growing infrastructure investments by Spanish Government

- In May 2024, plans to build a rail tunnel under the Strait of Gibraltar to connect Spain and Morocco were revived. The Spanish government hired state-owned engineering firm Ineco to update the feasibility study and cost estimates for the project. Initial estimates suggest the tunnel could cost between USD 5.33 billion and USD 10.67 billion, with funding expected from European and African lending institutions. The shortest route between Spain and Morocco is 14 km, but the sea is about 1000 m deep there, making construction difficult. Alternatives being considered are around 28 km long but at a more manageable depth of less than 300 meters. The current plan is for a single-bore tunnel, with the option to add a second parallel tunnel in the future. This tunnel would be used by both passenger and freight trains.

- In June 2024, Spain allocated USD 2.47 billion to enhance rail infrastructure in northern Spain, part of a broader USD 3.09 billion investment in Asturias. Out of this total, USD 2.35 billion is earmarked for EU projects slated for completion by 2030. Meanwhile, developments overseen by Spain's Ministry of Transport, with a budget of USD 744.95 million, are targeted for a 2050 finish. In October 2024, Spain greenlit a tripartite agreement to construct a new southern rail entrance to the Port of Barcelona, with expenses exceeding USD 805.65 million.

Owing to high fuel prices, a discount of USD 0.2 per liter was applied to the retail price as a subsidy by the Spanish government in 2022

- Spain has witnessed a consistent uptrend in fuel prices, with the average cost of a liter of petrol climbing to USD 1.78 by April 2024, marking a 0.96% increase for three consecutive months, reminiscent of mid-October levels. Diesel prices, on the other hand, stood at USD 1.66 per liter, reflecting an uptick of nearly 0.6% in the fourth week of the month. Moreover, gasoline prices have surged by 9.25% since the start of 2024, while diesel has seen a more modest increase of close to 4.5%.

- Fuel prices have been a major concern recently, along with food costs, significantly impacting Spaniards' budgets. By the end of 2024, the price of a liter of 95-octane gasoline is expected to be around USD 1.49, and diesel around USD 1.38. The main reason for this expected drop in fuel prices is the oil market, which is seeing a decline in both supply and demand. The International Energy Agency predicts that oil consumption will fall sharply, from 2.8 million barrels per day in the third quarter of 2023 to 1.1 million in 2024.

Spain Freight and Logistics Industry Overview

The Spain Freight and Logistics Market is fragmented, with the major five players in this market being Deutsche Bahn AG (including DB Schenker), DHL Group, Grupo Sese, Kuehne+Nagel and Rhenus Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51626

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Spain

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Spain

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Across Logistics

- 6.4.2 Alfil Logistics

- 6.4.3 Careers Logistics Group

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 FedEx

- 6.4.8 Grupo Sese

- 6.4.9 Kuehne+Nagel

- 6.4.10 Marcotran

- 6.4.11 Rhenus Group

- 6.4.12 Salvesen Logistica SA

- 6.4.13 TSB Trans

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.