PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851304

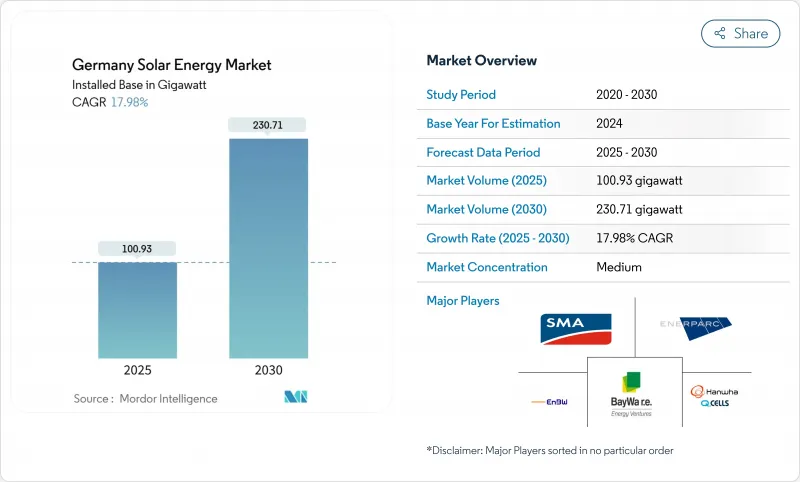

Germany Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany Solar Energy Market size in terms of installed base is expected to grow from 100.93 gigawatt in 2025 to 230.71 gigawatt by 2030, at a CAGR of 17.98% during the forecast period (2025-2030).

The expansion is reinforced by the country's 80% renewables-by-2030 target and the early-2025 milestone of surpassing 100 GW of installed solar capacity . Streamlined permitting under Solar Package I, the 87% plunge in module prices, and corporate off-take agreements are accelerating project pipelines across all system sizes. Rooftop mandates, balcony-plug-in adoption, and grid-fee inflation have turned households and small businesses into pivotal investors, while dispatchable technologies such as CSP are starting to secure pilot funding for evening peak support. Competitive intensity is heightening as institutional capital flows in, yet grid congestion and skilled-labour shortages continue to constrain the pace of new grid connections.

Germany Solar Energy Market Trends and Insights

Solar Package I & Rooftop Mandates Accelerating Approvals

Germany's solar energy market projects now clear rooftops without construction permits, as Solar Package I cut residential approval times by 70% and commercial by 45%. Higher feed-in incentives for specific system types and state-level obligations on new roofs have formed a multi-layered push that lifts annual installation potential by 4-5 GW by 2026. Legal simplification has broadened installer pipelines, reduced soft costs, and strengthened investor confidence in urban retrofit opportunities.

Corporate PPA Boom Lifting Unsubsidised Utility Projects

Falling feed-in tariffs redirected utility developers toward long-term corporate power purchase agreements. Germany became Europe's second-largest PPA market by 2024, with triple-digit growth in contracted volumes. Off-takers like Amazon and Mercedes-Benz use PPAs to lock in price certainty and meet Scope 2 decarbonisation goals, encouraging developers to move forward without subsidy dependence. The trend is spurring 100-plus-MW projects on reclaimed industrial land, closing financing swiftly, and diversifying revenue streams beyond traditional auctions.

Distribution-Grid Congestion & 24-Month Queue Times

Queue delays stretch to two years in several rural districts, curtailing 97% more solar output in 2024 than in 2023 and eroding investor returns. The mismatch between rapid capacity additions and slower grid reinforcement elevates balancing costs above EUR 4 billion, which feeds into retail tariffs. Dynamic line rating and hybrid plant designs offer partial relief, while the Solar Peak Law introduces feed-in caps during negative price hours. These measures, though helpful, cannot substitute for expanded conductor upgrades and digital substation roll-outs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Grid-Fee Inflation Driving Behind-the-Meter PV + Storage

- Mass Adoption of Balcony-Plug-in PV by Renters

- Skilled-Labour Shortages in Licensed Electricians & Installers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic commanded 100% of Germany's solar energy market size in 2024, enabled by module prices as low as 6-13 euro cents per W-p and LCOE near 3.7 euro cents per kWh. Residential, commercial, and utility stakeholders favour high-efficiency mono-PERC and increasingly bifacial modules that push yield without expanding footprint. Research by Fraunhofer ISE demonstrates perovskite-silicon tandem cell lab efficiencies above 33% , pointing toward future gains that can underpin further price declines.

Concentrated solar power holds no share today, yet is forecast to grow at an 18.5% CAGR through 2030. Its integrated thermal storage delivers evening peaking power and process heat, addressing intermittency concerns as PV penetration rises. European Commission roadmaps identify CSP hybridisation with existing district-heating networks and industrial steam loops, indicating supportive funding for demonstrators. If current pilot plants meet dispatchability and cost targets, the segment could evolve into a complementary pillar of the German solar energy market by the next decade.

The Germany Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Component (PV Modules, Inverters, Balance-Of-System, Battery Energy-Storage Systems, and Others), Application (Utility-Scale Solar Parks, Commercial and Industrial Rooftop, Residential Rooftop, and Others). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- BayWa r.e. AG

- SMA Solar Technology AG

- EnBW Energie Baden-Wurttemberg AG

- Hanwha Q CELLS GmbH

- IBC Solar AG

- Enerparc AG

- RWE Renewables GmbH

- Encavis AG

- juwi GmbH

- ABO Wind AG

- Vattenfall GmbH

- BayWa r.e. Power Solutions GmbH

- Next2Sun GmbH

- Solnet Green Energy OY

- Axitec Energy GmbH & Co. KG

- Solarwatt GmbH

- Meyer Burger Technology AG (Freiberg)

- Tesla Germany GmbH (Powerwall & Roof)

- 1KOMMA5° GmbH

- Centrotherm International AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Solar Package I & Rooftop Mandates Accelerating Approvals

- 4.2.2 Corporate PPA Boom Lifting Unsubsidised Utility Projects

- 4.2.3 Rising Grid-Fee Inflation Driving Behind-the-Meter PV + Storage

- 4.2.4 Mass Adoption of Balcony-Plug-in PV by Renters

- 4.2.5 87 % Module-Price Collapse Enables Cost-Parity vs. Wholesale

- 4.2.6 Integrated BIPV Requirements in New-Build Codes (from 2026)

- 4.3 Market Restraints

- 4.3.1 Distribution-Grid Congestion & 24-Month Queue Times

- 4.3.2 Skilled-Labour Shortages in Licensed Electricians & Installers

- 4.3.3 60 % Cost Gap on EU-vs-China Modules Creating Supply-Risk

- 4.3.4 Declining FiTs & Sudden Subsidy Tweaks Eroding Residential ROI

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook (EEG 2023, Solar-Paket I, State Rooftop Mandates)

- 4.6 Technological Outlook (Perovskite Tandems, Agrivoltaics, Vehicle-Integrated PV)

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Threat of Substitutes (Wind, Heat-Pumps, Demand Response)

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Component

- 5.2.1 PV Modules

- 5.2.2 Inverters (String, Central, Micro/Power-Optimiser)

- 5.2.3 Balance-of-System (Mounts, Cables)

- 5.2.4 Battery Energy-Storage Systems

- 5.2.5 Monitoring and SCADA Software

- 5.2.6 EPC and O&M Services

- 5.3 By Application

- 5.3.1 Utility-Scale Solar Parks

- 5.3.2 Commercial and Industrial Rooftop (30 kW - 1 MW)

- 5.3.3 Residential Rooftop (below 30 kW incl. Balcony PV)

- 5.3.4 Others (Agricultural/Agrivoltaics)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 BayWa r.e. AG

- 6.4.2 SMA Solar Technology AG

- 6.4.3 EnBW Energie Baden-Wurttemberg AG

- 6.4.4 Hanwha Q CELLS GmbH

- 6.4.5 IBC Solar AG

- 6.4.6 Enerparc AG

- 6.4.7 RWE Renewables GmbH

- 6.4.8 Encavis AG

- 6.4.9 juwi GmbH

- 6.4.10 ABO Wind AG

- 6.4.11 Vattenfall GmbH

- 6.4.12 BayWa r.e. Power Solutions GmbH

- 6.4.13 Next2Sun GmbH

- 6.4.14 Solnet Green Energy OY

- 6.4.15 Axitec Energy GmbH & Co. KG

- 6.4.16 Solarwatt GmbH

- 6.4.17 Meyer Burger Technology AG (Freiberg)

- 6.4.18 Tesla Germany GmbH (Powerwall & Roof)

- 6.4.19 1KOMMA5° GmbH

- 6.4.20 Centrotherm International AG

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment (e.g., Vehicle-to-Grid PV, Industrial Heat-via-PV-Electrolysis)