PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906141

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906141

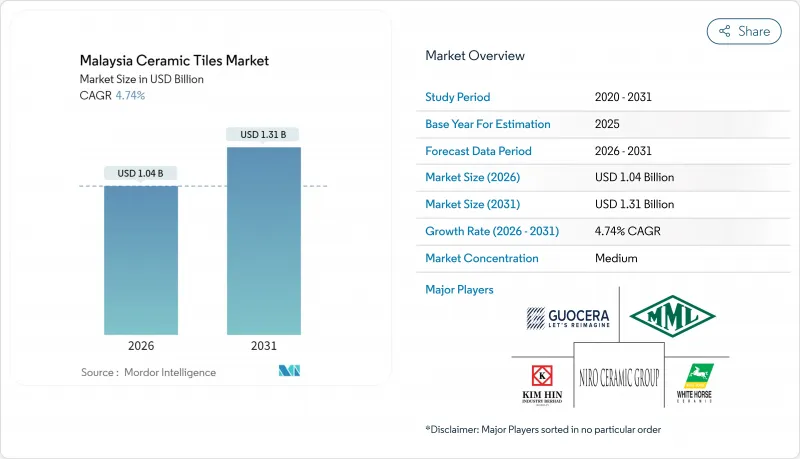

Malaysia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia ceramic tiles market was valued at USD 0.99 billion in 2025 and estimated to grow from USD 1.04 billion in 2026 to reach USD 1.31 billion by 2031, at a CAGR of 4.74% during the forecast period (2026-2031).

These figures position the Malaysia ceramic tiles market as a stable, mid-growth building-materials arena whose outlook is increasingly influenced by Klang Valley megaprojects, Sabah-Sarawak infrastructure upgrades, and rapid digitalization in retail channels. A record RM 183.7 billion worth of construction contracts was awarded in 2024, reinforcing downstream demand for tiles in both residential and commercial settings. Rapid technology adoption, especially large-format porcelain slab lines equipped with ink-jet printing, supports premiumization, while state-led affordable-housing quotas safeguard baseline volume. Competitive pressures from Chinese and Vietnamese imports are forcing local manufacturers to differentiate through sustainability credentials, advanced glazing, and omnichannel distribution strategies.

Malaysia Ceramic Tiles Market Trends and Insights

Rising Urban Middle-Class Demand

Rising disposable incomes in Kuala Lumpur, Selangor, and Penang continue to lift per-capita floor-covering expenditures, making the Malaysia ceramic tiles market a prime beneficiary. Household spending on decorative surfaces climbed from RM 530.6 million in 2018 to RM 640.2 million in 2022, and is projected to reach RM 760.0 million by 2026, a 4.4% CAGR. Transaction volumes for residential property grew 6.2%, with values up 14.4% in 2024, signaling robust renovation activity that favors premium porcelain formats. Middle-class buyers place higher value on durability and aesthetic coherence across open-plan layouts, driving up average square-meter purchases per project. The demographic trend also pushes retailers to widen online catalogs as urban consumers increasingly prefer digital visualization tools before selecting tile patterns.

Government-Led Affordable Housing Projects

Federal schemes such as MyHome, PR1MA, and Rumah Selangorku specify ceramic tiles for kitchens, bathrooms, and common areas, ensuring predictable order volumes for manufacturers. MyHome offers developers up to RM 30,000 per unit, unlocking a construction pipeline that directly feeds tile procurement. Sime Darby Property's Seed Homes initiative shows private builders aligning with state goals to supply budget apartments furnished with durable tile surfaces. Because designs and unit sizes are standardized, suppliers capture cost efficiencies through bulk purchase agreements, protecting margins despite compressed price points. Affordable-housing rules also compel local sourcing, shielding domestic players from import price warfare in this segment of the Malaysia ceramic tiles market. These programs typically specify ceramic tiles for wet areas and high-traffic zones, ensuring consistent baseline demand regardless of economic cycles. The standardized nature of affordable housing projects enables bulk procurement advantages, potentially improving profit margins for ceramic tile suppliers while maintaining competitive pricing structures.

Volatile Natural-Gas & Electricity Costs

Tile kilns consume large volumes of natural gas at temperatures exceeding 1,150 °C, leaving producers highly exposed to spot-price spikes. Utility bills already account for more than 30% of ex-factory cost on full-body porcelain lines, and electricity charges for digital printers add upward pressure. With Southeast Asia expected to represent 25% of global energy-demand growth by 2035, Malaysian plants face continued cost unpredictability. Smaller companies lack hedging instruments, forcing them either to absorb margin erosion or pass on price increases that risk volume loss in the Malaysia ceramic tiles market. The region's continued reliance on fossil fuels, which meet nearly 80% of energy demand, creates ongoing exposure to global commodity price volatility that manufacturers cannot fully control through operational efficiency improvements. Energy-intensive ceramic tile production faces particular challenges during peak demand periods when utility companies implement demand-based pricing structures, forcing manufacturers to optimize production scheduling around energy cost cycles.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Large-Format Porcelain Slabs

- Shift Toward Eco-Friendly Low-Carbon Tile Production

- Competition from Low-Cost Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain accounted for 41.62% of 2025 revenue in the Malaysia ceramic tiles market, while the segment is projected to accelerate at a 5.15% CAGR through 2031. The Malaysia ceramic tiles market size for porcelain therefore, remains the primary barometer of industry health. These gains rest on porcelain's sub-0.5% water-absorption rate, making it more durable in Malaysia's high-humidity climate. Advancements in dry-pressing and digital glazing now permit marble-look finishes that compete directly with natural stone, persuading upscale homeowners to upgrade.

Glazed ceramic tiles retain importance in mass-housing bathroom walls, whereas unglazed technical porcelain targets industrial and transit flooring where slip resistance is critical. Mosaic tiles secure niche value in hospitality accent walls and pools, capitalizing on bespoke color blends enabled by small-batch firing. Decorative "others," including hand-painted Nyonya-style tiles, command high margins among boutique developers who marry heritage motifs with modern geometry. As capacity expansions by Siam Cement Group come online, the supply of large-format porcelain is expected to ease, supporting the Malaysia ceramic tiles market's long-term premiumization trend.

Floor installations held a 58.72% share of the Malaysia ceramic tiles market in 2025, anchored by durability needs in retail malls and landed houses. Average floor areas per new condominium in Kuala Lumpur rose 6% between 2023 and 2025, lifting absolute volume demand. Wall applications, however, are penciled in for a 4.84% CAGR, the fastest within overall applications, as bathroom remodels prioritize hygienic, easy-wipe surfaces. Roofing applications maintain a specialized market position, particularly benefiting from research demonstrating that lighter-colored ceramic roof tiles can reduce peak temperatures by up to 16°C and achieve 13.14% annual energy cost savings in Malaysia's tropical climate.

The Malaysia ceramic tiles market size for wall coverings is benefiting from ink-jet textures that mimic wallpaper without the moisture issues common in tropical bathrooms. On the roofing side, research shows lighter-colored ceramic tiles can reduce attic temperatures by 16 °C and cut annual cooling bills by 13.14%. Commercial sectors appreciate low-maintenance grout systems, prompting wall-to-floor continuity to improve design coherence. Consequently, suppliers package multi-format SKUs that allow designers to run identical graphics across vertical and horizontal planes, an approach gaining traction in the Malaysia ceramic tiles industry.

The Malaysia Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, DIY Stores, Online Retail, Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Guocera Holdings Sdn Bhd

- White Horse Ceramic Industries Sdn Bhd

- Niro Ceramic Group

- Kim Hin Industry Berhad

- Yi-Lai Industry Berhad (Alpha Tiles)

- Seacera Group Berhad

- Malaysia Mosaic Sdn Bhd (MML)

- Claytan Group

- Venus Ceramic Industry Sdn Bhd

- Perfect Ceramic Tiles Sdn Bhd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- Siam Cement Group (SCG Tiles)

- Mohawk Industries Inc.

- Roca Tile Group

- Dongpeng Ceramic Co., Ltd.

- Johnson Tiles (Norcos plc)

- Somany Ceramics Ltd

- Monalisa Group Co., Ltd.

- Panaria Group Industrie Ceramiche S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urban Middle-Class Demand

- 4.2.2 Government-Led Affordable Housing Projects

- 4.2.3 Increasing Adoption of Large-Format Porcelain Slabs

- 4.2.4 Shift Toward Eco-Friendly Low-Carbon Tile Production

- 4.2.5 Digital Ink-Jet Printing Enabling Mass Customization

- 4.2.6 Acceleration of Government-Funded Infrastructure Megaprojects

- 4.3 Market Restraints

- 4.3.1 Volatile Natural-Gas & Electricity Costs

- 4.3.2 Competition From Low-Cost Imports (China, Vietnam)

- 4.3.3 Skilled-Labour Shortages In Advanced Manufacturing

- 4.3.4 Slow Diffusion of Building-Information-Modelling (Bim) Requirements In Malaysia's Mid-Tier Architectural Community

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Northern Malaysia

- 5.6.2 Central Malaysia (Klang Valley)

- 5.6.3 Southern Malaysia

- 5.6.4 East Coast Malaysia

- 5.6.5 East Malaysia (Sabah & Sarawak)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Guocera Holdings Sdn Bhd

- 6.4.2 White Horse Ceramic Industries Sdn Bhd

- 6.4.3 Niro Ceramic Group

- 6.4.4 Kim Hin Industry Berhad

- 6.4.5 Yi-Lai Industry Berhad (Alpha Tiles)

- 6.4.6 Seacera Group Berhad

- 6.4.7 Malaysia Mosaic Sdn Bhd (MML)

- 6.4.8 Claytan Group

- 6.4.9 Venus Ceramic Industry Sdn Bhd

- 6.4.10 Perfect Ceramic Tiles Sdn Bhd

- 6.4.11 RAK Ceramics PJSC

- 6.4.12 Kajaria Ceramics Ltd

- 6.4.13 Siam Cement Group (SCG Tiles)

- 6.4.14 Mohawk Industries Inc.

- 6.4.15 Roca Tile Group

- 6.4.16 Dongpeng Ceramic Co., Ltd.

- 6.4.17 Johnson Tiles (Norcos plc)

- 6.4.18 Somany Ceramics Ltd

- 6.4.19 Monalisa Group Co., Ltd.

- 6.4.20 Panaria Group Industrie Ceramiche S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 Smart Anti-Microbial Glazed Tiles With Iot Sensors

- 7.2 Carbon-Neutral Kiln Technologies Leveraging Hydrogen Fuel