PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910801

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910801

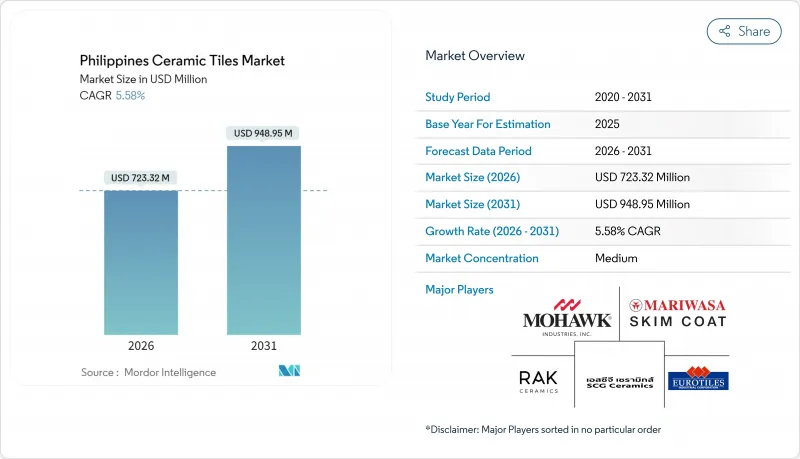

Philippines Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Philippines ceramic tiles market is expected to grow from USD 685.1 million in 2025 to USD 723.32 million in 2026 and is forecast to reach USD 948.95 million by 2031 at 5.58% CAGR over 2026-2031.

Expansion of public infrastructure, steady residential upgrades, and rising preference for durable floor finishes underpin this trajectory, even as producers grapple with volatile energy costs and import pressure. Domestic players are countering headwinds through energy-efficient kilns, ink-jet printing, and wider distribution footprints that help protect margins and sustain demand pull from the Build Better More program. Regional spending spillovers in Central Visayas and Mindanao are broadening addressable demand beyond Metro Manila, signaling healthy diversification in project pipelines. Simultaneously, pandemic-era hygiene concerns have accelerated the adoption of large-format porcelain slabs that promise easier cleaning and fewer grout lines, reinforcing premiumization trends in the Philippines' ceramic tiles market.

Philippines Ceramic Tiles Market Trends and Insights

Post-pandemic Residential Construction Rebound

Government-backed housing initiatives targeting 170,000 units across 55 projects are reviving labor demand and material procurement in the Philippines ceramic tiles market. Cebu's residential sector shows rising turnover as overseas Filipino workers channel remittances into mid-priced condominiums that typically specify ceramic tiles for wet areas and living spaces. Developers such as Cebu Landmasters hold roughly one-third share of condominium launches in Central Visayas and have scheduled 21 new projects collectively worth PHP 31.5 billion that will require extensive tile packages. Across Eastern Visayas, the value of building permits rose 5.4% year-on-year, and average residential construction costs hit PHP 9,151 per square meter, sustaining baseline consumption of ceramic finishes. A projected 10 million-unit national housing backlog underpins multi-year visibility for residential demand in the Philippines ceramic tiles market.

Expanding Commercial and Non-residential Construction

The growth in commercial and non-residential construction activities has become a significant driver for the ceramic tiles market, supported by the increasing presence of professional designers and architects who specify porcelain ceramic tiles for non-residential flooring applications. The development of various institutional, industrial, and commercial facilities has created substantial demand for ceramic floor tiles Philippines, with these materials being particularly valued for their ability to withstand heavy foot traffic and maintain their appearance in high-use areas. The expansion of agricultural facilities, educational institutions, and industrial complexes has further diversified the application base for ceramic tiles.

The commercial sector's growth is complemented by the rising sophistication of design requirements in modern business environments. The expanding ceramic tile market and dedicated tiles brand sector have created significant opportunities, with an increasing number of tiles brand name stores offering diverse product portfolios in single showrooms. This trend has been further enhanced by technological advancements such as online price comparison tools and augmented reality applications, allowing customers to make informed decisions and visualize designs directly at construction sites using smartphones, thereby streamlining the selection and installation process for commercial projects.

High Electricity Tariffs Squeezing Domestic Producers

Energy costs account for roughly one-third of production spending, exposing kiln-based manufacturing to price recalculations each month that MERALCO revises generation charges. Compared with peers in Thailand or Vietnam, Philippine factories pay premium kilowatt-hour rates, which curtail economies of scale and hamper export ambitions. LNG dependence will deepen as the county expands regasification capacity by 200%, baking long-term cost volatility into ceramic firing budgets. Smaller plants struggle to finance modern kilns or cogeneration units, and their thinner margins heighten liquidation risk when tariff spikes coincide with currency depreciation. Persistent cost stress may consolidate capacity, lowering supply diversity within the Philippines ceramic tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Interior Design Trends and Aesthetic Preferences

- Government "Build Better More" Infrastructure Pipeline

- Rising Import Penetration from China and Vietnam

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain commanded 54.85% revenue share in 2025, mirroring global durability standards and longstanding consumer trust in the Philippines ceramic tiles market size for premium finishes. The segment continues to reap benefits from ink-jet technology that replicates marble or timber visuals without the maintenance burden, entrenching brand loyalty among mid- to high-income homeowners. Mosaic tiles, though niche, are projected to record a 5.74% CAGR-fueled by accent-wall installations and artisanal revival programs that foothold local crafts into contemporary interiors. Unglazed and glazed ceramic formats retain loyalty in utility areas to slip resistance, while "other" decorative lines showcase hand-painted or patterned surfaces that support tourism-driven souvenir demand. Producers reallocating kiln cycles toward porcelain anticipate wider margin spreads, given the willingness among design-centric buyers to pay premiums while import pressure remains heavier in mass-market SKUs.

Porcelain's entrenched position also reflects cost-of-ownership economics: life cycles exceed 25 years, and low water absorption means fewer replacements, which resonates with investors building rental inventories in provincial cities. Imports once cornered top-end styles, but domestic imitations now match European aesthetics, tightening delivery timelines and lessening foreign exchange exposure for project owners. Mosaic uptake mirrors push toward bespoke bathrooms in hospitality refurbishments that prioritize Instagram-ready backdrops. Segment dynamics indicate that Philippines ceramic tiles market share held by porcelain is unlikely to cede ground, even as mosaics open incremental revenue pockets. Manufacturing priorities are thus skewing capital toward large-format porcelain lines that can toggle between glossy, matte, and textured finishes on demand.

Floor installations accounted for 51.62% of total demand in 2025, anchored by renovation cycles in Metro Manila's aging condominium stock and new-build schools funded by LGU budgets. Durability mandates make ceramic surfaces the baseline finish for malls, transport terminals, and healthcare corridors that face pedestrian loads exceeding 5,000 footfalls daily. Roofing applications, albeit just emerging, are set to clock the highest 5.63% CAGR as flood-resistant and solar-reflective tiles gain traction under climate-resilience building codes. Wall cladding sustains mid-single-digit growth as developers pivot toward hygienic, easy-to-sanitize surfaces in prep kitchens and restrooms, supplanting paints susceptible to mold. Application dispersion ensures diversified revenue streams, cushioning producers from cyclical dips in any single vertical within the broader Philippines ceramic tiles market.

Residential remodelers gravitate to anti-slip textures for kitchen refurbishments, while commercial landlords prefer stain-resistant variants that reduce janitorial expense over multi-year lease cycles. Flood-resistant rooftop tiles feature low water absorption and mechanical anchors suited for typhoon-exposed geographies such as Bicol and Eastern Visayas. Educational campuses adopting contact-safe surfaces after COVID-19 have swapped vinyl flooring for ceramic alternatives that withstand aggressive disinfectant regimens. Transport nodes-Clark Airport, MRT-7, Cebu BRT-embed porcelain in concourses due to abrasion grades PEI IV and V, reinforcing high-volume orders. Collectively, these patterns confirm floors will sustain the lion's share of Philippines ceramic tiles market size while emerging roofing specifications create promising adjacencies.

The Philippines Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, Home Improvement Stores, Online Retail, Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mariwasa Siam Ceramics Inc.

- Eurotiles Industrial Corporation

- SCG Ceramics (COTTO)

- RAK Ceramics PJSC

- PORCELANOSA Grupo

- Mohawk Industries Inc. (Daltile)

- Kajaria Ceramics Ltd.

- China Ceramics Co. Ltd.

- Guangdong Dongpeng Ceramic Co., Ltd.

- Pamesa Ceramica

- Grupo Lamosa

- HRD Singapore Pte Ltd (Niro Granite)

- Italgraniti Group

- Atlas Concorde S.p.A.

- FC Tile Depot

- ABC Tile Center

- Wilcon Depot Inc.

- Cebu Home and Builders Centre

- Tile Express Shop

- Royal Tern Ceramics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Residential Construction Rebound

- 4.2.2 Government "Build Better More" Infrastructure Pipeline

- 4.2.3 Growing Preference For Large-Format Porcelain Slabs

- 4.2.4 Retail-Chain Expansion In Tier-2 Cities

- 4.2.5 Energy-Efficient Kilns Lowering Unit Costs

- 4.2.6 Metro Manila Green-Building Mandate For Floor Finishes

- 4.3 Market Restraints

- 4.3.1 High Electricity Tariffs Squeezing Domestic Producers

- 4.3.2 Volatile LNG Prices Inflating Firing Costs

- 4.3.3 Rising Import Penetration From China And Vietnam

- 4.3.4 Skilled-Labor Shortages In Provincial Regions

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Luzon

- 5.6.2 Visayas

- 5.6.3 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Mariwasa Siam Ceramics Inc.

- 6.4.2 Eurotiles Industrial Corporation

- 6.4.3 SCG Ceramics (COTTO)

- 6.4.4 RAK Ceramics PJSC

- 6.4.5 PORCELANOSA Grupo

- 6.4.6 Mohawk Industries Inc. (Daltile)

- 6.4.7 Kajaria Ceramics Ltd.

- 6.4.8 China Ceramics Co. Ltd.

- 6.4.9 Guangdong Dongpeng Ceramic Co., Ltd.

- 6.4.10 Pamesa Ceramica

- 6.4.11 Grupo Lamosa

- 6.4.12 HRD Singapore Pte Ltd (Niro Granite)

- 6.4.13 Italgraniti Group

- 6.4.14 Atlas Concorde S.p.A.

- 6.4.15 FC Tile Depot

- 6.4.16 ABC Tile Center

- 6.4.17 Wilcon Depot Inc.

- 6.4.18 Cebu Home and Builders Centre

- 6.4.19 Tile Express Shop

- 6.4.20 Royal Tern Ceramics

7 Market Opportunities & Future Outlook

- 7.1 Adoption of flood-resistant outdoor ceramic paving tiles

- 7.2 Local producers adopting inkjet printing for custom designs