PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910587

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910587

Indonesia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

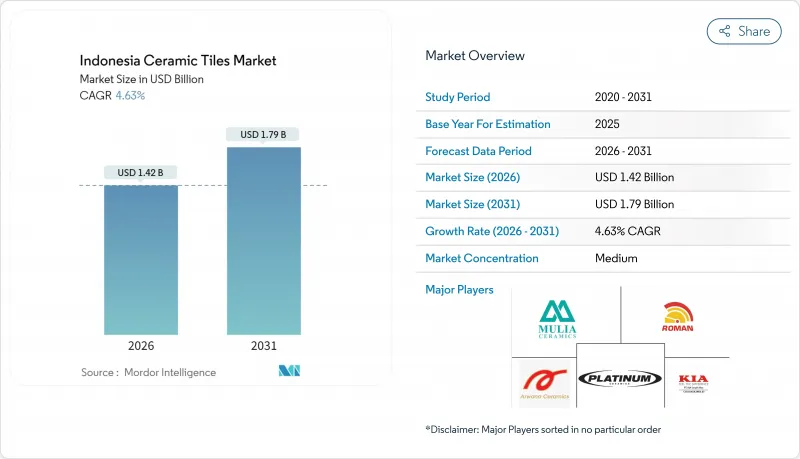

The Indonesia ceramic tiles market was valued at USD 1.36 billion in 2025 and estimated to grow from USD 1.42 billion in 2026 to reach USD 1.79 billion by 2031, at a CAGR of 4.63% during the forecast period (2026-2031).

Demand momentum stems from the government's subsidized-gas policy, a 100-200% duty wall against low-cost imports, and the massive 3 Million Houses program, all of which drive fresh orders across residential, commercial, and public projects. Robust GDP growth of 5.1% through 2027, steady urban migration, and higher renovation spending among middle-income households add multiple layers of resilience to construction activity. Manufacturers capitalize on porcelain's durability-driven appeal, while digital sales channels widen geographic reach and partly offset Indonesia's high inter-island freight costs. Local producers also benefit from mandatory SNI quality standards that raise compliance hurdles for importers and protect pricing power in premium product niches.

Indonesia Ceramic Tiles Market Trends and Insights

Gas-price cap for energy-intensive ceramics

The USD 6.75 per MMBTU ceiling under the Certain Natural Gas Price Policy trims roughly 30% of kiln operating costs for tile plants, granting domestic producers a decisive cost edge. Capacity-planning confidence rises because the subsidy runs through 2025, enabling factories to lock in feedstock and schedule equipment upgrades. The benefit concentrates in Java and Sumatra, where pipeline infrastructure supports high utilization despite national supply gaps. Subsidized gas helps plants counter rupiah depreciation impacts on imported raw materials. However, deliveries cover only 65-70% of contracted volumes, turning fuel availability into a gating constraint for near-term output growth. The government's broader strategy of using energy subsidies to support domestic manufacturing aligns with Indonesia's industrial policy objectives, positioning ceramic tiles as a strategic sector for import substitution and export development initiatives.

Post-pandemic residential boom in Java & Bali

Mortgage rate incentives and tax relief revived stalled housing projects and spurred new launches once mobility restrictions eased. Java's urban centers account for 60% of population and 58% of GDP, funneling a large portion of tile demand into high-density apartment and landed-housing schemes. Bali's premium villa pipeline favors large-format, design-rich tiles that lift average selling prices. The renovation wave also stays strong as remote work habits push home-owners to upgrade kitchens and bathrooms. Collectively, these drivers underpin more than half of all volume additions through 2027. The integration of smart home technologies and sustainable building practices in new residential developments creates opportunities for ceramic tile manufacturers to develop innovative products that meet evolving consumer expectations and regulatory requirements for energy-efficient construction.

Industrial gas-supply bottlenecks

Pipeline network limits force many kilns to operate below 70% of design loads, eroding economies of scale. Frequent pressure drops interrupt firing cycles and raise reject rates. Rent-seeking behavior in allocation processes adds further uncertainty to production planning. Manufacturers without dual-fuel capability must absorb idle costs or delay deliveries. Investors defer capacity expansion until transmission upgrades assure steady volume. Foreign investors' reconsideration of ceramic industry investments, as reported by Asaki, demonstrates how supply reliability concerns translate into reduced capital formation and technological upgrading that could otherwise support market expansion and competitiveness improvements.

Other drivers and restraints analyzed in the detailed report include:

- Duty hike on Chinese imports

- Government "One Million Houses" program

- Depreciating rupiah inflates imported raw-material costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles held a 46.58% share of the Indonesia ceramic tiles market in 2025, reflecting widespread acceptance in malls, hotels, and transit hubs where high abrasion resistance is crucial. The Indonesia ceramic tiles market size for porcelain is projected to widen alongside rapid commercial real-estate expansion in Jakarta and Surabaya. Mosaic formats, though starting at a smaller base, exhibit the highest 5.28% CAGR as homeowners embrace design individuality in bathroom and kitchen revamps. Domestic firms leverage ink-jet printing and large-slab presses to mimic marble and wood, capturing spend that once flowed to natural stone. Regulatory emphasis on low-VOC glazes also nudges producers toward eco-friendlier formulations, reinforcing porcelain's premium tag.

Value migration toward larger modules (60X120 cm and 80X80 cm) benefits efficient installation and modern aesthetics sought by architects. Unglazed and anti-slip variants gain traction in industrial floors and outdoor patios where functional safety tops visual preference. Handmade artisanal tiles retain a niche among luxury resorts in Bali, commanding high margins despite limited scale. The Indonesia ceramic tiles market continues to reward suppliers able to mesh technical attributes with on-trend looks, especially when backed by SNI certification that reassures buyers on durability benchmarks. Energy-efficient fast-firing kilns further lower cost per square meter, allowing competitive pricing even under fuel volatility.

Flooring captured 61.48% of the Indonesia ceramic tiles market share in 2025 because households value waterproofing and ease of cleaning amid tropical humidity. Developers increasingly specify 3-mm grout lines and rectified edges to achieve seamless visuals in high-traffic retail settings. Roofing tiles, expanding at 5.44% CAGR, meet rising demand for thermally stable, cyclone-resistant coverings in secondary cities prone to severe weather. Wall cladding benefits from heightening hygiene requirements in hospitals and educational premises where washable surfaces are mandatory. The Indonesia ceramic tiles industry also finds upside in modular raised-floor systems integrating airflow and cabling for future-ready office towers.

Continuous design innovation such as antibacterial glazes widens hospital and food-processing appeal. Outdoor decks adopt porcelain pavers that tolerate heavy footfall and monsoon deluges better than timber. Underfloor-heating compatibility, once limited to temperate markets, now appears in premium Indonesian villas, boosting ceramic relevance. Compliance with OECD resilience guidelines positions tile roofing as a preferred alternative to galvanized sheets in public housing upgrades. The segmentation underscores how functional imperatives and evolving building codes sustain diversified growth paths across applications.

The Indonesia Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Tile & Stone Stores, Home Improvement & DIY Stores, and More) and Geography (Java, Sumatra and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arwana Citramulia Tbk

- Mulia Keramik Indahraya

- Roman Ceramic International

- Platinum Ceramics Industry

- KIA Keramik Tbk

- Granito (PT Citra Granito)

- Diamond Keramik Indonesia

- Indogress (PT Inti Keramik Sejahtera)

- Indopenta Sakti Teguh

- Sun Power Ceramics

- Satyaraya Keramindo Indah (SRK)

- Candra Jaya Surya

- Royalboard Ceramics

- Sandimas Intimitra

- Terracotta Indonesia

- Muliakeramik Industri Indah

- Intikeramik Alamasri Industri Tbk

- Surya Toto Indonesia Tbk (Tile division)

- Dekkson Ceramics

- Madana Tiles Surabaya

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gas-price cap for energy-intensive ceramics

- 4.2.2 Post-pandemic residential boom in Java & Bali

- 4.2.3 Duty hike on Chinese imports

- 4.2.4 Government "One Million Houses" program

- 4.2.5 Rapid urbanisation of secondary cities

- 4.2.6 Rising middle-class renovation spending

- 4.3 Market Restraints

- 4.3.1 Industrial gas-supply bottlenecks

- 4.3.2 Depreciating rupiah inflates imported raw-material costs

- 4.3.3 Domestic over-capacity drives price wars

- 4.3.4 High inter-island logistics costs across the archipelago

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Java

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Bali & Nusa Tenggara

- 5.6.6 Papua & West Papua

- 5.6.7 Maluku Islands

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Arwana Citramulia Tbk

- 6.4.2 Mulia Keramik Indahraya

- 6.4.3 Roman Ceramic International

- 6.4.4 Platinum Ceramics Industry

- 6.4.5 KIA Keramik Tbk

- 6.4.6 Granito (PT Citra Granito)

- 6.4.7 Diamond Keramik Indonesia

- 6.4.8 Indogress (PT Inti Keramik Sejahtera)

- 6.4.9 Indopenta Sakti Teguh

- 6.4.10 Sun Power Ceramics

- 6.4.11 Satyaraya Keramindo Indah (SRK)

- 6.4.12 Candra Jaya Surya

- 6.4.13 Royalboard Ceramics

- 6.4.14 Sandimas Intimitra

- 6.4.15 Terracotta Indonesia

- 6.4.16 Muliakeramik Industri Indah

- 6.4.17 Intikeramik Alamasri Industri Tbk

- 6.4.18 Surya Toto Indonesia Tbk (Tile division)

- 6.4.19 Dekkson Ceramics

- 6.4.20 Madana Tiles Surabaya

7 Market Opportunities & Future Outlook

- 7.1 Rapid-set thin-tile technology for high-rise retrofits

- 7.2 "Smart-surface" IoT-embedded floor tiles