PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910841

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910841

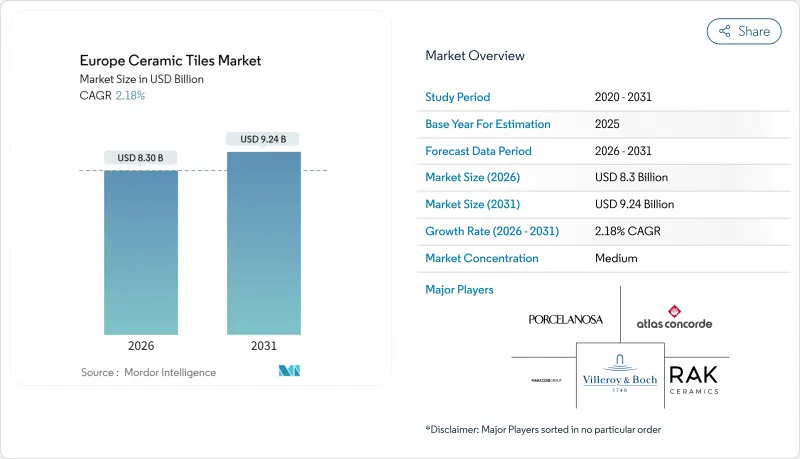

Europe Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe ceramic tiles market size in 2026 is estimated at USD 8.3 billion, growing from 2025 value of USD 8.12 billion with 2031 projections showing USD 9.24 billion, growing at 2.18% CAGR over 2026-2031.

The current demand environment remains stable because post-pandemic renovation spending, EU-funded retrofit grants and steady urbanization in Central and Eastern Europe counterbalance higher energy and carbon-compliance costs. Large producers mitigate volatile natural-gas prices through kiln modernizations, while OEMs emphasize antibacterial and low-VOC surfaces that align with green-building certification criteria. Digital sales channels accelerate, yet specialty retailers keep traction by offering in-store design services and professional installation support. Manufacturers that quickly adapt production lines for energy efficiency and ESG disclosure have clearer paths to preserve margins and secure public-sector renovation contracts.

Europe Ceramic Tiles Market Trends and Insights

Rapid Residential Renovation Wave Post-COVID Stimulus

European households redirected unspent travel and entertainment budgets toward home upgrades, and that behavior kept renovation volumes elevated through 2025. The Recovery and Resilience Facility channels close to EUR 90 billion per year into building upgrades, ensuring steady order inflows for tile suppliers. Premium porcelain formats benefit most as homeowners prioritize longevity and natural-look aesthetics in kitchens and bathrooms. Renovation activity is especially pronounced in Germany, France and the Netherlands, where disposable income levels remain supportive despite tighter monetary policy. Nevertheless, higher mortgage rates and consumer inflation could temper the pace of discretionary remodeling from 2026.

Energy-Efficient Kilns Lowering Production Cost

Next-generation kilns equipped with high-speed burners and waste-heat recovery reduce gas consumption by as much as 50% and improve EBITDA resilience when energy markets spike. Italian and Spanish clusters lead adoption, with 28 manufacturers operating combined-heat-and-power units by 2024. The European Investment Bank's EUR 50 million loan to Panariagroup underscores policy alignment between decarbonization goals and cost competitiveness. Producers achieving double-digit emission reductions earn EU ETS allowances and build reputational advantages that aid in public tender pre-qualification. Over the long term, kiln retrofits are expected to narrow variable-cost gaps between European and Turkish or Asian competitors.

Volatile Natural-Gas Prices

Natural-gas represents roughly 30% of production cost, and 2024 spot-price swings forced several producers to idle kilns for weeks. Input-cost volatility complicates long-term supply contracts, encouraging downstream wholesalers to diversify toward Asian imports. Firms with hedging programs or captive renewable power have fared better, yet pass-through pricing remains only partially effective in price-sensitive renovation sub-segments. The energy shock showcased Europe ceramic tiles market exposure to geopolitical risk and underlined the urgency of renewable electrification in firing lines. Short-term relief is visible as gas storage levels normalize, although volatility risks persist until hydrogen-ready kilns scale.

Other drivers and restraints analyzed in the detailed report include:

- EU "Renovation Wave" Policy Grants

- Green Building Certification Uptake

- Tightening EU ETS Carbon Costs on Kilns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles retained 46.75% share of the Europe ceramic tiles market in 2025 owing to frost resistance and sub-1% water absorption that suit indoor and outdoor environments. Mosaic formats, although volume-light, are projected to clock a 2.58% CAGR through 2031 because luxury bathroom and kitchen remodels favor intricate patterns and bold colorways. Glazed ceramic serves mid-price refurbishment jobs, while unglazed tiles keep traction in factory floors and transit hubs that demand slip resistance. The Europe ceramic tiles market size for porcelain is expected to exceed USD 4.28 billion by 2031, supported by wood-look and stone-look aesthetics that displace timber and marble. Premium suppliers differentiate via through-body pigmentation, rectified edges and thin-tile technologies that reduce shipping weight without sacrificing durability.

Mosaic manufacturing remains capital-intensive because glass-mesh backing and hand-placement steps add labor hours, yet unit margins compensate for modest volumes. Designers specify mosaics for hotel lobbies and spa facilities where bespoke geometry raises perceived property value. Automation advances such as robotic tesserae placement are gradually lowering cost per square meter, opening mid-market opportunities. Sustainability-minded architects also privilege mosaics that upcycle waste glass or porcelain shards, integrating circular-economy narratives into project bids. Overall, product differentiation will keep the Europe ceramic tiles market fragmented but profitable for firms with brand equity and specialized capability.

Floor installations captured 59.45% of the Europe ceramic tiles market size in 2025, underpinned by long replacement cycles and durability in high-traffic zones. Commercial landlords choose porcelain slabs to cut lifetime maintenance costs versus laminate or carpet, reinforcing baseline volume stability. The segment's CAGR is muted, yet shear volume ensures it remains a revenue bedrock for kiln operators. Ice-resistant extruded tiles also hold niche appeal in Nordic patios and alpine ski resorts, adding seasonal peaks to demand. Continuous-inkjet digital printing enhances realism, making floor tiles an affordable alternative to quarried stone.

Wall applications, while smaller, are forecast to expand at a 2.59% CAGR through 2031 due to germ-resistant glazes and large-format panels that create seamless visuals. Hospitals and hospitality venues increasingly request antimicrobial surfaces such as Panariagroup's PROTECT line, which inhibits 99.9% of bacterial colonization. Large 120 X 278 cm tiles shorten installation times and reduce grout lines that can harbor pathogens, attractive traits in post-pandemic design briefs. Lightweight slim panels also enable direct-to-existing-surface installation, avoiding demolition waste and lowering renovation downtime. Consequently, wall applications represent a strategic growth vector within the wider Europe ceramic tiles market.

The Europe Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Tile & Stone Stores, and More), and Geography (Germany, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Marazzi Group S.r.l

- Porcelanosa Grupo

- RAK Ceramics

- Ceramiche Atlas Concorde

- Villeroy & Boch

- Grupo STN

- Novoceram (Panaria)

- Tau Ceramica

- Iris Ceramica Group

- Gruppo Concorde

- ABK Group

- Emilgroup

- Florim

- Pamesa Ceramica

- Keraben Grupo

- Lasselsberger (Rako)

- Kajaria Ceramics (EU subsidiaries)

- Mohawk Industries (Dal-Tile Europe)

- Levantina

- Gigacer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid residential renovation wave post-COVID stimulus

- 4.2.2 Energy-efficient kilns lowering production cost

- 4.2.3 EU "Renovation Wave" policy grants

- 4.2.4 Green Building certification uptake

- 4.2.5 Urbanisation in CEE boosting multi-family housing

- 4.2.6 Shift to antibacterial & antiviral surface tiles

- 4.3 Market Restraints

- 4.3.1 Volatile natural-gas prices

- 4.3.2 Tightening EU ETS carbon costs on kilns

- 4.3.3 Substitution by LVT & SPC flooring

- 4.3.4 Labour shortages in Western Europe construction

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 Italy

- 5.6.3 Spain

- 5.6.4 France

- 5.6.5 United Kingdom

- 5.6.6 Poland

- 5.6.7 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.8 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Marazzi Group S.r.l

- 6.4.2 Porcelanosa Grupo

- 6.4.3 RAK Ceramics

- 6.4.4 Ceramiche Atlas Concorde

- 6.4.5 Villeroy & Boch

- 6.4.6 Grupo STN

- 6.4.7 Novoceram (Panaria)

- 6.4.8 Tau Ceramica

- 6.4.9 Iris Ceramica Group

- 6.4.10 Gruppo Concorde

- 6.4.11 ABK Group

- 6.4.12 Emilgroup

- 6.4.13 Florim

- 6.4.14 Pamesa Ceramica

- 6.4.15 Keraben Grupo

- 6.4.16 Lasselsberger (Rako)

- 6.4.17 Kajaria Ceramics (EU subsidiaries)

- 6.4.18 Mohawk Industries (Dal-Tile Europe)

- 6.4.19 Levantina

- 6.4.20 Gigacer

7 Market Opportunities & Future Outlook

- 7.1 Advances in Self-Cleaning Photocatalytic Coatings for Tiles

- 7.2 Circular Economy Initiatives: Tile Take-Back and Recycling Schemes