PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906158

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906158

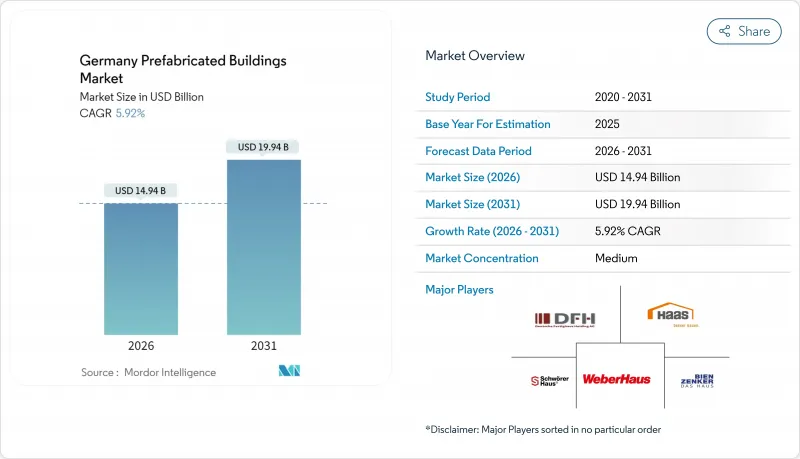

Germany Prefabricated Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany prefabricated buildings market was valued at USD 14.10 billion in 2025 and estimated to grow from USD 14.94 billion in 2026 to reach USD 19.94 billion by 2031, at a CAGR of 5.92% during the forecast period (2026-2031).

Ongoing housing shortages, evidenced by only 252,000 new apartments completed in 2024 against a federal goal of 400,000, sustain demand for faster, factory-led construction solutions. The adoption of timber modules that offer strong thermal performance and carbon storage gains momentum as the Gebaudeenergiegesetz (GEG) 2024 mandates at least 65% renewable energy in new heating systems, aligning low-carbon materials with regulatory compliance.

Skilled-labor deficits, with construction employment slipping 1.3% in 2024, incentivize off-site manufacturing that reduces site-based craft requirements while improving productivity. Meanwhile, digital design mandates such as Building Information Modeling (BIM) enable repeatable, serial production workflows, further strengthening the case for industrialized building methods.

Germany Prefabricated Buildings Market Trends and Insights

400k-Homes Federal Target Catalyzing Serial Construction

The federal target of 400,000 annual housing completions remains unmet, producing a structural gap that elevates serial construction techniques capable of compressing build times from up to 24 months to near 12 months. Municipalities increasingly earmark larger shares of new projects for factory-produced elements, while a degressive 5% depreciation incentive retroactively applied to October 2023 start dates further accelerates prefabricated uptake. Streamlined procurement frameworks and standardized component catalogs shorten approval cycles, allowing regional governments to bundle demand and negotiate volume-based pricing. Continuous demand visibility encourages manufacturers to invest in line automation, boosting annual module throughput and lowering per-unit costs. The resulting scalability cements the Germany prefabricated buildings market as a pivotal instrument in closing the national housing gap.

Skilled-Labor Shortage Elevating Off-Site Productivity Appeal

Construction employment fell by 6,000 positions to an average of 910,000 in 2025, and 24% of firms report order book constraints tied directly to workforce gaps. Shifting labor-intensive tasks into climate-controlled factories leverages repetitive workflows and robotics that can double per-worker output compared with on-site methods. Factory settings also improve occupational safety and job appeal, helping attract younger talent otherwise deterred by outdoor site conditions. As demographic headwinds persist, contractors are forging partnerships with vocational schools to integrate digital fabrication curricula, ensuring a steady pipeline of specialized technicians. Productivity gains derived from these partnerships underpin the steady 6.0% CAGR projected for the Germany prefabricated buildings market.

High Construction-Loan Interest & Tightened Lending for MMC

Elevated financing costs have suppressed residential starts, with building permits slipping 26.7% to 259,600 units in 2024. Banks categorize modern methods of construction as higher-risk, often insisting on larger equity buffers that smaller prefab developers struggle to supply. As interest rates remain above long-term averages, buyer affordability for prefabricated single-family homes priced near EUR 450,000 becomes constrained, extending sales cycles and inflating inventory carrying costs. Although state-backed KfW low-carbon loan programs mitigate some pressure, liquidity shortages for mid-tier manufacturers still dampen near-term capacity expansions. These funding headwinds subtract 1.1 percentage points from the otherwise buoyant Germany prefabricated buildings market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Gebaudeenergiegesetz (GEG) Favoring Low-Waste Timber Modules

- Digital-by-Default BIM Mandate Enabling Industrialized Design-for-Manufacture

- Disparate Lander Building Codes Inflating Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Timber accounted for 34.20% of the Germany prefabricated buildings market size in 2025 and is projected to grow at a segment-leading 6.51% CAGR through 2031. High carbon-sequestration capacity and outstanding thermal resistance enable timber modules to satisfy stringent GEG thresholds without expensive retrofits. Engineered formats such as CLT and dowel-laminated timber support five- to eight-storey builds, expanding timber's addressable market beyond single-family homes.

Momentum is visible in large-scale programs like Berlin's Schumacher Quartier, a 5,000-apartment community built predominantly from wood that will lock away substantial CO2 over its lifecycle. Glass remains critical for facade transparency and daylighting, while metal optimizes load-bearing junctions and hybrid stiffness, ensuring long-term durability. Concrete still performs foundational and shear-wall roles, yet its relative emissions push designers toward partial substitution with bio-based composites. Forward-looking research-exemplified by the University of Stuttgart's flax-reinforced pavilion-signals a pipeline of novel materials poised to enrich the Germany prefabricated buildings market over the next decade.

The Germany Prefabricated Buildings Market Report is Segmented by Material Type (Concrete, Glass, Metal, Timber, and Other Materials), Application (Residential, Commercial, and Others), Product Type (Modular Buildings, Panelized and Componentized Systems, Other Prefab Types), and Key Cities (Berlin, Hamburg, Munich, Cologne, Frankfurt, and Rest of Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DFH Deutsche Fertighaus Holding AG

- Bien-Zenker GmbH

- WeberHaus GmbH & Co. KG

- SchworerHaus KG

- Haas Fertigbau GmbH

- Goldbeck GmbH

- Cadolto Modulbau GmbH

- Kleusberg GmbH & Co. KG

- Kampa GmbH

- Luxhaus GmbH & Co. KG

- Baufritz GmbH & Co. KG

- WOLF System GmbH

- Viebrockhaus AG

- HELMA Eigenheimbau AG

- ALHO Systembau GmbH

- Renggli Deutschland GmbH

- Huf Haus GmbH & Co. KG

- Kleibauer Modulbau

- Otto Building Technologies GmbH

- WERKHAUS RaumSysteme GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 400k-Homes Federal Target Catalyzing Serial Construction

- 4.2.2 Skilled-Labour Shortage Elevating Off-Site Productivity Appeal

- 4.2.3 Stricter Gebaudeenergiegesetz (GEG) Favouring Low-Waste Timber Modules

- 4.2.4 Digital-by-Default BIM Mandate Enabling Industrialised Design-for-Manufacture

- 4.2.5 Bundeswehr "NextGen Barracks" Programme Specifying Volumetric Pods

- 4.2.6 Auto-OEM Brownfield Lines Repurposed for Worker Housing Micro-Units

- 4.3 Market Restraints

- 4.3.1 High Construction-Loan Interest & Tightened Lending for MMC

- 4.3.2 Disparate Lander Building Codes Inflating Compliance Costs

- 4.3.3 Fire-Insurance Premium Surge for Multi-Storey Timber Hybrids

- 4.3.4 Factory Utilisation Risk amid Cyclical Residential Demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Brief on Different Structures Used in Prefabricated Buildings

- 4.9 Cost Structure Analysis of Prefabricated Buildings

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Concrete

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Timber

- 5.1.5 Other Materials

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Others

- 5.3 By Product Type

- 5.3.1 Modular Buildings

- 5.3.2 Panelized & Componentized Systems

- 5.3.3 Other Prefab Types

- 5.4 By Key Cities

- 5.4.1 Berlin

- 5.4.2 Hamburg

- 5.4.3 Munich

- 5.4.4 Cologne

- 5.4.5 Frankfurt

- 5.4.6 Rest of Germany

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 DFH Deutsche Fertighaus Holding AG

- 6.4.2 Bien-Zenker GmbH

- 6.4.3 WeberHaus GmbH & Co. KG

- 6.4.4 SchworerHaus KG

- 6.4.5 Haas Fertigbau GmbH

- 6.4.6 Goldbeck GmbH

- 6.4.7 Cadolto Modulbau GmbH

- 6.4.8 Kleusberg GmbH & Co. KG

- 6.4.9 Kampa GmbH

- 6.4.10 Luxhaus GmbH & Co. KG

- 6.4.11 Baufritz GmbH & Co. KG

- 6.4.12 WOLF System GmbH

- 6.4.13 Viebrockhaus AG

- 6.4.14 HELMA Eigenheimbau AG

- 6.4.15 ALHO Systembau GmbH

- 6.4.16 Renggli Deutschland GmbH

- 6.4.17 Huf Haus GmbH & Co. KG

- 6.4.18 Kleibauer Modulbau

- 6.4.19 Otto Building Technologies GmbH

- 6.4.20 WERKHAUS RaumSysteme GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment