PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906892

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906892

Europe Prefabricated Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

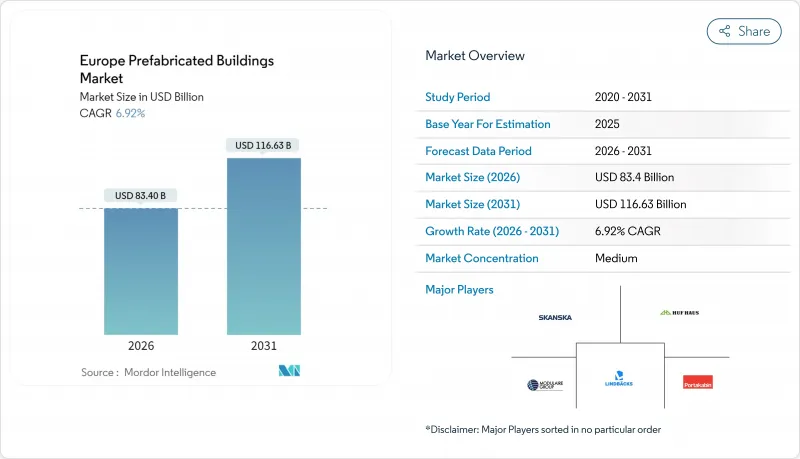

The Europe prefabricated buildings market was valued at USD 78.0 billion in 2025 and estimated to grow from USD 83.4 billion in 2026 to reach USD 116.63 billion by 2031, at a CAGR of 6.92% during the forecast period (2026-2031).

Demand gains reflect the alignment of off-site manufacturing with tightening embodied-carbon rules, growing ESG capital flows, and chronic construction labor shortages that favor factory-based production. Pan-European directives now require life-cycle carbon disclosure, giving prefabricators a measurable advantage in compliance and permitting speed.

Digitally enabled factories in Germany, Sweden, and the Netherlands are reducing cycle times by 20-35% through predictive quality control and automated assembly sequencing. At the same time, EU Taxonomy rules unlock lower-cost green bonds for projects that use timber and other low-carbon materials, expanding the pool of institutional capital available for large-scale modular programs. Collectively, these forces keep the Europe prefabricated buildings market on a structural growth path even as conventional on-site activity faces slowing building permits and cost overruns.

Europe Prefabricated Buildings Market Trends and Insights

EU-level embodied-carbon caps accelerating off-site construction

Member-state implementation of the revised Energy Performance of Buildings Directive requires all new homes to disclose life-cycle carbon as early as 2027, with Denmark tightening limits to 7.1 kg CO2e/m2/year beginning July 2025. Factory-built solutions consistently achieve 20-30% lower embodied carbon because controlled environments optimize material use and facilitate closed-loop waste recovery, giving compliant manufacturers a clear route to planning approvals and green financing. Digital product passports mandated under the 2024 Construction Products Regulation further favor standardized components whose emissions are traceable from cradle to gate. Prefabricators are therefore scaling capacity ahead of the enforcement timetable to secure early-mover contracts, particularly in Germany and the Nordics where municipalities have already embedded carbon ceilings in tender documents. The regulatory certainty is translating into long-term offtake agreements that underpin investment in next-generation volumetric lines.

Persistent skilled-labor shortages across Western Europe

Vacancy rates in European construction reached a decade high in 2025 as retirements outpaced new entrants and wage inflation cut margins for traditional contractors. Prefabrication addresses this structural gap by shifting up to 90% of trade hours into automated factories where training cycles are shorter and safety conditions are superior. Swedish plants already post 30% higher labor productivity than comparable on-site crews, proving how standardized workflows unlock scale without proportional head-count growth. Governments view the model as a route to maintain housing targets despite tight labor markets, which is why Germany's KfW climate-friendly new-build program links subsidized loans to projects demonstrating off-site assembly ratios. Near-term momentum therefore hinges on employers' ability to retrain workers for digitized factory roles rather than traditional wet-trade skills.

Cross-border permitting fragmentation within EU/EEA

The Construction Products Regulation introduces unified CE-marking and digital product passports, yet member-state interpretations of fire safety or seismic criteria still diverge, forcing prefab producers to carry multiple certification sets and redesign modules for each jurisdiction. Implementation timelines stretch to 2028, prolonging uncertainty and increasing engineering overheads that smaller manufacturers cannot amortize. Germany's stringent DIN standards on timber connections, for example, add structural reinforcement costs when exporting to France, where Eurocode adaptations are less prescriptive. Until harmonization matures, the Europe prefabricated buildings market will incur parallel design and testing expenses that suppress margin expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rapid hyperscale data-center rollout needing long-span PEBs

- Member-state green social-housing funds favor volumetric units

- High last-mile logistics cost for oversize modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Europe's prefabricated buildings market share reflects its suitability for both volumetric housing and multi-storey commercial schemes, where cross-laminated timber delivers high strength-to-weight ratios and four-hour fire ratings . The EU Taxonomy identifies engineered wood as a primary pathway to "Substantial Contribution" status, drawing in pension and sovereign wealth funds that view biogenic carbon storage as a hedge against future carbon pricing. Scandinavian supply chains currently dominate CLT exports, but capacity additions in Austria and Germany aim to mitigate lead-time bottlenecks.

Concrete holds a sizeable portion of the precast market, particularly for parking structures and industrial slabs, where controlled curing reduces embodied carbon relative to in-situ pours. Metal remains the default for long-span data center shells and logistics hubs, benefiting from high recycling rates that now exceed 90% in European steel production. Hybrid systems are gaining traction as designers specify timber cores paired with concrete podiums to optimize seismic resilience while retaining carbon benefits. Supply risk for structural wood is the principal headwind; certification bodies recorded a 12% shortfall in CE-marked CLT volumes in 2024, prompting research into laminated bamboo and agrifiber panels as complementary feedstocks that can widen material choice without compromising circularity targets.

Europe Prefabricated Buildings Market is Segmented by Material Type (Concrete, Glass, Metal, Timber, and Other Materials), Application (Residential, Commercial, and Others), Product Type (Modular Buildings, Panelized & Componentized Systems, Other Prefab Types), Country (Germany, UK, France, Spain, Italy, Netherlands, Sweden, Denmark, Norway, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Modulaire Group (Algeco Scotsman)

- Bouygues Construction

- Laing O'Rourke

- Skanska AB

- Lindbacks Bygg

- Portakabin Ltd

- Cadolto Modulares Bauen

- CREE GmbH

- Huscompagniet A/S

- Huf Haus

- Danwood S.A.

- Volumetric Building Companies (VBC Europe)

- Harmet OU

- Baufritz GmbH

- Peikko Group

- KOMA Modular

- Secalflor SE

- Leko Labs

- Goldbeck GmbH

- Ballex Metal

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU-level embodied-carbon caps accelerating off-site construction

- 4.2.2 Persistent skilled-labour shortages across Western Europe

- 4.2.3 Rapid hyperscale-data-centre rollout needing long-span PEBs

- 4.2.4 Member-state green-social-housing funds favour volumetric units

- 4.2.5 EU Taxonomy "Substantial Contribution" label unlocking green-bond capital (under-reported)

- 4.2.6 Industry 4.0 digital-twin factories slashing cycle-times (under-reported)

- 4.3 Market Restraints

- 4.3.1 Cross-border permitting fragmentation within EU/EEA

- 4.3.2 High last-mile logistics cost for oversize modules

- 4.3.3 Limited CLT & LVL supply versus fast-growing demand (under-reported)

- 4.3.4 VAT-treatment complexity on intra-EU modular transfers (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Brief on Different Structures Used in Prefabricated Buildings

- 4.9 Cost Structure Analysis of Prefabricated Buildings

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Concrete

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Timber

- 5.1.5 Other Materials

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Others

- 5.3 By Product Type

- 5.3.1 Modular Buildings

- 5.3.2 Panelized & Componentized Systems

- 5.3.3 Other Prefab Types

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 Netherlands

- 5.4.7 Sweden

- 5.4.8 Denmark

- 5.4.9 Norway

- 5.4.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Modulaire Group (Algeco Scotsman)

- 6.4.2 Bouygues Construction

- 6.4.3 Laing O'Rourke

- 6.4.4 Skanska AB

- 6.4.5 Lindbacks Bygg

- 6.4.6 Portakabin Ltd

- 6.4.7 Cadolto Modulares Bauen

- 6.4.8 CREE GmbH

- 6.4.9 Huscompagniet A/S

- 6.4.10 Huf Haus

- 6.4.11 Danwood S.A.

- 6.4.12 Volumetric Building Companies (VBC Europe)

- 6.4.13 Harmet OU

- 6.4.14 Baufritz GmbH

- 6.4.15 Peikko Group

- 6.4.16 KOMA Modular

- 6.4.17 Secalflor SE

- 6.4.18 Leko Labs

- 6.4.19 Goldbeck GmbH

- 6.4.20 Ballex Metal

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment