PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910471

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910471

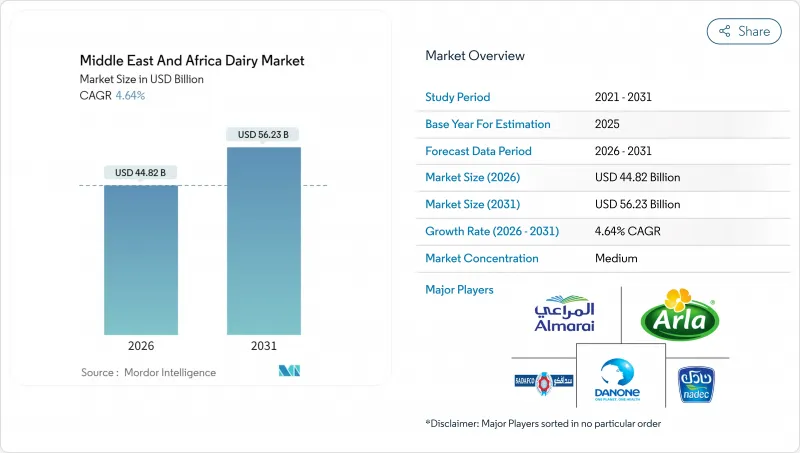

Middle East And Africa Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East and Africa dairy market size in 2026 is estimated at USD 44.82 billion, growing from 2025 value of USD 42.83 billion with 2031 projections showing USD 56.23 billion, growing at 4.64% CAGR over 2026-2031.

This growth is supported by government-funded school milk programs, product innovations catering to on-the-go consumption, and increasing demand for premium products with functional benefits. However, challenges such as gaps in cold-chain infrastructure and competition from plant-based alternatives are limiting further expansion. Saudi Arabia is projected to contribute 31.31% of the 2024 output, driven by Almarai's USD 4.8 billion investment in farm-to-logistics operations. The United Arab Emirates is expected to achieve the highest growth rate at a CAGR of 5.89%, supported by the growth of organic cow- and camel-milk brands. Yogurt is the fastest-growing category, with a CAGR of 5.93%, driven by the popularity of probiotic spoonable and drinkable products, while milk remains a key category due to shelf-stable ultra-high-temperature (UHT) products that address refrigeration challenges. Modern retail channels are anticipated to account for 65.43% of 2024 off-trade distribution, while on-trade channels, including hotels, restaurants, and cafes, are recovering alongside the resurgence of Gulf hospitality. Competitive intensity remains moderate, with leading national players benefiting from strong domestic market positions, while multinational companies are increasingly entering the market through joint ventures and premium product segments.

Middle East And Africa Dairy Market Trends and Insights

Rising Health Consciousness Boosting Interest in Probiotic, Fortified, and Lactose-Free Dairy

Functional dairy has shifted from being a niche category to a standard expectation in the Gulf Cooperation Council (GCC) region, driven by consumers' growing focus on ingredient labels for live cultures, added vitamins, and lactose-free claims. In Abu Dhabi, the 2024 school nutrition guidelines mandate that all dairy products served in public schools meet specific minimum thresholds for calcium and vitamin D, effectively excluding commodity suppliers and favoring brands that invest in fortification. For example, Mleiha Dairy in the United Arab Emirates launched a lactose-free laban product line in early 2025, quickly capturing a significant share of the emirate's laban market by addressing the needs of the substantial proportion of Middle Eastern adults who experience lactose malabsorption. In Saudi Arabia, the demand for probiotic yogurt surged, supported by social media campaigns highlighting the connection between gut microbiome health and immunity-a message that resonated strongly with consumers amid heightened health awareness following the pandemic. Similarly, Danone's Activia brand, reformulated with the Bifidobacterium lactis strain, experienced notable volume growth in Egypt during 2024, demonstrating how science-backed strain specificity can justify premium pricing, even in price-sensitive markets. Furthermore, in 2024, the federal government allocated AED 5 billion to healthcare, as reported by the United States-United Arab Emirates Business Council .

Government-Backed School Milk and Nutrition Programs Creating Stable Institutional Demand

School milk schemes provide a consistent demand base for producers, shielding them from retail market fluctuations while imposing strict quality and traceability requirements that often benefit vertically integrated dairies. In 2024, the Ministry of Education in Saudi Arabia renewed its five-year school milk contract, committing to supply hundreds of millions of 200-milliliter cartons annually to millions of students, representing a significant share of the Kingdom's total fluid milk consumption. Almarai and SADAFCO jointly hold this contract, utilizing ultra-high-temperature processing to extend shelf life for several months without refrigeration, a crucial feature for schools in remote areas with limited access to reliable cold storage. In Egypt, the Takaful and Karama social protection program, which supports millions of families, includes a monthly dairy voucher redeemable at government-approved retailers, channeling a substantial annual amount into the formal dairy sector and reducing reliance on informal, unbranded milk sources. Meanwhile, in Qatar, the Supreme Council of Health mandates that all school cafeterias provide at least one fortified dairy option per meal, prompting Baladna to develop a vitamin D-enriched flavored milk product that now contributes significantly to the company's domestic revenue. Additionally, in Saudi Arabia, the Ministry of Education has emphasized the impact of its nationwide school nutrition initiative, which serves 5.2 million students across 35,000 schools and has created a stable institutional demand valued at approximately USD 400 million in 2024 .

Rising Consumer Interest in Plant-Based Alternatives, Especially in Urban Centers

Plant-based milk alternatives have transitioned from niche health stores to prominent shelf space in mainstream supermarkets across Dubai, Riyadh, and Cairo, reducing dairy's volume share among urban millennials and Generation Z consumers. Nuitree, a United Arab Emirates-based oat milk brand launched in 2024, achieved listings in Carrefour and Spinneys within six months and reported first-year sales of USD 3.2 million. Although this figure may seem modest, it reflects the rapid adoption of plant-based dairy in a market where such products were nearly absent just a few years ago. In 2024, almond and oat drinks in the United Arab Emirates experienced significant volume growth, while conventional cow's milk saw minimal growth. This disparity led Almarai to announce in September 2025 its plans to consider launching a plant-based product line in 2026. Additionally, as of 2024, 10% of Saudi Arabia's population identified as vegetarian or vegan, according to Farmlandgrab .

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Preference for Convenient, Ready-to-Drink and Single-Serve Dairy Formats

- Cultural Attachment to Traditional Products Such as Laban, Labneh, and Sour Milk Drinks

- Inadequate Cold-Chain Coverage and Power Reliability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milk accounted for 33.12% of the product-type share in 2025, primarily driven by Ultra-High Temperature (UHT) milk variants, which hold a significant position in the Gulf Cooperation Council (GCC) region. The consistently high ambient temperatures in the region, typically ranging between 35 degrees Celsius and 45 degrees Celsius during the summer months, create logistical difficulties for distributing refrigerated fresh milk, particularly in areas outside major urban centers. This has led to a preference for UHT milk, which does not require refrigeration and is better suited to the region's climatic and logistical conditions.

Yogurt is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.70% from 2026 to 2031, supported by the increasing popularity of probiotic-enriched and drinkable formats that cater to on-the-go lifestyles. Notably, Danone's Activia and local brands such as SADAFCO's Saudia Yoghurt reported a combined volume growth of 21% in Saudi Arabia in 2024. Cheese imports are expected to increase by 26% in value by 2030, driven by expatriate demand for European-style natural cheeses and the reliance of quick-service restaurant chains on processed cheese for menu standardization. In South Africa, Clover Industries reported a 14% growth in its cheddar line in 2024, surpassing overall dairy market growth, as pizza and burger chains expanded their store networks.

The Middle East and Africa Dairy Market Report is Segmented by Product Type (Butter, Cheese, Cream, Dairy Desserts, Milk, Yogurt, Sour Milk Drinks), Distribution Channel (On-Trade, Off-Trade), and Geography (United Arab Emirates, Qatar, Saudi Arabia, Egypt, Bahrain, Oman, and Others). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

List of Companies Covered in this Report:

- Almarai Company

- Saudia Dairy and Foodstuff Company (SADAFCO)

- National Agricultural Development Company (NADEC)

- Arla Foods AmbA

- Groupe Lactalis

- Nestle S.A.

- Al Rashed Food Company

- AlRawabi Dairy Company

- Danone SA

- Bel SA

- Fonterra Co-operative Group

- National Food Products Company (NFC)

- Almunajem Foods

- Saad Group

- Al-Jouf Agriculture Development Company

- Al Marai Home

- Saudi Modern Factory for Food Industries

- Tamimi Markets

- Nesma Holding

- Gulf Dairy Products Company

- Bateel Dairy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health consciousness boosting interest in probiotic, fortified, and lactose-free dairy

- 4.2.2 Government-backed school milk and nutrition programs creating stable institutional demand

- 4.2.3 Public health campaigns that promote balanced diets and adequate calcium, vitamin D, and protein intake

- 4.2.4 Growing consumer preference for convenient, ready-to-drink and single-serve dairy formats

- 4.2.5 Rising interest in organic and "clean-label" dairy products

- 4.2.6 Cultural attachment to traditional products such as laban, labneh, and sour milk drinks

- 4.3 Market Restraints

- 4.3.1 Rising consumer interest in plant-based alternatives, especially in urban centers

- 4.3.2 Stricter environmental and animal-welfare expectations increasing compliance costs

- 4.3.3 Halal-certification delays and costs for imported ingredients limiting the speed of innovation and new product launches

- 4.3.4 Inadequate cold-chain coverage and power reliability

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Butter

- 5.1.2 Cheese

- 5.1.2.1 Natural Cheese

- 5.1.2.1.1 Cheddar

- 5.1.2.1.2 Cottage

- 5.1.2.1.3 Ricotta

- 5.1.2.1.4 Parmesan

- 5.1.2.1.5 Others

- 5.1.2.2 Processed Cheese

- 5.1.2.1 Natural Cheese

- 5.1.3 Cream

- 5.1.3.1 Fresh Cream

- 5.1.3.2 Cooking Cream

- 5.1.3.3 Whippng Cream

- 5.1.3.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 Ice Cream

- 5.1.4.2 Cheesecakes

- 5.1.4.3 Frozen Desserts

- 5.1.4.4 Others

- 5.1.5 Milk

- 5.1.5.1 Condensed milk

- 5.1.5.2 Flavored Milk

- 5.1.5.3 Fresh Milk

- 5.1.5.4 UHT Milk (Ultra-high temperature milk)

- 5.1.5.5 Powdered Milk

- 5.1.6 Yogurt

- 5.1.6.1 Drinkable

- 5.1.6.2 Spoonable

- 5.1.7 Sour Milk Drinks

- 5.2 By Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Convenience Stores

- 5.2.2.2 Specialist Retailers

- 5.2.2.3 Supermarkets and Hypermarkets

- 5.2.2.4 On-line Retail

- 5.2.2.5 Others

- 5.3 By Country

- 5.3.1 United Arab Emirates

- 5.3.2 Qatar

- 5.3.3 Saudi Arabia

- 5.3.4 Bahrain

- 5.3.5 Oman

- 5.3.6 Kuwait

- 5.3.7 Nigeria

- 5.3.8 Egypt

- 5.3.9 South Africa

- 5.3.10 Iran

- 5.3.11 Rest of the Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Almarai Company

- 6.4.2 Saudia Dairy and Foodstuff Company (SADAFCO)

- 6.4.3 National Agricultural Development Company (NADEC)

- 6.4.4 Arla Foods AmbA

- 6.4.5 Groupe Lactalis

- 6.4.6 Nestle S.A.

- 6.4.7 Al Rashed Food Company

- 6.4.8 AlRawabi Dairy Company

- 6.4.9 Danone SA

- 6.4.10 Bel SA

- 6.4.11 Fonterra Co-operative Group

- 6.4.12 National Food Products Company (NFC)

- 6.4.13 Almunajem Foods

- 6.4.14 Saad Group

- 6.4.15 Al-Jouf Agriculture Development Company

- 6.4.16 Al Marai Home

- 6.4.17 Saudi Modern Factory for Food Industries

- 6.4.18 Tamimi Markets

- 6.4.19 Nesma Holding

- 6.4.20 Gulf Dairy Products Company

- 6.4.21 Bateel Dairy

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK