PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911774

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911774

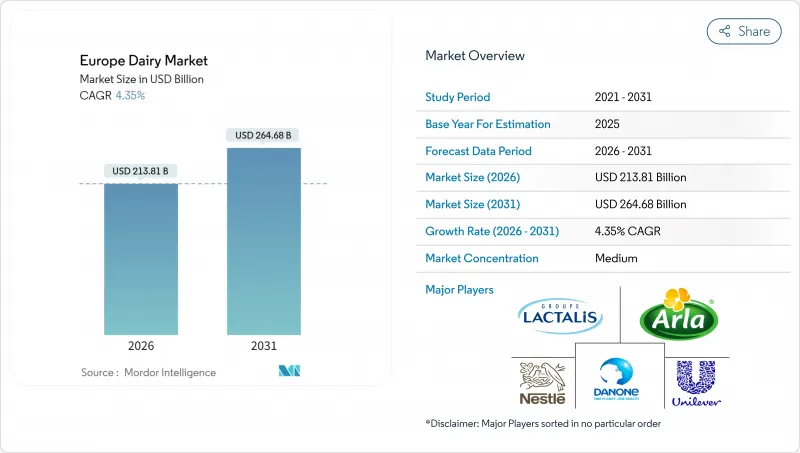

Europe Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European dairy market was valued at USD 204.90 billion in 2025 and estimated to grow from USD 213.81 billion in 2026 to reach USD 264.68 billion by 2031, at a CAGR of 4.35% during the forecast period (2026-2031).

Demand is shifting away from traditional fluid milk toward premium and functional categories, such as organic products, dairy desserts, and protein-fortified lines. Functional yogurts and fortified cheese products are experiencing increased innovation, driven by claims focusing on immune support, gut health, and bone strength. Growing health consciousness is fueling demand for low-fat, high-protein, and probiotic-rich dairy products, including Greek yogurts and fortified milk variants. The EU's strict food safety and labeling regulations strengthen consumer confidence by ensuring the purity and traceability of domestic dairy products. In response, major processors are adopting carbon-neutral certifications, recyclable packaging, and closer collaborations with farmers. These efforts help secure raw-milk supplies and premium shelf space. As liquid-milk volumes decline, sustainability mandates are driving herd optimization, capacity shifts, and investments in value-added formats that offer higher margins. The competitive landscape is intensifying as cooperatives and multinationals pursue mergers to offset raw-milk inflation and achieve scale efficiencies.

Europe Dairy Market Trends and Insights

Rising consumer demand for organic and natural dairy products

European consumers, particularly those who are health-conscious, are driving significant changes in the organic dairy segment by increasingly prioritizing transparency and sustainability in their food choices. This evolving preference extends beyond the confines of traditional organic certification. Processors are now focusing on eliminating artificial additives and promoting farm-to-table narratives to align with consumer expectations. Western European markets are at the forefront of this trend, as consumers in these regions exhibit a higher willingness to pay premiums for certified organic products. The European Union Organic Regulation 2018/848 plays a crucial role in this shift by providing a standardized framework for quality assurance, ensuring consumer trust in organic labeling. Data from Skal Europe Organization highlights that by 2025, 22% of German consumers and 28% of Italian consumers are expected to pay a premium for sustainably produced food. This growing demand is encouraging major cooperatives to adopt vertical integration strategies. These cooperatives are securing organic milk supplies through long-term partnerships with farmers, which helps maintain consistent premium positioning in the market. The organic premium typically ranges between 20-30% above the prices of conventional dairy products. For processors capable of scaling their operations within organic supply chains, this premium offers a significant opportunity for sustainable margin expansion, reinforcing the economic viability of the organic dairy segment.

Innovation in product formats such as mini-packs and on-the-go portion sizes

European consumers are increasingly driving growth in the dairy desserts category by seeking indulgent experiences paired with trusted dairy ingredients. Dairy firms are responding by innovating with products that combine traditional elements and modern twists, such as fruit-infused yogurts, salted caramel custards, and matcha cream desserts. By exploring diverse flavor profiles like saffron, vanilla, and regional specialties such as tiramisu and speculoos, these companies are expanding consumption and attracting a broader age range. This evolution reflects a strategic shift from a health-focused approach to one centered on emotional satisfaction and premium experiences, with ice cream, cheesecakes, and frozen desserts spearheading the category's growth. Cross-category innovation is also fueling the segment, as traditional dairy processors collaborate with confectionery companies to develop hybrid products that combine dairy's nutritional value with indulgent taste profiles. In 2024, Lactalis-Nestle's joint venture introduced "Piacere di Yogurt," featuring milk cream enrichment to deliver velvety textures and position yogurt within the indulgent segment. Additionally, the category's growth is supported by the recovery of the foodservice sector, where restaurants and cafes emphasize premium dairy desserts as high-margin menu items that enhance customer satisfaction and increase average transaction values.

Elevated raw milk prices in the EU

Raw milk price inflation across the European Union is exerting significant margin pressure throughout the dairy value chain, compelling processors to balance cost pass-through with consumer price sensitivity. Milk prices in Europe are rising due to declining milk production. The USDA projects European Union milk production to slightly decrease to 149.4 million metric tons (MMT) in 2025, compared to 149.6 MMT in 2024. According to the European Commission Market Observatory, milk prices remain above historical averages, driven by rising feed costs, higher energy expenses, and reduced milk yields caused by climate-related stress on dairy herds. This cost pressure is particularly challenging for processors of commodity dairy products, where price elasticity limits their ability to pass on cost increases, resulting in margin compression and potential shifts in market share toward premium segments with greater consumer price tolerance. These conditions are driving strategic moves toward vertical integration, with larger processors securing milk supplies through long-term contracts or cooperative ownership structures to achieve better cost predictability. Smaller processors face heightened risks, as they lack the scale to negotiate favorable milk prices or absorb temporary margin compression during cost adjustment periods.

Other drivers and restraints analyzed in the detailed report include:

- Increasing consumer inclination towards dairy desserts and indulgent dairy-based snacks

- Rising demand for value-added functional dairy products

- Declining traditional liquid milk consumption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cheese accounts for 34.78% of the European dairy market in 2025, highlighting the region's long-standing cheesemaking tradition and advanced processing expertise, which enhance its competitiveness in global exports. Europe's leadership in the cheese segment is further supported by its wide range of cheese varieties and protected designation of origin certifications, enabling premium pricing in international markets. This is particularly evident for specialty cheeses such as Parmigiano-Reggiano and aged Gouda. Dairy desserts represent the fastest-growing category, with a projected 4.48% CAGR through 2031. This growth is driven by premiumization trends and innovative formats that blur the lines between dairy and confectionery. Butter production faces challenges from health-conscious consumer preferences and competition from plant-based alternatives, while yogurt continues to grow steadily, supported by probiotic innovations and functional positioning.

Milk products show varied performance: fresh milk volumes decline due to the rise of plant-based substitutes, while UHT and flavored milk segments benefit from their convenience and extended shelf life. Cream products achieve premium pricing but face volume constraints due to limited raw milk availability and competition from plant-based alternatives in foodservice. This shift in the product mix reflects broader consumer preferences for indulgence and functionality. Consequently, traditional commodity dairy products are losing market share to value-added categories that justify premium pricing by delivering enhanced experiences or health benefits.

The Europe Dairy Market Report is Segmented by Product Type (Butter, Cheese, Cream, Dairy Desserts, Milk, Yogurt, Sour Milk Drinks), Distribution Channel (On-Trade, Off-Trade), and Geography (United Kingdom, Germany, France, Italy, Spain, Russia, Sweden, Belgium, Poland, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Lactalis Group

- Nestle SA

- Danone SA

- Arla Foods Amba

- Royal FrieslandCampina

- Muller Group

- Savencia Fromage and Dairy

- Sodiaal

- DMK Group

- Valio

- Emmi

- Hochland

- Meggle

- Froneri

- Glanbia Plc

- Hochland Group

- Zott SE and Co. KG

- Arla Foods Cooperative

- Tirol Milch

- Unilever PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer demand for organic and natural dairy products

- 4.2.2 Innovation in product formats such as mini-packs and on-the-go portion sizes

- 4.2.3 Increasing consumer inclination towards dairy desserts and indulgent dairy-based snacks

- 4.2.4 Rising demand for value-added functional dairy products

- 4.2.5 Carbon-neutral milk certification opening premium shelf space

- 4.2.6 Robust export appetite for European cheese

- 4.3 Market Restraints

- 4.3.1 Elevated raw milk prices in the EU

- 4.3.2 Declining traditional liquid milk consumption

- 4.3.3 Scope-3 decarbonisation costs driving herd rationalisation

- 4.3.4 Emerging livestock-carbon taxation in Northern Europe

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Butter

- 5.1.2 Cheese

- 5.1.2.1 Natural Cheese

- 5.1.2.1.1 Cheddar

- 5.1.2.1.2 Cottage

- 5.1.2.1.3 Ricotta

- 5.1.2.1.4 Parmesan

- 5.1.2.1.5 Others

- 5.1.2.2 Processed Cheese

- 5.1.2.1 Natural Cheese

- 5.1.3 Cream

- 5.1.3.1 Fresh Cream

- 5.1.3.2 Cooking Cream

- 5.1.3.3 Whippng Cream

- 5.1.3.4 Others (Clottted, Sour Cream)

- 5.1.4 Dairy Desserts

- 5.1.4.1 Ice Cream

- 5.1.4.2 Cheesecakes

- 5.1.4.3 Frozen Desserts

- 5.1.4.4 Others (Puddings/desserts, trifles, fools)

- 5.1.5 Milk

- 5.1.5.1 Condensed milk

- 5.1.5.2 Flavored Milk

- 5.1.5.3 Fresh Milk

- 5.1.5.4 UHT Milk (Ultra-high temperature milk)

- 5.1.5.5 Powdered Milk

- 5.1.6 Yogurt

- 5.1.6.1 Drinkable

- 5.1.6.2 Spoonable

- 5.1.7 Sour Milk Drinks

- 5.2 By Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Convenience Stores

- 5.2.2.2 Specialist Retailers

- 5.2.2.3 Supermarkets and Hypermarkets

- 5.2.2.4 On-line Retail

- 5.2.2.5 Others (Warehouse clubs, gas stations, etc.)

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 Sweden

- 5.3.8 Belgium

- 5.3.9 Poland

- 5.3.10 Netherlands

- 5.3.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Lactalis Group

- 6.4.2 Nestle SA

- 6.4.3 Danone SA

- 6.4.4 Arla Foods Amba

- 6.4.5 Royal FrieslandCampina

- 6.4.6 Muller Group

- 6.4.7 Savencia Fromage and Dairy

- 6.4.8 Sodiaal

- 6.4.9 DMK Group

- 6.4.10 Valio

- 6.4.11 Emmi

- 6.4.12 Hochland

- 6.4.13 Meggle

- 6.4.14 Froneri

- 6.4.15 Glanbia Plc

- 6.4.16 Hochland Group

- 6.4.17 Zott SE and Co. KG

- 6.4.18 Arla Foods Cooperative

- 6.4.19 Tirol Milch

- 6.4.20 Unilever PLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK