PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911780

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911780

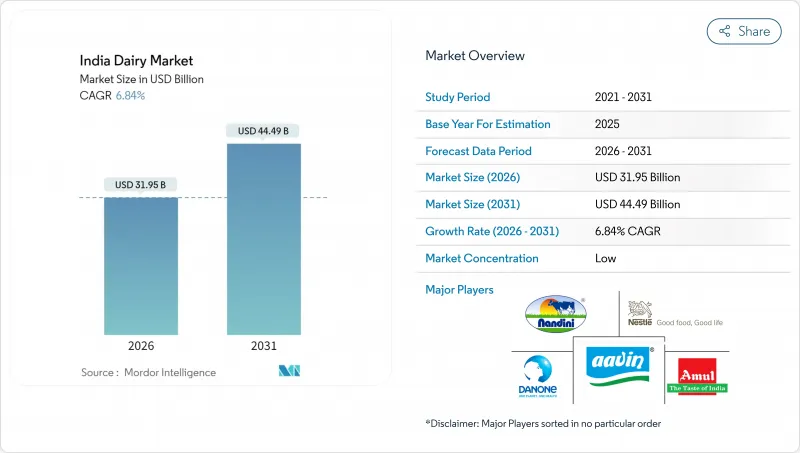

India Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Dairy market is expected to grow from USD 29.90 billion in 2025 to USD 31.95 billion in 2026 and is forecast to reach USD 44.49 billion by 2031 at 6.84% CAGR over 2026-2031.

This growth trajectory reflects the nation's position as the world's largest milk producer, with 239.3 million tonnes produced in 2023-24, supported by 80 million dairy farmers and a cooperative structure that processes over 60% of marketed milk . The market's resilience stems from India's unique dual structure combining traditional cooperatives with modern private enterprises, creating a competitive ecosystem that drives innovation while maintaining affordability. The market's resilience stems from India's unique dual structure combining traditional cooperatives with modern private enterprises, creating a competitive ecosystem that drives innovation while maintaining affordability. Rising urban incomes, expanding cold-chain corridors, and supportive digital payments spur organized retail penetration, while premium functional products widen profit pools for processors willing to invest in R&D. Private labels leverage subscription-based direct-to-consumer apps to bypass traditional intermediaries and defend margins against commodity-price swings. Meanwhile, government fiscal incentives for chilling centers and breed improvement anchor long-term supply stability, underpinning the India dairy products market's resilient growth story.

India Dairy Market Trends and Insights

Increasing Health Consciousness Drives Premium Dairy Adoption

Consumer behavior transformation positions protein-rich dairy products as essential nutrition sources, with 34% of Indian consumers actively seeking high-protein options according to recent surveys. This shift transcends traditional milk consumption patterns, driving demand for Greek yogurt, protein-enriched milk variants, and functional dairy products that address specific health concerns. Urban millennials and Gen-Z consumers increasingly view dairy as preventive healthcare, creating market opportunities for brands that communicate nutritional benefits effectively. The trend accelerates post-pandemic awareness about immunity and wellness, with dairy proteins positioned as accessible alternatives to expensive supplements. Premium pricing acceptance for health-focused products suggests sustainable margin expansion potential for manufacturers who invest in nutritional innovation and scientific validation.

Government Policy Framework Strengthens Cooperative Infrastructure

The National Programme for Dairy Development allocates INR 2,242 crore for 2024-25, focusing on productivity enhancement and infrastructure modernization across cooperative networks. This policy commitment extends beyond traditional subsidies to include technology adoption, breed improvement programs, and cold-chain development that directly impact market growth potential. The Rashtriya Gokul Mission's genetic improvement initiatives target 40% productivity increases through artificial insemination and superior breeding practices. Cooperative societies benefit from preferential lending rates and tax advantages that enable competitive pricing while maintaining farmer welfare objectives. The policy framework creates structural advantages for organized dairy processing, potentially consolidating market share away from informal sector participants who lack similar governmental support.

Perishability Constraints Limit Market Expansion Velocity

Cold-chain infrastructure gaps restrict dairy product distribution to within 200-300 kilometers of processing facilities, constraining national brand expansion and limiting rural market penetration. Product losses during transportation and storage average 15-20% for liquid milk products, creating cost structures that necessitate premium pricing in distant markets. Temperature-sensitive products like fresh cream and soft cheeses face even greater distribution challenges, limiting category growth potential in smaller cities. The constraint becomes more acute during summer months when ambient temperatures exceed 40°C across major dairy-producing regions. Investment requirements for cold-chain development often exceed small and medium processors' financial capabilities, creating competitive advantages for larger organizations with infrastructure resources.

Other drivers and restraints analyzed in the detailed report include:

- Product Innovation Accelerates Market Premiumization

- Ready-to-Consume Formats Capture Urban Convenience Demand

- Quality Standardization Challenges Undermine Consumer Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milk products command 61.07% market share in 2025, reflecting India's fundamental consumption patterns where liquid milk serves as the primary dairy staple across all economic segments. Fresh milk maintains the largest individual segment share, driven by daily consumption habits and cultural preferences for home-prepared dairy products like tea, coffee, and traditional sweets. UHT milk gains traction in urban markets where convenience and extended shelf-life justify premium pricing, while flavored milk variants capture younger demographics through innovative packaging and taste profiles, according to the National Dairy Development Board. Condensed milk and powdered milk segments serve both retail and industrial applications, with powdered variants particularly strong in rural areas where refrigeration limitations favor shelf-stable alternatives.

Yogurt emerges as the fastest-growing segment at 8.01% CAGR through 2031, driven by probiotic health benefits and premium positioning that attracts health-conscious consumers. Spoonable yogurt dominates this category, while drinkable variants gain momentum through convenience positioning and on-the-go consumption patterns. Cheese products experience robust growth despite lower absolute volumes, with processed cheese leading adoption through pizza and fast-food integration, while natural cheese varieties like cottage and ricotta cater to cooking applications. Dairy desserts including ice cream maintain steady growth, supported by premiumization trends and artisanal product launches. Cream products serve both retail and food service segments, with cooking cream and whipping cream benefiting from expanding bakery and confectionery industries.

The India Dairy Market is Segmented by Product Type (Butter, Cheese, Cream, Dairy Desserts, Milk, Sour Milk Drinks), and Distribution Channel (Off-Trade, On-Trade). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Gujarat Cooperative Milk Marketing Federation (GCMMF)

- National Dairy Development Board (NDDB)

- Hatsun Agro Product Ltd.

- Nestle S.A.

- Britannia Industries Ltd.

- Parag Milk Foods Ltd.

- Dodla Dairy Ltd.

- Karnataka Milk Federation (KMF)

- Tamil Nadu Milk Federation (Aavin)

- Rajasthan Co-operative Dairy Federation

- Heritage Foods Ltd.

- Milky Mist Dairy Food Ltd.

- Kwality Ltd.

- Schreiber Dynamix Dairies Ltd.

- Creamline Dairy Products Ltd.

- SHRI WARANA SHAKARI DUDHUTPADAK PRAKRIYA SANGH LTD (Warna Milk)

- Anik Milk Products Private Limited

- Lactalis India Pvt. Ltd.

- Danone India Pvt. Ltd.

- ITC Limited (Dairy Division)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing health consciousness and protein-rich diets

- 4.2.2 Product innovation in flavors, packaging, and formats

- 4.2.3 Government initiatives supporting dairy cooperatives and milk production

- 4.2.4 Rising awareness of hygiene and quality standards in dairy

- 4.2.5 Growth of ready-to-eat and convenience dairy products

- 4.2.6 Rising demand for functional and fortified dairy products

- 4.3 Market Restraints

- 4.3.1 High perishability of dairy products limiting shelf life

- 4.3.2 Quality adulteration and safety concerns among consumers

- 4.3.3 Seasonal fluctuations affecting milk supply and quality

- 4.3.4 Lack of cold-chain in rural and remote areas

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE and VOLUME )

- 5.1 Product Type

- 5.1.1 Butter

- 5.1.2 Cheese

- 5.1.2.1 Natural Cheese

- 5.1.2.1.1 Cheddar

- 5.1.2.1.2 Cottage

- 5.1.2.1.3 Ricotta

- 5.1.2.1.4 Parmesan

- 5.1.2.1.5 Others

- 5.1.2.2 Processed Cheese

- 5.1.2.1 Natural Cheese

- 5.1.3 Cream

- 5.1.3.1 Fresh Cream

- 5.1.3.2 Cooking Cream

- 5.1.3.3 Whippng Cream

- 5.1.3.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 Ice Cream

- 5.1.4.2 Cheesecakes

- 5.1.4.3 Frozen Desserts

- 5.1.4.4 Others

- 5.1.5 Milk

- 5.1.5.1 Condensed milk

- 5.1.5.2 Flavored Milk

- 5.1.5.3 Fresh Milk

- 5.1.5.4 UHT Milk (Ultra-high temperature milk)

- 5.1.5.5 Powdered Milk

- 5.1.6 Yogurt

- 5.1.6.1 Drinkable

- 5.1.6.2 Spoonable

- 5.1.7 Sour Milk Drinks

- 5.2 Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Convenience Stores

- 5.2.2.2 Specialist Retailers

- 5.2.2.3 Supermarkets and Hypermarkets

- 5.2.2.4 Online Retail

- 5.2.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Gujarat Cooperative Milk Marketing Federation (GCMMF)

- 6.3.2 National Dairy Development Board (NDDB)

- 6.3.3 Hatsun Agro Product Ltd.

- 6.3.4 Nestle S.A.

- 6.3.5 Britannia Industries Ltd.

- 6.3.6 Parag Milk Foods Ltd.

- 6.3.7 Dodla Dairy Ltd.

- 6.3.8 Karnataka Milk Federation (KMF)

- 6.3.9 Tamil Nadu Milk Federation (Aavin)

- 6.3.10 Rajasthan Co-operative Dairy Federation

- 6.3.11 Heritage Foods Ltd.

- 6.3.12 Milky Mist Dairy Food Ltd.

- 6.3.13 Kwality Ltd.

- 6.3.14 Schreiber Dynamix Dairies Ltd.

- 6.3.15 Creamline Dairy Products Ltd.

- 6.3.16 SHRI WARANA SHAKARI DUDHUTPADAK PRAKRIYA SANGH LTD (Warna Milk)

- 6.3.17 Anik Milk Products Private Limited

- 6.3.18 Lactalis India Pvt. Ltd.

- 6.3.19 Danone India Pvt. Ltd.

- 6.3.20 ITC Limited (Dairy Division)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK