PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910921

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910921

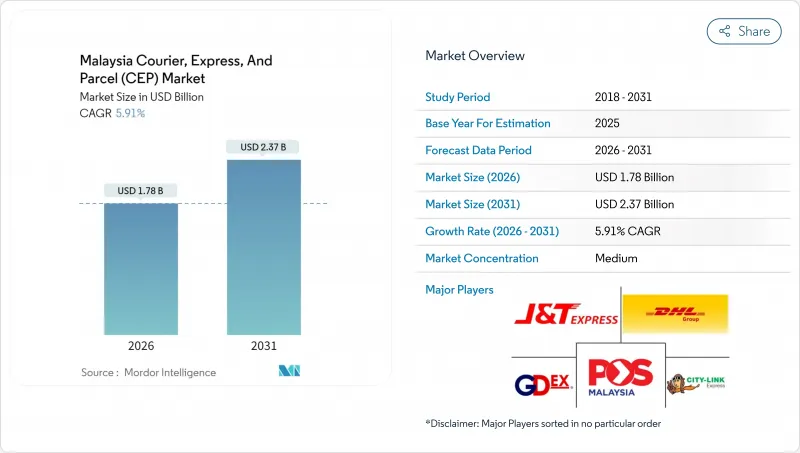

Malaysia Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia courier, express, and parcel market was valued at USD 1.68 billion in 2025 and estimated to grow from USD 1.78 billion in 2026 to reach USD 2.37 billion by 2031, at a CAGR of 5.91% during the forecast period (2026-2031).

Solid parcel volume growth stems from expanding e-commerce, rapid adoption of cash-less payments, and government programs that simplify cross-border clearance. Operators are investing in AI-enabled sorting, electrified fleets, and dark-store partnerships to improve delivery speed while managing the 56% spike in diesel prices that followed subsidy reforms in 2024. Competitive intensity has forced pricing discipline below a 5% industry-wide operating margin, yet scale advantages and technology deployments are beginning to restore profitability for larger firms such as J&T Express, which reported USD 110 million in regional net profit for 2024. The Malaysia courier, express, and parcel market is additionally buoyed by healthcare logistics demand, with pharmaceutical cold-chain shipments outpacing other verticals. Geographically, Klang Valley remains the epicenter of parcel flows thanks to proximity to KLIA and Port Klang, whereas East Malaysia continues to wrestle with addressing gaps and multimodal constraints.

Malaysia Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Boom and Growing Digital-Native Consumer Expectations

Online retail is forecast to reach USD 23.93 billion by 2030, with cross-border orders forming 40% of all transactions, a mix that reshapes line-haul planning and parcel mix. Ninety-plus percent internet penetration and mobile wallets have increased cash-on-delivery uptake to roughly 20% of orders, compelling couriers to refine reverse-logistics cash collection workflows. Seasonal peaks during Lunar New Year and Ramadan force temporary capacity layering, nudging operators to install pop-up sorting lines near Kuala Lumpur. Social-commerce live-streaming adds volume volatility and squeezes margins because of lower average parcel value, prompting network densification and dynamic routing. As a result, the Malaysia courier, express, and parcel market is skewing toward frequent, low-weight shipments that demand scalable automation.

Government-Backed Digital Free Trade Zone Accelerating Cross-Border Fulfillment

The ePAM regime allows simplified declarations two hours before aircraft arrival for parcels under RM500 CIF, triggering near-instant release and trimming dwell time at KLIA, Penang, and Kuching. Seven airports are now live on the system, creating a decisive advantage for carriers with air-freight partnerships and customs brokerage depth. ASEAN Express rail pilots linking Malaysia to Chongqing promise 9-day transit, underscoring the administration's bid to anchor regional logistics. However, because the RM500 threshold applies only to air, sea freight and trucking remain administratively heavier, preserving an air-centric bias in the Malaysia courier, express, and parcel market. Operators with multimodal reach are lobbying for parity to unlock further cost savings.

Sub-5% Operating Margin Pressure from Intense Price Wars

A fragmented vendor field has triggered tariff undercutting that keeps net margins under the 5% threshold even as diesel prices jump 56% post-subsidy removal. Large-scale players exploit automation and contract fuel hedging to ride out volatility, whereas small firms lack leverage and are exiting or consolidating. The SKDS 2.0 relief card offsets some diesel cost for eligible fleets, but allocation ceilings leave many operators partially exposed. Peak-season surcharges provide fleeting relief, making cost-to-serve discipline and yield management crucial for the Malaysia courier, express, and parcel market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Instant-Delivery Dark Stores in Klang Valley

- Network Optimization via AI-Driven Sorting Hubs and Route Planning

- Rural Addressing Gaps in East Malaysia Causing Delivery Retries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce orders made up 37.92% of 2025 parcel demand, but healthcare recorded the fastest 6.12% CAGR between 2026-2031 due to stricter cold-chain compliance and medical device proliferation. Temperature-controlled vans and GDP-certified warehouses lend premium margins.

Financial services, manufacturing, and wholesale trade sustain predictable B2B lanes that smooth seasonal e-commerce volatility. For carriers, diversified vertical exposure insulates revenue and reinforces service breadth in the Malaysia courier, express, and parcel market.

International consignments are climbing at a 6.11% CAGR between 2026-2031, even though domestic traffic held 64.42% of the Malaysia courier, express, and parcel market share in 2025. Cross-border e-commerce, ASEAN Express rail pilots, and the Digital Free Trade Zone elevate outbound SME parcels, sharpening demand for customs-compliant air connectivity. Domestic lanes capitalize on urban density in Klang Valley, where route density and near-zero failed-delivery rates secure stable cash flow.

The Malaysia courier, express, and parcel market size for cross-border flows is primed to widen as ePAM cuts clearance turnaround and the Pan-Asian Railway Network slashes transit to China to 9 days. Nonetheless, the RM500 air-only de-minimis cap restrains multimodal shift; road and sea consignments still wade through manual inspections, constricting end-to-end cost savings. Carriers with multimodal brokerage are best placed to arbitrage these gaps.

The Malaysia Courier, Express, and Parcel Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- City-Link Express

- DHL Group

- FedEx

- GDEX Group

- J&T Express

- Ninja Van

- POS Malaysia Bhd

- SF Express (KEX-SF)

- SkyNet Worldwide Express

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Boom and Growing Digital-Native Consumer Expectations

- 4.15.2 Government-Backed Digital Free Trade Zone (DFTZ) Accelerating Cross-Border Fulfilment

- 4.15.3 Rapid Expansion of Instant-Delivery "Dark Stores" in Klang Valley

- 4.15.4 Network Optimization via AI-Driven Sorting Hubs and Route Planning

- 4.15.5 Electrification of Last-mile Fleets Lowering Unit Delivery Cost

- 4.15.6 Cross-Border ASEAN 3-5-day Economy-Parcel Corridors Opening New SME Export Volumes

- 4.16 Market Restraints

- 4.16.1 Sub-5% Operating Margin Pressure from Intense Price Wars

- 4.16.2 Rural Addressing Gaps in East Malaysia Causing Delivery Retries

- 4.16.3 Double-Digit Fuel-Surcharge Volatility

- 4.16.4 Customs-Clearance Bottlenecks for Low-Value B2C Imports Despite De-Minimis Reforms

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 City-Link Express

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GDEX Group

- 6.4.5 J&T Express

- 6.4.6 Ninja Van

- 6.4.7 POS Malaysia Bhd

- 6.4.8 SF Express (KEX-SF)

- 6.4.9 SkyNet Worldwide Express

- 6.4.10 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment