PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911806

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911806

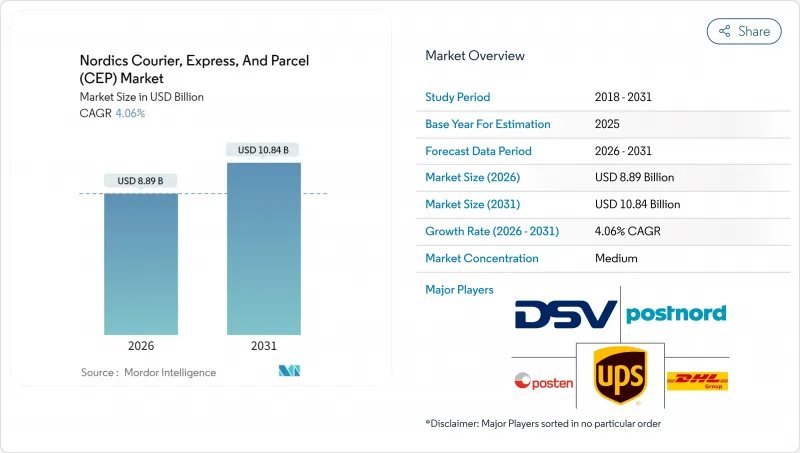

Nordics Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Nordics courier, express, and parcel (CEP) market was valued at USD 8.54 billion in 2025 and estimated to grow from USD 8.89 billion in 2026 to reach USD 10.84 billion by 2031, at a CAGR of 4.06% during the forecast period (2026-2031).

Rising cross-border e-commerce, robust digital infrastructure, and sustained pharmaceutical investment together lift shipment volumes, while mandatory digital customs processes in Norway sharpen efficiency and transparency. Sweden anchors regional volume on the back of improving GDP, yet Finland records the quickest expansion due to EUR 1.5 billion (USD 1.65 billion) rail upgrades. Express delivery growth, widespread parcel-locker roll-outs, and fleet electrification also reinforce competitive service differentiation across dense urban and remote rural locations. Intensifying regulatory pressure on emissions raises near-term operating costs, but it simultaneously accelerates modal shifts to cleaner road fleets and airfreight for time-critical healthcare shipments.

Nordics Courier, Express, And Parcel (CEP) Market Trends and Insights

Surging E-Commerce Penetration Across Nordic Countries

Online retail outperforms traditional channels across the region, translating each purchase into at least one shipment and frequently an additional return. Sweden's online sales momentum drives carrier investments in 6,000 parcel lockers that ease final-mile density. Finland, Norway, and Denmark display similar upward curves, helped by 95% household broadband coverage that supports seamless checkout and carrier-selection APIs. The resulting volume uplift benefits integrated providers, particularly those able to offer late-cutoff same-day options and flexible locker pickup for rural consumers. Continuous spending growth keeps volumes on a rising trajectory through 2030, underpinning positive operating leverage even as parcel weights trend lower.

Rising Consumer Demand for Same-Day and Next-Day Delivery

Rapid fulfillment expectations set new service standards. Carriers respond with urban micro-hubs and extended evening windows that now reach 22:00 in Copenhagen and Oslo. Night-distribution models such as Early Bird in Stockholm illustrate how existing newspaper routes shorten first-wave delivery times. Healthcare and premium electronics remain willing to pay extra for immediacy, lifting express CAGR above non-express. Yet cost complexity rises, pressing operators to blend route-optimizing software, zero-emission vans, and parcel-locker networks to uphold margins while meeting strict municipal emission caps.

High Labor Costs and Unionized Workforce

Average hourly logistics wages in Sweden and Denmark outstrip continental peers, squeezing margins even as parcel volumes rise. Collective agreements restrict scheduling flexibility during peak seasons, prompting accelerated automation trials in hubs that still face union resistance. DSV agreed to preserve German jobs for two years after the Schenker takeover, highlighting how labor clauses shape merger synergies and slow network realignment.

Other drivers and restraints analyzed in the detailed report include:

- Robust Digital Infrastructure Enabling End-to-End Visibility

- Cross-Border Trade Expansion Within EU and UK Post-Brexit Adjustments

- Stringent Environmental Regulations on Road Freight Emissions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare parcels expand at a 4.36% CAGR between 2026-2031, driven by Denmark's concentration of more than 50% of Nordic GMP sites and Novo Nordisk's multibillion-dollar capex that amplifies cold-chain demand. GDP-compliant hubs and validated insulated packaging become decisive tender criteria, letting specialized carriers earn price premiums.

E-commerce nevertheless remains the largest contributor at 42.20% of the 2025 value. The segment benefits from high smartphone penetration and consumer trust in digital payments. Manufacturing, wholesale, and retail maintain a stable baseline, while primary industry volumes fluctuate with commodity cycles.

International traffic, though smaller, is forecast to outpace domestic throughput at a 4.32% CAGR between 2026-2031, thanks to rising intra-EU commerce and smoother customs pre-clearance under Digitoll. DSV's enlarged network post-Schenker greatly boosts cross-border lane capacity, underpinning scalable returns consolidation. Domestic parcels retain 64.18% of the 2025 value as shoppers favor local platforms offering same-day delivery options and free returns. The combined structure ensures the Nordics courier, express, and parcel (CEP) market maintains balanced exposure to local density and international upside.

Nordics courier, express, and parcel (CEP) market size growth within domestic deliveries remains steady because metropolitan demand for instant fulfillment drives higher stop densities. International flows gain traction from EU-wide simplified data flows and Nordic exporters diversifying markets beyond the United Kingdom, supporting better aircraft load factors at Nordic air hubs.

The Nordics Courier, Express, and Parcel (CEP) Market Report is Segmented by Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Model (Business-To-Business (B2B), and More), Shipment Weight (Heavy Weight, and More), Mode of Transport (Air, Road, and Others), End User Industry (E-Commerce, and More), and Country (Denmark, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- GEODIS

- Instabee

- Jetpak Top Holding AB

- Posten Bring AS

- PostNord

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.13.1 Nordics

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Surging E-Commerce Penetration across Nordic Countries

- 4.15.2 Rising Consumer Demand for Same-Day and Next-Day Delivery

- 4.15.3 Robust Digital Infrastructure Enabling End-to-End Visibility

- 4.15.4 Cross-Border Trade Expansion Within EU and UK Post-Brexit Adjustments

- 4.15.5 Rapid Rollout of Parcel Lockers in Rural and Suburban Areas

- 4.15.6 Government EV Subsidies Lowering Last-Mile Costs

- 4.16 Market Restraints

- 4.16.1 High Labor Costs and Unionized Workforce

- 4.16.2 Stringent Environmental Regulations on Road Freight Emissions

- 4.16.3 Access Restrictions in Historic Urban Centers

- 4.16.4 Price Compression from Crowd-Shipping Entrants

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Denmark

- 5.7.2 Finland

- 5.7.3 Iceland

- 5.7.4 Norway

- 5.7.5 Sweden

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 DSV A/S (Including DB Schenker)

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 Instabee

- 6.4.6 Jetpak Top Holding AB

- 6.4.7 Posten Bring AS

- 6.4.8 PostNord

- 6.4.9 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment