PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934641

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934641

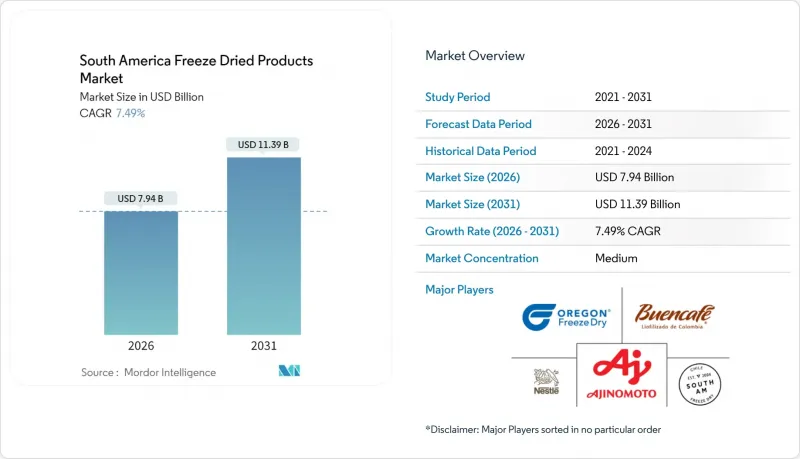

South America Freeze Dried Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The South America freeze-dried products market is expected to grow from USD 7.39 billion in 2025 to USD 7.94 billion in 2026 and is forecast to reach USD 11.39 billion by 2031 at 7.49% CAGR over 2026-2031.

As e-commerce flourishes and urban incomes rise, there's a noticeable shift towards clean-label foods, driving up demand for nutrient-dense, shelf-stable products. In 2024, Brazil's food-processing sector saw a 9.9% revenue boost, leading to increased purchases of freeze-dried ingredients for prepared meals, infant nutrition, and pet foods. Product developers highlight sublimation's edge, boasting a 95% nutrient retention over hot-air dehydration, a point that strikes a chord with health-conscious millennials who prioritize nutritional value and product transparency. The adoption of energy-efficient machinery, coupled with Agencia Nacional de Vigilancia Sanitaria's relaxed shelf-life regulations, not only reduces entry barriers but also steers competition towards process automation, enabling manufacturers to scale operations efficiently. While the segment commands premium pricing, government initiatives in Ecuador and Colombia are turning climate-sensitive crops into lucrative freeze-dried exports, supporting local farmers and enhancing the region's export potential.

South America Freeze Dried Products Market Trends and Insights

Rising consumer demand for convenient ready-to-eat meals

Urban employees grapple with lengthy commutes and limited cooking time. Freeze-dried ingredients, rehydrating in mere minutes, retain 95% of their vitamins, outpacing the 60% retention seen in hot-air dehydration. In Sao Paulo and Buenos Aires, major restaurant chains are adopting pre-portioned freeze-dried vegetables, aiming to standardize recipes and minimize inventory losses. Families appreciate the 25-year shelf life of these ingredients, a crucial buffer for food security amid climate-related logistical disruptions. Retail data for 2024 highlights a surge in single-serve soups featuring freeze-dried peas, corn, and carrots, boasting double-digit unit growth. Marketers emphasize the over 80% weight reduction of these ingredients, a significant advantage for home-delivery services. This narrative of convenience elevates freeze-dried products, branding them as premium time-savers rather than mere emergency provisions.

Growing use of freeze-dried inputs in infant and clinical nutrition

Studies from CONICET highlight that sublimation effectively preserves bioactives in breast milk, such as lactoferrin and immunoglobulins, underscoring its clinical significance beyond mere dehydration. This method ensures that essential nutrients and immune-boosting components remain intact, making it a valuable process for infant nutrition. Brands of infant formula are now incorporating freeze-dried powders of banana and spinach, achieving their desired micronutrient levels while maintaining a clean label, devoid of synthetic stabilizers. These formulations cater to health-conscious consumers seeking natural and nutrient-dense options for their children. In Santiago, hospitals are utilizing freeze-dried purees for patients with compromised immune systems, ensuring their diets are free from pathogens and meet strict safety standards. Parents are willing to pay a premium; in 2024, cross-promotions in the diaper category boosted sales of freeze-dried baby snacks by 23%, reflecting growing consumer interest in convenient and healthy snack options for infants. Regulatory bodies in Brazil and Argentina are expediting approvals for freeze-dried functional ingredients, acknowledging their minimal additive requirements and potential to enhance food safety and quality. Following suit, manufacturers catering to geriatrics and sports nutrition are driving up the demand for protein-rich freeze-dried dairy intermediates, which offer a convenient and shelf-stable source of high-quality protein for these specialized markets.

High retail price versus dehydrated and iqf alternatives

Supermarkets in Sao Paulo sell freeze-dried strawberries at a significantly higher price compared to hot-air-dried strawberries, reflecting a substantial premium. The use of energy-intensive processes, vacuum chambers, and extended cycle times significantly raises overhead costs, a burden that small processors struggle to distribute over larger volumes. During inflationary periods, consumers with incomes below the regional median gravitate towards more affordable dehydrated snacks. Retailers, wary of dedicating shelf space to premium SKUs that move slowly, often find themselves pressuring producers to finance in-store sampling. While price promotions can temporarily boost sales volume, they risk diminishing the product's perceived prestige, presenting a marketing conundrum. In a bid to bridge the price gap without compromising on texture, manufacturers are innovating with blended formats, such as chips that are half freeze-dried and half baked.

Other drivers and restraints analyzed in the detailed report include:

- Rapid expansion of e-grocery and last-mile delivery networks

- Preference for clean-label, natural ingredients over additives

- Energy-intensive processing inflating operating costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, freeze-dried fruits command a significant 29.02% share of the South American freeze-dried products market, underscoring the region's rich fruit supply and established snacking habits. This leadership position is bolstered by processors crafting fruit granulates and mixes, specifically designed for breakfast cereals, baked goods, and snack packs. Such innovations not only broaden distribution channels but also enhance consumption versatility. The health-conscious consumer further propels sales, drawn to freeze-dried fruits for their nutrient retention, flavor preservation, convenience, and extended shelf life. Both multinational and regional players bolster this segment's strength, emphasizing packaging innovations and sustainable sourcing. The appeal of freeze-dried fruits resonates in both retail and bulk sales, tapping into the rising disposable incomes and shifting dietary preferences in Brazil, Argentina, and their neighbors.

On the other hand, freeze-dried dairy products are the market's rising stars, with projections indicating a robust 9.26% CAGR. This growth is largely driven by the surging demand for fortified foods, especially in infant formulas and clinical diets. Dairy processors are honing in on techniques to maintain the bioactivity of whey proteins through meticulous sublimation, ensuring the batch consistency that's crucial for nutrition formulations. South American manufacturers are seizing export opportunities, sending freeze-dried yogurt bites and lactose-controlled snacks to North America's premium market. Innovation is at the forefront, with dairy companies harnessing freeze-drying advancements to craft new, ingredient-rich bite-sized snacks. The segment is also riding the wave of freeze-dried technology's acceptance in meal supplements, sports nutrition, and lactose-free products, setting the stage for sustained double-digit growth and broader international appeal.

The South America Freeze-Dried Products Report is Segmented by Product Type (Freeze-Dried Fruits, Freeze-Dried Vegetables, and More), Nature (Conventional, Organic), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Other Distribution Channel), and Geography (Brazil, Argentina, Chile, Colombia, Peru, Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle S.A.

- Ajinomoto Co., Inc.

- Asahi Group Holdings, Ltd.

- Harmony House Foods, Inc.

- OFD Foods, Inc.

- Thrive Life, LLC

- Expedition Foods Ltd.

- Solo Snacks Food Products

- SouthAm Freeze Dry

- Tropical Foods

- Fruitas Holdings Inc.

- Nutra Dried Food Company

- Dole Food Company

- Bonduelle

- Lionmeal

- JBS S.A. (Frezco snack division)

- Pomona Foods (Argentina)

- Mother Earth Products

- FDF Latin America

- European Freeze Dry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer demand for convenient ready-to-eat meals

- 4.2.2 Growing use of freeze-dried inputs in infant and clinical nutrition

- 4.2.3 Rapid expansion of e-grocery and last-mile delivery networks

- 4.2.4 Preference for clean-label, natural ingredients over additives

- 4.2.5 Plant-based meal-kit brands incorporating freeze-dried produce

- 4.2.6 Government-backed programs to valorise climate-impacted crops

- 4.3 Market Restraints

- 4.3.1 High retail price versus dehydrated and IQF alternatives

- 4.3.2 Energy-intensive processing inflating operating costs

- 4.3.3 "Ultra-processed food" perception among health-conscious buyers

- 4.3.4 High competition from fresh, frozen and canned foods

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Freeze-Dried Fruits

- 5.1.1.1 Strawberry

- 5.1.1.2 Raspberry

- 5.1.1.3 Pineapple

- 5.1.1.4 Apple

- 5.1.1.5 Mango

- 5.1.1.6 Other Fruits

- 5.1.2 Freeze-Dried Vegetables

- 5.1.2.1 Pea

- 5.1.2.2 Corn

- 5.1.2.3 Carrot

- 5.1.2.4 Potato

- 5.1.2.5 Mushroom

- 5.1.2.6 Other Vegetables

- 5.1.3 Freeze-Dried Meat and Seafood

- 5.1.4 Freeze-Dried Dairy Products

- 5.1.5 Freeze-Dried Beverages

- 5.1.6 Prepared Meals

- 5.1.7 Pet Food

- 5.1.1 Freeze-Dried Fruits

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channel

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 Asahi Group Holdings, Ltd.

- 6.4.4 Harmony House Foods, Inc.

- 6.4.5 OFD Foods, Inc.

- 6.4.6 Thrive Life, LLC

- 6.4.7 Expedition Foods Ltd.

- 6.4.8 Solo Snacks Food Products

- 6.4.9 SouthAm Freeze Dry

- 6.4.10 Tropical Foods

- 6.4.11 Fruitas Holdings Inc.

- 6.4.12 Nutra Dried Food Company

- 6.4.13 Dole Food Company

- 6.4.14 Bonduelle

- 6.4.15 Lionmeal

- 6.4.16 JBS S.A. (Frezco snack division)

- 6.4.17 Pomona Foods (Argentina)

- 6.4.18 Mother Earth Products

- 6.4.19 FDF Latin America

- 6.4.20 European Freeze Dry

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK