PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934726

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934726

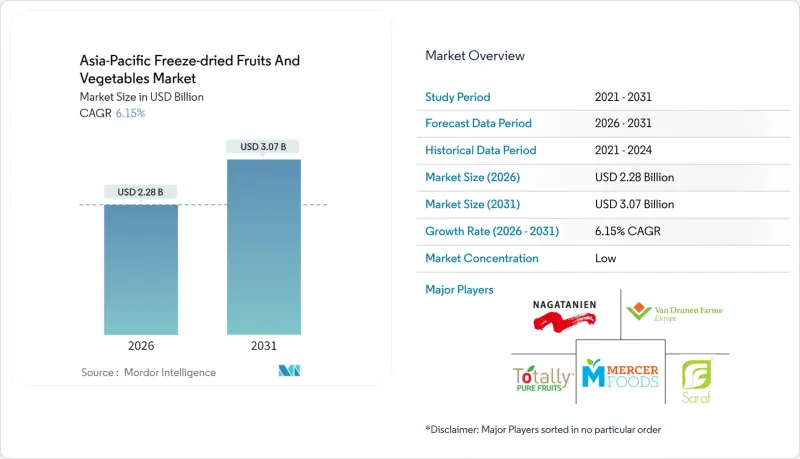

Asia-Pacific Freeze-dried Fruits And Vegetables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific freeze-dried fruits and vegetables market was valued at USD 2.15 billion in 2025 and estimated to grow from USD 2.28 billion in 2026 to reach USD 3.07 billion by 2031, at a CAGR of 6.15% during the forecast period (2026-2031).

Rapid urbanization, rising disposable incomes, and time-pressed lifestyles are steering households toward shelf-stable, nutrient-dense convenience foods. Policy liberalization that lifted quarantine requirements on frozen fruit imports in China is widening raw-material access for regional processors. Accelerated equipment innovation is lowering energy use and cycle times, allowing mid-sized companies to enter a segment once dominated by scale players. E-commerce growth across tier-1 and tier-2 cities is further propelling the adoption of premium snacks, while sustainability-minded consumers reward brands that pair clean-label claims with compostable packaging. In this context, the Asia-Pacific freeze-dried fruits and vegetables market is attracting capital for automated lines and integrated supply chains poised to capture downstream demand from confectionery, bakery, and plant-based product makers.

Asia-Pacific Freeze-dried Fruits And Vegetables Market Trends and Insights

Rising demand for processed and convenient foods

In the Asia-Pacific, changing demographics are reshaping food consumption. Consumers in China (68%), India (67%), and South Korea (53%) are increasingly prioritizing on-the-go solutions that balance nutrition and convenience. India's packaged food and beverage market expansion from USD 33.7 billion in 2023 to a projected USD 46.3 billion by 2028 creates substantial downstream demand for freeze-dried ingredients in ready-to-eat and ready-to-cook applications, according to the United States Department of Agriculture . This growth signals a rising demand for freeze-dried ingredients, especially in ready-to-eat and ready-to-cook products. The trend isn't limited to traditional snacking; freeze-dried fruits are now making their way into breakfast cereals and protein bars, catering to the dual desires for convenience and a natural touch. With urbanization rates surpassing 60% in major Asia-Pacific cities and a rise in dual-income households, this shift is gaining momentum. This presents a golden opportunity for processors to invest in automated freeze-drying capacities. Furthermore, the surge in e-commerce and the growth of modern retail are bolstering distribution channels, especially for premium, shelf-stable products boasting extended shelf lives.

Technological advancements in freeze-drying, enhancing quality and efficiency

Equipment manufacturers are unveiling innovative solutions to address longstanding challenges in freeze-drying adoption. These challenges, particularly energy consumption and time constraints, have restricted commercial scalability. GEA's RAY Plus freeze dryer series, introduced in October 2024, incorporates computational fluid dynamics modeling and a modular design. This enables processors to enhance energy efficiency while ensuring consistent product quality. Similarly, UFrost's patented flash-freezing technology, which achieves -100°C in under 10 seconds, marks a significant advancement. This technology not only lowers energy costs per unit but also preserves cellular structure integrity. In Asia-Pacific, China and India are leading the adoption of automated systems due to labor cost pressures and scaling needs. Conversely, Japan and South Korea prioritize precision robotics and Internet of Things (IoT) integration to enhance quality control. These technological advancements are expanding freeze-drying accessibility, particularly for mid-sized processors previously hindered by high capital requirements and operational complexities.

High production and operational costs

In emerging Asia-Pacific markets, smaller processors and price-sensitive consumers face challenges due to the high operational costs of energy-intensive freeze-drying processes. Freeze-drying requires 4-6 times more energy per unit compared to conventional drying methods, with electricity expenses contributing 15-25% of total production costs, depending on regional energy pricing. Rising coffee and cocoa prices have led manufacturers to adopt long-term supply contracts and bulk purchasing strategies to mitigate input cost volatility, setting an example for freeze-dried producers encountering similar issues. The significant capital investment for commercial-scale freeze-drying systems, ranging from USD 500,000 to USD 2 million, creates entry barriers that favor established players with access to financing and technical expertise. Furthermore, skilled operators, particularly in developed markets like Japan and South Korea, demand high wages for managing complex freeze-drying processes. However, advancements in technology, such as automated systems and energy-efficient designs, are gradually lowering per-unit costs, with manufacturers reporting 20-30% energy savings from next-generation equipment.

Other drivers and restraints analyzed in the detailed report include:

- Long shelf life and retention of nutrients

- Consumer demand for clean-label products

- Stringent regulatory requirements around food labeling and additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freeze-dried fruits maintain a dominant 60.74% market share in 2025, while the demand for premium confectionery and functional foods is driving freeze-dried vegetables to achieve a projected CAGR of 7.35% through 2031. In China, chocolate manufacturers are increasingly incorporating freeze-dried fruits into their "Chocolate+" formulations. This approach not only reduces their dependence on cocoa but also provides consumers with a unique sensory experience. Consequently, there is a growing demand for visually appealing fruit varieties such as strawberries, blueberries, and tropical options. At the same time, freeze-dried vegetables are benefiting from the rising popularity of plant-based foods. They are being utilized in breakfast cereals, soups, and snacks, where their concentrated flavors and extended shelf life offer significant advantages over fresh alternatives.

Individual fruit segments are experiencing distinct growth trends. Strawberries and blueberries are leading premium applications due to their ability to retain color and their strong consumer recognition. Meanwhile, tropical varieties like mango are gaining popularity, particularly in flavor profiles tailored to the Asian market. In the vegetable segment, beans, corn, and peas primarily serve B2B applications in processed food manufacturing, while mushrooms are emerging in retail snack formats aimed at health-conscious consumers. Although cranberry and blackberry segments remain niche, they command premium pricing in functional food applications. The technology's capability to preserve cellular structure ensures that vegetables maintain their texture during rehydration. This creates opportunities in ready-to-eat meal applications, where traditional drying methods often fail to meet quality expectations.

The Asia-Pacific Freeze-Dried Fruits and Vegetables Market Report is Segmented by Type (Fruits and Vegetables), End User (Foodservice/HoReCa, Food Processing, and Retail), and Geography (India, China, Japan, Australia, South Korea, and Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Nagatanien Co., Ltd.

- Mercer Foods LLC

- R. J. Van Drunen & Sons Inc.

- Bajaj Agro Foods India Ltd.

- Totally Pure Fruits Pty Ltd.

- Asahi Group

- European Freeze Dry Ltd.

- Chaucer Foods Ltd.

- Lianfu Food Co. Ltd.

- Kanegrade Ltd.

- SouthAm Freeze Dry

- Paradise Fruits Solutions GmbH & Co. KG

- ThriveLife LLC

- Saraf Foods Ltd.

- Harmony Foods

- Halo Corporation Co. Ltd.

- Verum Ingredients

- Greenfield Produce Co. Ltd.

- DMH Ingredients

- Freeze-Dry Foods GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for processed and convenient foods

- 4.2.2 Technological advancements in freeze-drying, enhancing quality and efficiency

- 4.2.3 Long shelf life and retention of nutrients

- 4.2.4 Consumer demand for clean-label products

- 4.2.5 Increasing health consciousness and preference for vegan, gluten-free products

- 4.2.6 Wider application across food sectors

- 4.3 Market Restraints

- 4.3.1 High production and operational costs

- 4.3.2 Stringent regulatory requirements around food labeling and additives

- 4.3.3 Seasonal availability and sourcing issues

- 4.3.4 Limited consumer awareness in rural regions

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST (VALUE AND VOLUME)

- 5.1 By Type

- 5.1.1 Fruits

- 5.1.1.1 Strawberry

- 5.1.1.2 Blueberry

- 5.1.1.3 Raspberry

- 5.1.1.4 Blackberry

- 5.1.1.5 Cranberry

- 5.1.1.6 Mango

- 5.1.1.7 Other Fruit Types

- 5.1.2 Vegetables

- 5.1.2.1 Beans

- 5.1.2.2 Corn

- 5.1.2.3 Peas

- 5.1.2.4 Tomato

- 5.1.2.5 Mushroom

- 5.1.2.6 Other Vegetable Types

- 5.1.1 Fruits

- 5.2 By End User

- 5.2.1 Foodservice/HoReCa

- 5.2.2 Food Processing

- 5.2.2.1 Breakfast Cereal

- 5.2.2.2 Soups and Snacks

- 5.2.2.3 Ice Cream and Desserts

- 5.2.2.4 Bakery and Confectionery

- 5.2.2.5 Others

- 5.2.3 Retail

- 5.2.3.1 Supermarkets/Hypermarkets

- 5.2.3.2 Specialty Stores

- 5.2.3.3 Online Retail

- 5.2.3.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nagatanien Co., Ltd.

- 6.4.2 Mercer Foods LLC

- 6.4.3 R. J. Van Drunen & Sons Inc.

- 6.4.4 Bajaj Agro Foods India Ltd.

- 6.4.5 Totally Pure Fruits Pty Ltd.

- 6.4.6 Asahi Group

- 6.4.7 European Freeze Dry Ltd.

- 6.4.8 Chaucer Foods Ltd.

- 6.4.9 Lianfu Food Co. Ltd.

- 6.4.10 Kanegrade Ltd.

- 6.4.11 SouthAm Freeze Dry

- 6.4.12 Paradise Fruits Solutions GmbH & Co. KG

- 6.4.13 ThriveLife LLC

- 6.4.14 Saraf Foods Ltd.

- 6.4.15 Harmony Foods

- 6.4.16 Halo Corporation Co. Ltd.

- 6.4.17 Verum Ingredients

- 6.4.18 Greenfield Produce Co. Ltd.

- 6.4.19 DMH Ingredients

- 6.4.20 Freeze-Dry Foods GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK