PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934865

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934865

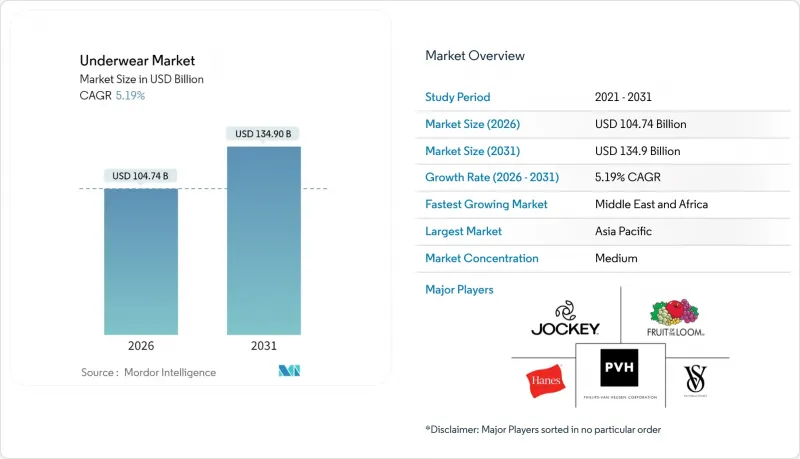

Underwear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global underwear market was valued at USD 99.57 billion in 2025 and estimated to grow from USD 104.74 billion in 2026 to reach USD 134.9 billion by 2031, at a CAGR of 5.19% during the forecast period (2026-2031).

Driven by robust e-commerce growth, the blending of athleisure with intimate wear, and swift fabric innovations, the textile industry is on an upward trajectory. Today's consumers are leaning towards versatile garments that transition seamlessly from gym to office. In response, producers are increasingly incorporating seamless knitting and moisture-wicking yarns into their designs to meet these evolving preferences. While Asia-Pacific stands as the cornerstone for both production and demand, the Middle East and Africa are gaining momentum, modernizing their mills with advanced technologies and actively seeking export orders to strengthen their global presence. India's ambition, bolstered by government initiatives like the Production Linked Incentive scheme, aims for a lofty target of USD 100 billion in textile exports by 2030, supported by investments in infrastructure and policy reforms to enhance competitiveness. However, challenges loom large: tariff shocks, fluctuations in cotton prices, and pressing sustainability mandates are compelling companies to diversify their sourcing strategies, embrace circular materials to reduce environmental impact, and refine their digital supply chains for greater efficiency and transparency.

Global Underwear Market Trends and Insights

Athleisure-inspired functional underwear gains popularity

As demand surges for intimates that seamlessly blend stretch, ventilation, and light compression, design pipelines are evolving. Brands are now weaving in performance yarns, once exclusive to sportswear, into everyday underwear. This trend isn't confined to the realms of traditional sportswear; consumers are increasingly gravitating towards versatile pieces that transition effortlessly from workout to workplace. The influence of athleisure has nudged conventional underwear manufacturers to adopt technical fabrics and ergonomic designs, once the hallmark of athletic wear. In 2024, Reliance Industries rolled out the ECOTHERM fiber, spotlighting its lightweight thermal insulation tailored for base layers. This cutting-edge fiber not only boosts comfort but also resonates with the rising consumer demand for high-performance materials in daily attire. Such a move underscores a burgeoning consumer willingness to invest in garments that marry technology with style. To align with seasonal drops catering to athleisure trends, manufacturers are upgrading their testing labs and streamlining processes, ensuring they adeptly meet the market's evolving demands.

E-commerce's apparel push broadens global reach

Online platforms have removed the constraints of physical storefronts, enabling direct-to-consumer brands to deliver curated packages to any postal address. Thanks to privacy measures, AI-driven fitting tools, and innovative subscription models, digital sales have surged, with US men's clothing stores witnessing a 27.9% year-on-year increase, according to the US Census Bureau. E-commerce has been a boon for smaller brands and niche markets, empowering them to offer specialized products, ranging from sustainable items to tech-savvy underwear, directly to their target audiences, all without the hefty investments typically associated with traditional retail infrastructures. To navigate the crowded online marketplace successfully, brands are channeling investments into logistics, particularly in last-mile delivery and reverse shipping. These efforts are crucial not only for managing return rates but also for fostering customer loyalty. Yet, this digital pivot demands substantial outlays in logistics, customer service, and digital marketing to ensure a competitive edge.

Volatility in raw-material prices

Manufacturers grapple with margin pressures due to fluctuating cotton prices. Projections for 2025 suggest this volatility will persist, driven by sluggish global economic growth and waning consumer demand. The National Cotton Council, citing high input costs and competition from crops like peanuts and corn, forecasts cotton prices in 2025 to hover between 66-79 cents per pound. The dynamics of the US cotton market, especially its ties with Chinese textile manufacturers, underscore the importance of trade policy changes and tariff adjustments, as highlighted by the US Bureau of Labor Statistics. These policy shifts and tariffs can create ripple effects across the supply chain, impacting pricing, availability, and overall market stability. In response to these challenges, manufacturers are turning to hedging strategies and diversifying their sourcing. Hedging helps mitigate risks associated with price volatility, while diversified sourcing reduces dependency on a single supplier or region. However, these methods demand advanced supply chain management skills, robust risk assessment frameworks, and significant working capital investments to ensure operational resilience and profitability.

Other drivers and restraints analyzed in the detailed report include:

- Rising disposable income and heightened fashion awareness

- Advances in fabric technology

- Geopolitical trade shocks affecting cotton supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Panties and Thongs dominated the underwear market, securing 32.57% of total revenue. Their lasting appeal can be attributed to their versatility, seamlessly integrating into the daily wardrobes of consumers across age groups. This segment's strength is bolstered by a growing demand for invisible panty lines and clean silhouettes, catering to shoppers who prioritize comfort and discretion. Features like heat-bonded edges and silicone-free grippers have enhanced comfort, supporting a premium market position and justifying elevated price points. Brands are capitalizing on these innovations to set their offerings apart and foster loyalty among style-savvy consumers. With their established prominence, Panties and Thongs continue to be a linchpin of the underwear market, benefiting from constant product enhancements and shifting consumer tastes.

Boxers are rapidly emerging as the fastest-growing segment in the underwear market, with projections indicating a CAGR of 5.27% through 2031. This swift growth is driven by younger men emphasizing breathable waistbands and inclusive sizing, mirroring a broader trend towards comfort and body positivity. The segment's growth is further propelled by subscription services from digital-first brands, promoting regular replenishment and personalized upselling via data insights. Central to this growth is product innovation, with fresh materials and fits catering to a diverse clientele's lifestyle needs. Moreover, the comeback of hybrid workwear has reignited interest in boxer-brief silhouettes, which offer a blend of coverage and stretch for added versatility. By bundling multipacks that merge value with premium features, brands are strategically positioned to dominate shelf space in both physical stores and online platforms, ensuring the boxer segment's continued expansion.

In 2025, men dominated the underwear market, capturing 52.17% of sales. This male dominance stems from their penchant for pricier items and more frequent replacements. Men are increasingly gravitating towards features like antimicrobial gussets, four-way stretch fabrics, and contemporary fly-less designs, many of which echo athleisure trends. Even in price-sensitive regions, brands are using performance-centric narratives to uphold a premium image. These innovations not only boost comfort and functionality but also foster brand loyalty among male consumers. Consequently, the men's segment stands out as a primary revenue generator, reaping rewards from both product innovations and marketing strategies that spotlight durability and performance.

Women's intimate wear is set to outpace all segments, boasting a vigorous CAGR of 5.62%. This surge is driven by a broadening product spectrum, from shapewear and lounge bras to maternity lines, addressing varied needs across life stages. Regular product unveilings, like influencer-led mini collections and exclusive colorways, rejuvenate the category and spur repeat buys. AI-driven fit quizzes have slashed return rates, bolstering the shopping experience and fostering trust. Brands are harnessing digital avenues and social media to engage female shoppers, providing tailored recommendations and exclusive drops. With women prioritizing both comfort and style, this segment is rapidly evolving, positioning itself as a hub for innovation and market growth in the underwear realm.

The Global Underwear Market Report is Segmented by Product Type (Briefs, Boxers, Panties and Thongs), End-User (Women, Men, Children), Fabric Material (Cotton, Synthetic, Others), Distribution Channel (Online Retail Stores, Supermarkets/Hypermarkets, Specialty Stores, Others), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region commanded a dominant 53.08% share of the revenue, driven by its low-cost manufacturing hubs, abundant fiber resources, and a burgeoning middle-class appetite. India's Production Linked Incentive program, alongside the PM MITRA mega-parks, is cultivating integrated hubs that not only expedite lead times but also amplify exports. Meanwhile, China's ambitious goal of achieving 70% digitalization by 2025 underscores its intent to bolster its leadership, leveraging smart looms, AI-driven patterning, and eco-friendly dyeing methods. Yet, in response to US tariffs, there's a noticeable pivot in sourcing towards Vietnam, Bangladesh, and Cambodia, reshaping the supply landscape of the Underwear market.

The Middle East and Africa are on a growth trajectory, boasting the fastest CAGR of 5.63% through 2031. Egypt is making waves with its USD 1.1 billion modernization drive, introducing Italian and Swiss spinning technologies to its state-run mills, thereby enhancing export quality. Its geographical closeness to Europe not only slashes freight expenses but also bolsters just-in-time delivery capabilities. Countries like Morocco, Ethiopia, and Kenya are sweetening the deal for brands with duty-free incentives and bolstering logistics networks. Meanwhile, urbanization in Gulf Cooperation Council nations is stoking a premium demand, and e-commerce initiatives across Africa are tapping into previously unreachable consumer segments.

While North America and Europe continue to be profitable on a per-capita scale, their overall growth has been more tempered. In the US, stringent PFAS regulations and heightened ESG audits are pushing companies in the Underwear market to demonstrate chemical compliance. Across the Atlantic, Europe is gearing up for the Digital Product Passport, a move that will enforce traceability right down to the fiber's origin, nudging mills towards advanced blockchain tracking. South America is making strides, with Andean and Mercosur countries working on smoother trade processes for textiles. However, challenges like currency fluctuations and port congestion are casting shadows on their growth ambitions.

- Hanesbrands Inc.

- Victoria-s Secret & Co.

- PVH Corp.

- Fruit of The Loom, Inc

- Jockey International Inc.

- Triumph Intertrade AG (Triumph Group)

- Wacoal Holdings Corp.

- Spanx, LLC

- Adidas AG

- Nike Inc.

- Under Armour Inc.

- Lululemon Athletica

- SAXX Underwear Co.

- Tommy John, Inc.

- Groupe Chantelle

- Marks & Spencer Group plc

- American Eagle Outfitters, Inc.

- H&M Group

- Fast Retailing Co., Ltd.

- Rupa & Company Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Athleisure-inspired functional underwear gains popularity

- 4.2.2 E-commerce's apparel push broadens global reach

- 4.2.3 Rising disposable income and heightened fashion awareness

- 4.2.4 Advances in fabric technology (like seamless, moisture-wicking)

- 4.2.5 Sustainability trends favoring bamboo and recycled fibers

- 4.2.6 Introduction of smart health-monitoring underwear

- 4.3 Market Restraints

- 4.3.1 Volatility in raw-material prices (cotton, synthetics)

- 4.3.2 Fragmentation and fierce price competition

- 4.3.3 Concerns over data privacy in sensor-based smart underwear

- 4.3.4 Geopolitical trade shocks affecting cotton supply

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Briefs

- 5.1.2 Boxers

- 5.1.3 Panties and thongs

- 5.2 By End-User

- 5.2.1 Women

- 5.2.2 Men

- 5.2.3 Children

- 5.3 By Fabric Material

- 5.3.1 Cotton

- 5.3.2 Synthetic

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Online Retail Stores

- 5.4.3 Specialty Stores

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Hanesbrands Inc.

- 6.4.2 Victoria-s Secret & Co.

- 6.4.3 PVH Corp.

- 6.4.4 Fruit of The Loom, Inc

- 6.4.5 Jockey International Inc.

- 6.4.6 Triumph Intertrade AG (Triumph Group)

- 6.4.7 Wacoal Holdings Corp.

- 6.4.8 Spanx, LLC

- 6.4.9 Adidas AG

- 6.4.10 Nike Inc.

- 6.4.11 Under Armour Inc.

- 6.4.12 Lululemon Athletica

- 6.4.13 SAXX Underwear Co.

- 6.4.14 Tommy John, Inc.

- 6.4.15 Groupe Chantelle

- 6.4.16 Marks & Spencer Group plc

- 6.4.17 American Eagle Outfitters, Inc.

- 6.4.18 H&M Group

- 6.4.19 Fast Retailing Co., Ltd.

- 6.4.20 Rupa & Company Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK