PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937315

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937315

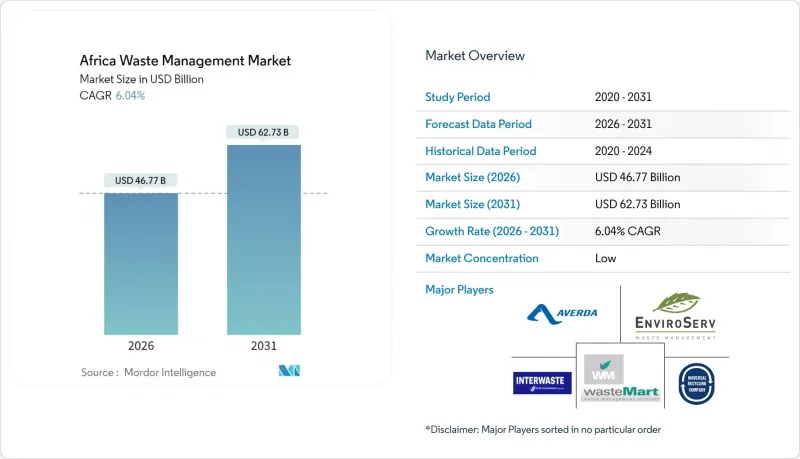

Africa Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa Waste Management Market size in 2026 is estimated at USD 46.77 billion, growing from 2025 value of USD 44.11 billion with 2031 projections showing USD 62.73 billion, growing at 6.04% CAGR over 2026-2031.

Rapid urbanization funnels unprecedented waste volumes into already-strained municipal systems, creating space for private-sector collection, treatment, and recycling solutions. Investor appetite grows as governments adopt extended producer responsibility (EPR) rules, while technology firms deploy AI-enabled route optimization to raise collection efficiencies. Waste-to-energy (WtE) developers are securing climate-finance backing, yet capital gaps persist for other large-scale treatment assets. Competition remains fragmented, but rising compliance costs favor operators able to integrate informal collectors into formal value chains.

Africa Waste Management Market Trends and Insights

Rising Urban Population Driving Municipal Solid Waste Volumes

Africa's cities gain roughly 22 million new residents every year, elevating household consumption and daily waste flows. Lagos alone generates 13,000-14,000 tons of refuse each day, yet formal recycling diverts just 0.37%, underscoring severe infrastructure gaps. Collection fleets struggle to keep pace, prompting municipalities to outsource operations and invite private investment in transfer stations and material-recovery facilities. Concentrated urban waste streams lower per-ton processing costs, improving project economics for WtE and sorting plants. Demographic trends will therefore keep municipal solid waste (MSW) the anchor of the Africa waste management market well beyond 2030.

Government Push for Higher Recycling Targets & EPR Frameworks

Kenya's 2024 EPR regulations oblige producers to finance end-of-life collection and recycling, mirroring South Africa's mandatory schemes under the National Environmental Management Waste Act. Egypt has rolled out a sustainable recycling initiative that links informal pickers to licensed processors, raising material quality while preserving livelihoods. Compliance costs are shifting recycling from voluntary programs to legally enforced obligations, pushing brand owners to sign long-term service contracts with certified operators. These mandates steadily enlarge feedstock volumes for plastic, metal, and e-waste recycling facilities, bolstering revenues across the Africa waste management market.

Weak Landfill Regulation & Enforcement

More than 90% of East Africa's waste still winds up in open dumps, releasing methane and leachate that threaten groundwater. Addis Ababa's Repi site alone receives wastes unchecked, yet only 65% of the city's refuse is formally collected. Non-enforcement allows unlicensed haulers to undercut compliant operators by dodging gate fees, eroding the economics of engineered landfills. Without uniform inspection regimes, municipalities cannot recover operating costs or enforce polluter-pays principles, delaying modernization of disposal infrastructure across the Africa waste management market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Investor Interest in Waste-to-Energy Projects

- Digitized Collection & Route-Optimization Platforms

- Capital Scarcity for Large-Scale Treatment Assets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential streams secured 60.45% of the Africa waste management market share in 2025 as household consumption grew alongside urban migration. Commercial volumes, however, are projected to post an 8.52% CAGR, fueled by mall and office expansion that heightens demand for scheduled pickups and secure document destruction. Retail chains sign multi-year contracts to meet EPR take-back obligations, adding predictable tonnage for integrated service providers. Industrial generators confront tighter hazardous-waste regulations, particularly in South Africa, pushing them toward licensed disposal partners. Medical waste also rises with increased healthcare investment, creating a high-margin niche for certified incineration firms.

The Africa waste management market benefits from diverse feedstocks: construction and demolition debris escalates as infrastructure budgets climb, while agricultural residues present biogas opportunities in peri-urban zones. Veolia's multi-source service model across several African countries showcases the value of bundling residential and commercial contracts to balance volume with higher-yield specialty waste. Informal networks remain pivotal for plastics retrieval, yet formalized aggregators are beginning to absorb them via franchise schemes that deliver standardized safety training and mobile-payment transparency.

The Africa Waste Management Report is Segmented by Source (Residential, Commercial, Industrial, Medical, and More), by Service Type (Collection, Transportation, Sorting & Segregation, and More), by Waste Type (Municipal Solid, Industrial Hazardous, E-Waste, Plastic, and More), and by Geography (Nigeria, South Africa, Egypt, Kenya, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Averda

- EnviroServ

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services

- WeCyclers

- The Waste Group

- SA Waste

- Veolia Africa

- SUEZ Recycling & Recovery Africa

- Biffa South Africa

- Mr Green Africa

- TakaTaka Solutions

- EcoPost

- Stericycle (MedWaste Africa)

- Dangote Recycling

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising urban population driving municipal solid waste volumes

- 4.2.2 Government push for higher recycling targets & EPR frameworks

- 4.2.3 Growing investor interest in waste-to-energy (WtE) projects

- 4.2.4 Digitised collection & route-optimisation platforms

- 4.2.5 Off-grid micro-pyrolysis for plastics-to-fuel in remote mines

- 4.3 Market Restraints

- 4.3.1 Weak landfill regulation & enforcement

- 4.3.2 Capital scarcity for large-scale treatment assets

- 4.3.3 Informal sector lock-in that deters formal private investment

- 4.3.4 Climate-linked insurance gaps for WtE plants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Logistics Infrastructure Insights

- 4.9 Startup & Innovation Spotlight

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Source

- 5.1.1 Residential

- 5.1.2 Commercial (retail, office, etc.)

- 5.1.3 Industrial

- 5.1.4 Medical (Health and Pharmaceutical)

- 5.1.5 Construction & Demolition

- 5.1.6 Others (institutional, agricultural, etc)

- 5.2 By Service Type

- 5.2.1 Collection, Transportation, Sorting & Segregation

- 5.2.2 Disposal / Treatment

- 5.2.2.1 Landfill

- 5.2.2.2 Recycling & Resource Recovery

- 5.2.2.3 Incineration & Waste-to-Energy

- 5.2.2.4 Others (Chemical Treatment, Composting, etc.)

- 5.2.3 Others (Consulting, Audit & Training, etc.)

- 5.3 By Waste Type

- 5.3.1 Municipal Solid Waste

- 5.3.2 Industrial Hazardous Waste

- 5.3.3 E-waste

- 5.3.4 Plastic Waste

- 5.3.5 Biomedical Waste

- 5.3.6 Construction & Demolition Waste

- 5.3.7 Agricultural Waste

- 5.3.8 Other Specialized Waste (radio active, etc)

- 5.4 By Geography

- 5.4.1 Nigeria

- 5.4.2 South Africa

- 5.4.3 Egypt

- 5.4.4 Kenya

- 5.4.5 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Averda

- 6.4.2 EnviroServ

- 6.4.3 Interwaste

- 6.4.4 WasteMart

- 6.4.5 Universal Recycling Company

- 6.4.6 Desco

- 6.4.7 PETCO

- 6.4.8 The Glass Recycling Company

- 6.4.9 Oricol Environmental Services

- 6.4.10 WeCyclers

- 6.4.11 The Waste Group

- 6.4.12 SA Waste

- 6.4.13 Veolia Africa

- 6.4.14 SUEZ Recycling & Recovery Africa

- 6.4.15 Biffa South Africa

- 6.4.16 Mr Green Africa

- 6.4.17 TakaTaka Solutions

- 6.4.18 EcoPost

- 6.4.19 Stericycle (MedWaste Africa)

- 6.4.20 Dangote Recycling

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment